Miami51961

Member

Finding Bullish Stocks On Weekly and Daily Time Frame For ThinkOrSwim

I know there has been much talk on finding trending or bullish stocks.

After playing around with the scanning feature and using the market phase indicator it really has become easy to find stocks based on bullish, bearish, accumulation, or whatever phase you are looking for. Below are some screenshots and explanations.

I am using the market phase by trend advisor Chuck Davis

https://usethinkscript.com/threads/market-phases-indicator-for-thinkorswim.1025/

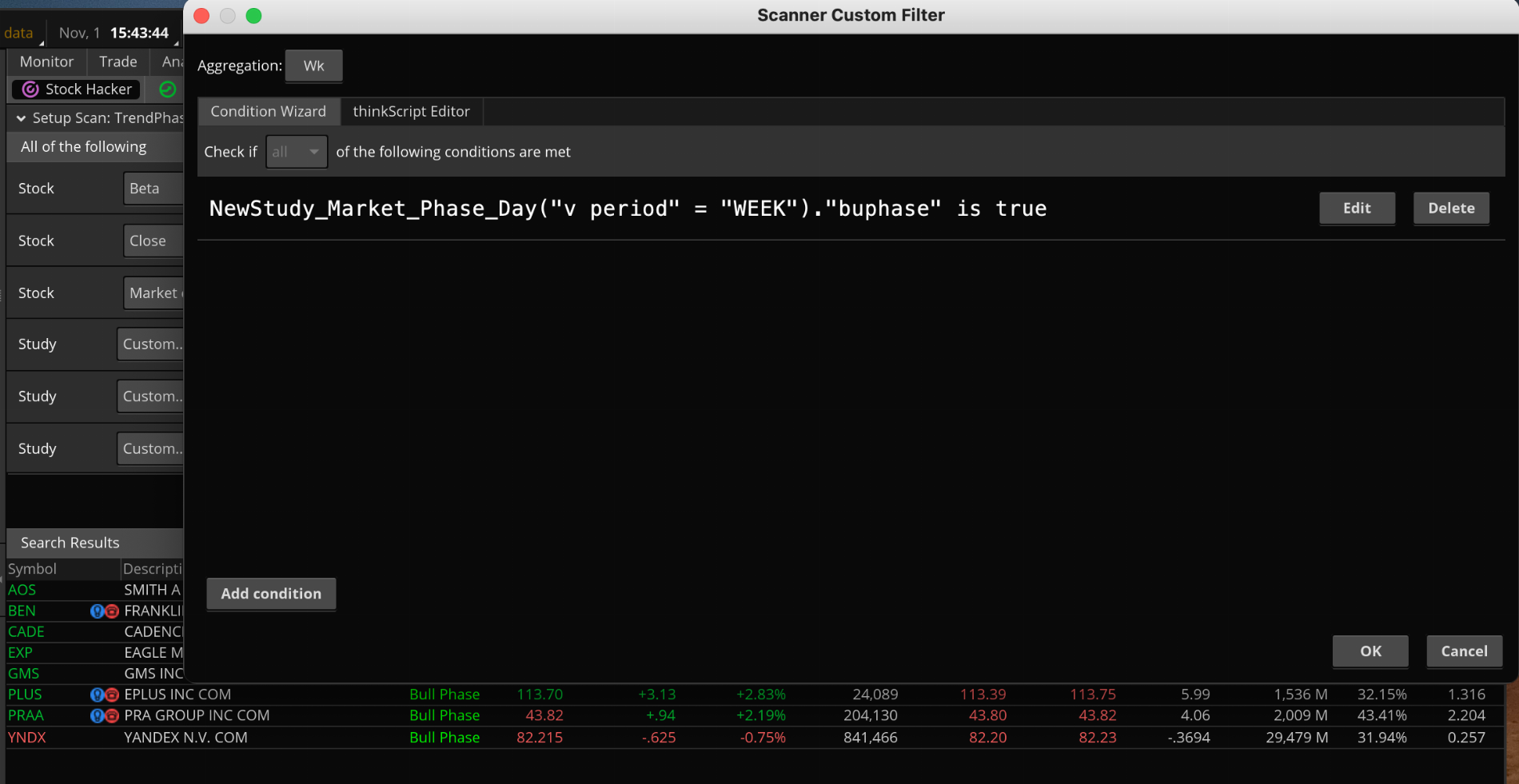

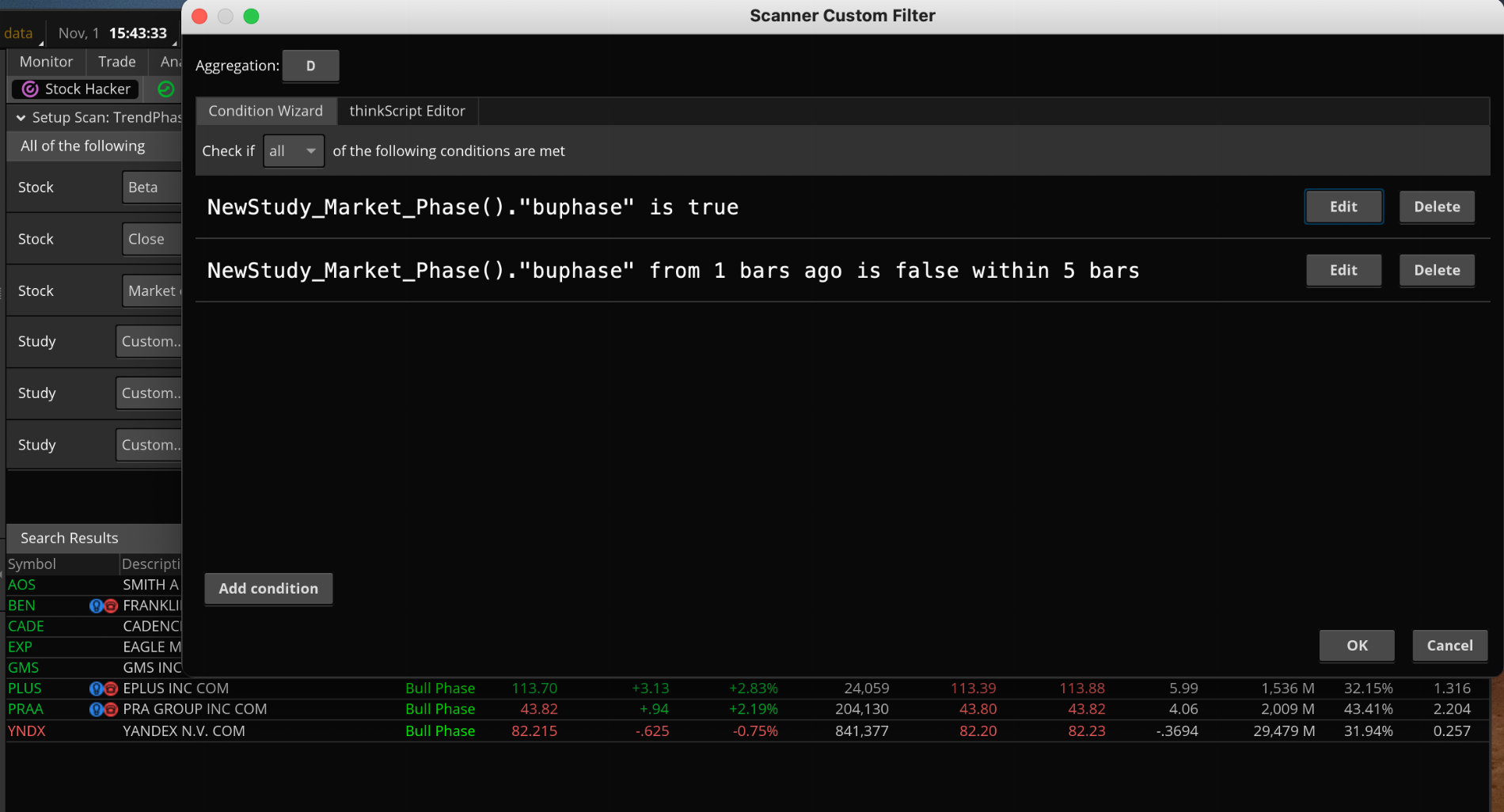

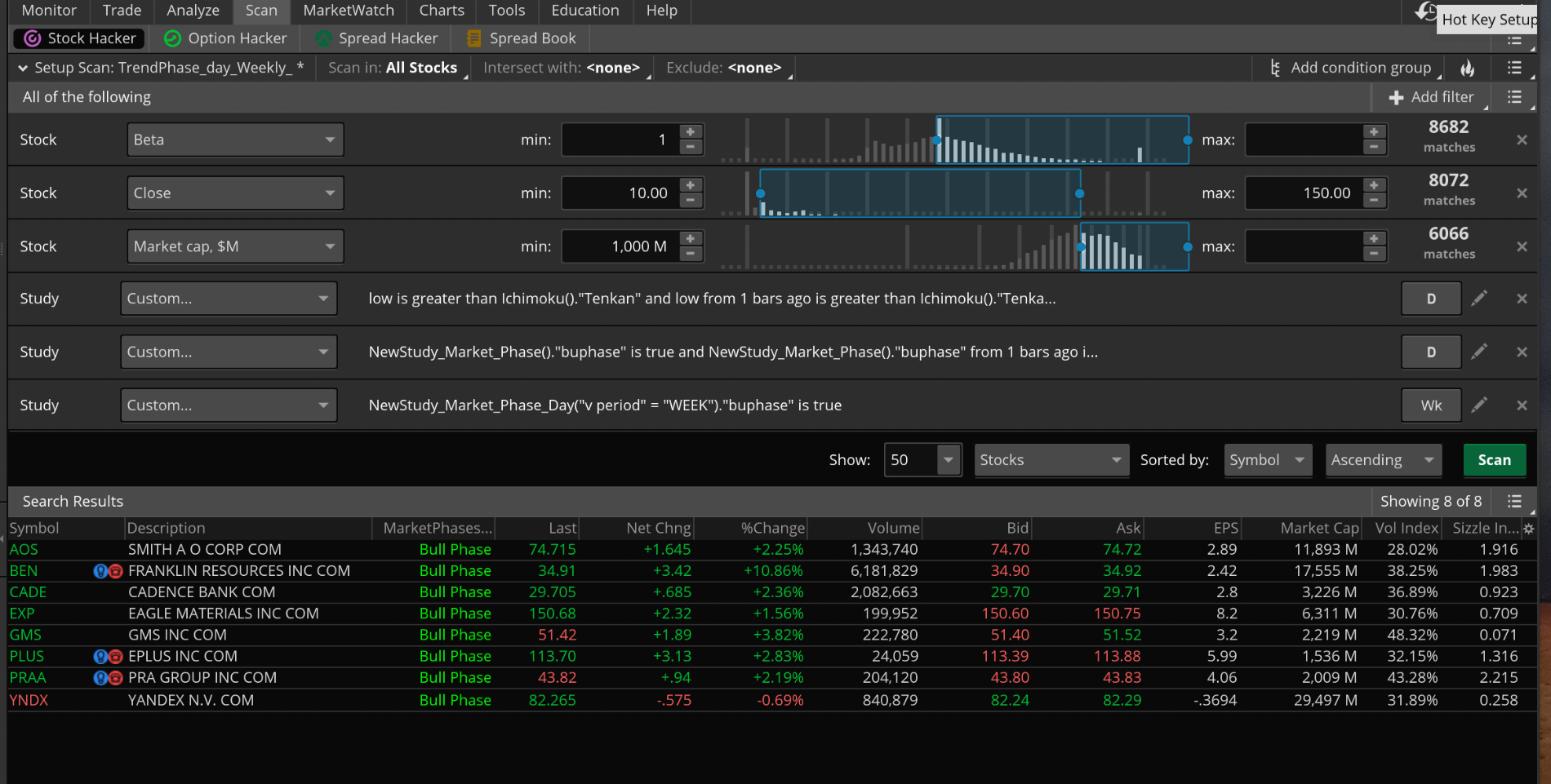

It works extremely well. The scans are set up to look for weekly and daily Bullish trends.

