I loaded up a watchlist using the macd, and ma cross 5/10/20 then ran a scan for divergence and saved the scan as such. I load up the divergence scan-and look for two lights to agree either green or red. It seems quite effective and matches the macd divergence chart. Note: the divergence both red and green are effective as well

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

MACD Divergence Indicator for ThinkorSwim

- Thread starter BenTen

- Start date

-

- Tags

- divergence

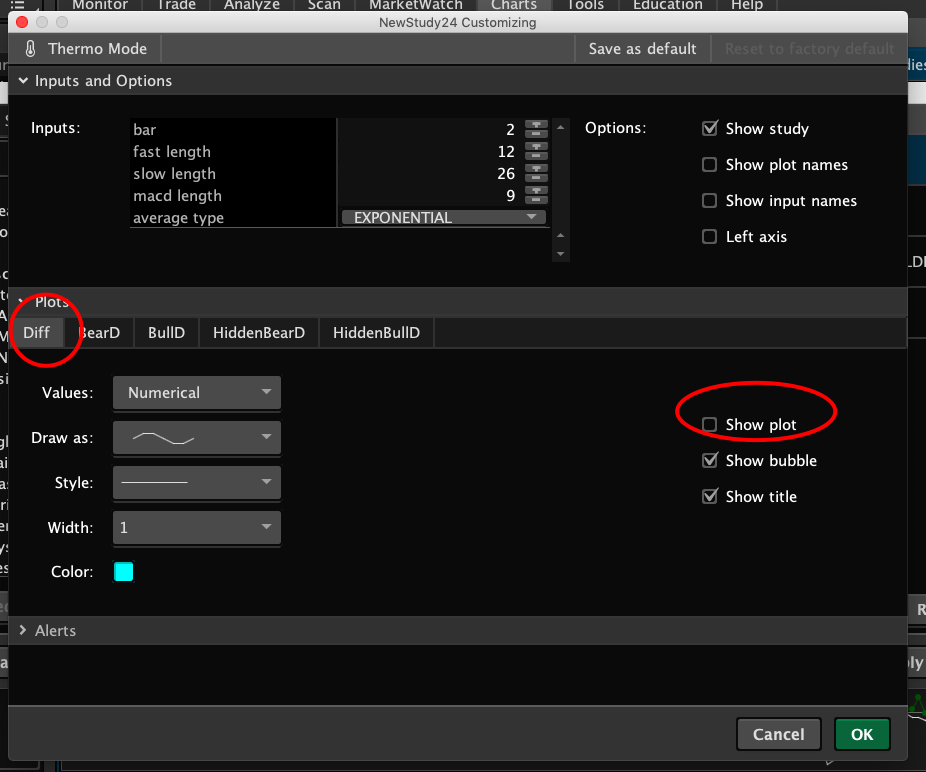

Hi @BenTen This fixed one of the problems I was seeing, thank you but I still do not seem to get any arrows in any direction generated.@ezrollin I see the issue now. Go to that specific indicator's setting and then untick "Show Plot" for the Diff option.

I am mostly looking at lower time frames (1m, 5m, 15m etc) and FX pairs - should I be seeing results at these timeframes?

I've not touched any of the other settings at all. Thank you

@BenTen - should have tried this earlier, I changed the MACD settings to 20, 50, 26 just to see if I could see anything and I now see some pink and green on the 15min charts. I'll need to research more appropriate settings for scalping lower timeframes.@mrmac Are you seeing any signals on the higher timeframe?

hi can you please tell me what is meaing of IWM thaank you!i too tried the divergence with IWM. It works quite well and i was able to simulate the buy/sell point on paper trade. I've actually entered a buy order at the last 5 minutes as it shows a double bottom. looking for another nice gap up tomorrow.

@alphabeta IWM is the ticker symbol for the iShares Russell 2000 Index.

actually it does both, however I was hoping that it can draw straight lines rather than arrows@BenTen , Does this one spot only hidden divergences?

Just trying to create a scan that finds higher MACD momentum trends.

Very simple but havent spent time looking into it and dont know what I'm doing! lol

Can I get some help?

Thanks!

Code:

input fastLength = 12;

input slowLength = 26;

input MACDLength = 9;

input averageType = AverageType.EXPONENTIAL;

plot Value = MovingAverage(averageType, close, fastLength) - MovingAverage(averageType, close, slowLength);

plot Avg = MovingAverage(averageType, Value, MACDLength);

plot Diff = Value - Avg;

def highermomentum = 1;

def lowermomentum = 2;

plot Momentum = if Diff < Diff[5] < Diff[10] < Diff[30] < Diff[50] < Diff[100] then highermomentum else LowerMomentum;

Last edited:

@BenTen Are you still using this? I can't get it to plot the lines in the upper study like @KevinSammy was experiencing.

timekeeper

New member

@murkr I'm not. I've concluded that divergences should be spot manually.

@BenTen hello. Im seeing what I think are false positives on the MACD_divergence_pivots. Does this code read divergence in Value line as well as Histogram.

Im looking for a divergence indicator for day trading. And notice you commented about manual spotting of divergence. Why do you say that?

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Repaints RSI, OBV, MACD, STOCH, CCI, or MFI Divergence For ThinkOrSwim | Indicators | 30 | |

| D | MACD-V For ThinkOrSwim | Indicators | 12 | |

| P | Ultimate MACD For ThinkOrSwim | Indicators | 16 | |

|

|

Super 6x: RSI, MACD, Stoch, Loxxer, CCI, & Velocity [Loxx] for ThinkOrSwim | Indicators | 62 | |

| K | Impulse MACD [LazyBear] For ThinkOrSwim | Indicators | 32 |

Similar threads

-

Repaints RSI, OBV, MACD, STOCH, CCI, or MFI Divergence For ThinkOrSwim

- Started by samer800

- Replies: 30

-

-

-

Super 6x: RSI, MACD, Stoch, Loxxer, CCI, & Velocity [Loxx] for ThinkOrSwim

- Started by samer800

- Replies: 62

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

731

Online

Similar threads

-

Repaints RSI, OBV, MACD, STOCH, CCI, or MFI Divergence For ThinkOrSwim

- Started by samer800

- Replies: 30

-

-

-

Super 6x: RSI, MACD, Stoch, Loxxer, CCI, & Velocity [Loxx] for ThinkOrSwim

- Started by samer800

- Replies: 62

-

Similar threads

-

Repaints RSI, OBV, MACD, STOCH, CCI, or MFI Divergence For ThinkOrSwim

- Started by samer800

- Replies: 30

-

-

-

Super 6x: RSI, MACD, Stoch, Loxxer, CCI, & Velocity [Loxx] for ThinkOrSwim

- Started by samer800

- Replies: 62

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.