Let’s look at buying put spreads and iron condors using the ThinkOrSwim (TOS) platform. As always we will stick with SPX for illustration.

DISCLAIMER: ALL TRADE SHOWN HERE ARE FOR ILLUSTRATION PURPOSES ONLY.

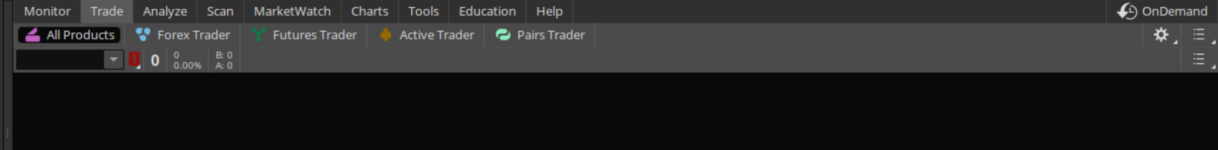

Log into TOS and navigate to the Trade -> All Products section

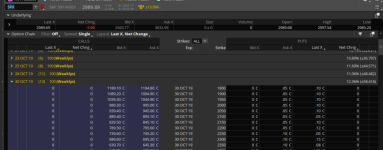

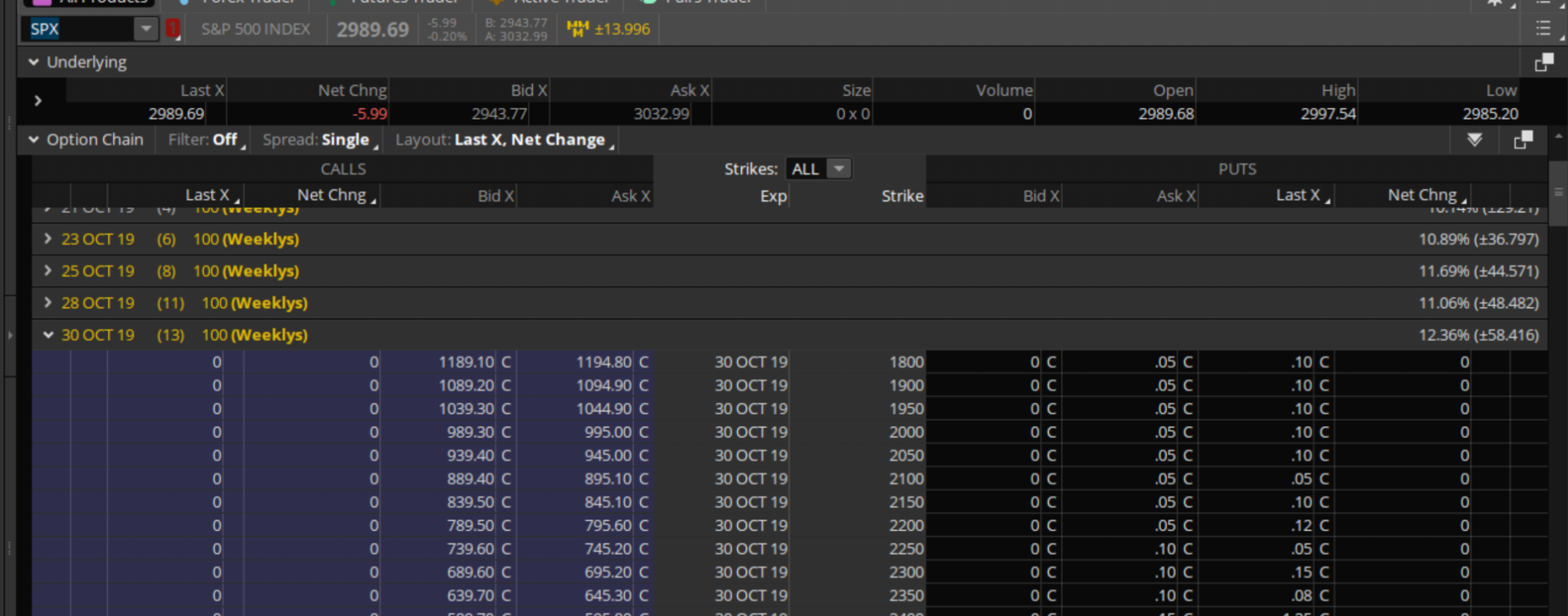

Step 2: Choose the underlying and expiration

Type in SPX in the underlying box and chose the S&P 500 Index. Once you finish choosing you should see the entire option chain pop up right in front of you. Open up the option chain in particular for the expiration that we are looking at. In this case 30th October 2019.

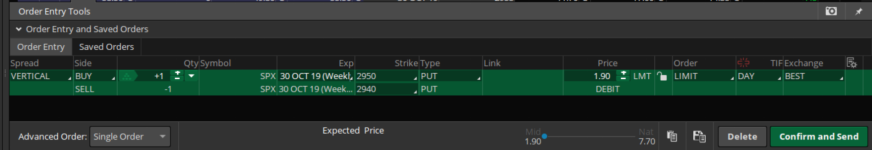

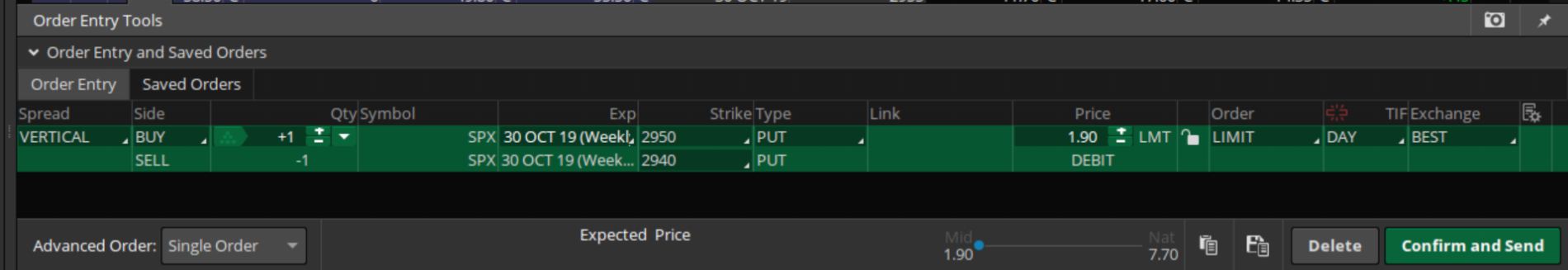

Step 3: Choosing the vertical

We want to buy the 2940/2950 put vertical, so scroll down to section where we can see them. Next step is choosing the trades. We always buy at the Ask price and sell at the Bid prices.The simplest way to remember this is you buy at a higher price and sell at a lower price.

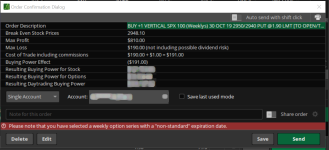

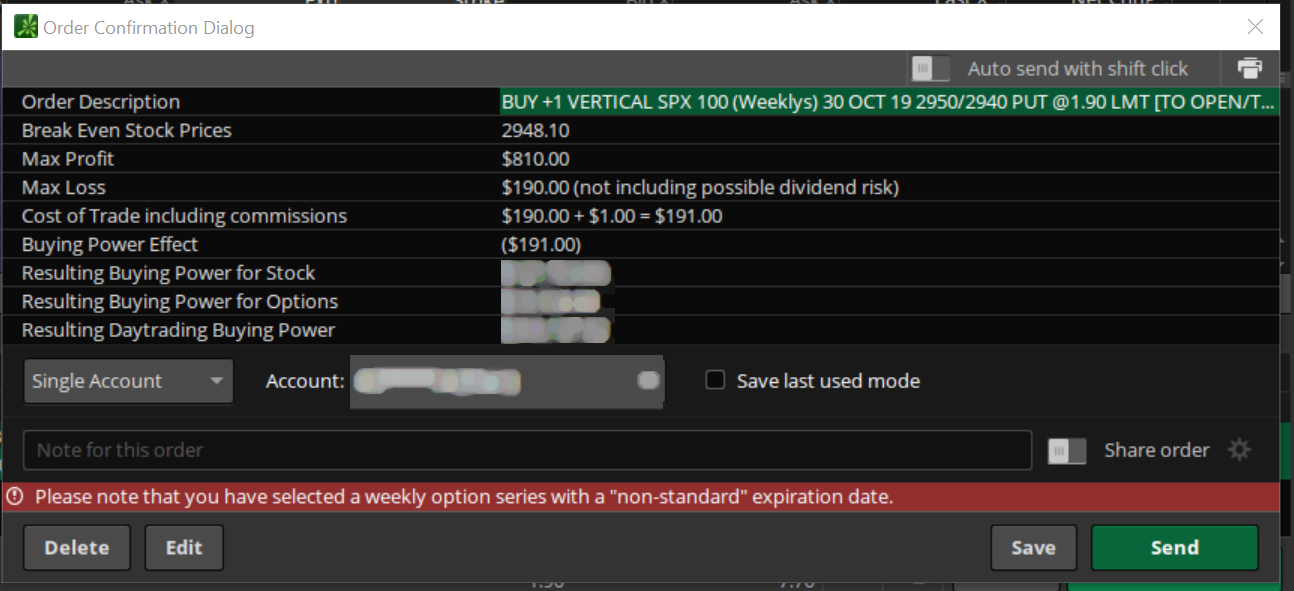

Step 4: Confirmation and Send

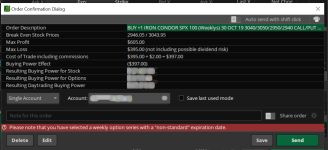

Click on Confirm and Send, you should be able to see the details of the trade shown with maximum profit and loss and the break even as discussed in the article.

Click Send to complete the trade.

You have successfully bought a Put Spread in ThinkorSwim.

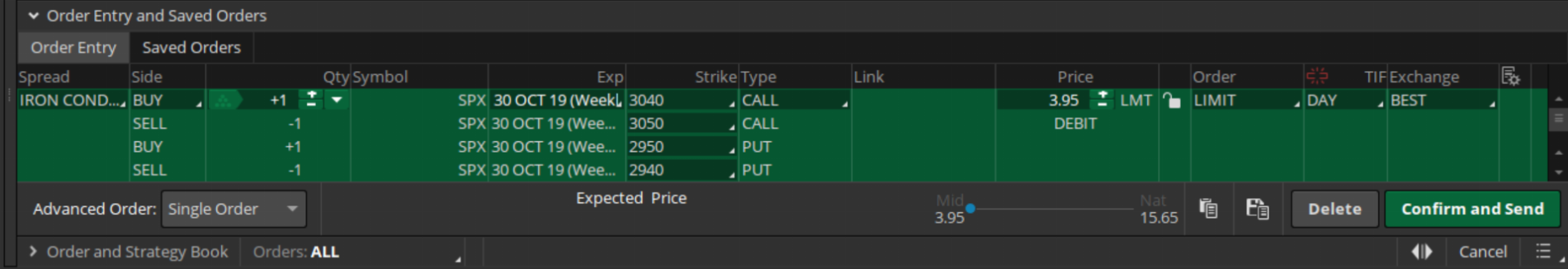

Step 3: Choosing the Iron Condor

As we discussed in our article, the Iron condor is a combination of a put spread and a call spread, In order to purchase an iron condor of 2940/2950/3040/3050 PUT/CALL, go through the following steps,

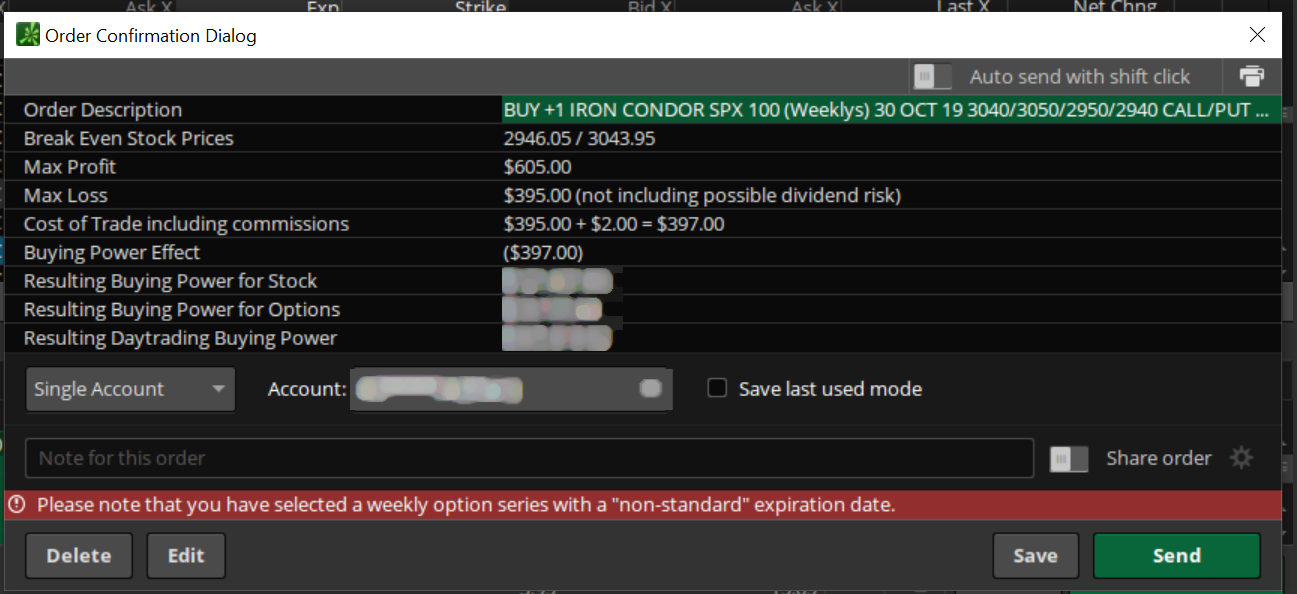

Confirm the following details in the screen,

Click on Confirm and Send after your have made necessary adjustments,

Click Send to complete the trade.

You have successfully bought an Iron Condor in ThinkorSwim.

DISCLAIMER: ALL TRADE SHOWN HERE ARE FOR ILLUSTRATION PURPOSES ONLY.

How To Buy Put Spreads on ThinkorSwim (desktop version)

Step 1: Navigate to Trade TabLog into TOS and navigate to the Trade -> All Products section

Step 2: Choose the underlying and expiration

Type in SPX in the underlying box and chose the S&P 500 Index. Once you finish choosing you should see the entire option chain pop up right in front of you. Open up the option chain in particular for the expiration that we are looking at. In this case 30th October 2019.

Step 3: Choosing the vertical

We want to buy the 2940/2950 put vertical, so scroll down to section where we can see them. Next step is choosing the trades. We always buy at the Ask price and sell at the Bid prices.The simplest way to remember this is you buy at a higher price and sell at a lower price.

- Click on the 2950 Ask on the PUT side

- Hold Ctrl key and click on the 2940 Bid on the PUT side

Step 4: Confirmation and Send

Click on Confirm and Send, you should be able to see the details of the trade shown with maximum profit and loss and the break even as discussed in the article.

Click Send to complete the trade.

You have successfully bought a Put Spread in ThinkorSwim.

How To Buy Iron Condors on ThinkorSwim (desktop version)

Step 1 and Step 2 : Follow the aboveStep 3: Choosing the Iron Condor

As we discussed in our article, the Iron condor is a combination of a put spread and a call spread, In order to purchase an iron condor of 2940/2950/3040/3050 PUT/CALL, go through the following steps,

- Click on the 2950 Ask on the PUT side

- Hold Ctrl key and click on the 2940 Bid on the PUT side

- At this point we have placed a PUT spread

- Hold Ctrl key and click on the 3040 Ask on the CALL side

- Hold Ctrl key and click on the 3050 Bid on the CALL side

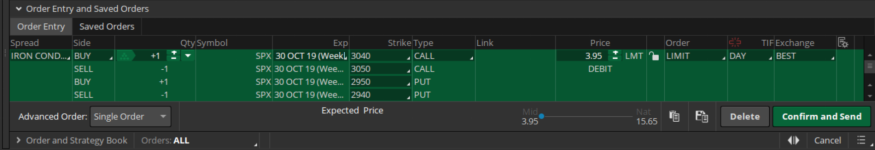

Confirm the following details in the screen,

- Spread type says IRON CONDOR

- Adjust quantity as needed

- Expiry and Strike prices (the call spread and put spread separately)

- Price to be paid

- GREEN background indicating that we are purchasing with a debit

Click on Confirm and Send after your have made necessary adjustments,

Click Send to complete the trade.

You have successfully bought an Iron Condor in ThinkorSwim.