So I get this question a lot: how do I receive ThinkorSwim alerts via phone notification when my charting platform is not open?

To receive a push notification about an alert in ThinkorSwim, follow the instructions below:

Now, let's get practical. Here is a walkthrough of the tutorial above.

Say I'm a busy person who can't have ThinkorSwim desktop app opened at work or that I'm always on the go and can't check on the market very often. But I don't want to miss out when the opportunity present itself.

I want to receive a push notification alert every time my Buy the Dip indicator gives a signal on the daily chart.

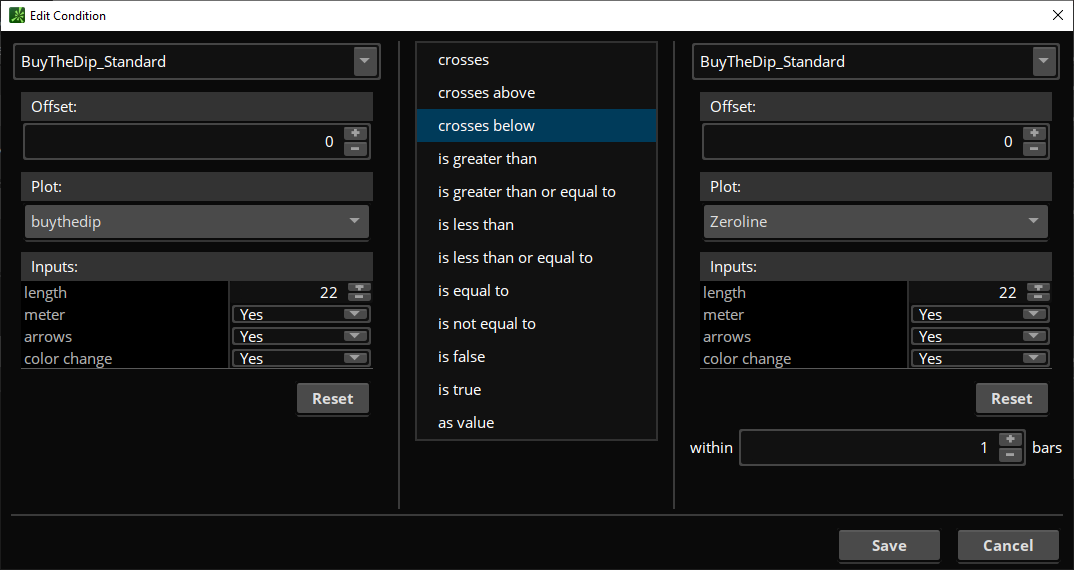

Step 1: Create a scanner for the indicator.

Here's the condition that will trigger the alert.

The thinkScript code for that would be:

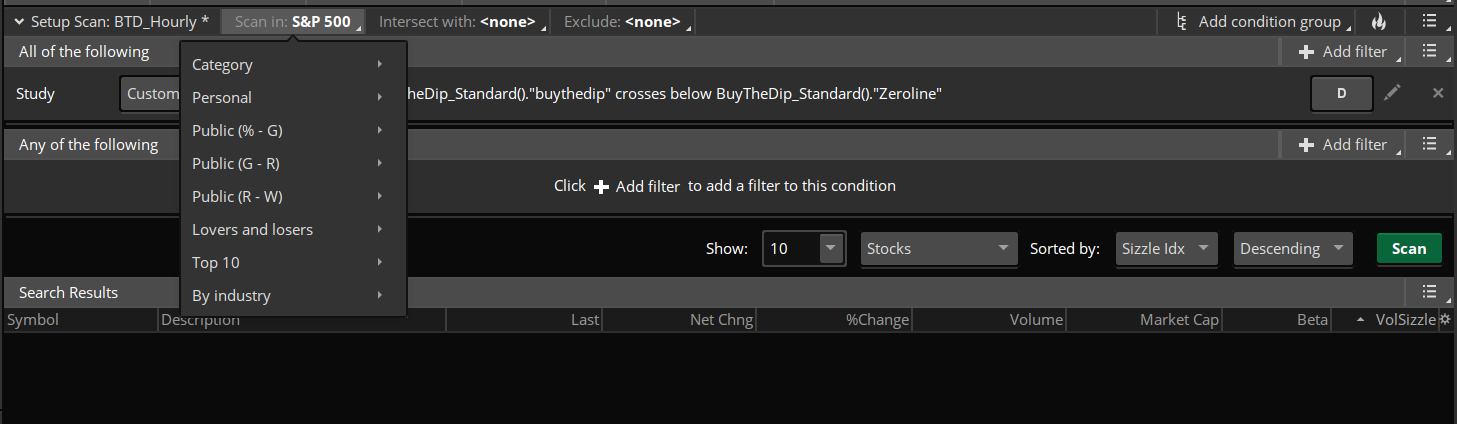

Step 2: Select a watchlist for the scanner to scan in. I'm going to choose the S&P 500. If you have a custom watchlist, then you can pick that as well.

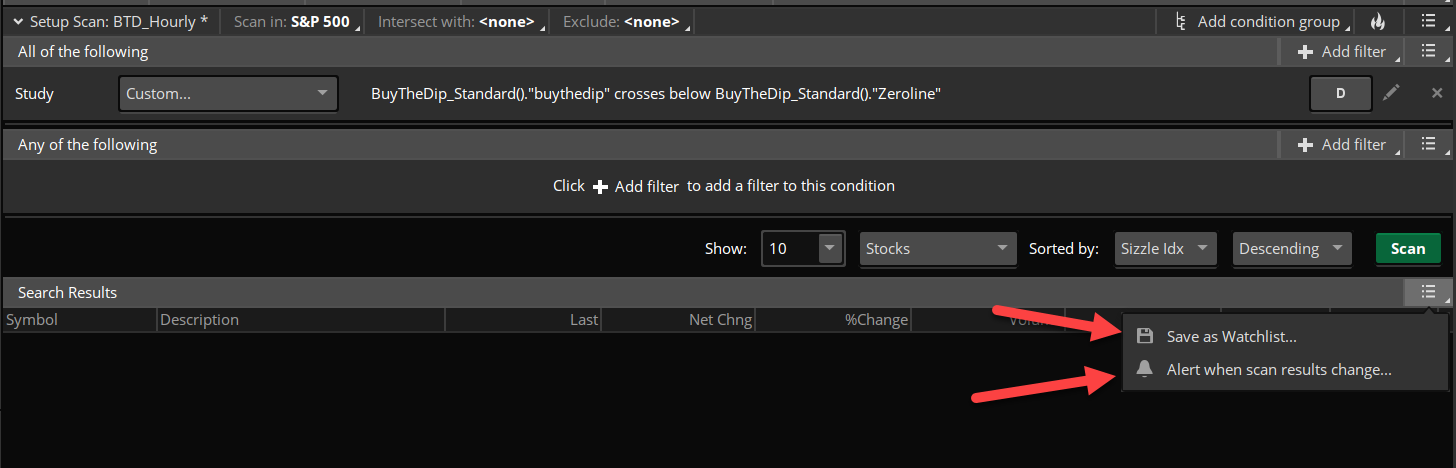

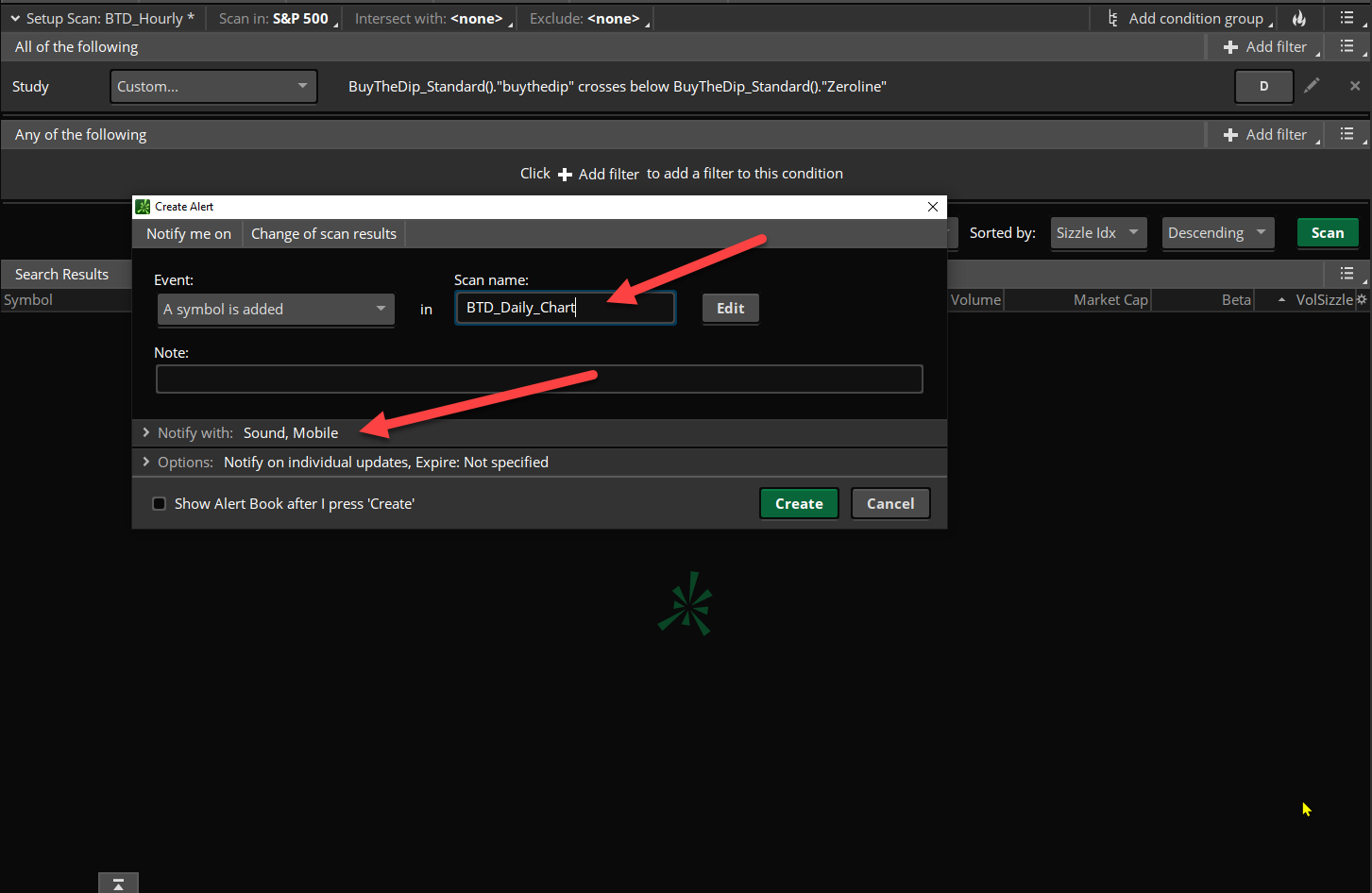

Step 3: Save your scanner as a watchlist and then select the following option: Alert when scan results change...

And that is it! From now on, an alert will be triggered right from my ThinkorSwim app via push notification whenever the Buy the Dip condition is met.

This method applies to almost every other indicator.

I hope that helps. Play around with it and let me know if you run into any issues.

To receive a push notification about an alert in ThinkorSwim, follow the instructions below:

- Download the ThinkorSwim mobile app from the AppStore or Google Play.

- Open the ThinkorSwim desktop platform and go to the Scan's page.

- Create a ThinkorSwim scanner with the condition of your choice.

- Select "Save as Watchlist"

- Select "Alert when scan results change..."

- Make sure the following option is enabled "Send push notifications to mobile devices."

Now, let's get practical. Here is a walkthrough of the tutorial above.

Say I'm a busy person who can't have ThinkorSwim desktop app opened at work or that I'm always on the go and can't check on the market very often. But I don't want to miss out when the opportunity present itself.

I want to receive a push notification alert every time my Buy the Dip indicator gives a signal on the daily chart.

Step 1: Create a scanner for the indicator.

Here's the condition that will trigger the alert.

The thinkScript code for that would be:

Code:

BuyTheDip_Standard()."buythedip" crosses below BuyTheDip_Standard()."Zeroline"Step 2: Select a watchlist for the scanner to scan in. I'm going to choose the S&P 500. If you have a custom watchlist, then you can pick that as well.

Step 3: Save your scanner as a watchlist and then select the following option: Alert when scan results change...

And that is it! From now on, an alert will be triggered right from my ThinkorSwim app via push notification whenever the Buy the Dip condition is met.

This method applies to almost every other indicator.

I hope that helps. Play around with it and let me know if you run into any issues.