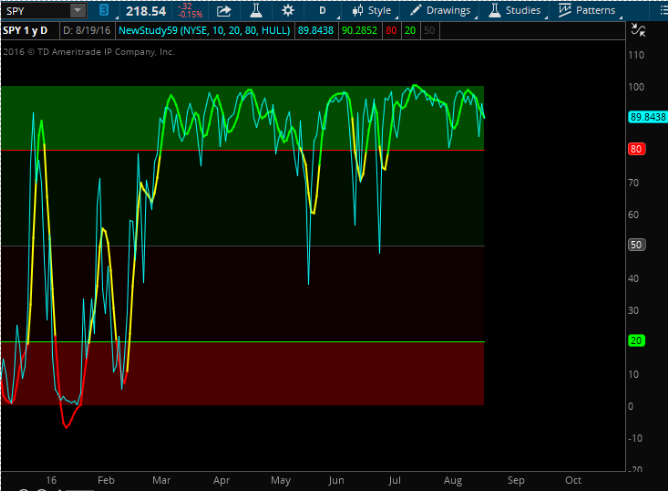

A leading indicator that compares stocks hitting new highs and new lows within the stock market. The Chart below is of the Market Meltdown in January, 2016. It's hard to be Bearish on the Market as a whole when new highs are breaking out!

Shared link https://tos.mx/VhAvab

Code:

#This indicator uses the Index New highs and Index New lows

#to help gauge overall Market sentiment. It's a leading indicator.

# Index New High - New Low Indicator

# Mobius v2018-March from JQ's OneNote

#After loading, pull it to the upper chart!

declare lower;

input Symb = {default "NYSE", "NASDQ", "AMEX", "ARCA", "ETF"};

input length = 10;

input OverSold = 20;

input OverBought = 80;

Input AvgType = AverageType.Hull;

def agg = AggregationPeriod.Day;

def NYSEH = close(Symbol = "$NYHGH", period = agg);

def NYSEL = close(Symbol = "$NYLOW", period = agg);

def NASDQH = close(Symbol = "$NAHGH", period = agg);

def NASDQL = close(Symbol = "$NALOW", period = agg);

def AMEXH = close(Symbol = "$AMHGH", period = agg);

def AMEXL = close(Symbol = "$AMLOW", period = agg);

def ARCAH = close(Symbol = "$ARHGH", period = agg);

def ARCAL = close(Symbol = "$ARLOW", period = agg);

def ETFH = close(Symbol = "$ETFHGH", period = agg);

def ETFL = close(Symbol = "$ETFLOW", period = agg);

def P;

Switch (Symb){

case "NYSE":

P = NYSEH / (NYSEH + NYSEL) * 100;

case "NASDQ":

P = NASDQH / (NASDQH + NASDQL) * 100;

case "AMEX":

P = AMEXH / (AMEXH + AMEXL) * 100;

case "ARCA":

P = ARCAH / (ARCAH + ARCAL) * 100;

case "ETF":

P = ETFH / (ETFH + ETFL) * 100;

}

def price = if isNaN(P) then price[1] else P;

plot data = if isNaN(close) then double.nan else price;

data.EnableApproximation();

data.SetDefaultColor(Color.Cyan);

plot avg = MovingAverage(AvgType, data, length);

avg.EnableApproximation();

avg.AssignValueColor(if between(avg, OverSold, OverBought)

then Color.yellow

else if avg >= OverBought

then Color.Green

else Color.Red);

avg.SetLineWeight(2);

plot OB = if isNaN(close) then double.nan else OverBought;

OB.SetDefaultColor(Color.Red);

plot OS = if isNaN(close) then double.nan else OverSold;

OS.SetDefaultColor(Color.Green);

plot neutral = if isNaN(close) then double.nan else 50;

neutral.SetdefaultColor(Color.Dark_Gray);

addCloud(0, OS, CreateColor(250,0,0), CreateColor(250,0,0));

addCloud(OS, neutral, createColor(50,0,0), createColor(50,0,0));

addCloud(neutral, OB, createColor(0,50,0), createColor(0,50,0));

addCloud(OB, 100, CreateColor(0,250,0), createColor(0,250,0));

# End High - Low IndexShared link https://tos.mx/VhAvab

Attachments

Last edited by a moderator: