Hi Gurus,

@BenTen @Zachc

My first post, Wonderful forum and I am an Invoice trader. Still learning

The Weekly scanner in the first page ( is this for shorting the stocks watch list or buy stocks watch list.)

below is the what the link has

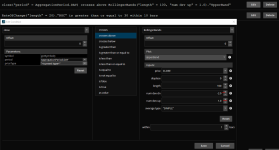

close("period" = AggregationPeriod.WEEK) crosses above BollingerBands("length" = 100)."UpperBand" and RateOfChange("length" = 20)."ROC" is greater than or equal to 30 within 10 bars

To find the stocks to buy should I need to change as below?

close("period" = AggregationPeriod.WEEK) crosses above BollingerBands("length" = 100)."LowerBand" and RateOfChange("length" = 20)."ROC" is greater than or equal to 30 within 10 bars

@BenTen @Zachc

My first post, Wonderful forum and I am an Invoice trader. Still learning

The Weekly scanner in the first page ( is this for shorting the stocks watch list or buy stocks watch list.)

below is the what the link has

close("period" = AggregationPeriod.WEEK) crosses above BollingerBands("length" = 100)."UpperBand" and RateOfChange("length" = 20)."ROC" is greater than or equal to 30 within 10 bars

To find the stocks to buy should I need to change as below?

close("period" = AggregationPeriod.WEEK) crosses above BollingerBands("length" = 100)."LowerBand" and RateOfChange("length" = 20)."ROC" is greater than or equal to 30 within 10 bars