#vimes - gap stas - chat discussion 2018-07-12

#only evaulates the first opening bar so set the chart to desired period

# for evaulation of gap fills in the first opening range of the chart period

declare hide_on_daily;

input mingap = 10; #hint: minimum gap to trade in pts (i.e identify gap trades of at least 6 /es pts or 10 /ym points)

input maxgap = 60;#hint: maxium gap to evaulate (filter to not analyze larger moves which might indicate bullish continuation

input usethreshold = yes;#hint: apply threshold? yes will only consider gaps less than threshold; no will evaulate every gap

def o = if GetYYYYMMDD() > GetYYYYMMDD()[1] then open else o[1];

def c = if GetYYYYMMDD() > GetYYYYMMDD()[1] then close[1] else c[1];

#helper scripts

script retrace {

input retrace_per = 0.5;

input o = open;

input c = close;

def retracement = if o > c then o - (o - c) * retrace_per else o + (c - o) * retrace_per;

plot retrace = retracement;

}

script guf {

input Gap = 1;

input tgt = close;

plot guf = if Gap and low <= tgt then 1 else 0;

plot percfill = totalsum(guf)/totalsum(gap)*100;

}

script gdf {

input gap = 1;

input tgt = close;

plot gdf = if gap and high >= tgt then 1 else 0;

plot percfill = totalsum(gdf)/totalsum(gap)*100;

}

script pts {

input gf = 1;

input tgt = close;

plot pts = if gf and open > tgt then open - tgt else if gf and open < tgt then tgt - open else 0;

def cnt = TotalSum(gf);

plot totpts = totalsum(pts);

plot avgpts = totpts / cnt;

def exc = if gf and open > tgt then high - open else if gf and open < tgt then open - low else 0;

plot avgexc = TotalSum(exc) / cnt;

plot maxexc = highestAll(exc);

}

#retrace levels

plot retrace100 = retrace(1,o,c);

plot retrace75 = retrace(0.75,o,c);

plot retrace50 = retrace(0.5, o, c);

plot retrace25 = retrace(0.25, o, c);

def retrace10 = retrace(0.1,o,c);

def newday = GetYYYYMMDD() <> GetYYYYMMDD()[1] ; #only analyzing the first bar of the day based on the chart period

def GapUP = if o > c and newday and usethreshold and o-c>=mingap and o-c<=maxgap then 1

else if o > c and newday and !usethreshold then 1 else 0;

def GapDN = if o < c and newday and usethreshold and c-o>mingap and c-o<=maxgap then 1

else if O < c and newday and !usethreshold then 1 else 0;

def cntGapUpDays = TotalSum(GapUP);

def cntGapDnDays = TotalSum(GapDN);

#50% retrace

#def guf50 = if GapUP and low <= retrace50 then 1 else 0;

def guf100 = guf(gapup,retrace100);

def guf75 = guf(gapup,retrace75);

def guf50 = guf(gapup,retrace50);

def guf25 = guf(gapup,retrace25);

def guf10 = guf(gapup,retrace10);

def gdf100 = gdf(gapdn,retrace100);

def gdf75 = gdf(gapdn,retrace75);

def gdf50 = gdf(gapdn,retrace50);

def gdf25 = gdf(gapdn,retrace25);

def gdf10 = gdf(gapdn,retrace10);

def pguf100 = guf(gapup,retrace100).percfill;

def pguf75 = guf(gapup,retrace75).percfill;

def pguf50 = guf(gapup,retrace50).percfill;

def pguf25 = guf(gapup,retrace25).percfill;

def pgdf100 = gdf(gapdn,retrace100).percfill;

def pgdf75 = gdf(gapdn,retrace75).percfill;

def pgdf50 = gdf(gapdn,retrace50).percfill;

def pgdf25 = gdf(gapdn,retrace25).percfill;

def ptsguf100 = pts(guf100, retrace100);

def totptsguf100 = pts(guf100, retrace100).totpts;

def avgptsguf100 = pts(guf100, retrace100).avgpts;

def avgexcguf100 = pts(guf100, retrace100).avgexc;

def maxexcguf100 = pts(guf100, retrace100).maxexc;

def ptsguf75 = pts(guf75, retrace75);

def totptsguf75 = pts(guf75, retrace75).totpts;

def avgptsguf75 = pts(guf75, retrace75).avgpts;

def avgexcguf75 = pts(guf75, retrace75).avgexc;

def maxexcguf75 = pts(guf75, retrace75).maxexc;

def ptsguf50 = pts(guf50, retrace50);

def totptsguf50 = pts(guf50, retrace50).totpts;

def avgptsguf50 = pts(guf50, retrace50).avgpts;

def avgexcguf50 = pts(guf50, retrace50).avgexc;

def maxexcguf50 = pts(guf50, retrace50).maxexc;

def ptsguf25 = pts(guf25, retrace25);

def totptsguf25 = pts(guf25, retrace25).totpts;

def avgptsguf25 = pts(guf25, retrace25).avgpts;

def avgexcguf25 = pts(guf25, retrace25).avgexc;

def maxexcguf25 = pts(guf25, retrace25).maxexc;

def ptsgdf100 = pts(gdf100, retrace100);

def totptsgdf100 = pts(gdf100, retrace100).totpts;

def avgptsgdf100 = pts(gdf100, retrace100).avgpts;

def avgexcgdf100 = pts(gdf100, retrace100).avgexc;

def maxexcgdf100 = pts(gdf100, retrace100).maxexc;

def ptsgdf75 = pts(gdf75, retrace75);

def totptsgdf75 = pts(gdf75, retrace75).totpts;

def avgptsgdf75 = pts(gdf75, retrace75).avgpts;

def avgexcgdf75 = pts(gdf75, retrace75).avgexc;

def maxexcgdf75 = pts(gdf75, retrace75).maxexc;

def ptsgdf50 = pts(gdf50, retrace50);

def totptsgdf50 = pts(gdf50, retrace50).totpts;

def avgptsgdf50 = pts(gdf50, retrace50).avgpts;

def avgexcgdf50 = pts(gdf50, retrace50).avgexc;

def maxexcgdf50 = pts(gdf50, retrace50).maxexc;

def ptsgdf25 = pts(gdf25, retrace25);

def totptsgdf25 = pts(gdf25, retrace25).totpts;

def avgptsgdf25 = pts(gdf25, retrace25).avgpts;

def avgexcgdf25 = pts(gdf25, retrace25).avgexc;

def maxexcgdf25 = pts(gdf25, retrace25).maxexc;

#check ladder to ladder as potential lower risk trade

def p10to25up = totalsum(guf25)/totalsum(guf10 or guf25)*100;

def p25to50up = totalsum(guf50)/totalsum(guf25 or guf50)*100;

def p50to75up = totalsum(guf75)/totalsum(guf50 or guf75)*100;

def p75to100up = totalsum(guf100)/totalsum(guf75 or guf100)*100;

def p10to25dn = totalsum(gdf25)/totalsum(gdf10 or gdf25)*100;

def p25to50dn = totalsum(gdf50)/totalsum(gdf25 or gdf50)*100;

def p50to75dn = totalsum(gdf75)/totalsum(gdf50 or gdf75)*100;

def p75to100dn = totalsum(gdf100)/totalsum(gdf75 or gdf100)*100;

def prof10to25dn = if gdf10 and gdf25 then retrace25-retrace10 else 0;

def prof25to50dn = if gdf25 and gdf50 then retrace50-retrace25 else 0;

def prof50to75dn = if gdf50 and gdf75 then retrace75-retrace50 else 0;

def prof75to100dn = if gdf75 and gdf100 then retrace100-retrace75 else 0;

def prof10to25up = if guf10 and guf25 then retrace10-retrace25 else 0;

def prof25to50up = if guf25 and guf50 then retrace25 - retrace50 else 0;

def prof50to75up = if guf50 and guf75 then retrace50 - retrace75 else 0;

def prof75to100up = if guf75 and guf100 then retrace75 - retrace100 else 0;

def c25u = totalsum(guf25);

def c50u = totalsum(guf50);

def c75u = totalsum(guf75);

def c100u = totalsum(guf100);

def ldr10to25up = totalsum(prof10to25up)/c25u;

def ldr25to50up = totalsum(prof25to50up)/c50u;

def ldr50to75up = totalsum(prof50to75up)/c75u;

def ldr75to100u = totalsum(prof75to100up)/c100u;

def c25d = totalsum(gdf25);

def c50d = totalsum(gdf50);

def c75d = totalsum(gdf75);

def c100d = totalsum(gdf100);

def ldr10to25dn = totalsum(prof10to25dn)/c25d;

def ldr25to50dn = totalsum(prof25to50dn)/c50d;

def ldr50to75dn = totalsum(prof50to75dn)/c75d;

def ldr75to100d = totalsum(prof75to100dn)/c100d;

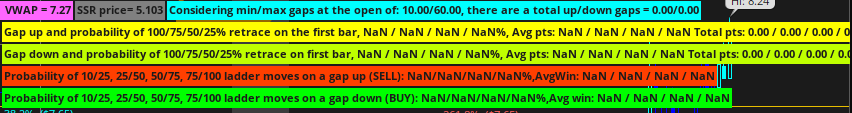

addlabel(!usethreshold,"Considering all gaps at the open there are a total of up/down gaps =, "

+ astext(cntGapUpDays) + "/" + astext(cntgapdndays)

,color.cyan);

addlabel(usethreshold,"Considering min/max gaps at the open of: " + astext(mingap) + "/" + astext(maxgap)

+", there are a total up/down gaps = " + astext(cntGapUpDays) + "/" + astext(cntgapdndays)

,color.cyan);

AddLabel(yes, "Gap up and probability of 100/75/50/25% retrace on the first bar, "

+ astext(pguf100) + " / " + astext(pguf75) + " / " + astext(pguf50) + " / " + astext(pguf25)

+ "%, Avg pts: " + AsText(avgptsguf100) + " / " + AsText(avgptsguf75) + " / " + AsText(avgptsguf50) + " / " + AsText(avgptsguf25)

+ " Total pts: " + astext(totptsguf100) + " / " + astext(totptsguf75) + " / " + astext(totptsguf50) + " / " + astext(totptsguf25)

+ ", Avg negative excursion on winning trades: " + AsText(avgexcguf100) + "/" + AsText(avgexcguf75) + "/" + AsText(avgexcguf50) + "/" + AsText(avgexcguf25)

+ ", Max Neg Excursion: " + AsText(maxexcguf100)

, color = Color.yellow);

AddLabel(yes, "Gap down and probability of 100/75/50/25% retrace on first bar, "

+ astext(pgdf100) + " / " + astext(pgdf75) + " / " + astext(pgdf50) + " / " + astext(pgdf25)

+ "%, Avg pts: " + AsText(avgptsgdf100) + " / " + AsText(avgptsgdf75) + " / " + AsText(avgptsgdf50) + " / " + AsText(avgptsgdf25)

+ " Total pts: " + astext(totptsgdf100) + " / " + astext(totptsgdf75) + " / " + astext(totptsgdf50) + " / " + astext(totptsgdf25)

+ ", Avg negative excursion on winning trades: " + AsText(avgexcgdf100) + "/" + AsText(avgexcgdf75) + "/" + AsText(avgexcgdf50) + "/" + AsText(avgexcgdf25)

+ ", Max Neg Excursion: " + AsText(maxexcgdf100)

, color = Color.lime);

addlabel(yes,"Probability of 10/25, 25/50, 50/75, 75/100 ladder moves on a gap up (SELL): "

+ astext(p10to25up) + "/" + astext(p25to50up) + "/" + astext(p50to75up) + "/" + astext(p75to100up) + "%"

+ ",AvgWin: " + astext(ldr10to25dn) + " / "+ astext(ldr25to50dn) + " / "+ astext(ldr50to75dn) + " / "+ astext(ldr75to100d)

,color.light_red);

addlabel(yes,"Probability of 10/25, 25/50, 50/75, 75/100 ladder moves on a gap down (BUY): "

+ astext(p10to25dn) + "/" + astext(p25to50dn) + "/" + astext(p50to75dn) + "/" + astext(p75to100dn) + "%"

+ ",Avg win: " + astext(ldr10to25up) + " / "+ astext(ldr25to50up) + " / "+ astext(ldr50to75up) + " / "+ astext(ldr75to100u) ,color.green);