Tiredoflosing

Member

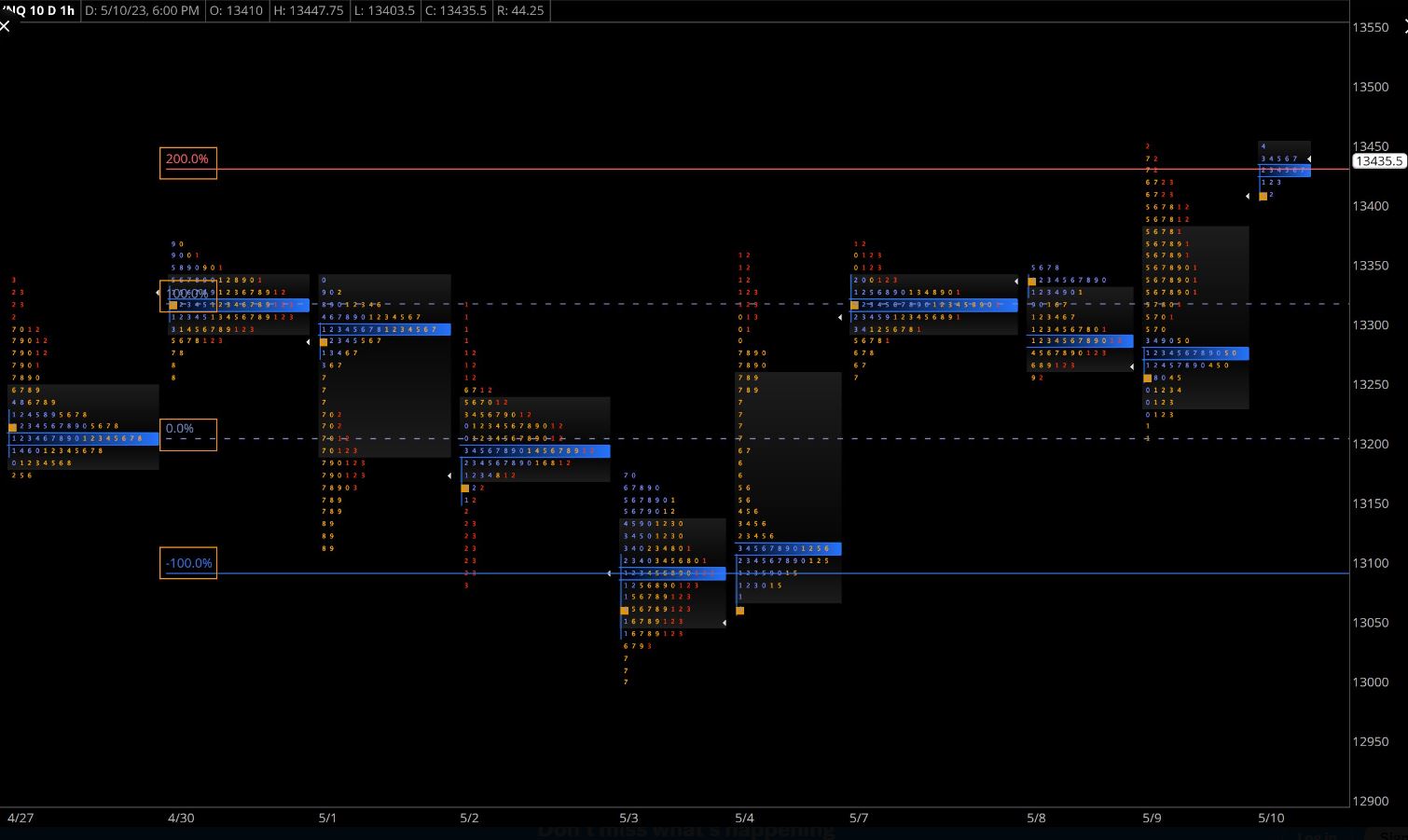

NextSignal's Market Volume Profile For ThinkOrSwim

Per @itsjt562 request

Per @itsjt562 request

This is a great script and a unique way of looking at volume profile. Highly recommend more people check it out. The POCExt lines are simply extensions of the POC and TPO_POC lines for the 'next' set of candles. I actually hide the POC and TPO_POC lines and ONLY use the EXT lines...but that's just me.

Ruby:

plot zero = 0;

zero.setdefaultcolor(color.black);

addlabel(yes," POC ",createcolor(100,0,255));

input pricePerRowHeightMode = {default TICKSIZE, AUTOMATIC};

input timePerProfile = {default Bar, CHART};

def onExpansion = no;

def period;

switch (timePerProfile) {

case CHART:

period = 0;

case Bar:

period = BarNumber() - 1;}

rec count = if period != period[1] then (count[1] + period - period[1]) % 20 else count[1];

def cond = count < count[1] + period - period[1];

def height;

switch (pricePerRowHeightMode) {

case AUTOMATIC:

height = PricePerRow.AUTOMATIC;

case TICKSIZE:

height = PricePerRow.TICKSIZE;}

profile vol = VolumeProfile("startNewProfile" = cond, "onExpansion" = onExpansion, "numberOfProfiles" = 1000, "pricePerRow" = height, "value area percent" = 68);

def con = CompoundValue(1, onExpansion, no);

def pc = if IsNaN(vol.GetPointOfControl()) and con then pc[1] else vol.GetPointOfControl();

def plotsDomain = IsNaN(close) == onExpansion;

vol.Show(CreateColor(40,60,80));

plot POC = if plotsDomain then pc else Double.NaN;

POC.setpaintingstrategy(paintingstrategy.horizontal);

POC.setdefaultcolor(createcolor(100,0,255));

POC.setlineweight(3);

POC.hidebubble();

POC.hidetitle();

profile tpo = timeProfile("startNewProfile" = cond, "onExpansion" = onExpansion, "numberOfProfiles" = 1000, "pricePerRow" = height, "value area percent" = 68);

def tpoPC = if IsNaN(tpo.getPointOfControl()) and con then tpoPC[1] else tpo.getPointOfControl();

plot tpoPOC = if plotsDomain then tpoPC else Double.NaN;

tpoPOC.setpaintingstrategy(paintingstrategy.horizontal);

tpoPOC.setdefaultcolor(createcolor(100,0,255));

tpoPOC.setlineweight(3);

tpoPOC.hidebubble();

tpoPOC.hidetitle();

### POC extensions

def y= if !IsNaN(pc) then pc else y[1];

plot vpocext = y[20];

vpocext.SetDefaultColor(CreateColor(100,0,255));

vpocext.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

vpocext.SetStyle(Curve.SHORT_DASH);

vpocext.HideBubble();

vpocext.HideTitle();

def x = if !IsNaN(tpoPC) then tpopc else x[1];

plot tpoext = x[20];

tpoext.SetDefaultColor(CreateColor(100,0,255));

tpoext.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

tpoext.SetStyle(Curve.SHORT_DASH);

tpoext.HideBubble();

tpoext.HideTitle();

Last edited by a moderator: