An inside day occurs when the stock trades within the range of the previous day high and low. Combining with Narrow Range 4 (NR4) will provide a high probability of trading the breakout or breakdown of the inside day bar.

Identify Inside Day:

Identify NR4:

So instead of just looking for inside day candlestick, we're now looking for an inside day with a range that is smaller than the 3 previous bars.

Now that you have the indicator and scanner on your ThinkorSwim, here is the guide on how to trade this particular inside day candlestick that includes the NR4 rules.

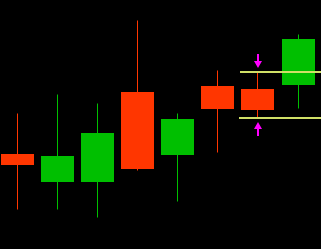

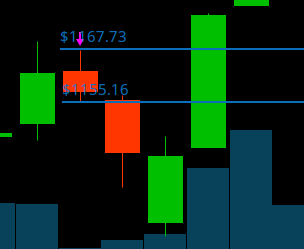

The above screenshot is $BABA 6m 1D timeframe with 2 inside days.

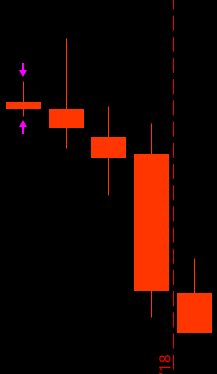

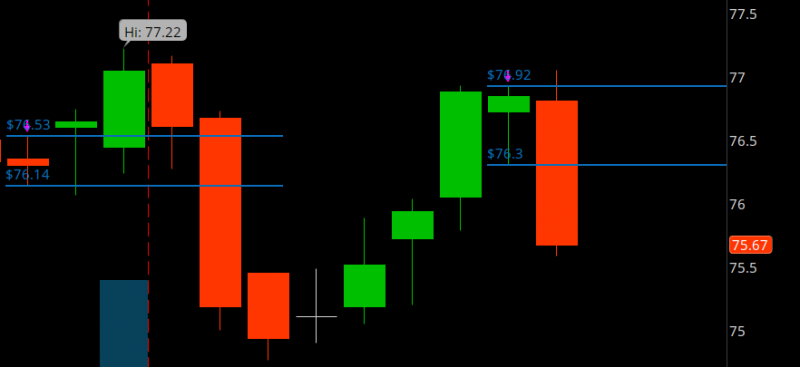

The strategy for trading this is fairly simple. You plot the high and low of the Inside Day bar. Something like this:

You can initiate a long position if the candlestick breaks above the high of the Inside Day bar or short the stock if the candlestick breaks below the low of the Inside Day bar.

That is how I would personally trade Inside Day + NR4.

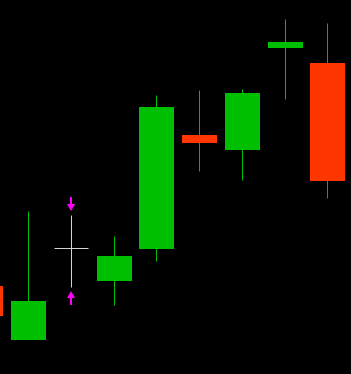

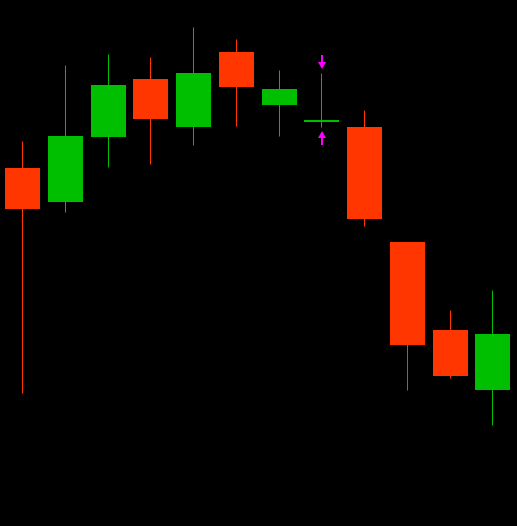

A few more examples:

Good luck with trading

Credits:

Identify Inside Day:

- When the bar is within the high and low of its previous day.

Identify NR4:

- Made up of 4 bars

- Most recent candlestick will have a range that is smaller than the 3 previous bars.

So instead of just looking for inside day candlestick, we're now looking for an inside day with a range that is smaller than the 3 previous bars.

thinkScript Code

Rich (BB code):

def lowVol = (VolatilityStdDev(6) / VolatilityStdDev(100)) < 0.5;

def insideDay = high < high[1] and low > low[1];

def range = high - low;

def NR4 = range < Lowest(range[1], 3);

plot signal = lowVol and insideDay and NR4;

plot signal2 = lowVol and insideDay and NR4;

signal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

signal.SetDefaultColor(Color.MAGENTA);

signal.SetLineWeight(1);

signal2.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

signal2.SetDefaultColor(Color.MAGENTA);

signal2.SetLineWeight(1);Inside Day + NR4 Scanner

Rich (BB code):

def lowVol = (VolatilityStdDev(6) / VolatilityStdDev(100)) < 0.5;

def insideDay = high < high[1] and low > low[1];

def range = high - low;

def NR4 = range < Lowest(range[1], 3);

def s = lowVol and insideDay and NR4;

plot signal = s within 1 bars;Now that you have the indicator and scanner on your ThinkorSwim, here is the guide on how to trade this particular inside day candlestick that includes the NR4 rules.

Inside Day and Narrow Range 4 Strategy

After you add the indicator, it will plot arrows pointing at any inside days. Here is an example.The above screenshot is $BABA 6m 1D timeframe with 2 inside days.

The strategy for trading this is fairly simple. You plot the high and low of the Inside Day bar. Something like this:

You can initiate a long position if the candlestick breaks above the high of the Inside Day bar or short the stock if the candlestick breaks below the low of the Inside Day bar.

- For long, stop loss would be the low of the Inside Day bar.

- For short, stop loss would be the high of the Inside Day bar.

That is how I would personally trade Inside Day + NR4.

A few more examples:

Good luck with trading

Credits:

- Robert for making the indicator and scanner.

- @TrueBubbleHead and @pierhk for the intro to Inside Day and Double Inside Day.

Last edited: