You should upgrade or use an alternative browser.

Opening Range (ORB) Watchlist Column for ThinkorSwim

- Thread starter markos

- Start date

vince92615

New member

I had added Opening Range (ORB) Watchlist Column for ThinkorSwim to my TOS. it works perfect but I need a little bit of upgrade help

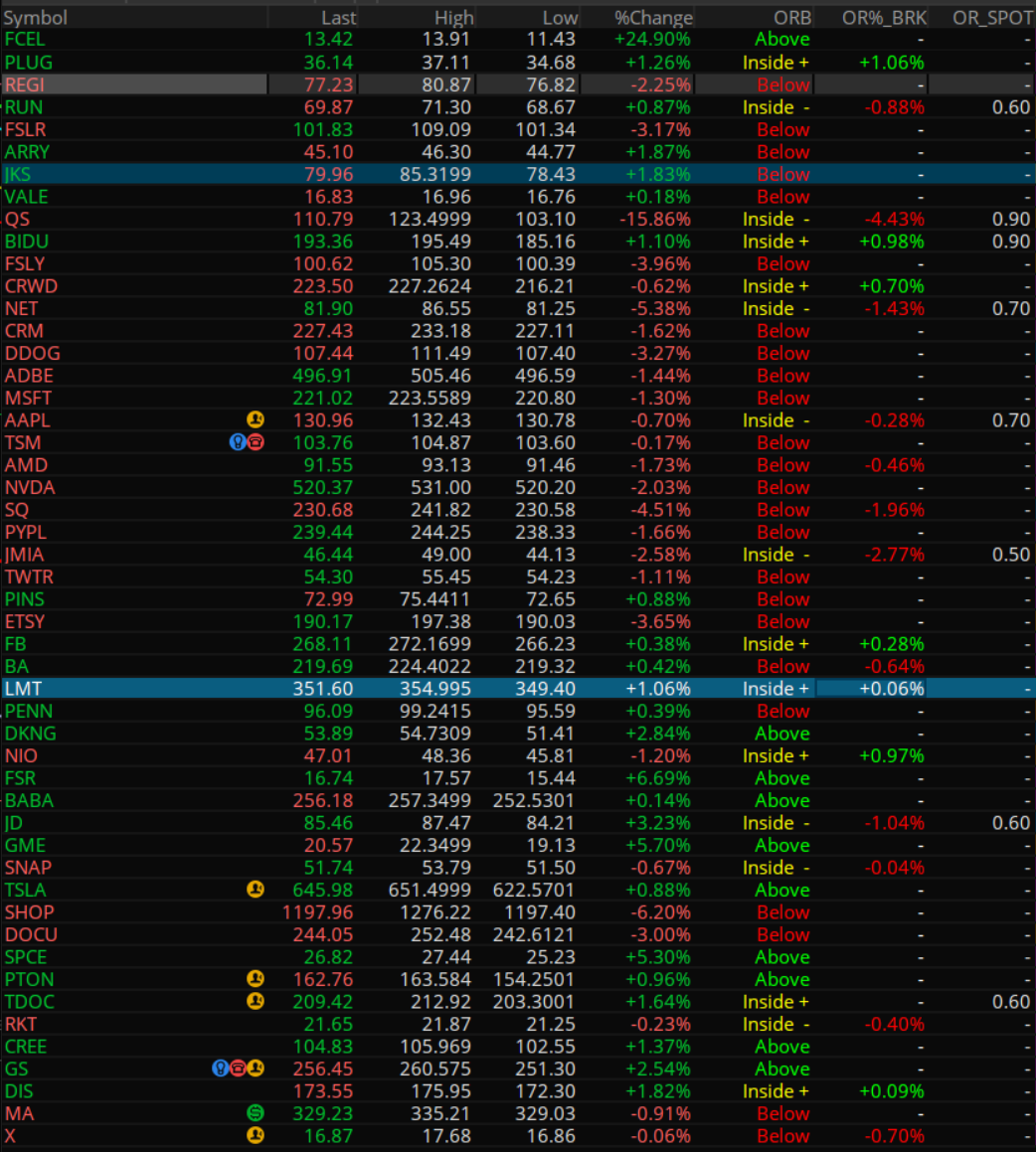

ORB watchlist showed current price whether it's above, in, or below the ORB.

But is there anyway we can add the ORB Highest/Lowest price to the watchlist? So I will be able to see how far my ticker will breakout/breakdown from the ORB from the Watchlist instead of the chart.

vince92615

New member

Plot value of opening range high:

# ORB Watch List Column

input StartTime = 0930;

input EndTime = 1000;

def h = high;

def l = low;

def c = close;

def ORActive = if SecondsFromTime(StartTime) > 0 and

SecondsTillTime(EndTime) >= 0

then 1

else 0;

def ORH = if ORActive and !ORActive[1]

then h

else if ORActive and

h > ORH[1]

then h

else ORH[1];

def ORL = if ORActive and !ORActive[1]

then l

else if ORActive and

l < ORL[1]

then l

else ORL[1];

def ORhigh = if !ORActive

then ORH

else Double.NaN;

def ORlow = if !ORActive

then ORL

else Double.NaN;

plot OR_high = ORH;Plot value of opening range low:

# ORB Watch List Column

input StartTime = 0930;

input EndTime = 1000;

def h = high;

def l = low;

def c = close;

def ORActive = if SecondsFromTime(StartTime) > 0 and

SecondsTillTime(EndTime) >= 0

then 1

else 0;

def ORH = if ORActive and !ORActive[1]

then h

else if ORActive and

h > ORH[1]

then h

else ORH[1];

def ORL = if ORActive and !ORActive[1]

then l

else if ORActive and

l < ORL[1]

then l

else ORL[1];

def ORhigh = if !ORActive

then ORH

else Double.NaN;

def ORlow = if !ORActive

then ORL

else Double.NaN;

plot OR_low = ORL;vince92615

New member

Nice ! Thank you so much@vince92615 Here you go:

Plot value of opening range high:

Code:# ORB Watch List Column input StartTime = 0930; input EndTime = 1000; def h = high; def l = low; def c = close; def ORActive = if SecondsFromTime(StartTime) > 0 and SecondsTillTime(EndTime) >= 0 then 1 else 0; def ORH = if ORActive and !ORActive[1] then h else if ORActive and h > ORH[1] then h else ORH[1]; def ORL = if ORActive and !ORActive[1] then l else if ORActive and l < ORL[1] then l else ORL[1]; def ORhigh = if !ORActive then ORH else Double.NaN; def ORlow = if !ORActive then ORL else Double.NaN; plot OR_high = ORH;

Plot value of opening range low:

Code:# ORB Watch List Column input StartTime = 0930; input EndTime = 1000; def h = high; def l = low; def c = close; def ORActive = if SecondsFromTime(StartTime) > 0 and SecondsTillTime(EndTime) >= 0 then 1 else 0; def ORH = if ORActive and !ORActive[1] then h else if ORActive and h > ORH[1] then h else ORH[1]; def ORL = if ORActive and !ORActive[1] then l else if ORActive and l < ORL[1] then l else ORL[1]; def ORhigh = if !ORActive then ORH else Double.NaN; def ORlow = if !ORActive then ORL else Double.NaN; plot OR_low = ORL;

On top of this , is there anyway can add alert ? So when price breakdown or breakout from the ORB H/L, we can know them immediately

again, thank you

fredcolclough

New member

The first is the % change required to break the OR - either up or down depending on which side of the middle the stock is currently sitting.

The second is how close it is to breaking it on a comparable basis. ie: 0.9 => 90% of the way to breaking the range. These only show up when >50%.

# ORB Watch List Column - % move to B/O

input StartTime = 0930;

input EndTime = 0945;

def h = high;

def l = low;

def c = close;

def ORActive = if SecondsFromTime(StartTime) > 0 and

SecondsTillTime(EndTime) >= 0

then 1

else 0;

def ORH = if ORActive and !ORActive[1]

then h

else if ORActive and

h > ORH[1]

then h

else ORH[1];

def ORL = if ORActive and !ORActive[1]

then l

else if ORActive and

l < ORL[1]

then l

else ORL[1];

def ORhigh = if !ORActive

then ORH

else Double.NaN;

def ORlow = if !ORActive

then ORL

else Double.NaN;

def ORMid = if !ORActive

then (ORHigh + ORLow) / 2

else Double.NaN;

def ORRange = if !ORActive

then ORHigh - ORLow

else Double.NaN;

AddLabel(1,

if (close < ORMid) and (close > ORLow) then "-" + astext(round((close - ORLow) / close * 100,2))+"%"

else if (close >= ORMid) and (close < ORHigh) then "+" + astext(round((ORHigh - close) / close * 100,2)) + "%"

else "-",

if close > ORHigh or close < ORLow then color.white

else if (close >= ORMid) and (close < ORHigh) then color.green

else if (close < ORMid) and (close > ORLow) < ORlow then color.red

else color.white

);# ORB Watch List Column - near B/O

input StartTime = 0930;

input EndTime = 0945;

def h = high;

def l = low;

def c = close;

def ORActive = if SecondsFromTime(StartTime) > 0 and

SecondsTillTime(EndTime) >= 0

then 1

else 0;

def ORH = if ORActive and !ORActive[1]

then h

else if ORActive and

h > ORH[1]

then h

else ORH[1];

def ORL = if ORActive and !ORActive[1]

then l

else if ORActive and

l < ORL[1]

then l

else ORL[1];

def ORhigh = if !ORActive

then ORH

else Double.NaN;

def ORlow = if !ORActive

then ORL

else Double.NaN;

def ORMid = if !ORActive

then (ORHigh + ORLow) / 2

else Double.NaN;

def ORRange = if !ORActive

then ORHigh - ORLow

else Double.NaN;

AddLabel(1,

if close >= ORMid and close <ORHigh and 1 - round((ORHigh - close) / (ORHigh - ORMid),1) >= 0.6 then astext(1 - round((ORHigh - close) / (ORHigh - ORMid),1))

else if close < ORMid and close >ORLow and round((ORMid - close) / (ORMid - ORLow),1) >= 0.5 then astext(round((ORMid - close) / (ORMid - ORLow),1))

else "-"

);This is only for long. I like to play for long from mid opening range or from second try, I have noticed if it hits the first T-1 and then does not reach it again, it's a good chance it will go to T2 or T3 to the upside. Then you also have the down side.I played with some code to get some better OR info into watchlists, thought maybe it'd help someone else. I always seem to be missing OR breaks and am hoping this helps to anticipate them and pull up a chart/ prepare trade.

...

fredcolclough

New member

This is only for long. I like to play for long from mid opening range or from second try, I have noticed if it hits the first T-1 and then does not reach it again, it's a good chance it will go to T2 or T3 to the upside. Then you also have the down side.

Interesting - so you wait for a mid break with stop at opening low? Similar idea to high break with stop at mid. From my limited experience most will hit a 2:1 RR but I'll have to keep yours in mind.

Falconaimc

New member

I tried to add these script to my watchlist column but they are both blank. Any help would be appreciated.I played with some code to get some better OR info into watchlists, thought maybe it'd help someone else. I always seem to be missing OR breaks and am hoping this helps to anticipate them and pull up a chart/ prepare trade.

The first is the % change required to break the OR - either up or down depending on which side of the middle the stock is currently sitting.

The second is how close it is to breaking it on a comparable basis. ie: 0.9 => 90% of the way to breaking the range. These only show up when >50%.

Code:# ORB Watch List Column - % move to B/O input StartTime = 0930; input EndTime = 0945; def h = high; def l = low; def c = close; def ORActive = if SecondsFromTime(StartTime) > 0 and SecondsTillTime(EndTime) >= 0 then 1 else 0; def ORH = if ORActive and !ORActive[1] then h else if ORActive and h > ORH[1] then h else ORH[1]; def ORL = if ORActive and !ORActive[1] then l else if ORActive and l < ORL[1] then l else ORL[1]; def ORhigh = if !ORActive then ORH else Double.NaN; def ORlow = if !ORActive then ORL else Double.NaN; def ORMid = if !ORActive then (ORHigh + ORLow) / 2 else Double.NaN; def ORRange = if !ORActive then ORHigh - ORLow else Double.NaN; AddLabel(1, if (close < ORMid) and (close > ORLow) then "-" + astext(round((close - ORLow) / close * 100,2))+"%" else if (close >= ORMid) and (close < ORHigh) then "+" + astext(round((ORHigh - close) / close * 100,2)) + "%" else "-", if close > ORHigh or close < ORLow then color.white else if (close >= ORMid) and (close < ORHigh) then color.green else if (close < ORMid) and (close > ORLow) < ORlow then color.red else color.white );

Code:# ORB Watch List Column - near B/O input StartTime = 0930; input EndTime = 0945; def h = high; def l = low; def c = close; def ORActive = if SecondsFromTime(StartTime) > 0 and SecondsTillTime(EndTime) >= 0 then 1 else 0; def ORH = if ORActive and !ORActive[1] then h else if ORActive and h > ORH[1] then h else ORH[1]; def ORL = if ORActive and !ORActive[1] then l else if ORActive and l < ORL[1] then l else ORL[1]; def ORhigh = if !ORActive then ORH else Double.NaN; def ORlow = if !ORActive then ORL else Double.NaN; def ORMid = if !ORActive then (ORHigh + ORLow) / 2 else Double.NaN; def ORRange = if !ORActive then ORHigh - ORLow else Double.NaN; AddLabel(1, if close >= ORMid and close <ORHigh and 1 - round((ORHigh - close) / (ORHigh - ORMid),1) >= 0.6 then astext(1 - round((ORHigh - close) / (ORHigh - ORMid),1)) else if close < ORMid and close >ORLow and round((ORMid - close) / (ORMid - ORLow),1) >= 0.5 then astext(round((ORMid - close) / (ORMid - ORLow),1)) else "-" );

@fredcolclough how can I scan for stocks where OR_SPOT >.90 <.95?

Use Between()... You really should put the link to the Learning Center in your Bookmarks/Favorites...

# ORB Watch List Column - near B/O

input StartTime = 0929;

input EndTime = 1000;

input CloudOn = yes; #hint CloudOn: Clouds Opening Range.

def h = high;

def l = low;

def c = close;

def ORActive = if SecondsFromTime(StartTime) > 0 and

SecondsTillTime(EndTime) >= 0

then 1

else 0;

def ORH = if ORActive and !ORActive[1]

then h

else if ORActive and

h > ORH[1]

then h

else ORH[1];

def ORL = if ORActive and !ORActive[1]

then l

else if ORActive and

l < ORL[1]

then l

else ORL[1];

def ORhigh = if !ORActive

then ORH

else Double.NaN;

def ORlow = if !ORActive

then ORL

else Double.NaN;

def ORMid = if !ORActive

then (ORhigh + ORlow) / 2

else Double.NaN;

def ORRange = if !ORActive

then ORhigh - ORlow

else Double.NaN;

def ORL3 = if !ORActive

then ORL

else Double.NaN;

plot ORh2 = ORhigh;

plot ORl2 = ORlow;

plot ORm1 = (ORhigh + ORlow) / 2;

plot ORU = (ORhigh + ORmid) / 2;

addCloud(if CloudOn == yes

then ORu

else double.nan

, orm1,createColor(66,244,131), createColor(66,244,131));

addCloud(if CloudOn == yes

then orh2

else double.nan

, ORu,createColor(238,130,238), createColor(238,130,238));

addCloud(if CloudOn == yes

then orl3

else double.nan

,orm1,createColor(244,83,66), createColor(244,83,66));Scanner

https://tos.mx/sTKfsby

Did you guys see this guy pedaling pretty much a free indicator from here plus overnight highs and lows https://www.momentum-options.com/orbi

There are a lot of shady characters out there taking advantage of unknowing novice traders...

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Similar threads

-

-

Opening Range Indicator with Measured Moves and VWAP For ThinkOrSwim

- Started by FutureTony

- Replies: 46

-

Opening Range Breakout Strategy with Market Volatility for ThinkorSwim

- Started by BenTen

- Replies: 168

-

-

Opening Range Breakout with Directional Day Filter for ThinkorSwim

- Started by BenTen

- Replies: 6

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

-

Opening Range Indicator with Measured Moves and VWAP For ThinkOrSwim

- Started by FutureTony

- Replies: 46

-

Opening Range Breakout Strategy with Market Volatility for ThinkorSwim

- Started by BenTen

- Replies: 168

-

-

Opening Range Breakout with Directional Day Filter for ThinkorSwim

- Started by BenTen

- Replies: 6

Similar threads

-

-

Opening Range Indicator with Measured Moves and VWAP For ThinkOrSwim

- Started by FutureTony

- Replies: 46

-

Opening Range Breakout Strategy with Market Volatility for ThinkorSwim

- Started by BenTen

- Replies: 168

-

-

Opening Range Breakout with Directional Day Filter for ThinkorSwim

- Started by BenTen

- Replies: 6

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/