You should upgrade or use an alternative browser.

Repaints Multi-timeframe (MTF) Moving Average Indicator for ThinkorSwim

- Thread starter BenTen

- Start date

krahsloop

Member

@krahsloop I don't use moving averages but I have seen discussions that have stated the same thing.Hi, my apologies if this is a stupid question.... What is the practical difference between multi-time frame moving averages, and moving averages of varying lengths? What I mean is, If you're on the 1-minute chart and want to see the average of the last 30 minutes, wouldn't a 30ma be the same thing as an MTF with a 30-minute time frame applied? I'm trying to understand the use here, because I have a hunch that MTF is in fact very useful but am having a hard time grasping the concept. Thanks to all for this awesome community.

I am hoping that someone makes a tutorial thread comparing the MTF MA with the longer length MA, it would be a great contribution to the community.

I have issues w/ MTF indicators. Novice traders don't understand why they can't make entry/exit on an MTF:

It would be awesome to give them other options...

@wcsharron @tradegeek After a bit of thought process, I think you are better off with labels than Plot.

check out labels study code below. This seems to work our regardless of Time or Tick charts.

Code:# # SM_MovingAverageLabels # # version 1.2 # declare on_volume; #Default moving average values: #SIMP 3 Close.DAY #SIMP 8 Close.DAY #SIMP 20 Close.DAY #SIMP 50 Close.DAY #SIMP 200 Close.DAY input aP = AggregationPeriod.DAY; input MA_1_length = 3; #simple input MA_2_length = 8; #simple input MA_3_length = 20; #simple input MA_4_length = 50; #simple input MA_5_length = 200; #simple def MA_1_closeType = close(period = aP); def MA_2_closeType = close(period = aP); def MA_3_closeType = close(period = aP); def MA_4_closeType = close(period = aP); def MA_5_closeType = close(period = aP); def MA_1_avg = round(Average(MA_1_closeType, MA_1_length),2); def MA_2_avg = round(Average(MA_2_closeType, MA_2_length),2); def MA_3_avg = round(Average(MA_3_closeType, MA_3_length),2); def MA_4_avg = round(Average(MA_4_closeType, MA_4_length),2); def MA_5_avg = round(Average(MA_5_closeType, MA_5_length),2); def currentPrice = close; AddLabel(1, "SMA" + " ", Color.YELLOW); def MA_1_above = if currentPrice > MA_1_avg then 1 else 0; def MA_1_below = if currentPrice <= MA_1_avg then 1 else 0; AddLabel(MA_1_above, MA_1_length + ": " + MA_1_avg + " ", Color.GREEN); AddLabel(MA_1_below, MA_1_length + ": " + MA_1_avg + " ", Color.RED); def MA_2_above = if currentPrice > MA_2_avg then 1 else 0; def MA_2_below = if currentPrice <= MA_2_avg then 1 else 0; AddLabel(MA_2_above, MA_2_length + ": " + MA_2_avg + " ", Color.GREEN); AddLabel(MA_2_below, MA_2_length + ": " + MA_2_avg + " ", Color.RED); def MA_3_above = if currentPrice > MA_3_avg then 1 else 0; def MA_3_below = if currentPrice <= MA_3_avg then 1 else 0; AddLabel(MA_3_above, MA_3_length + ": " + MA_3_avg + " ", Color.GREEN); AddLabel(MA_3_below, MA_3_length + ": " + MA_3_avg + " ", Color.RED); def MA_4_above = if currentPrice > MA_4_avg then 1 else 0; def MA_4_below = if currentPrice <= MA_4_avg then 1 else 0; AddLabel(MA_4_above, MA_4_length + ": " + MA_4_avg + " ", Color.GREEN); AddLabel(MA_4_below, MA_4_length + ": " + MA_4_avg + " ", Color.RED); def MA_5_above = if currentPrice > MA_5_avg then 1 else 0; def MA_5_below = if currentPrice <= MA_5_avg then 1 else 0; AddLabel(MA_4_above, MA_5_length + ": " + MA_5_avg + " ", Color.GREEN); AddLabel(MA_4_below, MA_5_length + ": " + MA_5_avg + " ", Color.RED); #EXPO 3 Close #EXPO 8 Close #EXPO 20 Close #EXPO 50 Close #EXPO 200 Close input EMA_1_length = 3; #exponential input EMA_2_length = 8; #exponential input EMA_3_length = 20; #exponential input EMA_4_length = 50; #exponential input EMA_5_length = 200; #exponential def EMA_1_closeType = close; def EMA_2_closeType = close; def EMA_3_closeType = close; def EMA_4_closeType = close; def EMA_5_closeType = close; def EMA_1_avg = round(ExpAverage(EMA_1_closeType, EMA_1_length),2); def EMA_2_avg = round(ExpAverage(EMA_2_closeType, EMA_2_length),2); def EMA_3_avg = round(ExpAverage(EMA_3_closeType, EMA_3_length),2); def EMA_4_avg = round(ExpAverage(EMA_4_closeType, EMA_4_length),2); def EMA_5_avg = round(ExpAverage(EMA_5_closeType, EMA_5_length),2); AddLabel(1, "EMA" + " ", Color.YELLOW); def EMA_1_above = if currentPrice > EMA_1_avg then 1 else 0; def EMA_1_below = if currentPrice <= EMA_1_avg then 1 else 0; AddLabel(EMA_1_above, EMA_1_length + ": " + EMA_1_avg + " ", Color.GREEN); AddLabel(EMA_1_below, EMA_1_length + ": " + EMA_1_avg + " ", Color.RED); def EMA_2_above = if currentPrice > EMA_2_avg then 1 else 0; def EMA_2_below = if currentPrice <= EMA_2_avg then 1 else 0; AddLabel(EMA_2_above, EMA_2_length + ": " + EMA_2_avg + " ", Color.GREEN); AddLabel(EMA_2_below, EMA_2_length + ": " + EMA_2_avg + " ", Color.RED); def EMA_3_above = if currentPrice > EMA_3_avg then 1 else 0; def EMA_3_below = if currentPrice <= EMA_3_avg then 1 else 0; AddLabel(EMA_3_above, EMA_3_length + ": " + EMA_3_avg + " ", Color.GREEN); AddLabel(EMA_3_below, EMA_3_length + ": " + EMA_3_avg + " ", Color.RED); def EMA_4_above = if currentPrice > EMA_4_avg then 1 else 0; def EMA_4_below = if currentPrice <= EMA_4_avg then 1 else 0; AddLabel(EMA_4_above, EMA_4_length + ": " + EMA_4_avg + " ", Color.GREEN); AddLabel(EMA_4_below, EMA_4_length + ": " + EMA_4_avg + " ", Color.RED); def EMA_5_above = if currentPrice > EMA_5_avg then 1 else 0; def EMA_5_below = if currentPrice <= EMA_5_avg then 1 else 0; AddLabel(EMA_4_above, EMA_5_length + ": " + EMA_5_avg + " ", Color.GREEN); AddLabel(EMA_4_below, EMA_5_length + ": " + EMA_5_avg + " ", Color.RED);

**Note: This code has 5 of SMA and EMA labels defined and all SMA are fixed to AggregatePeriod.Day where as EMA are current candle.

-Surya

Hi,

I tired to edit your code, SMA to EMA for aggregationperiod.day; However, it keeps showing SMA values. Anything wrong I'm doing. Here is the code. Please help fix the issue. Thank you!

# Expo_MovingAverageLabels

#Default exponential moving average values:

#EXPO 8 Close.DAY

#EXPO 21 Close.DAY

#EXPO 50 Close.DAY

#EXPO 100 Close.DAY

#EXPO 200 Close.DAY

input aP = AggregationPeriod.DAY;

input EMA_1_length = 8; #exponential

input eMA_2_length = 21; #exponential

input eMA_3_length = 50; #exponential

input eMA_4_length = 100; #exponential

input eMA_5_length = 200; #exponential

def eMA_1_closeType = close(period = aP);

def eMA_2_closeType = close(period = aP);

def eMA_3_closeType = close(period = aP);

def eMA_4_closeType = close(period = aP);

def eMA_5_closeType = close(period = aP);

def eMA_1_avg = Round(Average(eMA_1_closeType, eMA_1_length), 2);

def eMA_2_avg = Round(Average(eMA_2_closeType, eMA_2_length), 2);

def eMA_3_avg = Round(Average(eMA_3_closeType, eMA_3_length), 2);

def eMA_4_avg = Round(Average(eMA_4_closeType, eMA_4_length), 2);

def eMA_5_avg = Round(Average(eMA_5_closeType, eMA_5_length), 2);

def currentPrice = close;

AddLabel(1, "EMA" + " ", Color.YELLOW);

def eMA_1_above = if currentPrice > eMA_1_avg then 1 else 0;

def eMA_1_below = if currentPrice <= eMA_1_avg then 1 else 0;

AddLabel(eMA_1_above, eMA_1_length + ": " + eMA_1_avg + " ", Color.GREEN);

AddLabel(eMA_1_below, eMA_1_length + ": " + eMA_1_avg + " ", Color.RED);

def eMA_2_above = if currentPrice > eMA_2_avg then 1 else 0;

def eMA_2_below = if currentPrice <= eMA_2_avg then 1 else 0;

AddLabel(eMA_2_above, eMA_2_length + ": " + eMA_2_avg + " ", Color.GREEN);

AddLabel(eMA_2_below, eMA_2_length + ": " + eMA_2_avg + " ", Color.RED);

def eMA_3_above = if currentPrice > eMA_3_avg then 1 else 0;

def eMA_3_below = if currentPrice <= eMA_3_avg then 1 else 0;

AddLabel(eMA_3_above, eMA_3_length + ": " + eMA_3_avg + " ", Color.GREEN);

AddLabel(eMA_3_below, eMA_3_length + ": " + eMA_3_avg + " ", Color.RED);

def eMA_4_above = if currentPrice > eMA_4_avg then 1 else 0;

def eMA_4_below = if currentPrice <= eMA_4_avg then 1 else 0;

AddLabel(eMA_4_above, eMA_4_length + ": " + eMA_4_avg + " ", Color.GREEN);

AddLabel(eMA_4_below, eMA_4_length + ": " + eMA_4_avg + " ", Color.RED);

def eMA_5_above = if currentPrice > eMA_5_avg then 1 else 0;

def eMA_5_below = if currentPrice <= eMA_5_avg then 1 else 0;

AddLabel(eMA_4_above, eMA_5_length + ": " + eMA_5_avg + " ", Color.GREEN);

AddLabel(eMA_4_below, eMA_5_length + ": " + eMA_5_avg + " ", Color.RED);

ApeX Predator

Well-known member

Don't bother with the code edit here, got to the following, that give you a choice of MA selection and a HigherFrame, should you chose to use for lower frame charts.Hi,

I tired to edit your code, SMA to EMA for aggregationperiod.day; However, it keeps showing SMA values. Anything wrong I'm doing. Here is the code. Please help fix the issue. Thank you!

https://usethinkscript.com/threads/custom-moving-average-for-thinkorswim.8269/

In your input section of code : a #exponential does not state what type of average TOS calculates!Hi,

I tired to edit your code, SMA to EMA for aggregationperiod.day; However, it keeps showing SMA values. Anything wrong I'm doing. Here is the code. Please help fix the issue. Thank you!

# Expo_MovingAverageLabels

#Default exponential moving average values:

#EXPO 8 Close.DAY

#EXPO 21 Close.DAY

#EXPO 50 Close.DAY

#EXPO 100 Close.DAY

#EXPO 200 Close.DAY

input aP = AggregationPeriod.DAY;

input EMA_1_length = 8; #exponential

input eMA_2_length = 21; #exponential

input eMA_3_length = 50; #exponential

input eMA_4_length = 100; #exponential

input eMA_5_length = 200; #exponential

def eMA_1_closeType = close(period = aP);

def eMA_2_closeType = close(period = aP);

def eMA_3_closeType = close(period = aP);

def eMA_4_closeType = close(period = aP);

def eMA_5_closeType = close(period = aP);

def eMA_1_avg = Round(Average(eMA_1_closeType, eMA_1_length), 2);

def eMA_2_avg = Round(Average(eMA_2_closeType, eMA_2_length), 2);

def eMA_3_avg = Round(Average(eMA_3_closeType, eMA_3_length), 2);

def eMA_4_avg = Round(Average(eMA_4_closeType, eMA_4_length), 2);

def eMA_5_avg = Round(Average(eMA_5_closeType, eMA_5_length), 2);

def currentPrice = close;

AddLabel(1, "EMA" + " ", Color.YELLOW);

def eMA_1_above = if currentPrice > eMA_1_avg then 1 else 0;

def eMA_1_below = if currentPrice <= eMA_1_avg then 1 else 0;

AddLabel(eMA_1_above, eMA_1_length + ": " + eMA_1_avg + " ", Color.GREEN);

AddLabel(eMA_1_below, eMA_1_length + ": " + eMA_1_avg + " ", Color.RED);

def eMA_2_above = if currentPrice > eMA_2_avg then 1 else 0;

def eMA_2_below = if currentPrice <= eMA_2_avg then 1 else 0;

AddLabel(eMA_2_above, eMA_2_length + ": " + eMA_2_avg + " ", Color.GREEN);

AddLabel(eMA_2_below, eMA_2_length + ": " + eMA_2_avg + " ", Color.RED);

def eMA_3_above = if currentPrice > eMA_3_avg then 1 else 0;

def eMA_3_below = if currentPrice <= eMA_3_avg then 1 else 0;

AddLabel(eMA_3_above, eMA_3_length + ": " + eMA_3_avg + " ", Color.GREEN);

AddLabel(eMA_3_below, eMA_3_length + ": " + eMA_3_avg + " ", Color.RED);

def eMA_4_above = if currentPrice > eMA_4_avg then 1 else 0;

def eMA_4_below = if currentPrice <= eMA_4_avg then 1 else 0;

AddLabel(eMA_4_above, eMA_4_length + ": " + eMA_4_avg + " ", Color.GREEN);

AddLabel(eMA_4_below, eMA_4_length + ": " + eMA_4_avg + " ", Color.RED);

def eMA_5_above = if currentPrice > eMA_5_avg then 1 else 0;

def eMA_5_below = if currentPrice <= eMA_5_avg then 1 else 0;

AddLabel(eMA_4_above, eMA_5_length + ": " + eMA_5_avg + " ", Color.GREEN);

AddLabel(eMA_4_below, eMA_5_length + ": " + eMA_5_avg + " ", Color.RED);

look up AverageType

As for labels script for words will not change Simple to exponential average unless you use some type of if then statement

PennyFlipper101

New member

@BenTen Could you add bubbles to the MTF 20D average?If you want to display moving averages from higher timeframe such as the hourly or daily on your lower timeframe chart, this indicator will help you do that. It basically displays higher timeframe moving averages on your 5m, 15m, or 30m chart. Anything with a higher timeframe moving average will work.

Here I have the 20 Daily Exponential Moving Average on my 15 minute chart.

You have the option between EMA, SMA (simple moving average), Hull, Weighted, and Wilders.

thinkScript Code

Rich (BB code):# MTF Moving Average input Period = aggregationPeriod.HOUR; input AvgType = averageType.SIMPLE; input Length = 50; input priceclose = close; plot AVG = MovingAverage(AvgType, close(period = Period), Length); AVG.setdefaultcolor(color.yellow);

Shareable Link

https://tos.mx/5BpIqL

I'm unable to locate the original developer of this indicator. If you know who made this, please let me know.

Video Tutorial

JP782

Active member

#MTF MA

input price = FundamentalType.high;

input averageType = AverageType.simple;

input length = 9;

input HigherAggPeriod = AggregationPeriod.Day;

def chartAgg = GetAggregationPeriod();

plot MTF_MA = movingAverage(averageType, fundamental(price, period = HigherAggPeriod), length);

MTF_MA.setlineweight(2);

MTF_MA.SetDefaultColor(Color.orange);

ApeX Predator

Well-known member

When you are getting a Higher Frame MA(s) they are what they are, any smoothing they won't be the MA values, isn't it?Is there a way to smooth the lines out for this MTF MA??

JP782

Active member

i dunno its why i asked, i mean theyre accurate - my request is for aestheticsWhen you are getting a Higher Frame MA(s) they are what they are, any smoothing they won't be the MA values, isn't it?

ApeX Predator

Well-known member

Higher Frame MA values are calculated on close of the Higher Candle, Assuming your MA price = close. since the Chart frames are much smaller, they looks like steps, If you apply any kind of smoothing, then they are not the MA's as defined but they would be smoothed MA and the value will not match the defined MA length itself.i dunno its why i asked, i mean theyre accurate - my request is for aesthetics

Yoel Pablo

New member

But I can't achieve it, what are the conditions I need to achieve it. That when the 4 green dots are aligned they generate a sound alert and a signal arrow to buy on the Chart and the 4 red dots are aligned they generate a sound alert and a signal arrow to sell on the Chart...

...I'm sending you a screenshot and the code I'm working on so you have an idea of what I'm trying to accomplish, thanks in advance.

#MTF_MovingAverage_LowerStudy_Dots

#Caution: Anytime a higher timeframe row changes color between the white dots, the entire row between the white dots will change to the new color.

This will include dots that have previously plotted another color during that span between the white dots.

This could give you a misleading impression when viewing the lower timeframe chart.

# Original Inputs

input showchartbubbles = yes;

input show_white_dots = yes;

input timeFrame1 = AggregationPeriod.FIFTEEN_MIN;

input timeFrame2 = AggregationPeriod.THIRTY_MIN;

input timeFrame3 = AggregationPeriod.HOUR;

input timeFrame4 = AggregationPeriod.FOUR_HOURS;

input maLength1 = 1;

input maType1 = AverageType.EXPONENTIAL;

input maLength2 = 8;

input maType2 = AverageType.EXPONENTIAL;

#---------- Original MTF Section

def ma1 = MovingAverage(maType1, close(period = timeFrame1), maLength1);

def ma2 = MovingAverage(maType2, close(period = timeFrame1), maLength2);

def ma3 = MovingAverage(maType1, close(period = timeFrame2), maLength1);

def ma4 = MovingAverage(maType2, close(period = timeFrame2), maLength2);

def ma5 = MovingAverage(maType1, close(period = timeFrame3), maLength1);

def ma6 = MovingAverage(maType2, close(period = timeFrame3), maLength2);

def ma7 = MovingAverage(maType1, close(period = timeFrame3), maLength1);

def ma8 = MovingAverage(maType2, close(period = timeFrame3), maLength2);

#White Dots plotted, marking the last Higher Timeframe bar on the Lower Timeframe

input begin = 0930;

def minutes1 = timeFrame1 / 60000;

def minutes2 = timeFrame2 / 60000;

def minutes3 = timeFrame3 / 60000;

def minutes4 = timeFrame4 / 60000;

def barSeq = if SecondsTillTime(begin) == 0 and

SecondsFromTime(begin) == 0

then 0

else barSeq[1] + 1;

def bar = barSeq;

def bar1 = if (bar) % (minutes1 / (GetAggregationPeriod() / 60000)) == 0 then bar1[1] + 1 else bar1[1];

def bar1ext = if !IsNaN(close) and IsNaN(close[-1]) then bar1 else Double.NaN;

def bar2 = if (bar) % (minutes2 / (GetAggregationPeriod() / 60000)) == 0 then bar2[1] + 1 else bar2[1];

def bar2ext = if !IsNaN(close) and IsNaN(close[-1]) then bar2 else Double.NaN;

def bar3 = if (bar) % (minutes3 / (GetAggregationPeriod() / 60000)) == 0 then bar3[1] + 1 else bar3[1];

def bar3ext = if !IsNaN(close) and IsNaN(close[-1]) then bar3 else Double.NaN;

def bar4 = if (bar) % (minutes4 / (GetAggregationPeriod() / 60000)) == 0 then bar4[1] + 1 else bar4[1];

def bar4ext = if !IsNaN(close) and IsNaN(close[-1]) then bar4 else Double.NaN;

#---------- Signals Section

def allGreenDots = ma1 > ma2 and ma3 > ma4 and ma5 > ma6 and ma7 > ma8;

def allRedDots = ma1 <= ma2 and ma3 <= ma4 and ma5 <= ma6 and ma7 <= ma8;

#---------- Plots Section

plot longSignal = allGreenDots;

longSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

longSignal.SetDefaultColor(Color.CYAN);

longSignal.SetLineWeight(3);

plot shortSignal = allRedDots;

shortSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

shortSignal.SetDefaultColor(Color.MAGENTA);

shortSignal.SetLineWeight(3);

#---------- Alerts Section

#Alert(longSignal, "Long Signal", Alert.BAR, Sound.RING);

#Alert(shortSignal, "Short Signal", Alert.BAR, Sound.RING);ApeX Predator

Well-known member

#MTF_MovingAverage_LowerStudy_Dots

#Caution: Anytime a higher timeframe row changes color between the white dots, the entire row between the white dots will change to the new color.

#This will include dots that have previously plotted another color during that span between the white dots.

#This could give you a misleading impression when viewing the lower timeframe chart.

# Original Inputs

input showchartbubbles = yes;

input show_white_dots = yes;

input timeFrame1 = AggregationPeriod.FIFTEEN_MIN;

input timeFrame2 = AggregationPeriod.THIRTY_MIN;

input timeFrame3 = AggregationPeriod.HOUR;

input timeFrame4 = AggregationPeriod.FOUR_HOURS;

input maLength1 = 1;

input maType1 = AverageType.EXPONENTIAL;

input maLength2 = 8;

input maType2 = AverageType.EXPONENTIAL;

#---------- Original MTF Section

def ma1 = MovingAverage(maType1, close(period = timeFrame1), maLength1);

def ma2 = MovingAverage(maType2, close(period = timeFrame1), maLength2);

def ma3 = MovingAverage(maType1, close(period = timeFrame2), maLength1);

def ma4 = MovingAverage(maType2, close(period = timeFrame2), maLength2);

def ma5 = MovingAverage(maType1, close(period = timeFrame3), maLength1);

def ma6 = MovingAverage(maType2, close(period = timeFrame3), maLength2);

def ma7 = MovingAverage(maType1, close(period = timeFrame3), maLength1);

def ma8 = MovingAverage(maType2, close(period = timeFrame3), maLength2);

#White Dots plotted, marking the last Higher Timeframe bar on the Lower Timeframe

input begin = 0930;

def minutes1 = timeFrame1 / 60000;

def minutes2 = timeFrame2 / 60000;

def minutes3 = timeFrame3 / 60000;

def minutes4 = timeFrame4 / 60000;

def barSeq = if SecondsTillTime(begin) == 0 and SecondsFromTime(begin) == 0 then 0 else barSeq[1] + 1;

def bar = barSeq;

def bar1 = if (bar) % (minutes1 / (GetAggregationPeriod() / 60000)) == 0 then bar1[1] + 1 else bar1[1];

def bar1ext = if !IsNaN(close) and IsNaN(close[-1]) then bar1 else Double.NaN;

def bar2 = if (bar) % (minutes2 / (GetAggregationPeriod() / 60000)) == 0 then bar2[1] + 1 else bar2[1];

def bar2ext = if !IsNaN(close) and IsNaN(close[-1]) then bar2 else Double.NaN;

def bar3 = if (bar) % (minutes3 / (GetAggregationPeriod() / 60000)) == 0 then bar3[1] + 1 else bar3[1];

def bar3ext = if !IsNaN(close) and IsNaN(close[-1]) then bar3 else Double.NaN;

def bar4 = if (bar) % (minutes4 / (GetAggregationPeriod() / 60000)) == 0 then bar4[1] + 1 else bar4[1];

def bar4ext = if !IsNaN(close) and IsNaN(close[-1]) then bar4 else Double.NaN;

#---------- Signals Section

def allGreenDots = ma1 > ma2 and ma3 > ma4 and ma5 > ma6 and ma7 > ma8;

def allRedDots = ma1 <= ma2 and ma3 <= ma4 and ma5 <= ma6 and ma7 <= ma8;

#---------- Plots Section

plot longSignal = if allGreenDots and !allGreenDots[1] then low else Double.NaN;

longSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

longSignal.SetDefaultColor(Color.CYAN);

longSignal.SetLineWeight(3);

plot shortSignal = if allRedDots and !allRedDots[1] then high else Double.NaN;

shortSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

shortSignal.SetDefaultColor(Color.MAGENTA);

shortSignal.SetLineWeight(3);

#---------- Alerts Section

Alert(longSignal, "Long Signal", Alert.BAR, Sound.RING);

Alert(shortSignal, "Short Signal", Alert.BAR, Sound.DING);What does this line of code say?I really like this one, but wanted to use it on other time frames besides daily and allow different moving averages and display nonoverlapping bubbles (when the MA lines get close, the bubbles overlap). Note that SuryaKiranC and prolab also made a nice alternative version of Pensar's script for Daily charts in this same thread.

As has been noted by others here, one can put higher time frame MAs on a lower time frame simply by adjusting the numbers, e.g., a 120 period MA on a 5 minute chart is equivalent to the 10 period MA on an hourly chart, etc.

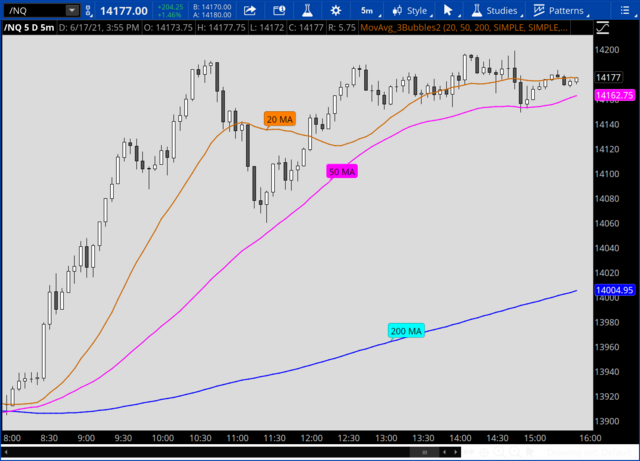

Hopefully a chart and the new code are shown below.

Code:# Modification of Pensar’s Daily Simple Moving Averages with Identifying Bubbles # Can be used on any time frame & the MAs can be different types # MovAvg_3Bubbles2 input avg_1 = 20; input avg_2 = 50; input avg_3 = 200; input avg_type1 = AverageType.SIMPLE; input avg_type2 = AverageType.SIMPLE; input avg_type3 = AverageType.SIMPLE; plot ma1 = MovingAverage(avg_type1,close,avg_1); ma1.SetDefaultColor(Color.DARK_ORANGE); ma1.SetLineWeight(2); plot ma2 = MovingAverage(avg_type2,close,avg_2); ma2.SetDefaultColor(Color.MAGENTA); ma2.SetLineWeight(2); plot ma3 = MovingAverage(avg_type3,close,avg_3); ma3.SetDefaultColor(Color.BLUE); ma3.SetLineWeight(2); #Bubbles input show_bubbles = yes; def x = !IsNaN(close[-50]) and IsNaN(close[-51]); def y = !IsNaN(close[-40]) and IsNaN(close[-41]); def z = !IsNaN(close[-30]) and IsNaN(close[-31]); AddChartBubble(show_bubbles and x, ma1, avg_1 + " MA", Color.DARK_ORANGE); AddChartBubble(show_bubbles and y, ma2, avg_2 + " MA", Color.MAGENTA); AddChartBubble(show_bubbles and z, ma3, avg_3 + " MA", Color.CYAN); #end code

def x = !IsNaN(close[-50]) and IsNaN(close[-51]);

def y = !IsNaN(close[-40]) and IsNaN(close[-41]);

def z = !IsNaN(close[-30]) and IsNaN(close[-31]);

The use of referencing bars back or bars future can be confusingWhat does this line of code say?

def x = !IsNaN(close[-50]) and IsNaN(close[-51]);

def y = !IsNaN(close[-40]) and IsNaN(close[-41]);

def z = !IsNaN(close[-30]) and IsNaN(close[-31]);

High[4] is the high from 4 bars ago, High[-4] is the high from 4 bars into the future. Bars that have not been yet traded. when viewing on a chart, those indicators will stop short of the right side of the chart by the negative numbers referenced. When viewed from the left side of the chart, your indicators will perform better than expected due to the use of foresight We all would like to now what the Market will do on Monday so that we could have traded it last Friday!

Thanks. What can I adjust the minus input to just 1 so it’s not a strain on my computer?The use of referencing bars back or bars future can be confusing

High[4] is the high from 4 bars ago, High[-4] is the high from 4 bars into the future. Bars that have not been yet traded. when viewing on a chart, those indicators will stop short of the right side of the chart by the negative numbers referenced. When viewed from the left side of the chart, your indicators will perform better than expected due to the use of foresight We all would like to now what the Market will do on Monday so that we could have traded it last Friday!

I have looked through the site to try and find this indicator or thinkscript, but have had no luck.

I am looking for a script that would plot the Daily EMAs on multiple time-frames, but instead of drawing the lines from the left, plot smaller lines on the right side of the chart, next to the price bar.

I draw these levels manually and adjust them as needed, but an automated process would be great! So if there is something in here like that, please point me in the right direction!

I tried to post a picture, but no sure how.

Thanks in advance!

I moved your post to this thread. There are 9 pages of discussion of MTF moving average. Plug&Play until you find one that fits your needs.Hello everyone,

I have looked through the site to try and find this indicator or thinkscript, but have had no luck.

I am looking for a script that would plot the Daily EMAs on multiple time-frames, but instead of drawing the lines from the left, plot smaller lines on the right side of the chart, next to the price bar.

I draw these levels manually and adjust them as needed, but an automated process would be great! So if there is something in here like that, please point me in the right direction!

I tried to post a picture, but no sure how.

Thanks in advance!

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Similar threads

-

-

Repaints Multi-TimeFrame (MTF) MACD Indicator for ThinkorSwim

- Started by horserider

- Replies: 92

-

-

Repaints Multi Time Frame MTF Squeeze PRO Labels for ThinkOrSwim

- Started by caseyjbrett

- Replies: 45

-

Repaints Multi Time Frame MTF Squeeze HISTOGRAM Colored Labels for ThinkOrSwim

- Started by caseyjbrett

- Replies: 25

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

-

Repaints Multi-TimeFrame (MTF) MACD Indicator for ThinkorSwim

- Started by horserider

- Replies: 92

-

-

Repaints Multi Time Frame MTF Squeeze PRO Labels for ThinkOrSwim

- Started by caseyjbrett

- Replies: 45

-

Repaints Multi Time Frame MTF Squeeze HISTOGRAM Colored Labels for ThinkOrSwim

- Started by caseyjbrett

- Replies: 25

Similar threads

-

-

Repaints Multi-TimeFrame (MTF) MACD Indicator for ThinkorSwim

- Started by horserider

- Replies: 92

-

-

Repaints Multi Time Frame MTF Squeeze PRO Labels for ThinkOrSwim

- Started by caseyjbrett

- Replies: 45

-

Repaints Multi Time Frame MTF Squeeze HISTOGRAM Colored Labels for ThinkOrSwim

- Started by caseyjbrett

- Replies: 25

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/