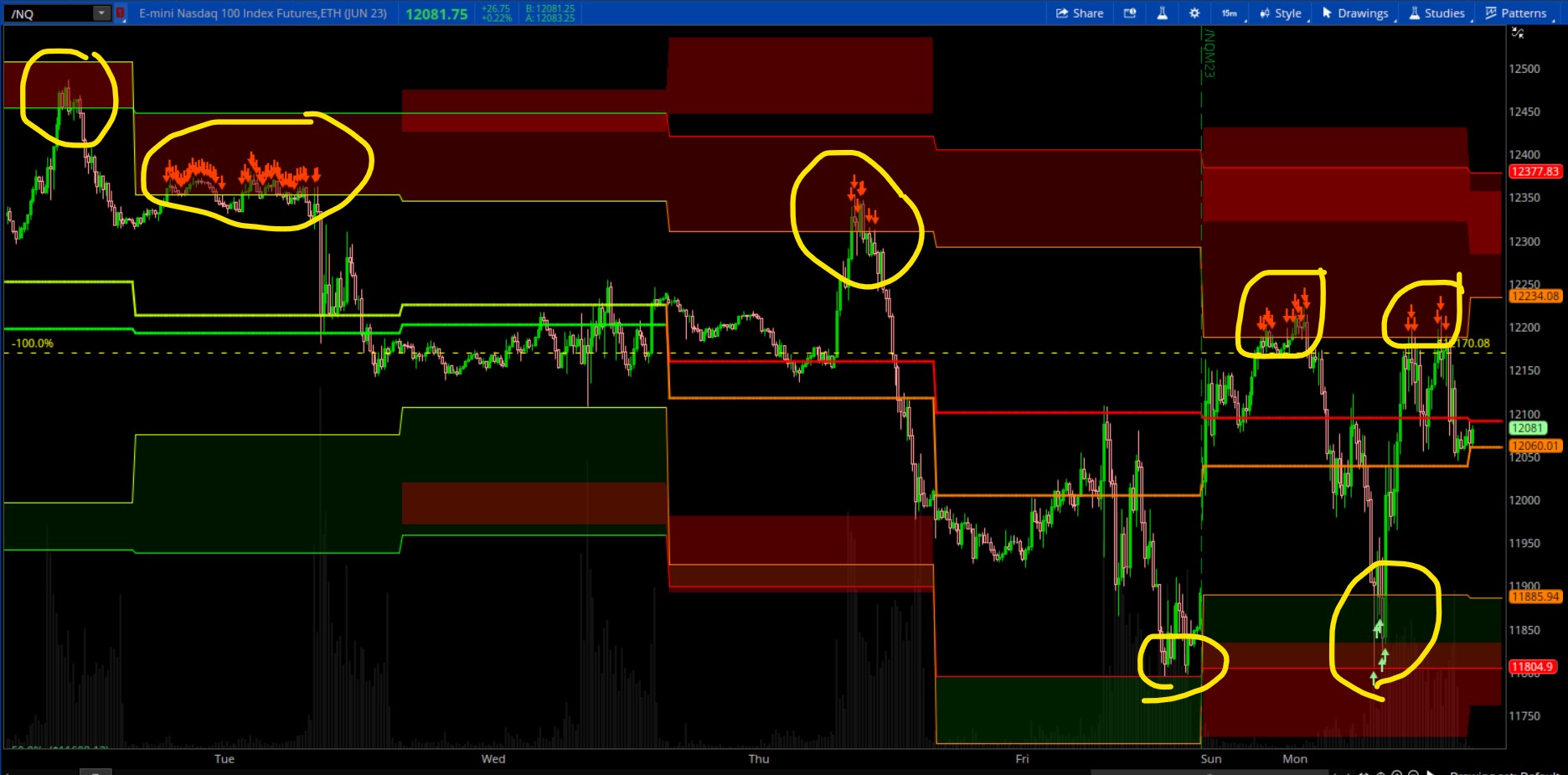

This indicator is best for intraday trading. It uses a 3 and 8 EMA Bollinger band that is based on the daily aggregation. Arrows will appear when price is extended past the 3 upper or lower Bollinger band. Squeezes are red/orange and indicate when price is about to break out. When the 3 is above the 8, the colors are greenish, when the 3 is below the 8, colors are reddish. Since this is based on the daily aggregation, the bands and averages will move slightly throughout the day but will not repaint once the day is over. Here is an example of 15 min chart of /NQ.

Shareable Link:

http://tos.mx/kL4HrRt

Code:

Shareable Link:

http://tos.mx/kL4HrRt

Code:

Code:

#Intraday 3-8 BollingerBand with Squeeze

#Assembled by Chewie on 3-13-2023

input length1 = 3;

input length2 = 8;

input displace = 0;

input aggregationPeriod1 = AggregationPeriod.day;

input aggregationPeriod2 = AggregationPeriod.day;

def price1 = close(period = aggregationPeriod1);

def price2 = close(period = aggregationPeriod2);

plot AVG1 = ExpAverage(price1[-displace], length1);

plot AVG2 = ExpAverage(price2[-displace], length2);

AVG1.AssignValueColor(if AVG1 >= AVG2 then color.lime

else if AVG1 <= AVG2 then color.dark_orange else color.gray);

AVG2.AssignValueColor(if AVG2 >= AVG1 then color.red

else if AVG2 <= AVG1 then color.green else color.gray);

AVG1.SetLineWeight(2);

AVG2.SetLineWeight(2);

#Bands

input Num_Dev_Dn = -2.0;

input Num_Dev_up = 2.0;

def sDev = stdev(data = price1[-displace], length = length1);

plot LowerBand = AVG1 + num_Dev_Dn * sDev;

plot UpperBand = AVG1 + num_Dev_Up * sDev;

LowerBand.AssignValueColor(if AVG1 >= AVG2 then color.lime

else if AVG1 <= AVG2 then color.dark_orange else color.gray);

UpperBand.AssignValueColor(if AVG1 >= AVG2 then color.lime

else if AVG1 <= AVG2 then color.dark_orange else color.gray);

def sDev2 = stdev(data = price2[-displace], length = length2);

plot LowerBand2 = AVG2 + num_Dev_Dn * sDev2;

plot UpperBand2 = AVG2 + num_Dev_Up * sDev2;

LowerBand2.AssignValueColor(if AVG1 >= AVG2 then color.green

else if AVG1 <= AVG2 then color.red else color.gray);

UpperBand2.AssignValueColor(if AVG1 >= AVG2 then color.green

else if AVG1 <= AVG2 then color.red else color.gray);

plot OB = HIGH > UpperBand;

OB.SetDefaultColor(Color.light_red);

OB.SetLineWeight(1);

OB.SetPaintingStrategy(PaintingStrategy.Boolean_arrow_DOWN);

plot OS = LOW < LowerBand;

OS.SetDefaultColor(Color.light_green);

OS.SetLineWeight(1);

OS.SetPaintingStrategy(PaintingStrategy.Boolean_arrow_up);

AddCloud(lowerband, lowerband2, Color.dark_GREEN, Color.CURRENT);

AddCloud(upperband2, upperband, Color.RED, Color.CURRENT);

AddCloud(lowerband2, lowerband, Color.dark_GREEN, Color.CURRENT);

AddCloud(upperband, upperband2, Color.RED, Color.CURRENT);

# SQUEEZE

input Squeeze = yes;

def lengths = 5;

def averageTypes = AverageType.SIMPLE;

def sDev1 = StDev(data = price1[-displace], length = lengths);

def MidLine = if Squeeze then MovingAverage(averageTypes, data = price1[-displace], length = lengths) else Double.NaN;

def LowerBandS = if Squeeze then MidLine + Num_Dev_Dn * sDev1 else Double.NaN;

def UpperBandS = if Squeeze then MidLine + Num_Dev_up * sDev1 else Double.NaN;

#KELTNER CHANNELS

def factorH = 1.0;

def factorM = 1.5;

def high1 = high(period = aggregationPeriod1);

def low1 = close(period = aggregationPeriod1);

def trueRangeAverageType = AverageType.SIMPLE;

def shiftH = factorH * MovingAverage(trueRangeAverageType, TrueRange(high1, price1, low1), lengths);

def shiftM = factorM * MovingAverage(trueRangeAverageType, TrueRange(high1, price1, low1), lengths);

def average = MovingAverage(averageTypes, price1, lengths);

def Upper_BandH = if Squeeze then average[-displace] + shiftH[-displace] else Double.NaN;

def Lower_BandH = if Squeeze then average[-displace] - shiftH[-displace] else Double.NaN;

def Upper_BandM = if Squeeze then average[-displace] + shiftM[-displace] else Double.NaN;

def Lower_BandM = if Squeeze then average[-displace] - shiftM[-displace] else Double.NaN;

AddCloud(if Squeeze and Upper_BandH < UpperBandS and Upper_BandH < Upper_BandM then Double.NaN else Upper_BandH, UpperBandS, Color.YELLOW, Color.YELLOW);

AddCloud(if Squeeze and Lower_BandH > LowerBandS then Double.NaN else Lower_BandH, LowerBandS, Color.YELLOW, Color.YELLOW);

AddCloud(if Squeeze and Upper_BandM < UpperBandS then Double.NaN else Upper_BandM, UpperBandS, Color.RED, Color.RED);

AddCloud(if Squeeze and Lower_BandM > LowerBandS then Double.NaN else Lower_BandM, LowerBandS, Color.RED, Color.RED);

# End Code