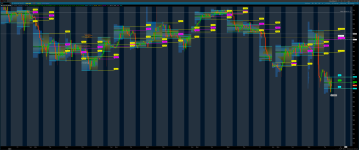

# _VP_TPO_Hybrid_Profile_Optimized_

# Based on: https://usethinkscript.com/threads/go-with-the-flow.20732/post-151661

# Combines Volume Profile and Time Profile features with optimized performance

# ===== Session Control =====

input MarketSelector = {default "Custom", "Micro NQ (/MNQ)", "NASDAQ 100 (/NQ)", "Gold (/GC)", "Oil (/CL)", "SPY"};

input customBeginTime = 1800; # Only used when MarketSelector is "Custom"

input respectTimeframe = yes; # When yes, ensures profiles work consistently across timeframes

def begin;

def end;

switch (MarketSelector) {

case "Custom":

begin = customBeginTime;

end = 0; # Not used in original code

case "Micro NQ (/MNQ)":

begin = 1800;

end = 1700;

case "NASDAQ 100 (/NQ)":

begin = 1800;

end = 1700;

case "Gold (/GC)":

begin = 0820;

end = 0120;

case "Oil (/CL)":

begin = 0900;

end = 1430;

case "SPY":

begin = 0930;

end = 1600;

}

# This improves consistency across timeframes

def isNewDay = GetDay() != GetDay()[1];

def beginTime = SecondsFromTime(begin) == 0 and secondsTillTime(begin) == 0;

# Use either time-based or day-based session detection based on setting

def rth = if respectTimeframe then (beginTime or (GetAggregationPeriod() >= AggregationPeriod.HOUR and isNewDay and !IsNaN(close))) else beginTime;

# ===== Profile Configuration =====

input pricePerRowHeightMode = {AUTOMATIC, default TICKSIZE};

def height = if pricePerRowHeightMode == pricePerRowHeightMode.AUTOMATIC

then PricePerRow.AUTOMATIC

else PricePerRow.TICKSIZE;

def height2 = PricePerRow.AUTOMATIC;

input timePerProfile = {CHART, MINUTE, HOUR, default DAY, WEEK, MONTH, "OPT EXP", BAR};

input multiplier = 1;

input profiles = 2;

input valueAreaPercent = 70;

input showpointofcontrol = yes;

input showvaluearea = no;

input showvolumehistogram = yes;

input opacity = 50;

input shownakedonly = yes;

input start = 0;

input showLabels = yes;

input bubbleOffset = 10;

input showBubblesOnNewProfiles = yes;

# ===== Period/Timing Logic =====

def period;

def yyyymmdd = GetYYYYMMDD();

def seconds = SecondsFromTime(0);

def month = GetYear() * 12 + GetMonth();

def day_number = DaysFromDate(First(yyyymmdd)) + GetDayOfWeek(First(yyyymmdd));

def dom = GetDayOfMonth(yyyymmdd);

def dow = GetDayOfWeek(yyyymmdd - dom + 1);

def expthismonth = (if dow > 5 then 27 else 20) - dow;

def exp_opt = month + (dom > expthismonth);

switch (timePerProfile) {

case CHART: period = 0;

case MINUTE: period = Floor(seconds / 60 + day_number * 24 * 60);

case HOUR: period = Floor(seconds / 3600 + day_number * 24);

case DAY: period = CountTradingDays(Min(First(yyyymmdd), yyyymmdd), yyyymmdd) - 1;

case WEEK: period = Floor(day_number / 7);

case MONTH: period = Floor(month - First(month));

case "OPT EXP": period = exp_opt - First(exp_opt);

case BAR: period = BarNumber() - 1;

}

# ===== Volume Profile Creation =====

profile vol = VolumeProfile("startNewProfile" = rth, "onExpansion" = no, "numberOfProfiles" = 1000, pricePerRow = height);

def count = CompoundValue(1, if period != period[1] then (count[1] + period - period[1]) % multiplier else count[1], 0);

def cond = count < count[1] + period - period[1];

profile vol2 = VolumeProfile("startNewProfile" = cond, "numberOfProfiles" = profiles, "pricePerRow" = height2, "value area percent" = valueAreaPercent, onExpansion = no);

# ===== Current Session Levels =====

def pca = if IsNaN(vol.GetPointOfControl()) then pca[1] else vol.GetPointOfControl();

def hVA = if IsNaN(vol.GetHighestValueArea()) then hVA[1] else vol.GetHighestValueArea();

def lVA = if IsNaN(vol.GetLowestValueArea()) then lVA[1] else vol.GetLowestValueArea();

def poc = if !rth or IsNaN(close) then poc[1] else pca;

def ub = if !rth or IsNaN(close) then ub[1] else hVA;

def lb = if !rth or IsNaN(close) then lb[1] else lVA;

# ===== Previous Session Levels =====

def HVA2 = if IsNaN(vol.GetHighestValueArea()) then HVA2[1] else vol.GetHighestValueArea();

def pHVA = CompoundValue(1, if cond then HVA2[1] else pHVA[1], Double.NaN);

def LVA2 = if IsNaN(vol.GetLowestValueArea()) then LVA2[1] else vol.GetLowestValueArea();

def pLVA = CompoundValue(1, if cond then LVA2[1] else pLVA[1], Double.NaN);

def POC2 = if IsNaN(vol.GetPointOfControl()) then POC2[1] else vol.GetPointOfControl();

def pPOC = CompoundValue(1, if cond then POC2[1] else pPOC[1], Double.NaN);

# ===== Plot Current Session Levels =====

plot VPOC = poc;

plot VAH = ub;

plot VAL = lb;

VPOC.SetDefaultColor(Color.GREEN);

VAH.SetDefaultColor(CreateColor(0, 255, 255)); # Cyan

VAL.SetDefaultColor(CreateColor(0, 255, 255)); # Cyan

VPOC.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

VAH.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

VAL.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

VPOC.SetLineWeight(2);

VAH.SetLineWeight(2);

VAL.SetLineWeight(2);

# ===== Plot Previous Session Levels =====

plot PrevVHVA = pHVA;

plot PrevVLVA = pLVA;

PrevVHVA.SetDefaultColor(Color.YELLOW);

PrevVLVA.SetDefaultColor(Color.YELLOW);

PrevVHVA.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PrevVLVA.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PrevVHVA.SetLineWeight(2);

PrevVLVA.SetLineWeight(2);

plot PrevVPOC = pPOC;

PrevVPOC.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PrevVPOC.SetDefaultColor(Color.MAGENTA);

PrevVPOC.SetLineWeight(2);

# ===== Show Volume Profile =====

vol.Show(CreateColor(0, 102, 204), if showpointofcontrol then Color.GREEN else Color.CURRENT, if showvaluearea then Color.YELLOW else Color.CURRENT, if showvolumehistogram then opacity else 0);

# ===== Define Past POCs =====

def newDay = cond;

def pocDay1 = if newDay then vol2.GetPointOfControl()[1] else pocDay1[1];

def pocDay2 = if newDay then pocDay1[1] else pocDay2[1];

def pocDay3 = if newDay then pocDay2[1] else pocDay3[1];

def pocDay4 = if newDay then pocDay3[1] else pocDay4[1];

def pocDay5 = if newDay then pocDay4[1] else pocDay5[1];

# ===== Naked Virgin POCs Script =====

script NakedVirginPOC {

input poc_value = 0;

plot x = if Between(poc_value, low, high) or close crosses poc_value then BarNumber() else Double.NaN;

plot poc = if IsNaN(LowestAll(x)) then poc_value else if BarNumber() > LowestAll(x) then Double.NaN else poc_value;

}

# ===== Global Colors =====

DefineGlobalColor("NakedPOC", Color.WHITE);

DefineGlobalColor("TouchedPOC", Color.MAGENTA);

# ===== Generate Naked POCs =====

plot v1 = NakedVirginPOC(pocDay1).poc;

plot v2 = NakedVirginPOC(pocDay2).poc;

plot v3 = NakedVirginPOC(pocDay3).poc;

plot v4 = NakedVirginPOC(pocDay4).poc;

plot v5 = NakedVirginPOC(pocDay5).poc;

v1.AssignValueColor(if !IsNaN(LowestAll(NakedVirginPOC(pocDay1).x)) then GlobalColor("TouchedPOC") else GlobalColor("NakedPOC"));

v2.AssignValueColor(if !IsNaN(LowestAll(NakedVirginPOC(pocDay2).x)) then GlobalColor("TouchedPOC") else GlobalColor("NakedPOC"));

v3.AssignValueColor(if !IsNaN(LowestAll(NakedVirginPOC(pocDay3).x)) then GlobalColor("TouchedPOC") else GlobalColor("NakedPOC"));

v4.AssignValueColor(if !IsNaN(LowestAll(NakedVirginPOC(pocDay4).x)) then GlobalColor("TouchedPOC") else GlobalColor("NakedPOC"));

v5.AssignValueColor(if !IsNaN(LowestAll(NakedVirginPOC(pocDay5).x)) then GlobalColor("TouchedPOC") else GlobalColor("NakedPOC"));

v1.SetPaintingStrategy(PaintingStrategy.DASHES);

v2.SetPaintingStrategy(PaintingStrategy.DASHES);

v3.SetPaintingStrategy(PaintingStrategy.DASHES);

v4.SetPaintingStrategy(PaintingStrategy.DASHES);

v5.SetPaintingStrategy(PaintingStrategy.DASHES);

v1.SetLineWeight(2);

v2.SetLineWeight(2);

v3.SetLineWeight(2);

v4.SetLineWeight(2);

v5.SetLineWeight(2);

# ===== Labels =====

def currentBar = HighestAll(if !IsNaN(close) then BarNumber() else Double.NaN);

def bubbleBar = currentBar + bubbleOffset;

def isTargetBar = BarNumber() == bubbleBar;

def newProfile = period != period[1];

def profileStart = CompoundValue(1, if newProfile then BarNumber() else profileStart[1], 0);

AddChartBubble(isTargetBar and showLabels, VPOC, "POC", Color.GREEN, yes);

AddChartBubble(isTargetBar and showLabels, VAH, "VAH", CreateColor(0, 255, 255), yes);

AddChartBubble(isTargetBar and showLabels, VAL, "VAL", CreateColor(0, 255, 255), yes);

AddChartBubble(isTargetBar and showLabels, PrevVPOC, "PVPOC", Color.MAGENTA, yes);

AddChartBubble(isTargetBar and showLabels, PrevVHVA, "PVHVA", Color.YELLOW, yes);

AddChartBubble(isTargetBar and showLabels, PrevVLVA, "PVLVA", Color.YELLOW, yes);

AddChartBubble(newProfile and profileStart != 0 and showBubblesOnNewProfiles and showLabels, PrevVHVA[1], "PVHVA", Color.YELLOW, yes);

AddChartBubble(newProfile and profileStart != 0 and showBubblesOnNewProfiles and showLabels, PrevVLVA[1], "PVLVA", Color.YELLOW, yes);

AddChartBubble(newProfile and profileStart != 0 and showBubblesOnNewProfiles and showLabels, PrevVPOC[1], "PVPOC", Color.MAGENTA, yes);

AddChartBubble(isTargetBar and showLabels and !IsNaN(v1), v1, "NV-POC1", GlobalColor("NakedPOC"), yes);

AddChartBubble(isTargetBar and showLabels and !IsNaN(v2), v2, "NV-POC2", GlobalColor("NakedPOC"), yes);

AddChartBubble(isTargetBar and showLabels and !IsNaN(v3), v3, "NV-POC3", GlobalColor("NakedPOC"), yes);

AddChartBubble(isTargetBar and showLabels and !IsNaN(v4), v4, "NV-POC4", GlobalColor("NakedPOC"), yes);

AddChartBubble(isTargetBar and showLabels and !IsNaN(v5), v5, "NV-POC5", GlobalColor("NakedPOC"), yes);

However, it is available for TradingView, but it is not open source, so the amazing @samer800 will not be able to convert it...

However, it is available for TradingView, but it is not open source, so the amazing @samer800 will not be able to convert it...