#Original labels code from Markos and Bobomatic https://usethinkscript.com/threads/market-internals-labels-for-thinkorswim.833/

# Modified by MTG 10/2023 to include $TRIN, $Put/Call ratio, Vix for Futures, Percent of SP500 stocks trading above their (50, 100, and 200)day averages, and $TICK for SP500 - 10/2023

##############################################################

# Weighted A/D

# concept from shadowtrader.net

# coded by TWOO

# https://www.spglobal.com/spdji/en/indices/equity/sp-500/#data

# sector-breakdown

# modified by CWPARKER23

# modifiedTrueRange by Sam4COK @ 07/2022

# modified by MTG to show full sector name and include Overall ratio sum 9/2023

###############################################################

input market = {default NYSE, NASDAQ, SP};

input open_time = 930;

input length = 12;

input ShowLabel = yes;

def price1 = close(symbol = "/vx", period = AggregationPeriod.DAY);

input length1 = 45; #SMA length for VIX of futures

input displace1 = 0;

def SMA1 = Average(price1[-displace1], length1);

# Market Internal Labels

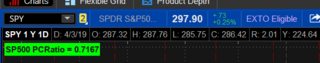

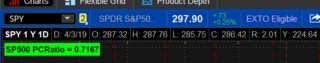

input SYMB = "$ADSPDc"; #Hint SYMB:$ADSPD for SP500 Adv-Decline Issues - composites include the data from all exchanges

input SYMB2 = "$TIKSPc"; #Hint SYMB2:$tIKSP for SP500 Tick

input Symb3 = "$TRINSPc"; #Hint symb: $TrinSp for SP500 Trin

input Symb4 = "$PCSP"; #Hint symb: $PCSP Put/Call Ratio SP500

input Symb5 = "$ADVSPC"; #Hint symb: $ADVSPC Advance Issues Composite SP500 Trin

input Symb6 = "$DECLSPC"; #Hint symb: $DECLSPC Decline Issues SP500

input symb7 = "/vx"; #Hint symb: /vx is volatility index

input symb8 = "$SPXA50R"; #Hint this is the percent of SP500 Stocks trading above their 50 day average

input symb9 = "$SPXA100R"; #Hint this is the percent of SP500 Stocks trading above their 100 day average

input symb10 = "$SPXA200R"; #Hint this is the percent of SP500 Stocks trading above their 200 day average

input InformationTechnology = 26.8; # xlkwt

input HealthCare = 15.1; # xlvwt

input Financials = 10.8; # xlfwt

input ConsumerDiscretionary = 10.5; # xlywt

input Communications = 8.9; # xlcwt

input Industrials = 7.8; # xliwt

input ConsumerStaples = 7.0; # xlpwt

input Energy = 4.4; # xlewt

input Utilities = 3.1; # xluwt

input RealEstate = 2.9; # xlrewt

input Materials = 2.6; # xlbwt

def na = Double.NaN ;

def SectorCount = 11;

def Scale = 5000;

def displace = 0;

#### COLORS

DefineGlobalColor("Bullish", Color.CYAN);

DefineGlobalColor("Bearish", Color.PINK);

DefineGlobalColor("Channel", CreateColor(100, 181, 246));

#SP500 ETF sectors percent change

script PC {

input Symbol = "SPX";

def isFirstBar = GetTime() == RegularTradingStart(GetYYYYMMDD()) + 1;

def O = if isFirstBar then close(Symbol) else O[1];

def C = close(Symbol);

plot PctChg = (C - O) / O;

}

def xlkPctChg = PC("XLK");

def xlyPctChg = PC("XLY");

def xlvPctChg = PC("XLV");

def xlfPctChg = PC("XLF");

def xlcPctChg = PC("XLC");

def xliPctChg = PC("XLI");

def xlpPctChg = PC("XLP");

def xlrePctChg = PC("XLRE");

def xlePctChg = PC("XLE");

def xlbPctChg = PC("XLB");

def xluPctChg = PC("XLU");

def xlkSizing = xlkPctChg * InformationTechnology;

def xlvSizing = xlvPctChg * HealthCare;

def xlySizing = xlyPctChg * ConsumerDiscretionary;

def xlfSizing = xlfPctChg * Financials;

def xlcSizing = xlcPctChg * Communications;

def xliSizing = xliPctChg * Industrials;

def xlpSizing = xlpPctChg * ConsumerStaples;

def xleSizing = xlePctChg * Energy;

def xlreSizing = xlrePctChg * RealEstate;

def xlbSizing = xlbPctChg * Materials;

def xluSizing = xluPctChg * Utilities;

def combinedSizing = Scale * (

xlkSizing +

xlvSizing +

xlySizing +

xlfSizing +

xlcSizing +

xliSizing +

xlpSizing +

xleSizing +

xlreSizing +

xlbSizing +

xluSizing

) / SectorCount;

# Weighted_AD

def Weighted_AD = if !IsNaN(combinedSizing) then combinedSizing else na;

# SPX Non_Weighted_AD

def spxcombinedSizing = Scale *

(xlkPctChg +

xlvPctChg +

xlyPctChg +

xlfPctChg +

xlcPctChg +

xliPctChg +

xlpPctChg +

xlePctChg +

xlrePctChg +

xlbPctChg +

xluPctChg);

#SP500 ETF sectors BUBBLE

script pct {

input Symbol = "SPX";

def aggregationPeriod = AggregationPeriod.DAY;

def price = open(Symbol, period = aggregationPeriod);

def diff = close (Symbol) - open(Symbol, period = aggregationPeriod);

plot d_pct = 100 * diff / price;

}

def XLK_d_pct = pct(“XLK”) ;

def XLV_d_pct = pct(“XLV”) ;

def XLY_d_pct = pct(“XLY”) ;

def XLC_d_pct = pct(“XLC”) ;

def XLF_d_pct = pct(“XLF”) ;

def XLI_d_pct = pct(“XLI”) ;

def XLP_d_pct = pct(“XLP”) ;

def XLRE_d_pct = pct(“XLRE”) ;

def XLB_d_pct = pct(“XLB”) ;

def XLU_d_pct = pct(“XLU”) ;

def XLE_d_pct = pct(“XLE”) ;

# 11 Sector total percent values

def SumOfPctValues = XLK_d_pct + XLV_d_pct + XLY_d_pct + XLC_d_pct + XLF_d_pct + XLI_d_pct + XLP_d_pct + XLRE_d_pct + XLB_d_pct + XLU_d_pct + XLE_d_pct;

def UVOLSP = close("$UVOLSPc");

def DVOLSP = close("$DVOLSPc");

def Data = close("$ADSPDc");

# Calculate secondary periods

def AD = close(symbol = SYMB, period = AggregationPeriod.DAY);

def TK = close(symbol = SYMB2, period = AggregationPeriod.DAY);

def TR = close(symbol = Symb3, period = AggregationPeriod.DAY);

def PutCall = close(symbol = Symb4, period = AggregationPeriod.DAY);

def VX = close (symbol = symb7, period = AggregationPeriod.DAY);

def SP50 = close (symbol = symb8, period = AggregationPeriod.DAY);

def SP100 = close (symbol = symb9, period = AggregationPeriod.DAY);

def SP200 = close (symbol = symb10, period = AggregationPeriod.DAY);

# Calculate AD2 with aggregation period DAY

def AD2 = close(Symb5, period = AggregationPeriod.DAY) / close(Symb6, period = AggregationPeriod.DAY);

# SP Breadth ratio

def SPratio = if (UVOLSP >= DVOLSP) then (UVOLSP / DVOLSP) else -(DVOLSP / UVOLSP);

# Add Labels

#Weighted A/D Ratio

AddLabel(ShowLabel, "Weighted A/D SP500: " + Round(SumOfPctValues, 2), (if SumOfPctValues > 0 then Color.GREEN else if SumOfPctValues < 0 then Color.RED else Color.YELLOW));

#Unweighted A/D ratio

AddLabel(yes, " A/D S&P500: " + AD2, if AD2 >= 0 then Color.GREEN else Color.RED);

# A/D value

AddLabel(yes, "A/D SP500: " + AD, if AD >= 0 then Color.GREEN else Color.RED);

#Tick for SP500

AddLabel(yes, "TikSP: " + TK, if TK >= 0 then Color.GREEN else Color.RED);

#Trin for SP500

AddLabel(yes, "TrinSP: " + TR, if TR >= 1.3 then Color.RED else if TR <= .6 then Color.GREEN else Color.YELLOW);

#Put/Call Ratio for SP500

AddLabel(yes, "Put/Call Ratio SP500: " + PutCall, if putcall >= 1 then Color.RED else if putcall <= .1 then Color.GREEN else Color.YELLOW);

#Up/Down Volume for SP500

AddLabel(yes, Concat(Round(SPratio, 2), " :SP Vol"), if SPratio >= 0 then Color.GREEN else Color.RED);

#Vix for Futures

AddLabel(yes, "VIX SP500: " + vx, if vx >= sma1 then Color.cyan else if vx <= sma1 then Color.yellow else Color.YELLOW);

#Percent of SP500 stocks trading above 50 day average

AddLabel(yes, " SP(50)Day: " + sp50, if sp50>= 0 then Color.GREEN else Color.RED);

#Percent of SP500 stocks trading above 100 day average

AddLabel(yes, " SP(100)Day: " + sp100, if sp100>= 0 then Color.GREEN else Color.RED);

#Percent of SP500 stocks trading above 200 day average

AddLabel(yes, " SP(200)Day: " + sp200, if sp200 >= 0 then Color.GREEN else Color.RED);

#End Code