updated version:

https://usethinkscript.com/threads/...e-histogram-for-thinkorswim.6076/#post-113649

Hey good people...thought I'd break the ice with a cut and paste of the first ToS indicator that I've managed to cobble together.

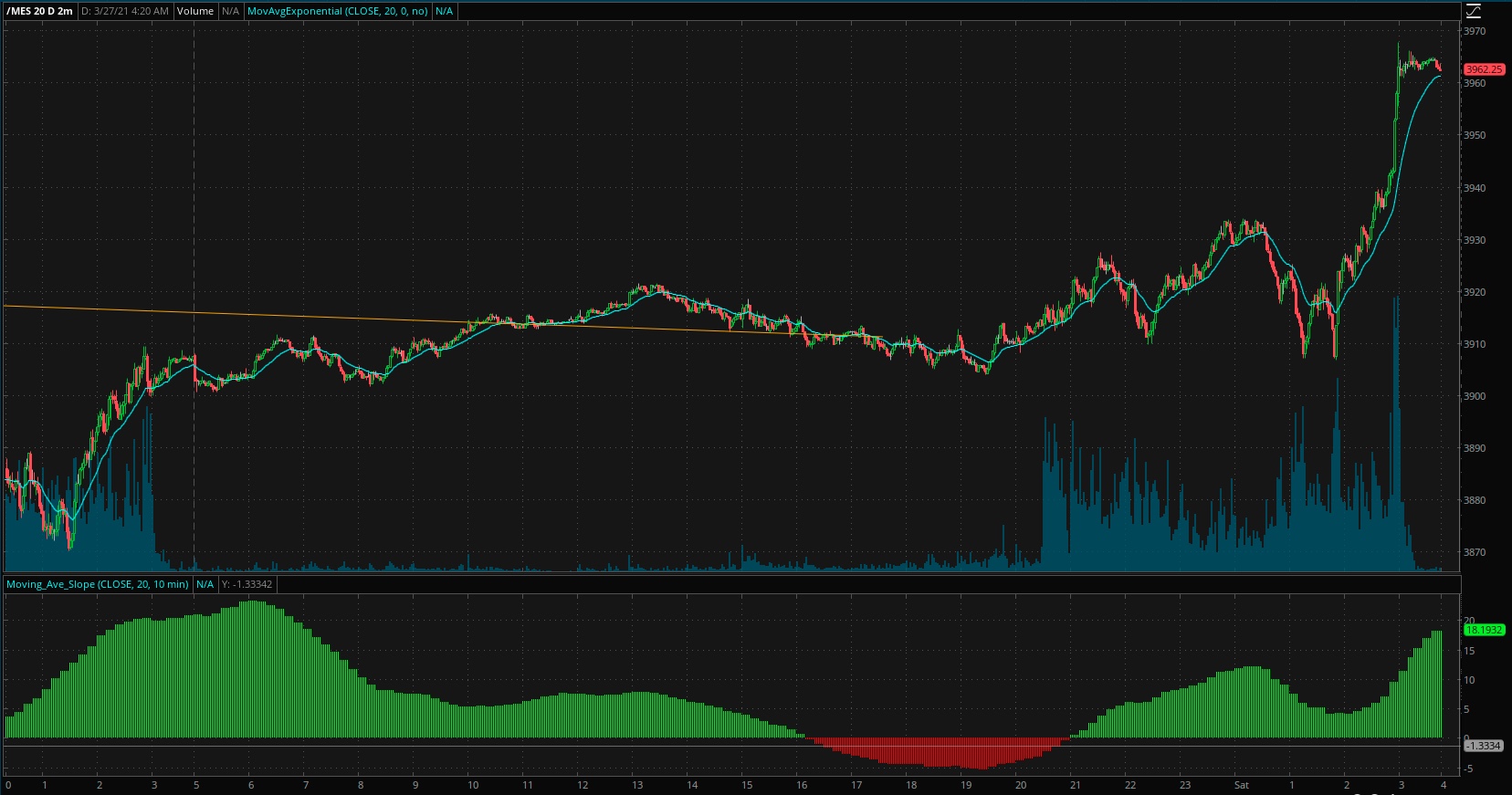

Looking at Rob Hoffman's IRB strategy, I thought it would be handy to have a view of the slope of a higher timeframe moving average. I've been using this to day trade ES mini futures, 2 min chart. I like using the EZ Trend indicator on 2 min and MA Slope Histogram on 5 min or 10 min...trade in the direction the colors line up. Do whatever works for you. Simple but it works.

I did some digging and put this together:

S&P E-micro futures, 2 min chart w/ EMA slope histogram on 10 min...

[/COLOR]

[/COLOR]

https://usethinkscript.com/threads/...e-histogram-for-thinkorswim.6076/#post-113649

Hey good people...thought I'd break the ice with a cut and paste of the first ToS indicator that I've managed to cobble together.

Looking at Rob Hoffman's IRB strategy, I thought it would be handy to have a view of the slope of a higher timeframe moving average. I've been using this to day trade ES mini futures, 2 min chart. I like using the EZ Trend indicator on 2 min and MA Slope Histogram on 5 min or 10 min...trade in the direction the colors line up. Do whatever works for you. Simple but it works.

I did some digging and put this together:

Code:

# MTF Moving Average Slope Histogram

# DaysOff

declare lower;

input price = close;

input length = 10;

input agperiod = { "1 min", "2 min", "5 min", default "10 min", "15 min", "30 min", "60 min", "4 hours"};

def avg = ExpAverage(close(period = agperiod), length);

plot height = avg - avg[length];

height.setPaintingStrategy(PaintingStrategy.HISTOGRAM);

height.DefineColor("height >= 0" , Color.GREEN);

height.DefineColor("height < 0", Color.RED);

height.assignValueColor(if height >= 0 then height.color("height >= 0") else height.color("height < 0"));S&P E-micro futures, 2 min chart w/ EMA slope histogram on 10 min...

Last edited by a moderator: