You should upgrade or use an alternative browser.

OnBalanceVolume OBV OBVM Scan, Watchlist, Label For ThinkOrSwim

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

I couldn't find the OBV_Scan condition?.@Rojo Grande Use the script below:

Code:# # TD Ameritrade IP Company, Inc. (c) 2008-2020 # declare lower; def OBV = TotalSum(Sign(close - close[1]) * volume); plot scan = if OBV > OBV[1] then 1 else double.nan;

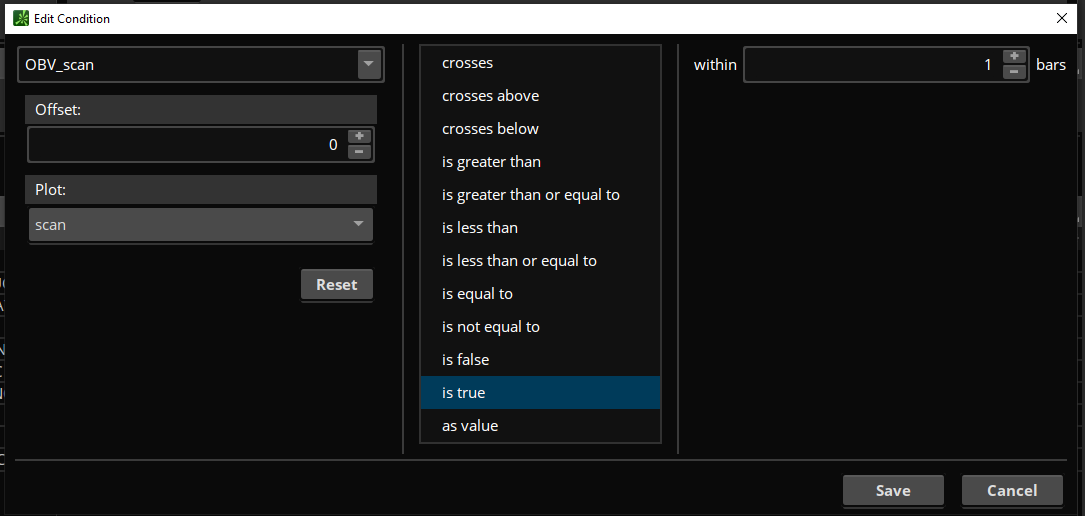

Add it as an indicator and then set up your scanner to something like this:

OBV scan link: http://tos.mx/TromDeb Click here for --> Easiest way to load shared links

#

# TD Ameritrade IP Company, Inc. (c) 2020-2021

#

declare lower;

input length = 7;

input signalLength = 10;

input averageType = AverageType.EXPONENTIAL;

input levelLine = -5;

plot Level = levelLine;

def obv = reference OnBalanceVolume();

plot OBVM = MovingAverage(averageType, obv, length);

plot Signal = MovingAverage(averageType, OBVM, signalLength);

OBVM.SetDefaultColor(GetColor(8));

Signal.SetDefaultColor(GetColor(2));So I wrote the input levelLine = -5; plot Level = levelLine; part. The issue is for some reason the line always plots at 0. Not sure exactly why this is. Any help would be appreciated.

Hmm it's still stuck at 0. I plotted -5000 but it stays at 0.@fungus12

The other two plots in this script are in thousands, so a plot of -5 comes out as -0.005.

So you have to plot -5000 or divide each of the two other plots by 1000.

I have other lower indicators but not on top of each other. Can you please link your code? Not sure why it's not happening for me.

It's the same exact code you posted.

Just changed -5 to -5000.

#

# TD Ameritrade IP Company, Inc. (c) 2020-2021

#

declare lower;

input length = 7;

input signalLength = 10;

input averageType = AverageType.EXPONENTIAL;

input levelLine = -5000;

plot Level = levelLine;

def obv = reference OnBalanceVolume();

plot OBVM = MovingAverage(averageType, obv, length);

plot Signal = MovingAverage(averageType, OBVM, signalLength);

OBVM.SetDefaultColor(GetColor(8));

Signal.SetDefaultColor(GetColor(2));That was odd, it works now. Thanks for the help dude.@fungus12

It's the same exact code you posted.

Just changed -5 to -5000.

Code:# # TD Ameritrade IP Company, Inc. (c) 2020-2021 # declare lower; input length = 7; input signalLength = 10; input averageType = AverageType.EXPONENTIAL; input levelLine = -5000; plot Level = levelLine; def obv = reference OnBalanceVolume(); plot OBVM = MovingAverage(averageType, obv, length); plot Signal = MovingAverage(averageType, OBVM, signalLength); OBVM.SetDefaultColor(GetColor(8)); Signal.SetDefaultColor(GetColor(2));

Sorry dude just one more quick question. When I drag the OBV up to the other graph, I get these black bars on the side that say "millions". Is there any way to remove those?@fungus12

It's the same exact code you posted.

Just changed -5 to -5000.

Code:# # TD Ameritrade IP Company, Inc. (c) 2020-2021 # declare lower; input length = 7; input signalLength = 10; input averageType = AverageType.EXPONENTIAL; input levelLine = -5000; plot Level = levelLine; def obv = reference OnBalanceVolume(); plot OBVM = MovingAverage(averageType, obv, length); plot Signal = MovingAverage(averageType, OBVM, signalLength); OBVM.SetDefaultColor(GetColor(8)); Signal.SetDefaultColor(GetColor(2));

Could you please assist and assign the arrows to be plotted on the actual candle of the chart?

declare lower;

input length = 7;

input maxVolumeCutOff = 2.5;

input signalLength = 10;

input averageType = AverageType.EXPONENTIAL;

def OBV = TotalSum(Sign(close - close[1]) * volume);

plot OBVM = MovingAverage(averageType, OBV, length);

plot Signal = MovingAverage(averageType, OBVM, signalLength);

OBVM.SetDefaultColor(GetColor(8));

Signal.SetDefaultColor(GetColor(2));

input showarrows = yes;

def price = close ;

def up = OBVM > Signal and Signal < OBVM ;

def dn = OBVM < Signal and Signal > OBVM ;

def neutral = between(close,min(OBVM,SIGNAL),max(SIGNAL,OBVM));

def x = CompoundValue(1,

if x[1]>=0 and (dn[1] or up[1]==0) and up

then 1

else if x[1]>=1 and (up or !dn)

then x[1]+1

else 0, 1);

def y = CompoundValue(1,

if y[1]<=0 and (up[1] or dn[1]==0) and dn

then 1

else if y[1]>=1 and (dn or !up)

then y[1]+1

else 0, 1);

plot uparrow = if showarrows and x == 3 and up then 1 else 0;

uparrow.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

uparrow.SetLineWeight(1);

uparrow.SetDefaultColor(Color.yellow);

plot dnarrow = if showarrows and y == 3 and dn then 1 else 0;

dnarrow.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

dnarrow.SetLineWeight(1);

dnarrow.SetDefaultColor(Color.white);

#

Hi Team,

Could you please assist and assign the arrows to be plotted on the actual candle of the chart?

declare lower;

input length = 7;

input maxVolumeCutOff = 2.5;

input signalLength = 10;

input averageType = AverageType.EXPONENTIAL;

def OBV = TotalSum(Sign(close - close[1]) * volume);

plot OBVM = MovingAverage(averageType, OBV, length);

plot Signal = MovingAverage(averageType, OBVM, signalLength);

OBVM.SetDefaultColor(GetColor(8));

Signal.SetDefaultColor(GetColor(2));

input showarrows = yes;

def price = close ;

def up = OBVM > Signal and Signal < OBVM ;

def dn = OBVM < Signal and Signal > OBVM ;

def neutral = between(close,min(OBVM,SIGNAL),max(SIGNAL,OBVM));

def x = CompoundValue(1,

if x[1]>=0 and (dn[1] or up[1]==0) and up

then 1

else if x[1]>=1 and (up or !dn)

then x[1]+1

else 0, 1);

def y = CompoundValue(1,

if y[1]<=0 and (up[1] or dn[1]==0) and dn

then 1

else if y[1]>=1 and (dn or !up)

then y[1]+1

else 0, 1);

plot uparrow = if showarrows and x == 3 and up then 1 else 0;

uparrow.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

uparrow.SetLineWeight(1);

uparrow.SetDefaultColor(Color.yellow);

plot dnarrow = if showarrows and y == 3 and dn then 1 else 0;

dnarrow.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

dnarrow.SetLineWeight(1);

dnarrow.SetDefaultColor(Color.white);

#

The indicator along with the arrows will move to the upper panel when you just change this

declare lower;#declare lower;Basically I would like arrows to plot only if the OBV UpArrow is true and a confirmed ROC is greater than ZeroLine. And the opposite for the DnArrow so then plot the OBV DnArrow when combined with the ROC when its smaller than ZeroLine and confirmed.

input length = 14;

input signalLength = 26;

input averageType = AverageType.EXPONENTIAL;

input showarrows = yes;

def OBV = TotalSum(Sign(close - close[1]) * volume);

def OBVM = MovingAverage(averageType, OBV, length);

def Signal = MovingAverage(averageType, OBVM, signalLength);

def price = close ;

def up = OBVM > Signal and Signal < OBVM ;

def dn = OBVM < Signal and Signal > OBVM ;

def neutral = between(close,min(OBVM,SIGNAL),max(SIGNAL,OBVM));

def x = CompoundValue(1,

if x[1]>=0 and (dn[1] or up[1]==0) and up

then 1

else if x[1]>=1 and (up or !dn)

then x[1]+1

else 0, 1);

def y = CompoundValue(1,

if y[1]<=0 and (up[1] or dn[1]==0) and dn

then 1

else if y[1]>=1 and (dn or !up)

then y[1]+1

else 0, 1);

def uparrow = if showarrows and x == 1 and up then 1 else 0;

#uparrow.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

#uparrow.SetLineWeight(1);

#uparrow.SetDefaultColor(Color.yellow);

def dnarrow = if showarrows and y == 1 and dn then 1 else 0;

#dnarrow.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

#dnarrow.SetLineWeight(1);

#dnarrow.SetDefaultColor(Color.white);

###

input length2 = 14;

input colorNormLength = 14;

assert(length2 > 0, "'length' must be positive: " + length2);

def ROC = if price[length2] != 0 then (price / price[length2] - 1) * 100 else 0;

def ZeroLine = 0;

#ROC.DefineColor("Highest", Color.YELLOW);

#ROC.DefineColor("Lowest", Color.LIGHT_RED);

#ROC.AssignNormGradientColor(colorNormLength, ROC.color("Lowest"), ROC.color("Highest"));

#ZeroLine.SetDefaultColor(GetColor(5));

def highestROC = HighestAll(ROC);

def lowestROC = LowestAll(ROC);

def midPtHighestROC = highestROC/2;

def midPtLowestROC = lowestROC/2;

#highestROC.setLineWeight(3);

#lowestROC.setLineWeight(3);

#highestROC.setDefaultColor(Color.Red);

#lowestROC.setDefaultColor(Color.Green);

#midPtHighestROC.setLineWeight(1);

#midPtLowestROC.setLineWeight(1);

#midPtHighestROC.setStyle(Curve.Short_Dash);

#midPtLowestROC.setStyle(Curve.Short_Dash);

#midPtHighestROC.setDefaultColor(Color.light_red);

#midPtLowestROC.setDefaultColor(Color.light_green);

def extremeHigh = ROC < HighestROC and ROC >= midPtHighestROC;

def extremeLow = ROC > LowestROC and ROC <= midPtLowestROC;

def ROCUpSignal = extremeLow and (ROC > ROC[1]);

def ROCDownSignal = extremeHigh and (ROC < ROC[1]);

plot bullSignal = if UpArrow and ROC > ZeroLine and ZeroLine < ROC then UpArrow else double.nan;

plot bearSignal = if DnArrow and ROC < ZeroLine and ZeroLine > ROC then DnArrow else double.nan;

bullSignal.setPaintingStrategy(PaintingStrategy.Arrow_Up);

bullSignal.setDefaultColor(Color.Green);

bullSignal.setLineWeight(3);

bearSignal.setPaintingStrategy(PaintingStrategy.Arrow_Down);

bearSignal.setDefaultColor(Color.Red);

bearSignal.setLineWeight(3);

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Custom OnBalanceVolume (OBV) Indicator for ThinkorSwim | Indicators | 19 | |

|

|

Repaints RSI, OBV, MACD, STOCH, CCI, or MFI Divergence For ThinkOrSwim | Indicators | 30 | |

| D | RSI with On Balance Volume OBV For ThinkorSwim? | Indicators | 8 |

Similar threads

-

-

Repaints RSI, OBV, MACD, STOCH, CCI, or MFI Divergence For ThinkOrSwim

- Started by samer800

- Replies: 30

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

-

Repaints RSI, OBV, MACD, STOCH, CCI, or MFI Divergence For ThinkOrSwim

- Started by samer800

- Replies: 30

-

Similar threads

-

-

Repaints RSI, OBV, MACD, STOCH, CCI, or MFI Divergence For ThinkOrSwim

- Started by samer800

- Replies: 30

-

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/