it happens, some people just dont like using the "search" feature on google, if they cant use the search feature then they deserve to lose money for being lazy, they want to be hand fed. They will not make it in the trading world being lazy and not wanting to research. I can usually tell even on these forums whos not going to make it, the easy red flag are the lazy people that want to be spoon fed and cant simply use the "search" feature to answer their commonly asked question.Did you guys see this guy pedaling pretty much a free indicator from here plus overnight highs and lows https://www.momentum-options.com/orbi

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Opening Range (ORB) Watchlist Column for ThinkorSwim

- Thread starter markos

- Start date

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Hahahah he blocked me out of the FB group when I told him I made the same indicator and pointed out that it's opening range with overnight highs and lows and a trailing stop is a trend line hahah.it happens, some people just dont like using the "search" feature on google, if they cant use the search feature then they deserve to lose money for being lazy, they want to be hand fed. They will not make it in the trading world being lazy and not wanting to research. I can usually tell even on these forums whos not going to make it, the easy red flag are the lazy people that want to be spoon fed and cant simply use the "search" feature to answer their commonly asked question.

MomentumOptionsTrading

New member

Hey,Hahahah he blocked me out of the FB group when I told him I made the same indicator and pointed out that it's opening range with overnight highs and lows and a trailing stop is a trend line hahah.

Eric from MomentumOptions here, you were removed from my group because you were being rude and trying to start a fight, I know your type. I have shared my setups and analysis for years, for a long time for FREE even, but people follow my trades and consistently make money and stick around so I created my MomentumTrades and wanted to help them learn more so I kept improving my business by creating ORBI.

You made an ORB and think you have made the same thing as me but you haven't. I told you, unlike your program mine adheres to a strict set of rules and only signals entry when conditions across multiple timeframes are right for price to continue to our targets. The program is designed and does very well at always trading WITH the trend and has a built-in stop-loss so even an average new trader can follow the system and consistently find profitable trades.

My program monitors all the studies of my strategy across multiple timeframes to only signal entry when studies are lined up for price to move in that direction so it does very well at staying out of the chop. Our targets are entirely custom as well and extremely accurate as they tend to line up to the penny with my longer-term analysis using Fibonacci.

When you pair ORBI with my scanners you are sitting on gold. You literally commented on a post from a customer bragging about what a great day he had followed by multiple other customers thanking me for ORBI and such a great Friday. Just above that was a post from a customer saying he had grown his account 20% every day this week. You were being a hater and haters aren't welcome. Those who want to make money and learn to navigate the market are, my goal with ORBI was to make the best product that literally anyone could use to navigate the markets and make money which is something I am very proud I can say I have done.

Last edited:

First of all, I asked him to explain the methodology, the reason why he was entering in the trade. He could not. You chimed in with a pitch. Then I asked you about why you entered in that spot and that stock and you again gave a pitch and not an actual reason for entry.Hey,

Eric from MomentumOptions here, you were removed from my group because you were being rude and trying to start a fight, I know your type. I have shared my setups and analysis for years, for a long time for FREE even, but people follow my trades and consistently make money and stick around so I created my MomentumTrades and wanted to help them learn more so I kept improving my business by creating ORBI.

You made an ORB and think you have made the same thing as me but you haven't. I told you, unlike your program mine adheres to a strict set of rules and only signals entry when conditions across multiple timeframes are right for price to continue to our targets. The program is designed and does very well at always trading WITH the trend and has a built-in stop-loss so even an average new trader can follow the system and consistently find profitable trades.

My program monitors all the studies of my strategy including MACD, RSI, EMAs, DMI, CCI, TTM Squeeze, and Volume across multiple timeframes to only signal entry when studies are lined up for price to move in that direction so it does very well at staying out of the chop. Our targets are entirely custom as well and extremely accurate as they tend to line up to the penny with my longer-term analysis using Fibonacci.

When you pair ORBI with my scanners you are sitting on gold. You literally commented on a post from a customer bragging about what a great day he had followed by multiple other customers thanking me for ORBI and such a great Friday. Just above that was a post from a customer saying he had grown his account 20% every day this week. You were being a hater and haters aren't welcome. Those who want to make money and learn to navigate the market are, my goal with ORBI was to make the best product that literally anyone could use to navigate the markets and make money which is something I am very proud I can say I have done.

I write indicators not systems. I do in fact have a reason for entry that are my own system that combines multiple time frames and indicators. And I have strict rules for entry and exits. And I can explain to you where the strong, multi period momentum exists and when it is going off the trend or support level (and can explain the reason why that trend or support level is important.)

If you are a true teacher as you say, and not another of the thousands of fake gurus, you would want your students to know why they get in the trade besides just blindly following a flashing light on a screen or whatever message they get sent to them. I choose to believe that a man needs to learn how to fish not just be handed said fish in the high season. If you think that is being a hater....Well, I think I have my answer as to which you are. I taught university level mathematics, the Socratic method is how I operate and I view everyone as a student, including myself. If I am wrong, I tip my hat.

@Shyam The watchlist column will not help you achieve that. You need to setup a scanner for your ORB indicator and then save it as a watchlist.

MomentumOptionsTrading

New member

I share my methodology every single week in my setups and have step-by-step video training on how to use all of my studies, indicators, and tools so that new traders can learn to identify the same type of trades for themselves included with purchase of ORBI. There are even in-depth videos explaining what ORBI looks at, how it works to identify entry, and how you can identify stocks that are most likely to give great signals ahead of time.First of all, I asked him to explain the methodology, the reason why he was entering in the trade. He could not. You chimed in with a pitch. Then I asked you about why you entered in that spot and that stock and you again gave a pitch and not an actual reason for entry.

I write indicators not systems. I do in fact have a reason for entry that are my own system that combines multiple time frames and indicators. And I have strict rules for entry and exits. And I can explain to you where the strong, multi period momentum exists and when it is going off the trend or support level (and can explain the reason why that trend or support level is important.)

If you are a true teacher as you say, and not another of the thousands of fake gurus, you would want your students to know why they get in the trade besides just blindly following a flashing light on a screen or whatever message they get sent to them. I choose to believe that a man needs to learn how to fish not just be handed said fish in the high season. If you think that is being a hater....Well, I think I have my answer as to which you are. I taught university level mathematics, the Socratic method is how I operate and I view everyone as a student, including myself. If I am wrong, I tip my hat.

The goal of ORBI was to create a system that teaches new traders how to navigate the market and learn to identify profitable setups on their own consistently. I have worked very hard to create the best product for my customers and ensure they have a positive trading experience.

You took literally zero time looking through my website, any of my posts, members posts, or anything I have shared to see what MomentumOptions or ORBI was about. You merely joined my group to share you had an indicator of your own and to criticize me which you have clearly continued to do here.

This is my last reply on the topic here, if you want to continue it, we can take it off the forum into discord or chat or telegram or Facebook messenger or whatever. This community is not about this.You took literally zero time looking through my website, any of my posts, members posts, or anything I have shared to see what MomentumOptions or ORBI was about. You merely joined my group to share you had an indicator of your own and to criticize me which you have clearly continued to do here.

I have been a member fo your fb group for months, possibly over a year and saying I have ACUALLY taken zero time to look though your website and posts is stretch. $697 or $997 OR 1199 (it keeps changing) for a collection of free indicators is still crazy , however elegant your indicator may look in comparison to my charts (that yes, use all that in multiple time frames ... I can combine them, but it works as is.)

As I said, if you actually teach them why they are entering, hat's off to you.

Last edited:

@fredcolclough, would you consider sharing the script for the Watchlist ORB Column. I've tried writing it but my skills lack!

Last edited:

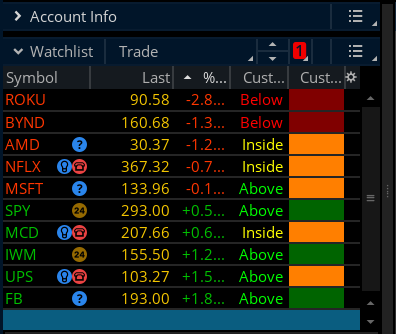

I changed the code in this from whats up top to whats down hereBelow are two custom watchlist columns for the Opening Range Breakout indicator. Add either one to your watchlist of stocks and it will tell you which tickers are currently breaking out, breaking down, or within the trading range of the first 30mins.

Both work the same way - just visually different. First one was created by Mobius and the second one by @WalkingBallista.

Mobius ThinkScript Lounge 2017

Rich (BB code):# ORB Watch List Column input StartTime = 0930; input EndTime = 1000; def h = high; def l = low; def c = close; def ORActive = if SecondsFromTime(StartTime) > 0 and SecondsTillTime(EndTime) >= 0 then 1 else 0; def ORH = if ORActive and !ORActive[1] then h else if ORActive and h > ORH[1] then h else ORH[1]; def ORL = if ORActive and !ORActive[1] then l else if ORActive and l < ORL[1] then l else ORL[1]; def ORhigh = if !ORActive then ORH else Double.NaN; def ORlow = if !ORActive then ORL else Double.NaN; AddLabel(1, if close > ORhigh then "Above" else if close < ORlow then "Below" else "Inside", if close > ORhigh then color.green else if close < ORlow then color.red else color.yellow);

WalkingBallista's thinkScript Code

Code:# 30 min opening range # Robert Payne # WalkingBallista Watchlist def OpenRangeMinutes = 30; def MarketOpenTime = 0930; input ShowTodayOnly = yes; def Today = if GetDay() == GetLastDay() then 1 else 0; def FirstMinute = if SecondsFromTime(MarketOpenTime) < 60 then 1 else 0; def OpenRangeTime = if SecondsFromTime(MarketOpenTime) < 60 * OpenRangeMinutes then 1 else 0; def ORHigh = if FirstMinute then high else if OpenRangeTime and high > ORHigh[1] then high else ORHigh[1]; def ORLow = if FirstMinute then low else if OpenRangeTime and low < ORLow[1] then low else ORLow[1]; def OpenRangeHigh = if ShowTodayOnly and !Today then Double.NaN else if !OpenRangeTime then ORHigh else Double.NaN; def OpenRangeLow = if ShowTodayOnly and !Today then Double.NaN else if !OpenRangeTime then ORLow else Double.NaN; def dailyRange = high(period = "day" )[1] - low(period = "day" )[1]; def range = Average(dailyRange, 10); plot status = if close > OpenRangeHigh then 1 else if close < OpenRangeLow then 0 else -1; status.AssignValueColor(if status == 1 then Color.Dark_Green else if status == 0 then Color.Dark_Red else Color.Dark_Orange); AssignBackgroundCOlor(if status == 1 then Color.Dark_Green else if status == 0 then Color.Dark_Red else Color.Dark_Orange);

Shareable Links

@BenTen contributed to this post.

If u switch out the openrangehigh/openrangelow for the ORhigh and orlow, it will signal green yellow or red when the CLOSing price breaks either the bull or bear line. and if it crosses back into the cloud it goes yellow

plot status = if close >OrHigh then 1 else if close < orlow then 0 else -1;

status.AssignValueColor(if status == 1 then Color.Dark_Green else if status == 0 then Color.Dark_Red else Color.yellow);

AssignBackgroundCOlor(if status == 1 then Color.Dark_Green else if status == 0 then Color.Dark_Red else Color.yellow);

bigmit2011

New member

I am trying to under the code to tweak it.if ORActive and !ORActive[1]

What exactly is the !ORActive[1] checking?

MP432

Member

Hello All, First time posting here. I am new to Scripting and have been learning a lot just modifying things I like from this site.

ORB is a great tool and I love the watchlist scripts you guys have put together.

I wanted to see if someone had any improvements to this modification or notice any miscalculated figures

I have taken the WL column from @fredcolclough and have tried to tweak it to not only give a percentage to ORB from but also a percentage from ORB. So as it breaks ORB we will see "by (x)%" .

The way I have set up my WL I will see

"Above | by (x) % " or "Below | by (x) %"

or

" In OR | Needs (X) % "

The colors indicate which direction price is moving

** Perhaps someone can look it over and make sure the math is correct because some tickers give me odd readings still although it has been working for most. Sometimes the MidORB would lean either closer to top or bottom ORB levels which seems to fudge the perception of what the percentage is telling me.

- Also if anyone has any advice to not "exceed custom expression limit". I know there is a limit on what data can be shown at once, but I have tried to trim my charts and WL and still get the exceeding error.

Thanks for checking it out and I hope it serves you.

ORB is a great tool and I love the watchlist scripts you guys have put together.

I wanted to see if someone had any improvements to this modification or notice any miscalculated figures

I have taken the WL column from @fredcolclough and have tried to tweak it to not only give a percentage to ORB from but also a percentage from ORB. So as it breaks ORB we will see "by (x)%" .

The way I have set up my WL I will see

"Above | by (x) % " or "Below | by (x) %"

or

" In OR | Needs (X) % "

The colors indicate which direction price is moving

** Perhaps someone can look it over and make sure the math is correct because some tickers give me odd readings still although it has been working for most. Sometimes the MidORB would lean either closer to top or bottom ORB levels which seems to fudge the perception of what the percentage is telling me.

- Also if anyone has any advice to not "exceed custom expression limit". I know there is a limit on what data can be shown at once, but I have tried to trim my charts and WL and still get the exceeding error.

Thanks for checking it out and I hope it serves you.

Code:

# ORB Watch List Column - % move To and FROM

input StartTime = 0930;

input EndTime = 0945;

def h = high;

def l = low;

def c = close;

def ORActive = if SecondsFromTime(StartTime) > 0 and

SecondsTillTime(EndTime) >= 0

then 1

else 0;

def ORH = if ORActive and !ORActive[1]

then h

else if ORActive and

h > ORH[1]

then h

else ORH[1];

def ORL = if ORActive and !ORActive[1]

then l

else if ORActive and

l < ORL[1]

then l

else ORL[1];

def ORhigh = if !ORActive

then ORH

else Double.NaN;

def ORlow = if !ORActive

then ORL

else Double.NaN;

def ORMid = if !ORActive

then (ORHigh + ORLow) / 2

else Double.NaN;

def ORRange = if !ORActive

then ORHigh - ORLow

else Double.NaN;

AddLabel(1,

if (close < ORMid) and (close > ORLow) then "Needs " + astext(round((close - ORLow) / close * 100,2))+"%"

else if (close >= ORMid) and (close < ORHigh) then "Needs " + astext(round((close - ORhigh) / close * 100,2)) + "%"

else if (close > ORHigh) then "by " + astext(round((Close - ORhigh) / ORHigh * 100,2))+"%" else if (close < ORLow) then "by " + astext(round((ORLow - close) / close *100,2)) + "%" else "@ Level",

if close > ORHigh then color.green else if close < ORLow then color.red

else if (close >= ORMid) and (close <= ORHigh) then color.green

else if (close <= ORMid) and (close >= ORLow) < ORlow

then color.red

else color.white

);You need to get the watchlist population down to within ToS acceptable resources before you can troubleshoot whether the expressions are calculating correctly. Your example doesn't have the resources to do anything correctly.if anyone has any advice to not "exceed custom expression limit". I know there is a limit on what data can be shown at once, but I have tried to trim my charts and WL and still get the exceeding error.

https://usethinkscript.com/threads/thinkorswim-custom-expression-subscription-limit-exceeded.1441/

DO have a code that plots the second fib on charts? i like to set up flex grid and watch for which stock breakouts,,, thanksWhat time frame? Would you care to share a screenshot of said 2nd fib? I dont know 2nd fib, I know 38% or 61% Thanks

hello! any experts knows how can we readjust this watchlist column script to use Premarket range?

You would have to change the time in the code.

Similar threads

-

-

Opening Range Indicator with Measured Moves and VWAP For ThinkOrSwim

- Started by FutureTony

- Replies: 46

-

Opening Range Breakout Strategy with Market Volatility for ThinkorSwim

- Started by BenTen

- Replies: 168

-

-

Opening Range Breakout with Directional Day Filter for ThinkorSwim

- Started by BenTen

- Replies: 6

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

726

Online

Similar threads

-

-

Opening Range Indicator with Measured Moves and VWAP For ThinkOrSwim

- Started by FutureTony

- Replies: 46

-

Opening Range Breakout Strategy with Market Volatility for ThinkorSwim

- Started by BenTen

- Replies: 168

-

-

Opening Range Breakout with Directional Day Filter for ThinkorSwim

- Started by BenTen

- Replies: 6

Similar threads

-

-

Opening Range Indicator with Measured Moves and VWAP For ThinkOrSwim

- Started by FutureTony

- Replies: 46

-

Opening Range Breakout Strategy with Market Volatility for ThinkorSwim

- Started by BenTen

- Replies: 168

-

-

Opening Range Breakout with Directional Day Filter for ThinkorSwim

- Started by BenTen

- Replies: 6

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.