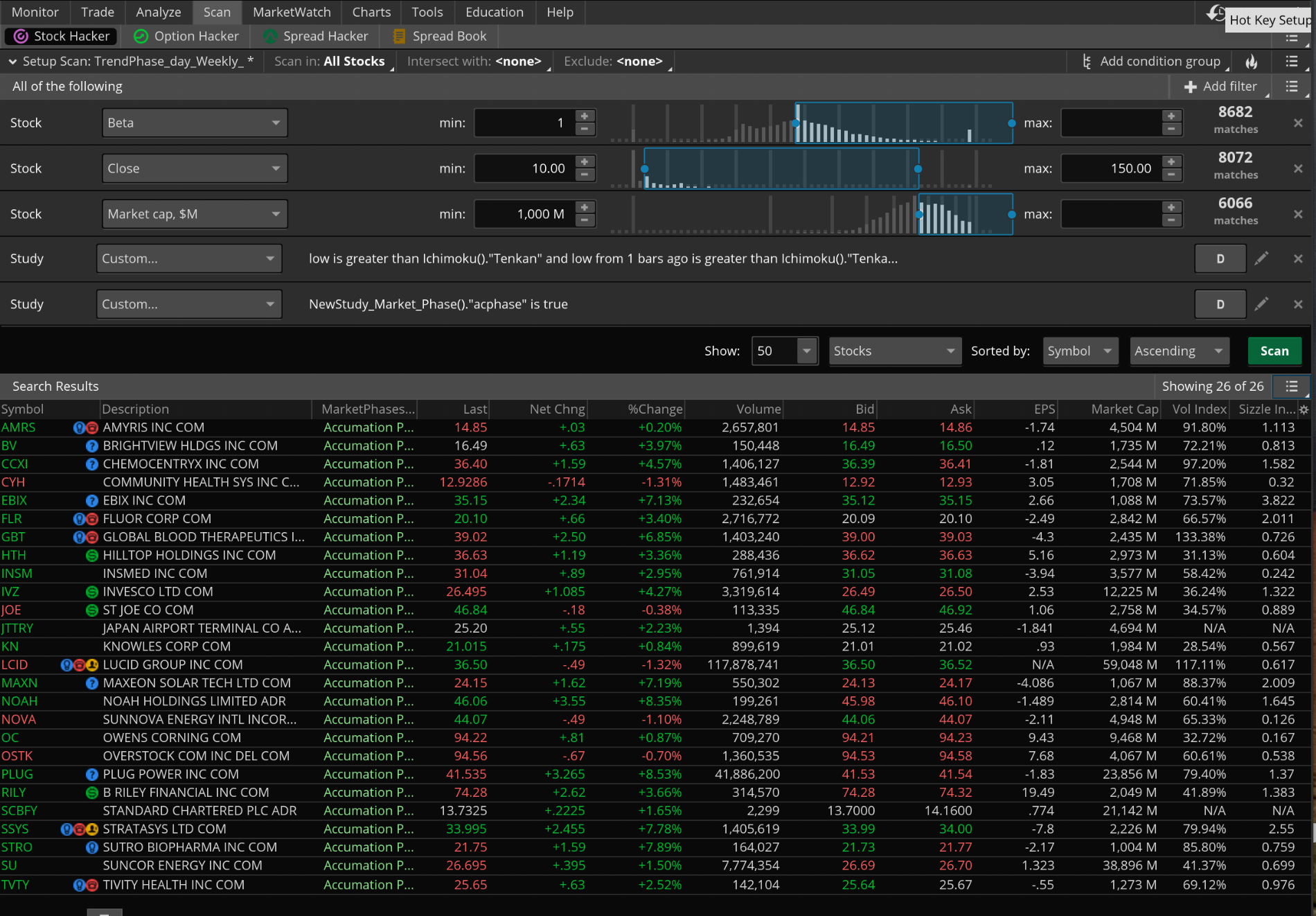

What I found interesting is setting it to look for stocks in the accumulation phase gave some great results.

I also set it to look for stocks that just went from accumulation to the bullish phase.

By doing this I limited my scans to only the strong trending stocks.

I was also using "ichimoko" but you could use whatever method you like of course.

This scan just limits the strong trending stocks. If there are any suggestions or improvements please let me know.

I am scanning for only bullish stocks in this scan. I will add the accumulation phase and give an example.

Setting the scans becomes easy and utilizing both weekly and daily time frames hone in on good stocks.

I also added the market phase in my scan column. Hope this will help some people.

Scan for accumulation on the daily time frame is below

I know there has been much talk on finding trending or bullish stocks.

After playing around with the scanning feature and using the market phase indicator it really has become easy to find stocks based on bullish, bearish, accumulation, or whatever phase you are looking for. Below are some screenshots and explanations.

I am using the market phase by trend advisor Chuck Davis

https://usethinkscript.com/threads/market-phases-indicator-for-thinkorswim.1025/

It works extremely well. The scans are set up to look for weekly and daily Bullish trends.

What I found interesting is setting it to look for stocks in the accumulation phase gave some great results.

I also set it to look for stocks that just went from accumulation to the bullish phase.

By doing this I limited my scans to only the strong trending stocks.

I was also using "ichimoko" but you could use whatever method you like of course.

This scan just limits the strong trending stocks. If there are any suggestions or improvements please let me know.

I am scanning for only bullish stocks in this scan. I will add the accumulation phase and give an example.

Setting the scans becomes easy and utilizing both weekly and daily time frames hone in on good stocks.

I also added the market phase in my scan column. Hope this will help some people.

Scan for accumulation on the daily time frame is below

Last edited by a moderator: