You should upgrade or use an alternative browser.

Hourly Vwap

- Thread starter TonXas

- Start date

- Status

- Not open for further replies.

germanburrito

Active member

look at this on a 5 minute chart so, its looking back 12 5 minute candles which is an houris there any way to do an hourly vwap similar to the one in the bookmap?

# Identify - Input Bars Back

# Mobius

#German BURRITO

input BarsBack = 12;

def currentBar = if isnan(close[-1]) and !isnan(close)

then barnumber()

else currentBar[1];

def barCount = if barnumber()== 1

then highestall(currentBar)

else if barCount[1] > 1

then barCount[1] - 1

else 0;

plot count = if barCount == BarsBack then barCount else double.nan;

count.SetPaintingStrategy(PaintingStrategy.Values_Below);

plot Number1 = if barCount == barsBack then low - (3* TickSize()) else double.nan;

Number1.SetStyle(Curve.Points);

Number1.SetLineWeight(5);

Number1.SetDefaultColor(Color.Pink);

def LocH = (hl2) * volume;

def LocL = (hl2) * volume;

rec PH;

rec VH;

if count {

PH = LocH;

VH = volume;

} else {

PH = compoundValue(1, LocH + PH[1], Double.NaN);

VH = compoundValue(1, volume + VH[1], Double.NaN);

}

plot Vw = PH / VH;Thanks for posting the script, is this line or a label? I copied the script but nothing showed up?look at this on a 5 minute chart so, its looking back 12 5 minute candles which is an hour

Code:# Identify - Input Bars Back # Mobius #German BURRITO input BarsBack = 12; def currentBar = if isnan(close[-1]) and !isnan(close) then barnumber() else currentBar[1]; def barCount = if barnumber()== 1 then highestall(currentBar) else if barCount[1] > 1 then barCount[1] - 1 else 0; plot count = if barCount == BarsBack then barCount else double.nan; count.SetPaintingStrategy(PaintingStrategy.Values_Below); plot Number1 = if barCount == barsBack then low - (3* TickSize()) else double.nan; Number1.SetStyle(Curve.Points); Number1.SetLineWeight(5); Number1.SetDefaultColor(Color.Pink); def LocH = (hl2) * volume; def LocL = (hl2) * volume; rec PH; rec VH; if count { PH = LocH; VH = volume; } else { PH = compoundValue(1, LocH + PH[1], Double.NaN); VH = compoundValue(1, volume + VH[1], Double.NaN); } plot Vw = PH / VH;

is there any way to do an hourly vwap similar to the one in the bookmap?

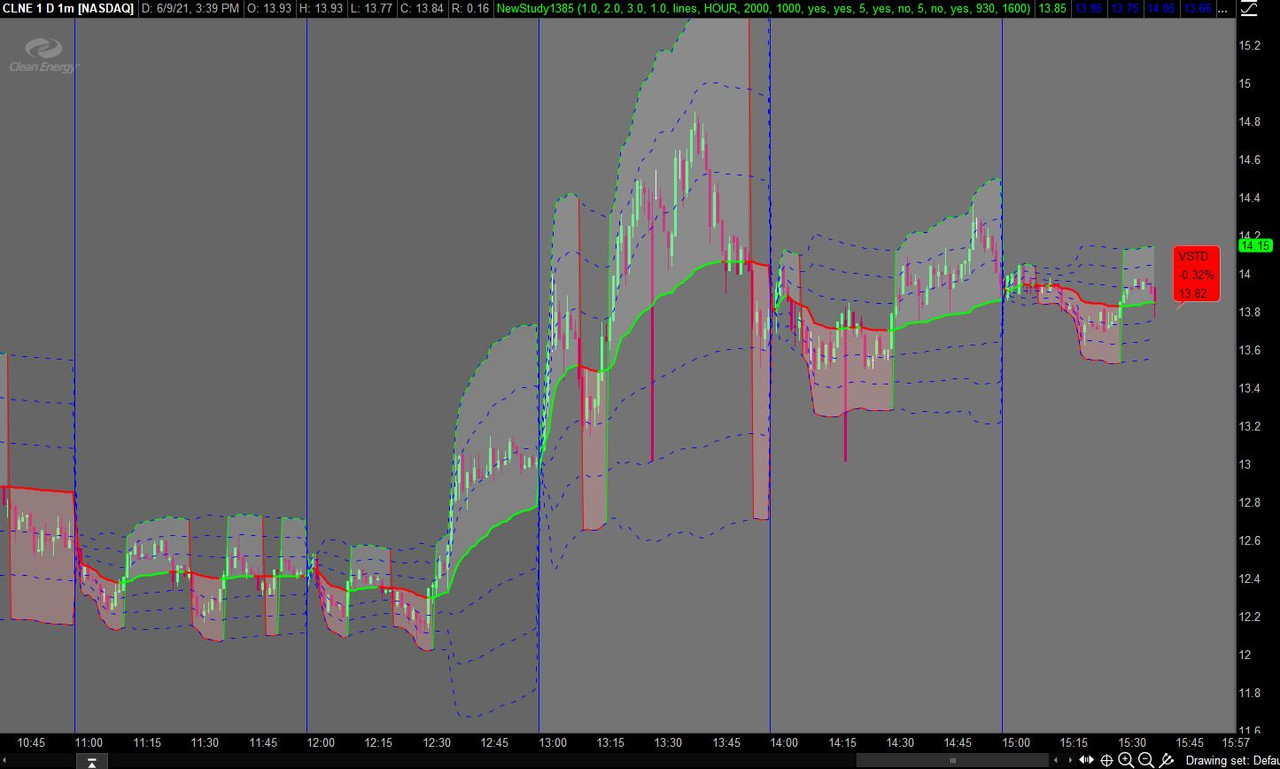

Here is something I did quite awhile ago that may help. There are a lot of options or your can remove what you do not wan added limited lines and full lines # instead of normal curves

Code:##################################################################### #VWAP_Limited_Full_Lines 2011.11.12 14:45pst zzz added limited lines and full lines # instead of normal curves #VWAP Study: thinkorswim, inc. (c) 2011 # 2012-02-06 duplicated the thinkorswim code # modified some thinkorswim variable names # modified default colors for plotting # and added code for 2nd deviation # input num1stDevUp = 1.0; input num2ndDevUp = 2.0; input num3rdDevUp = 3.0; def num1stDevDn = -num1stDevUp; def num2ndDevDn = -num2ndDevUp; def num3rdDevDn = -num3rdDevUp; input multiplier = 1.0;#Hint multiplier: Change to +/- number of "Days", "Weeks", etc input lines = {default limited, horizontal, lines}; input timeFrame = {MINUTE, MIN2, MIN3, MIN5, MIN10, MIN15, MIN20, MIN30, default HOUR, TWOHOUR, FOURHOUR, DAY, WEEK, MONTH, CHART}; def cap = GetAggregationPeriod(); def errorInAggregation = timeFrame == timeFrame.DAY and cap >= AggregationPeriod.WEEK or timeFrame == timeFrame.WEEK and cap >= AggregationPeriod.MONTH; Assert(!errorInAggregation, "vwap timeFrame should be not less than current chart aggregation period"); def yyyyMmDd = GetYYYYMMDD(); def periodIndx; def seconds = SecondsFromTime(0); def minutes; def day_number = DaysFromDate(First(yyyyMmDd)) + GetDayOfWeek(First(yyyyMmDd)); switch (timeFrame) { case MINUTE: periodIndx = Floor(seconds / 60 + day_number * 24 * 60); minutes = 1; case MIN2: periodIndx = Floor(seconds / 120 + day_number * 24); minutes = 2; case MIN3: periodIndx = Floor(seconds / 180 + day_number * 24); minutes = 3; case MIN5: periodIndx = Floor(seconds / 300 + day_number * 24); minutes = 5; case MIN10: periodIndx = Floor(seconds / 600 + day_number * 24); minutes = 10; case MIN15: periodIndx = Floor(seconds / 900 + day_number * 24); minutes = 15; case MIN20: periodIndx = Floor(seconds / 1200 + day_number * 24); minutes = 20; case MIN30: periodIndx = Floor(seconds / 1800 + day_number * 24); minutes = 30; case HOUR: periodIndx = Floor(seconds / 3600 + day_number * 24); minutes = 60; case TWOHOUR: periodIndx = Floor(seconds / 7200 + day_number * 24); minutes = 120; case FOURHOUR: periodIndx = Floor(seconds / 14400 + day_number * 24); minutes = 240; case DAY: periodIndx = CountTradingDays(Min(First(yyyyMmDd), yyyyMmDd), yyyyMmDd) - 1; minutes = 720; case WEEK: periodIndx = Floor((DaysFromDate(First(yyyyMmDd)) + GetDayOfWeek(First(yyyyMmDd))) / 7); minutes = 3600; case MONTH: periodIndx = RoundDown(yyyyMmDd / 100, 0); minutes = 15120; case CHART: periodIndx = 0; minutes = 0; } def countindx = CompoundValue(1, if periodIndx != periodIndx[1] then (countindx[1] + periodIndx - periodIndx[1]) % multiplier else countindx[1], 0); def isPeriodRolled = countindx < countindx[1] + periodIndx - periodIndx[1]; #def isPeriodRolled = CompoundValue(1, periodIndx != periodIndx[1], yes); input num_vwap_displayed = 2000; def Count = num_vwap_displayed; def cond = if isPeriodRolled then 1 else Double.NaN; def dataCount = CompoundValue(1, if !IsNaN(cond) then dataCount[1] + 1 else dataCount[1], 0); rec volumeSum; rec volumeVwapSum; rec volumeVwap2Sum; if (isPeriodRolled) { volumeSum = volume; volumeVwapSum = volume * vwap; volumeVwap2Sum = volume * Sqr(vwap); } else { volumeSum = CompoundValue(1, volumeSum[1] + volume, volume); volumeVwapSum = CompoundValue(1, volumeVwapSum[1] + volume * vwap, volume * vwap); volumeVwap2Sum = CompoundValue(1, volumeVwap2Sum[1] + volume * Sqr(vwap), volume * Sqr(vwap)); } def price = volumeVwapSum / volumeSum; def deviation = Sqrt(Max(volumeVwap2Sum / volumeSum - Sqr(price), 0)); rec v = if IsNaN(vwap) then v[1] else price; rec v1 = if IsNaN(vwap) then v1[1] else price + num1stDevUp * deviation; rec v2 = if IsNaN(vwap) then v2[1] else price - num1stDevUp * deviation; rec v3 = if IsNaN(vwap) then v3[1] else price + num2ndDevUp * deviation; rec v4 = if IsNaN(vwap) then v4[1] else price - num2ndDevUp * deviation; rec v5 = if IsNaN(vwap) then v5[1] else price + num3rdDevUp * deviation; rec v6 = if IsNaN(vwap) then v6[1] else price - num3rdDevUp * deviation; plot VWAP; plot FirstUpperBand; plot FirstLowerBand; plot SecondUpperBand; plot SecondLowerBand; plot ThirdUpperBand; plot ThirdLowerBand; input showlineinchartlength = 5; input showlines = yes; if (!errorInAggregation) and lines == lines.limited { VWAP = if IsNaN(close) then Double.NaN else if IsNaN(close[-showlineinchartlength]) and HighestAll(dataCount) - dataCount <= Count - 1 then v else Double.NaN ; FirstUpperBand = if IsNaN(close[-showlineinchartlength]) and HighestAll(dataCount) - dataCount <= Count - 1 then v1 else Double.NaN ; FirstLowerBand = if IsNaN(close[-showlineinchartlength]) and HighestAll(dataCount) - dataCount <= Count - 1 then v2 else Double.NaN ; SecondUpperBand = if IsNaN(close[-showlineinchartlength]) and HighestAll(dataCount) - dataCount <= Count - 1 then v3 else Double.NaN ; SecondLowerBand = if IsNaN(close[-showlineinchartlength]) and HighestAll(dataCount) - dataCount <= Count - 1 then v4 else Double.NaN ; ThirdUpperBand = if IsNaN(close[-showlineinchartlength]) and HighestAll(dataCount) - dataCount <= Count - 1 then v5 else Double.NaN ; ThirdLowerBand = if IsNaN(close[-showlineinchartlength]) and HighestAll(dataCount) - dataCount <= Count - 1 then v6 else Double.NaN ; } else if (!errorInAggregation) and lines == lines.horizontal and HighestAll(dataCount) - dataCount <= Count - 1 { VWAP = HighestAll(if IsNaN(close) then v else Double.NaN ); FirstUpperBand = HighestAll(if IsNaN(close) then v1 else Double.NaN ); FirstLowerBand = HighestAll(if IsNaN(close) then v2 else Double.NaN ); SecondUpperBand = HighestAll(if IsNaN(close) then v3 else Double.NaN ); SecondLowerBand = HighestAll(if IsNaN(close) then v4 else Double.NaN ); ThirdUpperBand = HighestAll(if IsNaN(close) then v5 else Double.NaN ); ThirdLowerBand = HighestAll(if IsNaN(close) then v6 else Double.NaN ); } else if (!errorInAggregation) and lines == lines.lines and HighestAll(dataCount) - dataCount <= Count - 1 { VWAP = price; FirstUpperBand = price + num1stDevUp * deviation; FirstLowerBand = price - num1stDevUp * deviation; SecondUpperBand = price + num2ndDevUp * deviation; SecondLowerBand = price - num2ndDevUp * deviation; ThirdUpperBand = price + num3rdDevUp * deviation; ThirdLowerBand = price - num3rdDevUp * deviation; } else { VWAP = Double.NaN; FirstUpperBand = Double.NaN; FirstLowerBand = Double.NaN; SecondUpperBand = Double.NaN; SecondLowerBand = Double.NaN; ThirdUpperBand = Double.NaN; ThirdLowerBand = Double.NaN; } #VWAP.SetDefaultColor(Color.BLUE); VWAP.AssignValueColor(if VWAP > VWAP[1] then Color.GREEN else Color.RED); FirstUpperBand.SetDefaultColor(Color.BLUE); FirstLowerBand.SetDefaultColor(Color.BLUE); SecondUpperBand.SetDefaultColor(Color.BLUE); SecondLowerBand.SetDefaultColor(Color.BLUE); ThirdUpperBand.SetDefaultColor(Color.BLUE); ThirdLowerBand.SetDefaultColor(Color.BLUE); VWAP.SetPaintingStrategy(PaintingStrategy.LINE); FirstUpperBand.SetStyle(Curve.SHORT_DASH); FirstLowerBand.SetStyle(Curve.SHORT_DASH); SecondUpperBand.SetStyle(Curve.SHORT_DASH); SecondLowerBand.SetStyle(Curve.SHORT_DASH); ThirdUpperBand.SetStyle(Curve.SHORT_DASH); ThirdLowerBand.SetStyle(Curve.SHORT_DASH); VWAP.SetLineWeight(2); FirstUpperBand.SetLineWeight(1); FirstLowerBand.SetLineWeight(1); SecondUpperBand.SetLineWeight(1); SecondLowerBand.SetLineWeight(1); ThirdUpperBand.SetLineWeight(1); ThirdLowerBand.SetLineWeight(1); VWAP.HideBubble(); FirstUpperBand.HideBubble(); FirstLowerBand.HideBubble(); SecondUpperBand.HideBubble(); SecondLowerBand.HideBubble(); ThirdUpperBand.HideBubble(); ThirdLowerBand.HideBubble(); FirstUpperBand.SetHiding(!showlines); FirstLowerBand.SetHiding(!showlines); SecondUpperBand.SetHiding(!showlines); SecondLowerBand.SetHiding(!showlines); ThirdUpperBand.SetHiding(!showlines); ThirdLowerBand.SetHiding(!showlines); input showbubblesVSTD = yes; input bubblemoverVSTD = 5;#Hint bubblemoverVSTD: Number of Spaces VSTD bubble offset in expansion def p = bubblemoverVSTD; def p1 = p + 1; AddChartBubble(showbubblesVSTD and IsNaN(close[p]) and !IsNaN(close[p1]) , close[p1], "VSTD" + "\n" + AsPercent((close[p1] - price[p1]) / deviation[p1] / 100) + "\n" + Round(close[p1], 2) , if close[p1] > VWAP[p1] then if close[p1] > close[p1 + 1] then Color.GREEN else Color.LIGHT_GREEN else if close[p1] > close[p1 + 1] then Color.LIGHT_RED else Color.RED ); input showclouds = yes; def green = if low >= VWAP and close > open then 1 else if green[1] == 1 and high >= VWAP then 1 else if green[1] == 1 and close > open then 1 else 0; def g = !isnan(green); AddCloud(if showclouds and g then ThirdUpperBand else Double.NaN, VWAP, Color.LIGHT_GRAY, Color.LIGHT_GRAY); AddCloud(if showclouds and !g then VWAP else Double.NaN, ThirdLowerBand, Color.PINK, Color.PINK); plot x = if showclouds then if g then ThirdUpperBand else ThirdLowerBand else Double.NaN; x.AssignValueColor(if g then Color.GREEN else Color.RED); input showbubblescurrent = no; input bubblemovercurrent = 5;#Hint bubblemoverVSTD: Number of Spaces Above/Below VWAP bubble offset in expansion def q = bubblemovercurrent; def q1 = q + 1; AddChartBubble(showbubblescurrent and IsNaN(close[q]) and !IsNaN(close[q1]) , close[q1], "V" , if g[q1] then Color.GREEN else Color.RED ); input usealerts = yes; Alert(usealerts and g[1] != g, "VWAP - " + if g == 1 then "Green" else "Red", Alert.BAR, Sound.Chimes); # end of VWAP Study #Vertical Line @VWAP timeframe input showverticalline = yes; input begin = 0930; input end = 1600; def start = if (timeFrame == timeFrame.TWOHOUR or timeFrame == timeFrame.FOURHOUR) then SecondsTillTime(0800) == 0 and SecondsFromTime(0800) == 0 else if timeFrame == timeFrame.HOUR then SecondsTillTime(0900) == 0 and SecondsFromTime(0900) == 0 else SecondsTillTime(0930) == 0 and SecondsFromTime(0930) == 0; def bar = if start then 0 else bar[1] + 1; AddVerticalLine(if showverticalline and GetDay() == GetLastDay() and SecondsFromTime(begin) >= 0 then bar % ((Ceil(minutes) * multiplier) / (GetAggregationPeriod() / 60000)) == 0 else Double.NaN, color = Color.BLUE, stroke = Curve.FIRM);

Not that I am aware as I cannot find that TOS has that data available in thinkscript.Is there anyway to incorporate cumulative volume delta to this?

def volsum = volume + volume[1]+ volume[2]+ volume[3]+ volume[4]+ volume[5];

def vwapsum = volume*close + volume[1]*close[1] + volume[2]*close[2] + volume[3]*close[3] + volume[4]*close[4] + volume[5]*close[5];

plot myvwap = vwapsum/volsum;

germanburrito

Active member

hmmm... interesting we can definitely explore this idea in other ways. Good idea!How to we use Compound here.. trying to generate VWAP for last few bars ... instead of the whole day..

def volsum = volume + volume[1]+ volume[2]+ volume[3]+ volume[4]+ volume[5];

def vwapsum = volume*close + volume[1]*close[1] + volume[2]*close[2] + volume[3]*close[3] + volume[4]*close[4] + volume[5]*close[5];

plot myvwap = vwapsum/volsum;

One way is using my code above, which you can copy and use to limit the plot as you suggest. There is an input option 'lines', which I set to limit and 'showlinesinchartlength' to '5'. You can turn off the vertical lines at the input also if you want. Here is the result using the above inputsHow to we use Compound here.. trying to generate VWAP for last few bars ... instead of the whole day..

def volsum = volume + volume[1]+ volume[2]+ volume[3]+ volume[4]+ volume[5];

def vwapsum = volume*close + volume[1]*close[1] + volume[2]*close[2] + volume[3]*close[3] + volume[4]*close[4] + volume[5]*close[5];

plot myvwap = vwapsum/volsum;

hmmm... interesting we can definitely explore this idea in other ways. Good idea!

If you want a simpler way to limit the plot of the TOS standard vwap then this might help

Code:input xbars = 5; def lastbar = HighestAll(if !IsNaN(close) and IsNaN(close[-1]) then BarNumber() else Double.NaN); plot vwap = if BarNumber() < lastbar - xbars then Double.NaN else reference VWAP(); plot vwapu = if BarNumber() < lastbar - xbars then Double.NaN else reference VWAP().UpperBand; plot vwapl = if BarNumber() < lastbar - xbars then Double.NaN else reference VWAP().LowerBand;

TonXas

New member

# Identify - Input Bars Back

# Mobius

#German BURRITO

input BarsBack = 12;

def currentBar = if isnan(close[-1]) and !isnan(close)

then barnumber()

else currentBar[1];

def barCount = if barnumber()== 1

then highestall(currentBar)

else if barCount[1] > 1

then barCount[1] - 1

else 0;

plot count = if barCount == BarsBack then barCount else double.nan;

count.SetPaintingStrategy(PaintingStrategy.Values_Below);

plot Number1 = if barCount == barsBack then low - (3* TickSize()) else double.nan;

Number1.SetStyle(Curve.Points);

Number1.SetLineWeight(5);

Number1.SetDefaultColor(Color.Pink);

def LocH = (hl2) * volume;

def LocL = (hl2) * volume;

rec PH;

rec VH;

if count {

PH = LocH;

VH = volume;

} else {

PH = compoundValue(1, LocH + PH[1], Double.NaN);

VH = compoundValue(1, volume + VH[1], Double.NaN);

}

plot Vw = PH / VH;Is there any way to do a market profile (TPO) like how this vwap is setup? (i know you can do it by time segments)

See if this helps

Code:input xbars = 12; def lastbar = HighestAll(if !IsNaN(close) and IsNaN(close[-1]) then BarNumber() else Double.NaN); plot vwap = if BarNumber() < lastbar - xbars then Double.NaN else reference TPOProfile("time per profile" = "HOUR", "on expansion" = No); plot vwapu = if BarNumber() < lastbar - xbars then Double.NaN else reference TPOProfile("time per profile" = "HOUR", "on expansion" = No).VAHigh; plot vwapl = if BarNumber() < lastbar - xbars then Double.NaN else reference TPOProfile("time per profile" = "HOUR", "on expansion" = No).VALow;

TonXas said:

Is there any way to do a market profile (TPO) like how this vwap is setup? (i know you can do it by time segments)

Also try this. I have not determined whether it produces correct results, but it plots in the direction of the trend on the one's I checked

Code:# Identify - Input Bars Back # Mobius #German BURRITO #Sleepyz - mod changing tpoprofile for volume input BarsBack = 12; def currentBar = if IsNaN(close[-1]) and !IsNaN(close) then BarNumber() else currentBar[1]; def barCount = if BarNumber() == 1 then HighestAll(currentBar) else if barCount[1] > 1 then barCount[1] - 1 else 0; plot count = if barCount == BarsBack then barCount else Double.NaN; count.SetPaintingStrategy(PaintingStrategy.VALUES_BELOW); plot Number1 = if barCount == BarsBack then low - (3 * TickSize()) else Double.NaN; Number1.SetStyle(Curve.POINTS); Number1.SetLineWeight(5); Number1.SetDefaultColor(Color.PINK); input timePerProfile = {default CHART, MINUTE, HOUR, DAY, WEEK, MONTH, "OPT EXP", BAR}; def tpo = reference TPOProfile("time per profile" = timeperprofile, "on expansion" = no); def LocH = (hl2) * tpo ; def LocL = (hl2) * tpo; rec PH; rec VH; if count { PH = LocH; VH = tpo; } else { PH = CompoundValue(1, LocH + PH[1], Double.NaN); VH = CompoundValue(1, tpo + VH[1], Double.NaN); } plot Vw = PH / VH;

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| A | hourly ORB question? | Questions | 1 | |

| G | Indicator to Draw Hourly Support and Resistance Lines on 1 Min or 5 Min Timeframe Chart | Questions | 2 | |

| R | hourly level vbox? | Questions | 1 | |

| B | Put daily EMA on Hourly | Questions | 3 | |

|

|

IV % auto draw a line based on HOURLY / DAILY | Questions | 1 |

Similar threads

-

-

Indicator to Draw Hourly Support and Resistance Lines on 1 Min or 5 Min Timeframe Chart

- Started by gsvector24

- Replies: 2

-

-

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

-

Indicator to Draw Hourly Support and Resistance Lines on 1 Min or 5 Min Timeframe Chart

- Started by gsvector24

- Replies: 2

-

-

-

Similar threads

-

-

Indicator to Draw Hourly Support and Resistance Lines on 1 Min or 5 Min Timeframe Chart

- Started by gsvector24

- Replies: 2

-

-

-

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/