You should upgrade or use an alternative browser.

Mimicking "Power X Strategy" by Markus Heitkoetter

- Thread starter Joseph Patrick 18

- Start date

- Status

- Not open for further replies.

New Indicator: Buy the Dip

Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas. Scanner, watchlist columns, and add-ons are included.

ApeX Predator

Well-known member

Here is a post that has a list of all updated studies.

https://usethinkscript.com/threads/mimicking-power-x-strategy-by-markus-heitkoetter.4283/post-43868

if you are looking for the Whole grid setup, here it is https://tos.mx/UQ8j12s

in addition to that you may have to copy and past the scan script in your study, to make use of scanners. for details and instructions on scanner look for the following post.

https://usethinkscript.com/threads/mimicking-power-x-strategy-by-markus-heitkoetter.4283/post-46140

Hope this helps you with the setup, if you are looking for instructions on how to use it, please look for the last few posts from @cos251 in page 14,15 & 16.

-Surya

ApeX Predator

Well-known member

What kind of result have you been seeing from swing trades? For RSI_Laguerre are you looking at gamma?I have been using this for about week and half. I do use it in conjunction with RSI_Laguerre for both scalp and swing. I do use 5 min for scalp and 2h,4h & 1D for swing. @venkat

ApeX Predator

Well-known member

Hi all, I apologize if this is a dumb question, but I was trying to scan for all the stocks that are currently in uptrend, not just Uptrend is starting, but looking through the posts it doesn't look like that's an option yet. I've followed ronebbay's instruction on post#318 to scan for stocks for which uptrend is starting and are in uptrend, but doesn't look like it's working. I scanned for "Uptrend is true" condition, but it's giving me stocks that are not in the green cloud. Ex: ABBV, FISV, MNST, EEM, VLO, PSX and roughly 30 other ones. How would I scan for stocks that're already in the uptrend/ in the "green cloud"? I apologize for the inconvenience, but I'm still trying to figure thinkscript out.

@dhman06 there are 4 scan Queries available.

Scan Queries:

FVO_RSM_Scan().UpTrendJustStarted

FVO_RSM_Scan().DownTrendJustStarted

FVO_RSM_Scan().UpTrend

FVO_RSM_Scan().DownTrend

The way I setup is, Take a scanner windows, clear all filters and filter Groups, Add filters in "Any of the Following" condition Group.

Add 2 of them and set both to Script and custom, add UpTrend and UpTrendJustStarted and save the query, if you want to restrict the Query to a specific watch list or a default list like S&P 500 you can do so in the dropdown right next to scan setup.

Make sure the scanner timeframe and the chart timeframe you are looking are the same. Also, most of the cloud formation starts after the close of the candle, so if you are referring to 1D charts, and the trend has just started you would have to wait for next candle before you start to see the cloud.

-Surya

ApeX Predator

Well-known member

I look for the direction of movement and the target using RSI_Laguerre in the same timeframe I am running the scanner, for secondary conformation.What kind of result have you been seeing from swing trades? For RSI_Laguerre are you looking at gamma?

HikingMan

New member

@cos251 Scroll down to the middle of this page here: https://usethinkscript.com/threads/btd-percentile-stats.4978/Can you share a screenshot of what you are looking for?

I ran the UpTrend scan, but it's picking up stocks that are not in UpTrend. For Ex: ABBV, FISV, MNST, EEM, VLO, PSX and roughly 30 other ones.@dhman06 there are 4 scan Queries available.

Scan Queries:

FVO_RSM_Scan().UpTrendJustStarted

FVO_RSM_Scan().DownTrendJustStarted

FVO_RSM_Scan().UpTrend

FVO_RSM_Scan().DownTrend

The way I setup is, Take a scanner windows, clear all filters and filter Groups, Add filters in "Any of the Following" condition Group.

Add 2 of them and set both to Script and custom, add UpTrend and UpTrendJustStarted and save the query, if you want to restrict the Query to a specific watch list or a default list like S&P 500 you can do so in the dropdown right next to scan setup.

Make sure the scanner timeframe and the chart timeframe you are looking are the same. Also, most of the cloud formation starts after the close of the candle, so if you are referring to 1D charts, and the trend has just started you would have to wait for next candle before you start to see the cloud.

-Surya

ApeX Predator

Well-known member

Can you post a screenshot? list details what timeframe is your scanner, what timeframe is your chart.I ran the UpTrend scan, but it's picking up stocks that are not in UpTrend. For Ex: ABBV, FISV, MNST, EEM, VLO, PSX and roughly 30 other ones.

ApeX Predator

Well-known member

@andre.muhammad that looks like a VIP link, @cos251 can't access it. check with @BenTen if you are allowed to share a screenshot, with out the code.@cos251 Scroll down to the middle of this page here: https://usethinkscript.com/threads/btd-percentile-stats.4978/

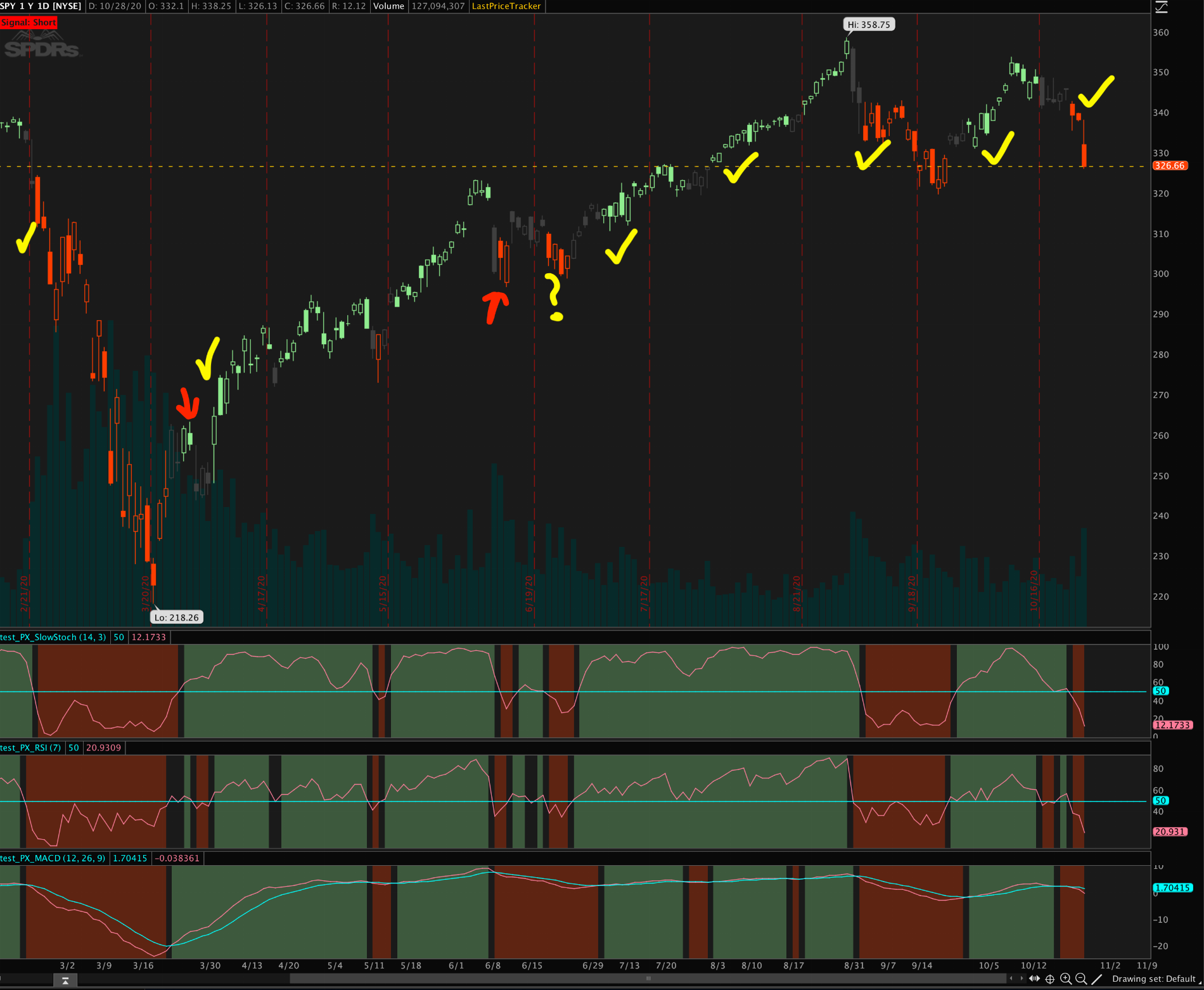

can you share TOS link for this?Here is my interpretation.

Total of 12 tradable signals.

9 wins.

2 losses.

1 questionable.

Edit: I forgot to label 2 good long trades in the screenshot below.

Thoughts?

Can you post a screenshot? list details what timeframe is your scanner, what timeframe is your chart.

Please see the attached links below. Scan code shows that I'm scanning for tickers that have "Uptrend = True" condition on Daily and Scan results shows some of the tickers, ex: ABBV, FISV, MNST, EEM, VLO that aren't on Uptrend showing up. Both the scan and my charts are on Daily

Good catch. I will adjust the code to accommodate for this bug. Thx for finding it @HikingManI will be day-trading this each day this coming week using a 1 and 5 minute chart. I concur that this is a beautiful effort you have assembled here. One thing to point out, not that it is any problem, is that when you set the upper study to show only LONG trades rather than BOTH, it will still draw the shaded Profit/Loss setup onto the chart when it is not a LONG setup. The setting appears to only remove the down arrow. It might be nice to only show the Profit/Loss setup on the selected LONG/SHORT setting chosen. Easy enough to work with as is though. I'll let you all know how the day-trading goes using this.

- Status

- Not open for further replies.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| C | Bull Bear Power VOID Oscillator For ThinkOrSwim | Indicators | 21 | |

| I | PMF (Power Momentum Formula) for ThinkorSwim | Indicators | 10 | |

|

|

Balance of Power Trend Indicator for ThinkorSwim | Indicators | 34 | |

|

|

Hima Reddy RSI Power Zones Indicator for ThinkorSwim | Indicators | 13 | |

|

|

Power Earnings Gaps (PEG) Scanner for ThinkorSwim | Indicators | 14 |

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

Similar threads

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/