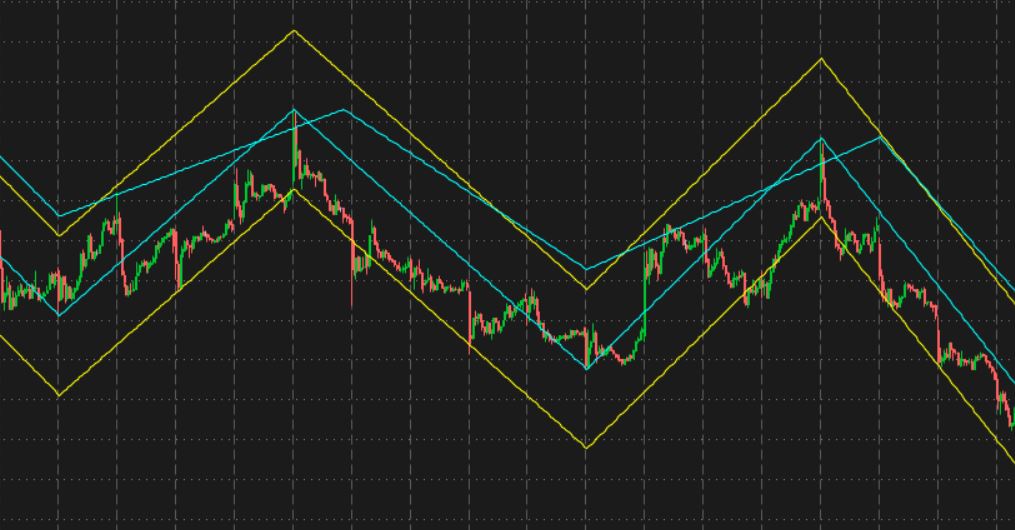

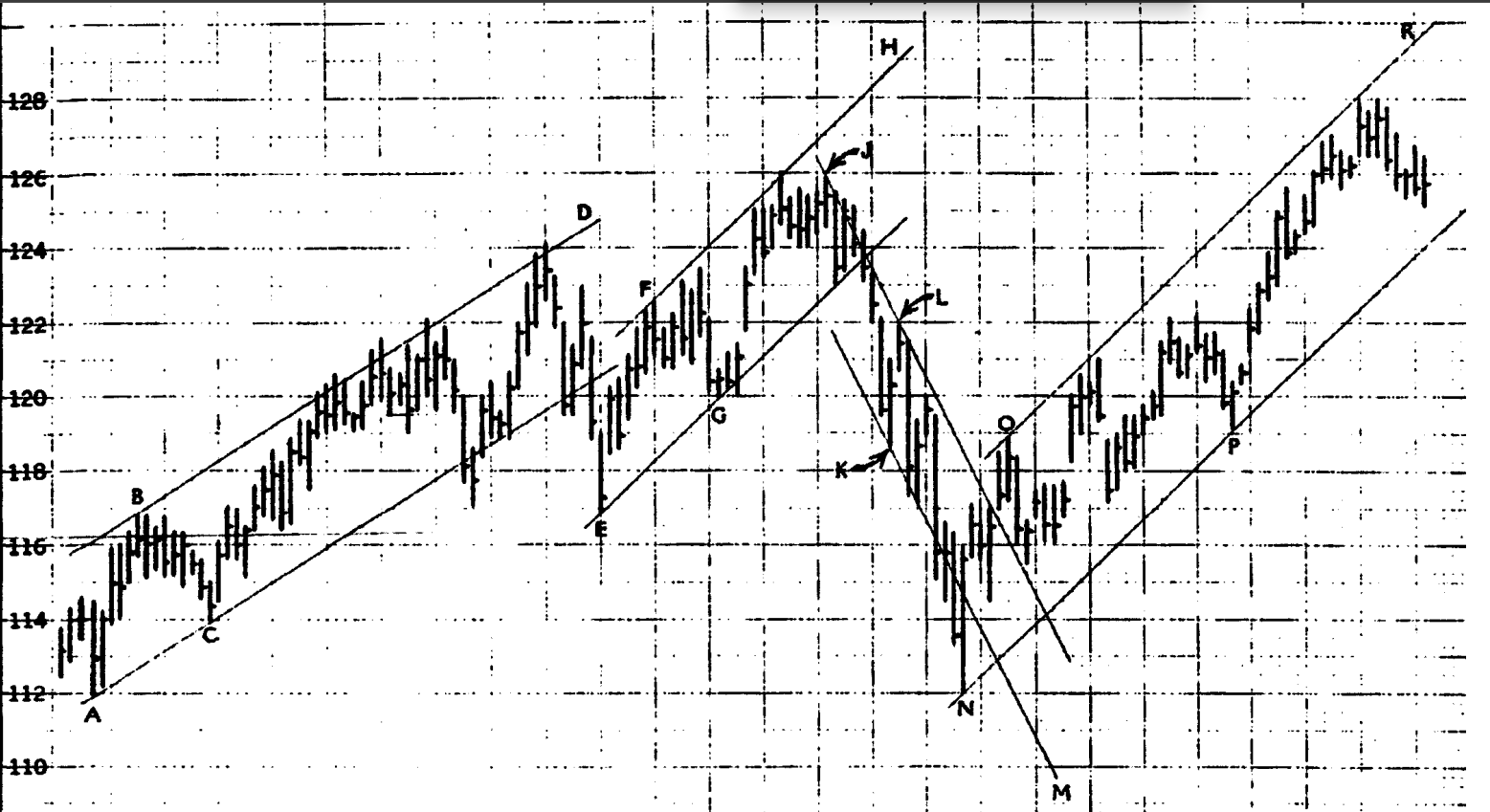

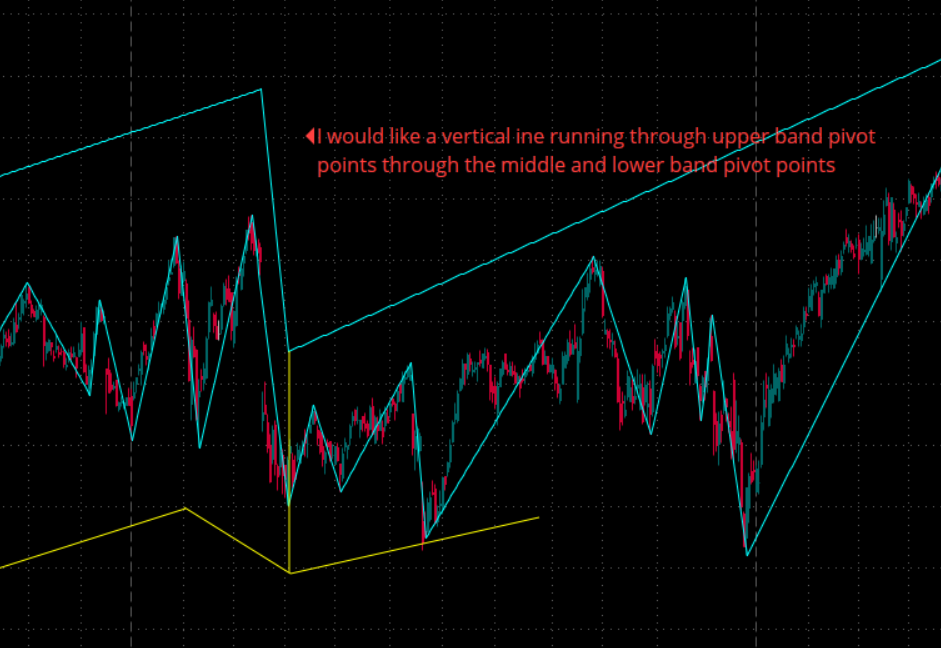

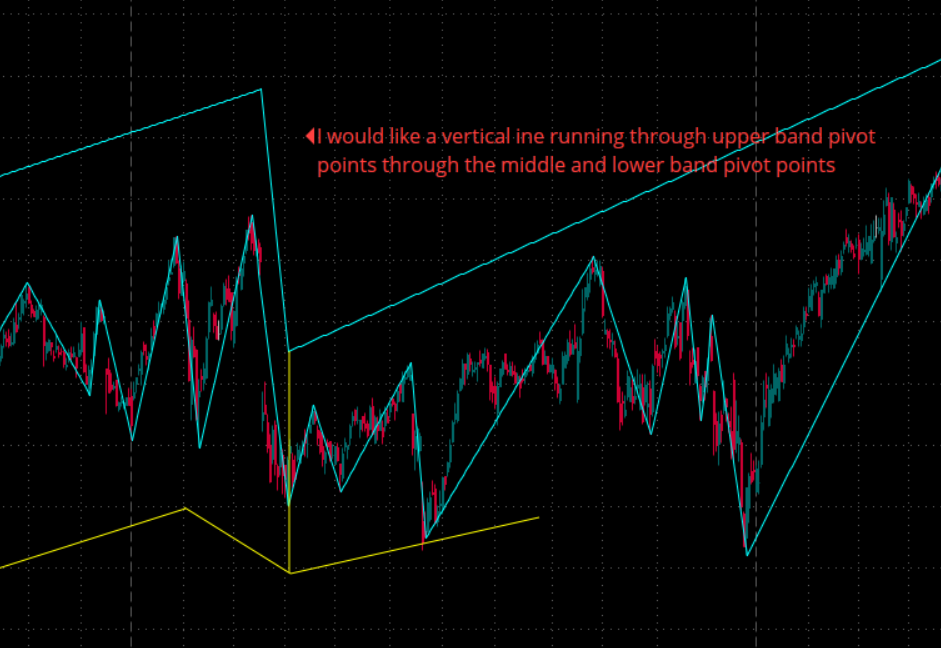

I'm trying to code an upper/lower band on the zigzag indicator based on user input but having some difficulty aligning the pivots. Any assistance would be appreciated.

Ruby:

def bn = BarNumber();

def na = Double.NaN;

def lastbn = HighestAll(If(IsNaN(close), 0, bn));

def lastbar = if (bn == lastbn) then 1 else 0;

def hibn = HighestAll(bn);

#def lastbar = !isnan(close[0]) and isnan(close[-1]);

def priceH = high;

def priceL = low;

def priceC = close;

def o = open;

def h = high;

def l = low;

def c = close;

input percentageReversal = 3;

input absoluteReversal = 0.0;

input atrLength = 2;

input atrReversal = 2;

input tickReversal = 0;

Assert(percentageReversal >= 0, "'percentage reversal' must not be negative: " + percentageReversal);

Assert(absoluteReversal >= 0, "'absolute reversal' must not be negative: " + absoluteReversal);

Assert(atrReversal >= 0, "'atr reversal' must not be negative: " + atrReversal);

Assert(tickReversal >= 0, "'ticks' must not be negative: " + tickReversal);

Assert(percentageReversal != 0 or absoluteReversal != 0 or atrReversal != 0 or tickReversal != 0, "Either 'percentage reversal' or 'absolute reversal' or 'atr reversal' or 'tick reversal' must not be zero");

def absReversal;

if (absoluteReversal != 0) {

absReversal = absoluteReversal;

} else {

absReversal = tickReversal * TickSize();

}

def hlPivot;

if (atrReversal != 0) {

hlPivot = percentageReversal / 100 + WildersAverage(TrueRange(high, close, low), atrLength) / close * atrReversal;

} else {

hlPivot = percentageReversal / 100;

}

def state = {default init, undefined, uptrend, downtrend};

def maxPriceH;

def minPriceL;

def newMax;

def newMin;

def prevMaxH = GetValue(maxPriceH, 1);

def prevMinL = GetValue(minPriceL, 1);

if GetValue(state, 1) == GetValue(state.init, 0) {

maxPriceH = priceH;

minPriceL = priceL;

newMax = yes;

newMin = yes;

state = state.undefined;

} else if GetValue(state, 1) == GetValue(state.undefined, 0) {

if priceH >= prevMaxH {

state = state.uptrend;

maxPriceH = priceH;

minPriceL = prevMinL;

newMax = yes;

newMin = no;

} else if priceL <= prevMinL {

state = state.downtrend;

maxPriceH = prevMaxH;

minPriceL = priceL;

newMax = no;

newMin = yes;

} else {

state = state.undefined;

maxPriceH = prevMaxH;

minPriceL = prevMinL;

newMax = no;

newMin = no;

}

} else if GetValue(state, 1) == GetValue(state.uptrend, 0) {

if priceL <= prevMaxH - prevMaxH * hlPivot - absReversal {

state = state.downtrend;

maxPriceH = prevMaxH;

minPriceL = priceL;

newMax = no;

newMin = yes;

} else {

state = state.uptrend;

if (priceH >= prevMaxH) {

maxPriceH = priceH;

newMax = yes;

} else {

maxPriceH = prevMaxH;

newMax = no;

}

minPriceL = prevMinL;

newMin = no;

}

} else {

if priceH >= prevMinL + prevMinL * hlPivot + absReversal {

state = state.uptrend;

maxPriceH = priceH;

minPriceL = prevMinL;

newMax = yes;

newMin = no;

} else {

state = state.downtrend;

maxPriceH = prevMaxH;

newMax = no;

if (priceL <= prevMinL) {

minPriceL = priceL;

newMin = yes;

} else {

minPriceL = prevMinL;

newMin = no;

}

}

}

def barNumber = BarNumber();

def barCount = HighestAll(If(IsNaN(priceH), 0, barNumber));

def newState = GetValue(state, 0) != GetValue(state, 1);

def offset = barCount - barNumber + 1;

def highPoint = state == state.uptrend and priceH == maxPriceH;

def lowPoint = state == state.downtrend and priceL == minPriceL;

def lastH;

if highPoint and offset > 1 {

lastH = fold iH = 1 to offset with tH = priceH while !IsNaN(tH) and !GetValue(newState, -iH) do if GetValue(newMax, -iH) or iH == offset - 1 and GetValue(priceH, -iH) == tH then Double.NaN else tH;

} else {

lastH = Double.NaN;

}

def lastL;

if lowPoint and offset > 1 {

lastL = fold iL = 1 to offset with tL = priceL while !IsNaN(tL) and !GetValue(newState, -iL) do if GetValue(newMin, -iL) or iL == offset - 1 and GetValue(priceL, -iL) == tL then Double.NaN else tL;

} else {

lastL = Double.NaN;

}

plot ZZ;

if barNumber == 1 {

ZZ = fold iF = 1 to offset with tP = Double.NaN while IsNaN(tP) do if GetValue(state, -iF) == GetValue(state.uptrend, 0) then priceL else if GetValue(state, -iF) == GetValue(state.downtrend, 0) then priceH else Double.NaN;

} else if barNumber == barCount {

ZZ = if highPoint or state == state.downtrend and priceL > minPriceL then priceH else if lowPoint or state == state.uptrend and priceH < maxPriceH then priceL else Double.NaN;

} else {

ZZ = if !IsNaN(lastH) then lastH else if !IsNaN(lastL) then lastL else Double.NaN;

}

ZZ.SetDefaultColor(GetColor(1));

ZZ.EnableApproximation();

input toggle = yes;

input reversalamount = 8.0;

def chg = close - GetValue(zz, 1);

def isUp = chg >= 0;

def isdn = chg <= 0;

def isConf = AbsValue(chg) >= reversalamount or (IsNaN(GetValue(ZZ, 1)) and GetValue(isConf, 1));

ZZ.DefineColor("Up Trend", Color.UPTICK);

ZZ.DefineColor("Down Trend", Color.DOWNTICK);

ZZ.DefineColor("Undefined", Color.DARK_ORANGE);

ZZ.AssignValueColor(if !isConf then ZZ.Color("Undefined") else if isUp then ZZ.Color("Up Trend") else ZZ.Color("Down Trend"));

DefineGlobalColor("Unconfirmed", Color.DARK_ORANGE);

DefineGlobalColor("Up", Color.UPTICK);

DefineGlobalColor("Down", Color.DOWNTICK);

#Upper Band

input WMA = 5;

def wma_wma_c = close + wma;

def wma_bn = BarNumber();

def wma_na = Double.NaN;

def wma_o = open + wma;

def wma_h = high+ wma;

def wma_l = low + wma ;

def wma_c = close + wma;

def wma_lastbn = HighestAll(If(IsNaN(wma_c ), 0, wma_bn));

def wma_lastbar = if (wma_bn == wma_lastbn) then 1 else 0;

def wma_hibn = HighestAll(wma_bn);

#def wma_lastbar = !isnan(wma_wma_c [0]) and isnan(wma_wma_c [-1]);

def wma_priceH = high + wma;

def wma_priceL = low + wma;

def wma_priceC = close + wma;

input wma_percentageReversal= 3;

input wma_absoluteReversal = 0.0;

input wma_atrLength = 2;

input wma_atrReversal = 2;

input wma_tickReversal = 0;

Assert(wma_percentageReversal>= 0, "'percentage reversal' must not be negative: " + wma_percentageReversal);

Assert(wma_absoluteReversal >= 0, "'absolute reversal' must not be negative: " + wma_absoluteReversal);

Assert(wma_atrReversal >= 0, "'atr reversal' must not be negative: " + wma_atrReversal );

Assert(wma_tickReversal >= 0, "'ticks' must not be negative: " + wma_tickReversal );

Assert(wma_percentageReversal!= 0 or wma_absoluteReversal != 0 or wma_atrReversal != 0 or wma_tickReversal != 0, "Either 'percentage reversal' or 'absolute reversal' or 'atr reversal' or 'tick reversal' must not be zero");

def wma_absReversal ;

if (wma_absoluteReversal != 0) {

wma_absReversal = absoluteReversal;

} else {

wma_absReversal = wma_tickReversal * TickSize();

}

def wma_hlPivot ;

if (wma_atrReversal != 0) {

wma_hlPivot = wma_percentageReversal/ 100 + WildersAverage(TrueRange(wma_h , wma_c , wma_l ), wma_atrLength ) / wma_c * wma_atrReversal ;

} else {

wma_hlPivot = wma_percentageReversal/ 100;

}

def wma_state = {default init, undefined, uptrend, downtrend};

def wma_maxPriceH;

def wma_minPriceL;

def wma_newMax;

def wma_newMin;

def wma_prevMaxH = GetValue(wma_maxPriceH, 1);

def wma_prevMinL = GetValue(wma_minPriceL, 1);

if GetValue(wma_state, 1) == GetValue(wma_state.init, 0) {

wma_maxPriceH = wma_priceH;

wma_minPriceL = wma_priceL;

wma_newMax = yes;

wma_newMin = yes;

wma_state = wma_state.undefined;

} else if GetValue(wma_state, 1) == GetValue(wma_state.undefined, 0) {

if wma_priceH >= wma_prevMaxH {

wma_state = wma_state.uptrend;

wma_maxPriceH = wma_priceH;

wma_minPriceL = wma_prevMinL ;

wma_newMax = yes;

wma_newMin = no;

} else if wma_priceL <= wma_prevMinL {

wma_state = wma_state.downtrend;

wma_maxPriceH = prevMaxH;

wma_minPriceL = wma_priceL;

wma_newMax = no;

wma_newMin = yes;

} else {

wma_state = wma_state.undefined;

wma_maxPriceH = prevMaxH;

wma_minPriceL = wma_prevMinL ;

wma_newMax = no;

wma_newMin = no;

}

} else if GetValue(wma_state, 1) == GetValue(wma_state.uptrend, 0) {

if wma_priceL <= wma_prevMaxH - wma_prevMaxH * wma_hlPivot - wma_absReversal {

wma_state = wma_state.downtrend;

wma_maxPriceH = prevMaxH;

wma_minPriceL = wma_priceL;

wma_newMax = no;

wma_newMin = yes;

} else {

wma_state = wma_state.uptrend;

if (wma_priceH >= prevMaxH) {

wma_maxPriceH = wma_priceH;

wma_newMax = yes;

} else {

wma_maxPriceH = prevMaxH;

wma_newMax = no;

}

wma_minPriceL = wma_prevMinL ;

wma_newMin = no;

}

} else {

if wma_priceH >= wma_prevMinL + wma_prevMinL * wma_hlPivot + wma_absReversal {

wma_state = wma_state.uptrend;

wma_maxPriceH = wma_priceH;

wma_minPriceL = wma_prevMinL ;

wma_newMax = yes;

wma_newMin = no;

} else {

wma_state = wma_state.downtrend;

wma_maxPriceH = prevMaxH;

wma_newMax = no;

if (wma_priceL <= wma_prevMinL ) {

wma_minPriceL = wma_priceL;

wma_newMin = yes;

} else {

wma_minPriceL = wma_prevMinL ;

wma_newMin = no;

}

}

}

def wma_barNumber = BarNumber();

def wma_barCount = HighestAll(If(IsNaN(wma_priceH), 0, wma_barNumber ));

def wma_newState = GetValue(wma_state, 0) != GetValue(wma_state, 1);

def wma_offset = wma_barCount - wma_barNumber + 1;

def wma_highPoint = wma_state == wma_state.uptrend and wma_priceH == wma_maxPriceH;

def wma_lowPoint = wma_state == wma_state.downtrend and wma_priceL == wma_minPriceL;

def wma_lastH ;

if wma_highPoint and wma_offset > 1 {

wma_lastH = fold aH = 1 to wma_offset with kH = wma_priceH while !IsNaN(kH) and !GetValue(wma_newState , -aH) do if GetValue(wma_newMax, -aH) or aH == wma_offset - 1 and GetValue(wma_priceH, -aH) == kH then Double.NaN else kH;

} else {

wma_lastH = Double.NaN;

}

def wma_lastL ;

if wma_lowPoint and wma_offset > 1 {

wma_lastL = fold xL = 1 to wma_offset with gL = wma_priceL while !IsNaN(gL) and !GetValue(wma_newState , -xL) do if GetValue(wma_newMin, -xL) or xL == wma_offset - 1 and GetValue(wma_priceL, -xL) == gL then Double.NaN else gL;

} else {

wma_lastL = Double.NaN;

}

plot wma_ZZ;

if barNumber == 1 {

wma_ZZ = fold dF = 1 to wma_offset with fP = Double.NaN while IsNaN(fP) do if GetValue(state, -dF) == GetValue(wma_state.uptrend, 0) then wma_priceL else if GetValue(wma_state, -dF) == GetValue(wma_state.downtrend, 0) then wma_priceH else Double.NaN;

} else if barNumber == wma_barCount {

wma_ZZ = if wma_highPoint or wma_state == wma_state.downtrend and wma_priceL > wma_minPriceL then wma_priceH else if wma_lowPoint or wma_state == wma_state.uptrend and wma_priceH < wma_maxPriceH then wma_priceL else Double.NaN;

} else {

wma_ZZ = if !IsNaN(wma_lastH) then wma_lastH else if !IsNaN(wma_lastL) then wma_lastL else Double.NaN;

}

wma_ZZ.SetDefaultColor(GetColor(1));

wma_ZZ.EnableApproximation();

Last edited: