Are you familiar with Amalia's work...sharing his breakout for different time frames https://tos.mx/97IdXDBI will start by saying, nothing works all the time. The calculations here are simple - 50% of the opening move range added above and below the range. By default, it uses the opening 15m but I know some use the opening 5m or the opening 1m.

If you were to look into using a weekly range, you could try time-based OR you could check out this study with a different approach - Weekly Opening Range Breakout. Let us know if you find anything interesting!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Opening Range Indicator with Measured Moves and VWAP For ThinkOrSwim

- Thread starter FutureTony

- Start date

No, I am not familiar with this work.Are you familiar with Amalia's work...sharing his breakout for different time frames https://tos.mx/97IdXDB

@FutureTony I was pondering over the weekly ORB idea you shared and thought what if we use the either Monday’s open/close or High or Low, how would that look like…I’m curious but I lack coding to try the idea. Do you mind helping meI will start by saying, nothing works all the time. The calculations here are simple - 50% of the opening move range added above and below the range. By default, it uses the opening 15m but I know some use the opening 5m or the opening 1m.

If you were to look into using a weekly range, you could try time-based OR you could check out this study with a different approach - Weekly Opening Range Breakout. Let us know if you find anything interesting!

IMO - you don't need an indicator to try this out. Manually plot some of these points you mention in past weeks and see how they perform. Try Sunday session if you are plotting futures, try all Monday, try the first hour of Monday, etc. Once you find something that you think is working consistently, bring that idea back to this thread and others can help with building out the indicator...@FutureTony I was pondering over the weekly ORB idea you shared and thought what if we use the either Monday’s open/close or High or Low, how would that look like…I’m curious but I lack coding to try the idea. Do you mind helping me

Sounds good, thank you for the response and insightIMO - you don't need an indicator to try this out. Manually plot some of these points you mention in past weeks and see how they perform. Try Sunday session if you are plotting futures, try all Monday, try the first hour of Monday, etc. Once you find something that you think is working consistently, bring that idea back to this thread and others can help with building out the indicator...

Replace the last two AddChartBubble commands with this:This is a beautiful indicator.

I am only using the OR High and OR Low lines and bubbles for my needs. I'm trying to figure out how to get the actual price value in the bubble?

AddChartBubble(showBubbles and showBubbleNow[1], ORHigh[1], ORHigh[1], Color.GRAY, yes);

AddChartBubble(showBubbles and showBubbleNow[1], ORLow[1], ORLow[1], Color.GRAY, no);

Will print the values instead of the simple ORHigh/ORLow label.

The lines start printing as soon as the end time specified is reached. If you want to see them 'in progress', try adding this to the bottom of your study:How do I get the lines to all the way across the screen? during the initial house, the line is hard to see as it starts printing as the day progresses. I'd like to be able to see the lines as soon as the timeframe is reached

input showORInProgress = yes;

AddLabel(showORInProgress,"ORH: " + ORhigh + " | ORL: " + ORLow,Color.WHITE);

Thanks for the quick response. I think I messed up in my explanation. The lines progress as the day progresses, But stays at price levels determined at the close of the opening time (in my case 930-1000)The lines start printing as soon as the end time specified is reached. If you want to see them 'in progress', try adding this to the bottom of your study:

input showORInProgress = yes;

AddLabel(showORInProgress,"ORH: " + ORhigh + " | ORL: " + ORLow,Color.WHITE);

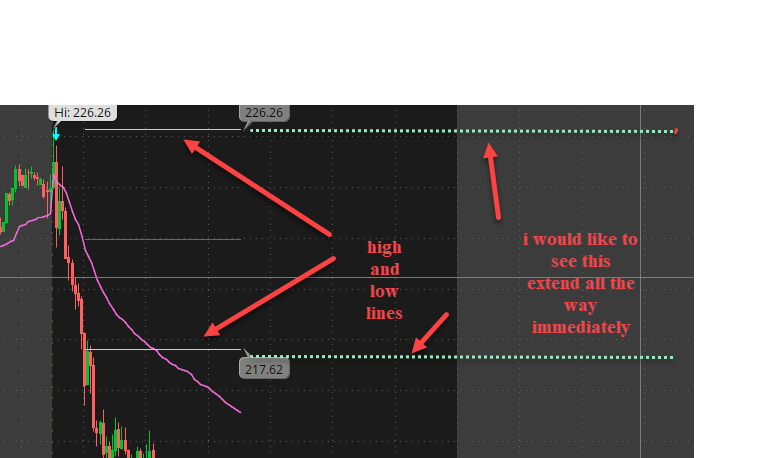

what I was asking is once the price levels are determined, I would like to see the lines extend all the way across, instead of seeing them print as the day progresses. The reason is that in the first few hours, because the line is so small, it is hard to see . I would like to see the line go across the screen as soon as it's 1000

Sorry, I'm not quite sure why it is doing that. I tried a couple of quick things but it did not make a difference. Would require more debugging and I do not have the time to do that right now. Hopefully the labels help a bit.Thanks for the quick response. I think I messed up in my explanation. The lines progress as the day progresses, But stays at price levels determined at the close of the opening time (in my case 930-1000)

what I was asking is once the price levels are determined, I would like to see the lines extend all the way across, instead of seeing them print as the day progresses. The reason is that in the first few hours, because the line is so small, it is hard to see . I would like to see the line go across the screen as soon as it's 1000

Goingdark365

Member

@FutureTony can we get the atr from opening range of the previus 5 days as the targets ?

I'm not quite sure I follow. Do you mean the average move for the first x minutes over the previous 5 days and then plot that as our expected range for today? If so, I'm not sure how useful that will be as some days have news drivers or other events that can produce increased moves and may 'throw off' the average...@FutureTony can we get the atr from opening range of the previus 5 days as the targets ?

Goingdark365

Member

Yes like atr I meant to say 50 days. I tried the atr formula with the code but just gives me what the label is already showing as the rangeI'm not quite sure I follow. Do you mean the average move for the first x minutes over the previous 5 days and then plot that as our expected range for today? If so, I'm not sure how useful that will be as some days have news drivers or other events that can produce increased moves and may 'throw off' the average...

I believe you would have to manually calculate that, even within the study. There is no easy way to retrieve the OR for the past 50 days as far as I know. I could add an input variable that you could manually change for an 'expected range' but not sure how helpful that would be...Yes like atr I meant to say 50 days. I tried the atr formula with the code but just gives me what the label is already showing as the range

Goingdark365

Member

no matter what look back i try it still dosnt work gives me same result

Exactly. I believe you would need to store yesterday's range at the start of each day. So would need 5 variables to hold the range for the last 5 days and then would need to calculate the average of those 5 days. And if you want 50 days, you need a chart showing 50 days of data and you would need 50 variables. Unless someone else has a better idea...I believe you would have to manually calculate that, even within the study. There is no easy way to retrieve the OR for the past 50 days as far as I know. I could add an input variable that you could manually change for an 'expected range' but not sure how helpful that would be...

Hey @FutureTony, great indicator! I'm assuming this is build mainly for futures though -- for some reason, I can't get this to display properly for equities with extended hours off:

This is the basic display set to show From RTH start, showing the anchored vwap from 9:30 to 16:00. However, as you can see it instead just anchors to the beginning of the chart, and doesn't really set the targets properly either. Do you know the reason for this? Is there a relatively simple way to get this to display with extended hours off?

This is the basic display set to show From RTH start, showing the anchored vwap from 9:30 to 16:00. However, as you can see it instead just anchors to the beginning of the chart, and doesn't really set the targets properly either. Do you know the reason for this? Is there a relatively simple way to get this to display with extended hours off?

Hmm. I created it so that it would work on tick charts on futures as well. My guess is that using it on an equities chart with extended hours off might require you to change the end time input from 16:00 to one candle earlier. Try 15:57 in your chart above (or maybe even a bit earlier). That should hopefully get it to 'reset' for the next day.Hey @FutureTony, great indicator! I'm assuming this is build mainly for futures though -- for some reason, I can't get this to display properly for equities with extended hours off:

This is the basic display set to show From RTH start, showing the anchored vwap from 9:30 to 16:00. However, as you can see it instead just anchors to the beginning of the chart, and doesn't really set the targets properly either. Do you know the reason for this? Is there a relatively simple way to get this to display with extended hours off?

Yep, you had it right! It was actually setting the opening time input to after 9:30, or maybe a combination of both. But using a starting time of 9:33 and an end time of 15:57 works just fine now on a 3 minute chart -- thanks for trouble shooting that.Hmm. I created it so that it would work on tick charts on futures as well. My guess is that using it on an equities chart with extended hours off might require you to change the end time input from 16:00 to one candle earlier. Try 15:57 in your chart above (or maybe even a bit earlier). That should hopefully get it to 'reset' for the next day.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Similar threads

-

Opening Range Indicator for ThinkorSwim with Fibonacci Levels

- Started by BenTen

- Replies: 43

-

-

Opening Range Breakout Strategy with Market Volatility for ThinkorSwim

- Started by BenTen

- Replies: 168

-

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1162

Online

Similar threads

-

Opening Range Indicator for ThinkorSwim with Fibonacci Levels

- Started by BenTen

- Replies: 43

-

-

Opening Range Breakout Strategy with Market Volatility for ThinkorSwim

- Started by BenTen

- Replies: 168

-

-

Similar threads

-

Opening Range Indicator for ThinkorSwim with Fibonacci Levels

- Started by BenTen

- Replies: 43

-

-

Opening Range Breakout Strategy with Market Volatility for ThinkorSwim

- Started by BenTen

- Replies: 168

-

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.