Hi guys! Found this great TTM_Squeeze replica by Mobius that I have successfully adapted to Multi Time Frame capability. Here you go!

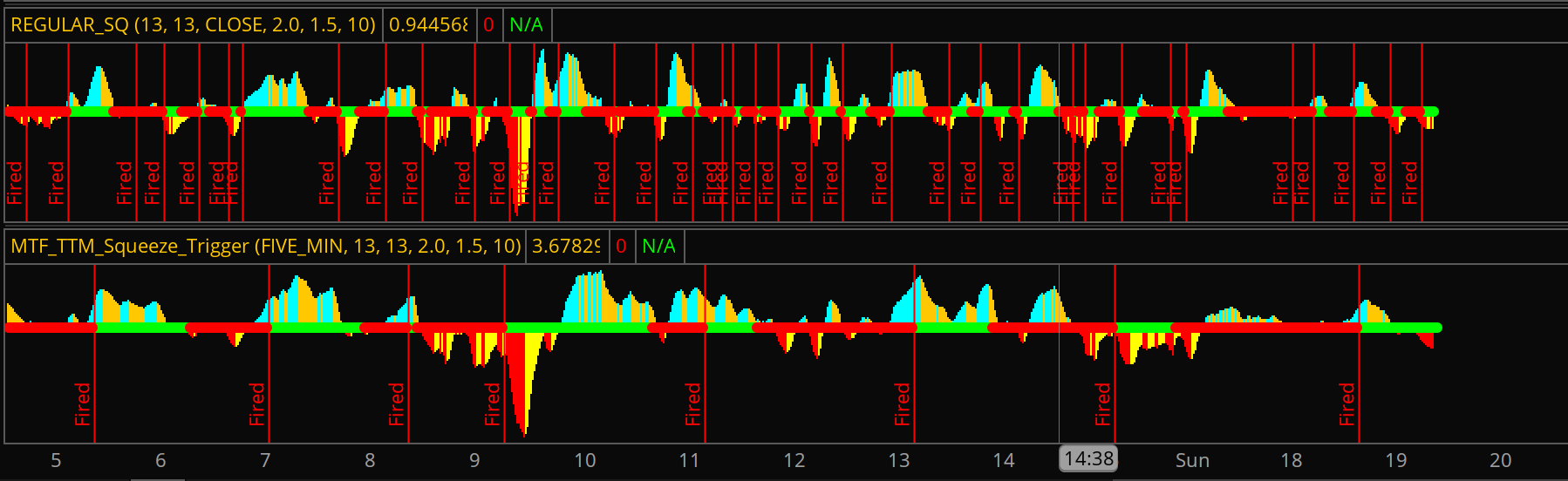

This is from a One Minute chart showing the Regular SQ study on top and my MTF adaptation on bottom:

Here is the shareable link:

https://tos.mx/ccsvLyW

This is from a One Minute chart showing the Regular SQ study on top and my MTF adaptation on bottom:

Here is the shareable link:

https://tos.mx/ccsvLyW

Here is the code:

Code:

# Momentum Squeeze and Volume Mod 08.17.18

# Mobius

# Added Squeeze Label with directional color

# Label is green when momentum is ascending, red when descending

# Added UI for separate Squeeze and Oscillator lenghts

# This code precisely replicates TTM_Squeeze. At default settings

# the output is the same as TTM_Squeeze. Top is Momentum squeeze

# study and bottom is TTM_Squeeze. The Oscillator can be adjusted

# separately with this version. I prefer the oscillator at 13, as

# it makes it more timely

#

# Squeeze was originated by John Bollinger and the Momentum Oscillator

# has been around long before Carter's version. He just painted it

# those colors.

#

# Some years ago we ran some statistics on squeeze breakouts and

# it was right around 50/50 with some variance with price near high

# volume pivots being a bit more easily read.

#

# If there was a high volume pivot within 3 or 4 bars of a low and

# then a squeeze, the probability of an expansion in price upward was

# nearer 1 st dev. If there was a low volume high pivot near a squeeze

# the probability was for a downward expansion of price.

#

# Squeeze in those cases denotes the indecision (price compression)

# before a trend change. The same price compression is what the

# SuperTrend code picks up on

# Modified by blt, 7.26.2016

# Bars painted GRAY if we are in a squeeze, BLUE if we are long and

# ORANGE if we are short. Also added addverticalline when squeeze fires

declare lower;

input AGG = AggregationPeriod.FIVE_MIN;

input Slength = 20; #hint Slength: Length for Squeeze

input Klength = 20; #hint Klength: Length for Oscillator

def price = close(period = AGG);

input SDmult = 2.0;

input ATRmult = 1.5;

def K = (Highest(high(period = AGG), Klength) + Lowest(low(period = AGG), Klength)) /

2 + ExpAverage(close(period = AGG), Klength);

plot Momo = Inertia(close - K/2, Klength);

Momo.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

Momo.SetLineWeight(3);

Momo.assignValueColor(if Momo > Momo[1] and Momo > 0

then Color.Cyan

else if Momo > 0 and Momo < Momo[1]

then Color.ORANGE

else if Momo < 0 and Momo < Momo[1]

then Color.Red

else Color.Yellow);

def SD = StDev(close(period = AGG), Slength);

def Avg = Average(close(period = AGG), Slength);

def ATR = Average(TrueRange(high(period = AGG), close(period = AGG), low(period = AGG)), Slength);

def SDup = Avg + (SDmult * SD);

def ATRup = Avg + (ATRmult * ATR);

plot Squeeze = if SDup < ATRup

then 0

else Double.NaN;

Squeeze.SetPaintingStrategy(PaintingStrategy.POINTS);

Squeeze.SetLineWeight(3);

Squeeze.SetDefaultColor(Color.RED);

plot zero = if IsNaN(close(period = AGG)) or !IsNaN(Squeeze) then Double.NaN else 0;

zero.SetPaintingStrategy(PaintingStrategy.POINTS);

zero.SetLineWeight(3);

zero.SetDefaultColor(Color.GREEN);

AddLabel(!IsNaN(Squeeze), "Squeeze", if IsAscending(Momo)

then Color.GREEN

else Color.RED);

# End Code - Momentum Squeeze

AddVerticalLine(!IsNaN(squeeze[1]) and IsNaN(squeeze), "Fired", Color.RED, Curve.FIRM);

#ADDED Volume###################################################################

#Colored Volume By Ethans080901

#Mod TroyX-8-17-18

#If today's closing price and volume is greater than 'n' days ago, color green

#If today's closing price is greater than 'n' days ago but volume is not, color blue

#If today's closing price is less than 'n' days ago, color orange

#If today's closing price is less than 'n' days ago but volume is not, color red

input n = 10;

def CN = Average(close(period = AGG), n);

def VN = Average(volume(period = AGG), n);

def G = close(period = AGG) > CN and volume(period = AGG) > VN ;

def B = close(period = AGG) > CN and volume(period = AGG) == VN;

def O = close(period = AGG) < CN and volume(period = AGG) == VN;

def R = close(period = AGG) < CN and volume(period = AGG) >= VN;

#Added volume Label

AddLabel( G, "Bullish Volume" , Color.CYAN); #Strong Bull

AddLabel( B, "Bullish Volume" , Color.blue); #Weak Bull

AddLabel( O, "Bearish Volume" , Color.YELLOW); #Weak Bear

AddLabel( R, "Bearish Volume" , Color.ORANGE); #Strong Bear

#How to use:

#Buy on Green or Blue

#Sell on Yellow or Orange

#End