Hello all,

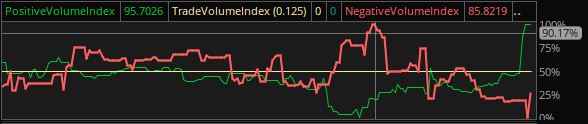

I would like to scan for the negative volume index trendline being above the positive volume index trendline (as shown in the below image where the cursor crosshair is):

The intuitive way to do this would be to simply scan for the NegativeVolumeIndex value being higher than the PositiveVolumeIndex value but that won't work apparently, because even though the negative trendline is charting above the positive trendline, the actual value for the negative trendline is smaller (85.8219 vs. 95.7026). I don't understand how the math is working to make that the case*, so I don't understand how to make this scan work.

Does anyone know how this could be done?

*Edit: On further thought I guess the reason (that the absolute value can be lower while the trendline can be higher than the other index's trendline) is that these index trendlines are showing relative changes over time instead of absolute values.

I would like to scan for the negative volume index trendline being above the positive volume index trendline (as shown in the below image where the cursor crosshair is):

The intuitive way to do this would be to simply scan for the NegativeVolumeIndex value being higher than the PositiveVolumeIndex value but that won't work apparently, because even though the negative trendline is charting above the positive trendline, the actual value for the negative trendline is smaller (85.8219 vs. 95.7026). I don't understand how the math is working to make that the case*, so I don't understand how to make this scan work.

Does anyone know how this could be done?

*Edit: On further thought I guess the reason (that the absolute value can be lower while the trendline can be higher than the other index's trendline) is that these index trendlines are showing relative changes over time instead of absolute values.

Last edited: