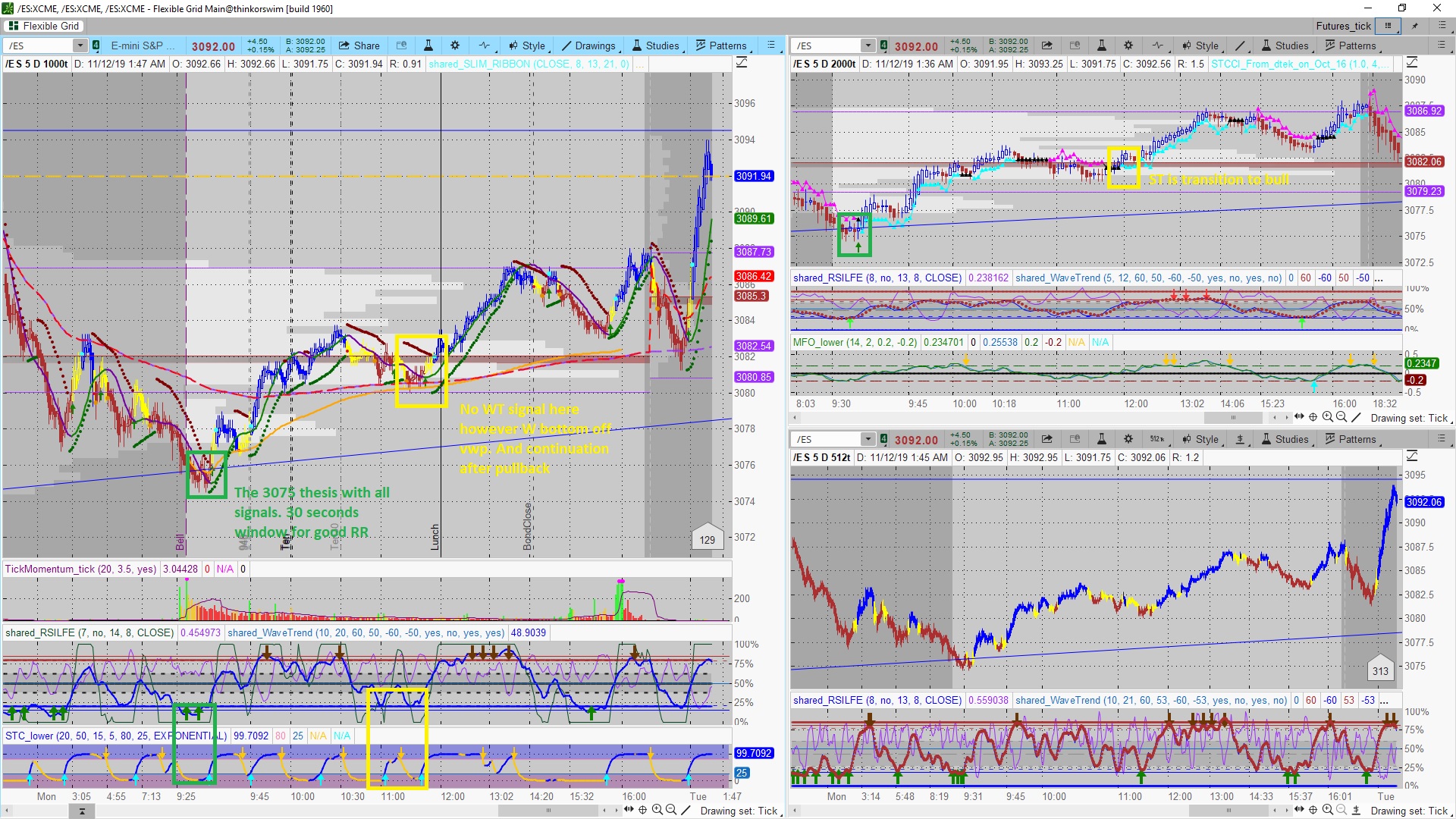

IT is the chart setup black posted. I only changed personal layout preference (like colors and such). The MFO study in this thread I posted above. The only new thing here is volume profile : daily on 1000t and weekly on 2000t. its a built-in TOS study@skynetgen Can you send a link to the chart like your set up

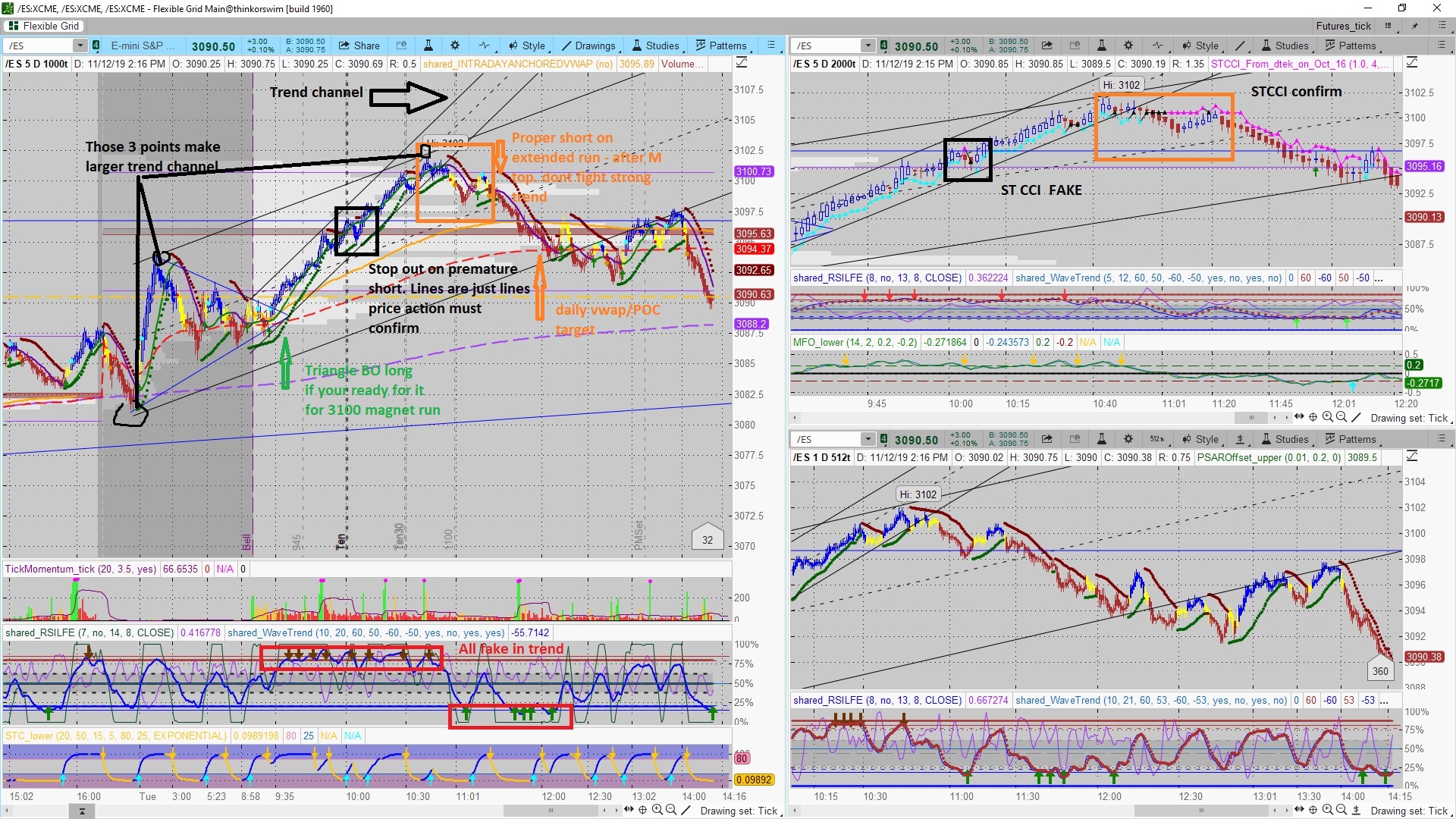

Its not that I mind sharing it. ITs just I believe it would lead to confusion. The blakecmathis settings is original one and the one I am working with. When/if I figure out a way to meaningfully improve on his setup I will post it here. but the personal tweaks over his clean setup might be counterproductive