Thanks for the pointer. Much appreciated!Hey @Kayben - so sorry for the delayed reply. In that script (which we cannot code for)- I simply set a rule to check for those arrows being true all at the same time a plotted a yellow arrow - just serves as another visual queue.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Mimicking "Power X Strategy" by Markus Heitkoetter

- Thread starter Joseph Patrick 18

- Start date

- Status

- Not open for further replies.

New Indicator: Buy the Dip

Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas. Scanner, watchlist columns, and add-ons are included.

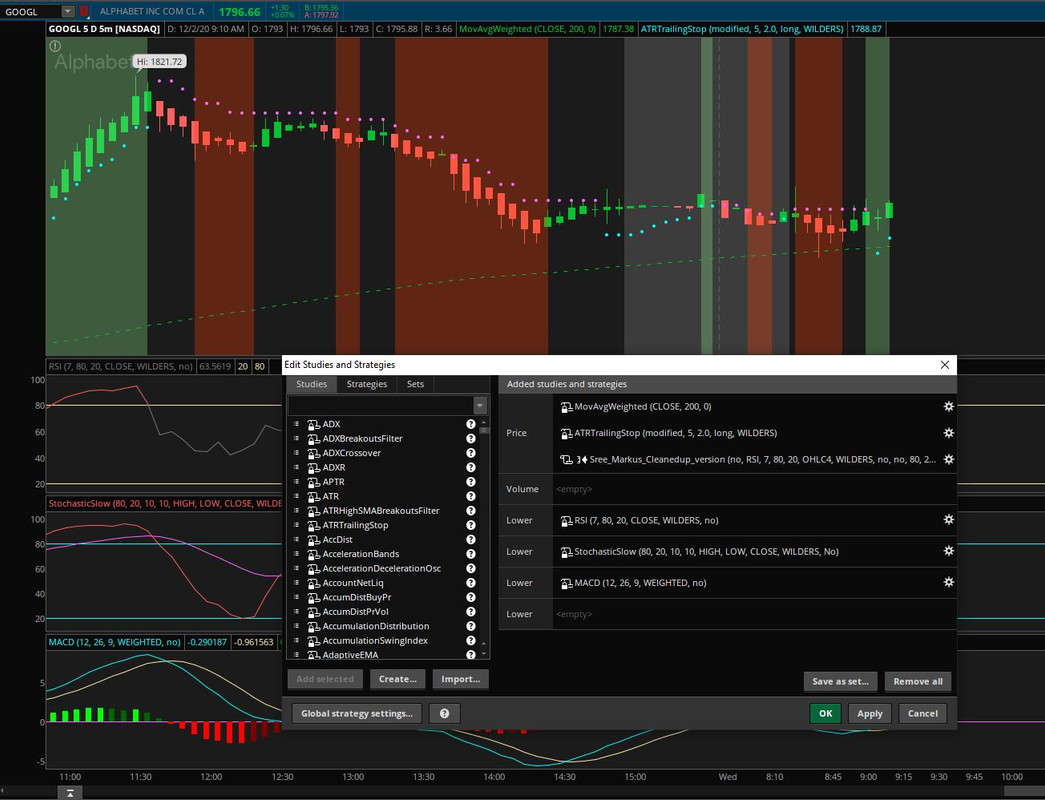

@Sree Do you mind sharing your tos link for ur setup plzHere you go: All standard except the Beta testing of this indicator study on upper studies in the chart. I have switched off the labels as it is not helping me at this time. This reduces clutter. Uptrend and downtrend arrow plot is also switched off as the color coded vertical bars indicate the same. Also removed 50 period MA as the tolerances between it and 200 are very little in the 5 min chart. you can compare this one to the above chart and you will see what I mean. Less clutter

Candle style: Heiken Ashi

Hi Cos and all good people on this thread. I am new here. I was looking for information on powerX strategy and saw this thread and your work. I am a swing option trader using a different trading platform. I would be grateful if you can guide me how to get this scanner - which i would mainly use to trade options. I have dowloaded the thinkorswim mobile app and cant find scanner there. Where should i go and what should i do to get the scanner. Thanks

ApeX Predator

Well-known member

@singe2309 you need to install desktop versions on a windows or a mac. Linux may be possible but I don't recommend it.

-S

-S

@cos251 Thank you so much for all the work you are doing. I really like this indicator and I use it all the time, however, I would really appreciate it if you can add additional time frames. I would really like it if the Weekly, Monthly, Quarterly, and Yearly were added. If it's too much trouble to add all of these then maybe just the weekly and the monthly. Thank you again.

So far I've analyzed /ES on 4 days in December - days which had some strong uptrends, strong downtrends, and also some stretches of back and forth range movement, some of it highly volatile, other times a bit low on volume - a pretty comprehensive sample, as small as it may be. I specifically analyzed the relationship of the 50 simple moving average in relation to the signals on a 1 minute chart. Here are my findings:

Long signals above the 50 sma: 16 wins, 9 losses

Long signals at the 50 sma (can be a couple ticks above or below): 4 wins, 5 losses

Long signals below the 50 sma: 6 wins, 20 losses

Short signals below the 50 sma: 22 wins, 10 losses

Short signals at the 50 sma: 5 wins, 1 loss

Short signals above the 50 sma: 8 wins, 11 losses

After the first couple of days, I stopped counting the signals on the wrong side of the 50 sma that were obviously going to fail so the number of losses of long signals below the 50 sma and short signals above the 50 sma are actually larger than what I noted. In other words, long signals below the 50 sma and short signals above the 50 sma fail more than what I've stated.

Keep in mind that during strong trends, some of these winning signals can yield up to 50 points or more.

The majority of the wins were at least 3R. The minority were 1R.

This seems to be a winning system in and of itself, but I plan on also analyzing the relationship of the 100 and 200 SMAs, and possibly some faster EMAs, to better define the rules.

I also need to analyze this system on the other futures indexes and stocks.

Long signals above the 50 sma: 16 wins, 9 losses

Long signals at the 50 sma (can be a couple ticks above or below): 4 wins, 5 losses

Long signals below the 50 sma: 6 wins, 20 losses

Short signals below the 50 sma: 22 wins, 10 losses

Short signals at the 50 sma: 5 wins, 1 loss

Short signals above the 50 sma: 8 wins, 11 losses

After the first couple of days, I stopped counting the signals on the wrong side of the 50 sma that were obviously going to fail so the number of losses of long signals below the 50 sma and short signals above the 50 sma are actually larger than what I noted. In other words, long signals below the 50 sma and short signals above the 50 sma fail more than what I've stated.

Keep in mind that during strong trends, some of these winning signals can yield up to 50 points or more.

The majority of the wins were at least 3R. The minority were 1R.

This seems to be a winning system in and of itself, but I plan on also analyzing the relationship of the 100 and 200 SMAs, and possibly some faster EMAs, to better define the rules.

I also need to analyze this system on the other futures indexes and stocks.

Last edited:

@Chence27 - nice work. So many things to consider when trading of course. Let us know what you find and if there is a component that makes the strategy more reliable, we can definitely incorporate that into so we can share it with the community.

Hi @TradeUp - are you referring to the RSM Signals for those time frames. I believe they should work, you just need to have enough data on the chart for the indicators to capture and calculate. Let me know if you are looking for something else.

Hi @singe2309 - I would concur with @SuryaKiranC - you'll need the desktop version of Thinkorswim in order to use the scan's available here from myself or @SuryaKiranC. Otherwise, creating a scan for this on another platform should be relatively straight forward. Let me know if we can assist with that or if you have other questions with the TOS Scans.

Hi @TradeUp - are you referring to the RSM Signals for those time frames. I believe they should work, you just need to have enough data on the chart for the indicators to capture and calculate. Let me know if you are looking for something else.

Hi @singe2309 - I would concur with @SuryaKiranC - you'll need the desktop version of Thinkorswim in order to use the scan's available here from myself or @SuryaKiranC. Otherwise, creating a scan for this on another platform should be relatively straight forward. Let me know if we can assist with that or if you have other questions with the TOS Scans.

I like this strategy. Close to what I've been doing as well. I like an entry on the 2m and looking to the 5m and 15m for continuation as sometimes the 2m will give an exit signal but is just a pull back on the 5m or 15m TF's. Other factors that I like - ATR, RVOL, higher highs and candle patterns.Which indicator? @HikingMan

Thanks @SuryaKiranC for the detailed explanation; do you mind point me to the scanner details (comment # if already explained)

ApeX Predator

Well-known member

if you are referring to MTF label at the top of the chart, Look at the alternative version. This is a configurable timeframe on the property of the indicator, But you need to add multiple instance of the script each with a different timeframe.@cos251 Thank you so much for all the work you are doing. I really like this indicator and I use it all the time, however, I would really appreciate it if you can add additional time frames. I would really like it if the Weekly, Monthly, Quarterly, and Yearly were added. If it's too much trouble to add all of these then maybe just the weekly and the monthly. Thank you again.

https://usethinkscript.com/threads/mimicking-power-x-strategy-by-markus-heitkoetter.4283/post-46770

@andre.muhammad - I've been playing with the script made available --- HERE --- to test out your request. I am looking to see what makes the most sense to post and a baseline for this. As soon as I have a good mock up I'll get it posted for ya'. (It is the FPL Extended by EddieLee and Mobius)@cos251 I saw where a guy added a study to Ben’s BTD study. Using the time frame that you are on, it counted the number of profitable entries with win and loss percentages. I noticed that the Power X has that same data. Is it possible that can be added to this?

@Chence27 - These are the two lines of code dictating UpTrend and DownTrend activation. I think what you may be noticing is that this version of the strategy only shades or declares a trend when ALL 3 signals are in alignment.I noticed that the rsi doesn't activate until it reaches 60, whereas the power x strategy calls for its activation when it's over 50. Can someone tell me how I can change the settings so I'm getting signals when rsi passes 50 rather than 60?

Code:

plot UpTrend = if RSI >= 50 and SlowK >= 50 and Value > Avg then 1 else 0;

plot DownTrend = if RSI < 50 and SlowK < 50 and Value < Avg then 1 else 0;ApeX Predator

Well-known member

Configure 3 instances of bottom study, Set each instance to RSI, Stoch & MACD with RSM shades enabled to each instance, you will know what @cos251 is talking about.I noticed that the rsi doesn't activate until it reaches 60, whereas the power x strategy calls for its activation when it's over 50. Can someone tell me how I can change the settings so I'm getting signals when rsi passes 50 rather than 60?

-S

Thanks for your reply . After installing on windows laptop . Whats the next step pls? Thx@singe2309 you need to install desktop versions on a windows or a mac. Linux may be possible but I don't recommend it.

-S

I noticed that the rsi doesn't activate until it reaches 60, whereas the power x strategy calls for its activation when it's over 50. Can someone tell me how I can change the settings so I'm getting signals when rsi passes 50 rather than 60?

Does the candle color change before it closes and the shading is done at close? Using the scanner and scanning for UpTrendJustStarted seems to show the candle green but the RSI, Stoch, and MACD are not shaded.Configure 3 instances of bottom study, Set each instance to RSI, Stoch & MACD with RSM shades enabled to each instance, you will know what @cos251 is talking about.

-S

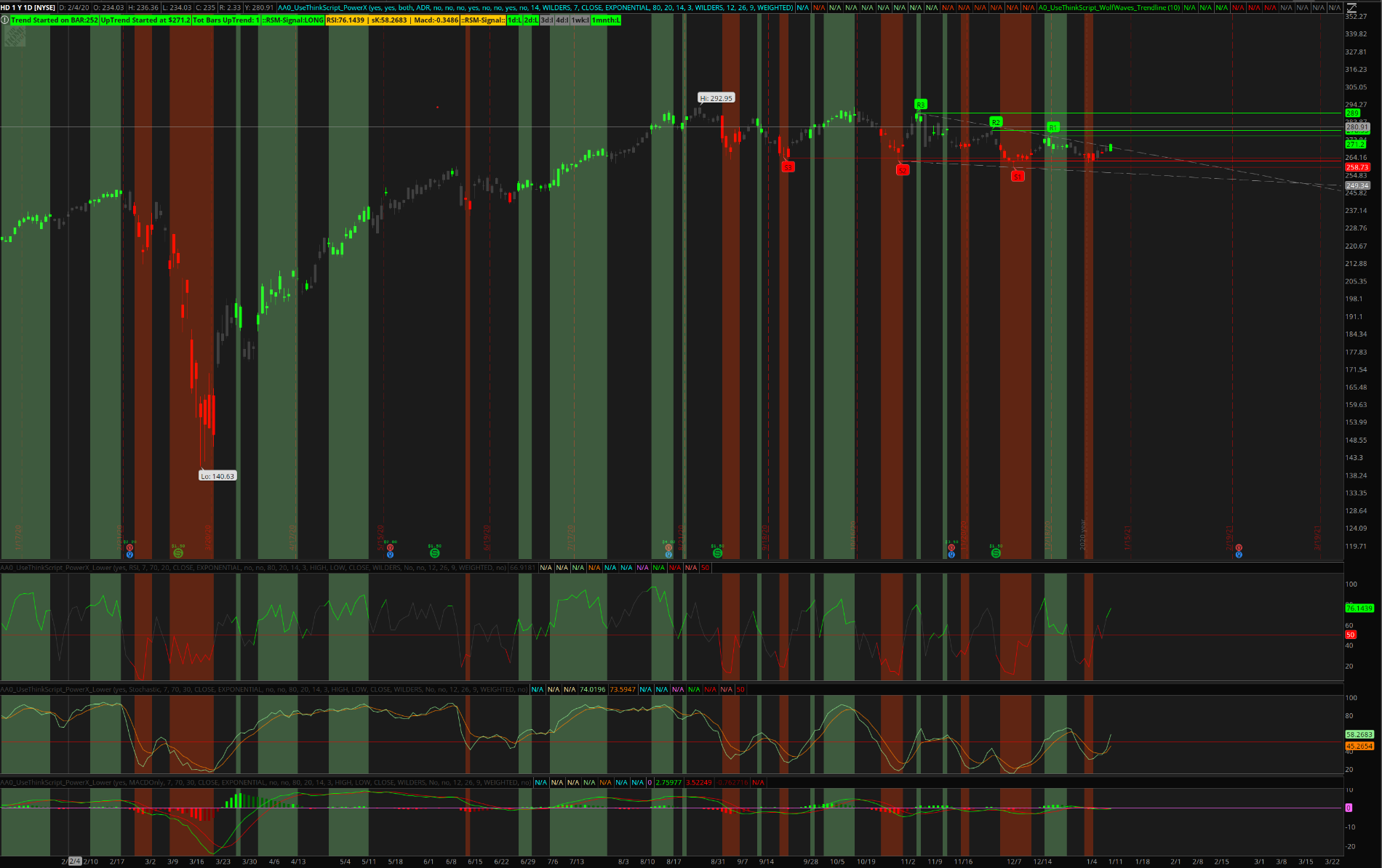

Looking at HD right now (it came up on the UpTrendJustStarted Scan) and that is the case. Going into lower timeframes (1hr, 78m, 15m, etc.) everything matches so I'm guessing that is what it is. Awesome job on this indicator by the way. I was just looking at this strategy after catching some of Markus's YouTube content.

The problem in using this indicator is that the signals can erase before the candle is finished forming. To be sure the arrow will stay, you have to be two candles into the signal, and to be sure that the cloud will stay, you have to already be three candles into the signal. It seems at least half of the signals that make it to the cloud stage fail just after the cloud is formed.

ApeX Predator

Well-known member

Look at this thread, you have details for where to grab the actual chart studies and the scanner. there are pointers on how to setup the scanners too.Thanks for your reply . After installing on windows laptop . Whats the next step pls? Thx

Note: the below post will lead to multiple posts. each pointing to different script.

https://usethinkscript.com/threads/mimicking-power-x-strategy-by-markus-heitkoetter.4283/post-47414

-S

ApeX Predator

Well-known member

You must be looking at shorter timeframes. and you should use general support/resistance levels and general sense of market, Just like all the zillion indicators that are out there.The problem in using this indicator is that the signals can erase before the candle is finished forming. To be sure the arrow will stay, you have to be two candles into the signal, and to be sure that the cloud will stay, you have to already be three candles into the signal. It seems at least half of the signals that make it to the cloud stage fail just after the cloud is formed.

I always use some sort of Volume Indicator to find buying/Selling pressure on the day I am making trade and compare with past few days.

This signals can change while the candle is forming. As long as you are not using an MTF version of the script there should be no repainting. As for the shading, it usually happens at close of candle. Some of this is due to the nuances of TOS.Does the candle color change before it closes and the shading is done at close? Using the scanner and scanning for UpTrendJustStarted seems to show the candle green but the RSI, Stoch, and MACD are not shaded.

Looking at HD right now (it came up on the UpTrendJustStarted Scan) and that is the case. Going into lower timeframes (1hr, 78m, 15m, etc.) everything matches so I'm guessing that is what it is. Awesome job on this indicator by the way. I was just looking at this strategy after catching some of Markus's YouTube content.

- Status

- Not open for further replies.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| C | Bull Bear Power VOID Oscillator For ThinkOrSwim | Indicators | 21 | |

| I | PMF (Power Momentum Formula) for ThinkorSwim | Indicators | 10 | |

|

|

Balance of Power Trend Indicator for ThinkorSwim | Indicators | 34 | |

|

|

Hima Reddy RSI Power Zones Indicator for ThinkorSwim | Indicators | 13 | |

|

|

Power Earnings Gaps (PEG) Scanner for ThinkorSwim | Indicators | 14 |

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1548

Online

Similar threads

Similar threads

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.