blakecmathis

Well-known member

Still trying to set up are you using regular candles or hiking ashi

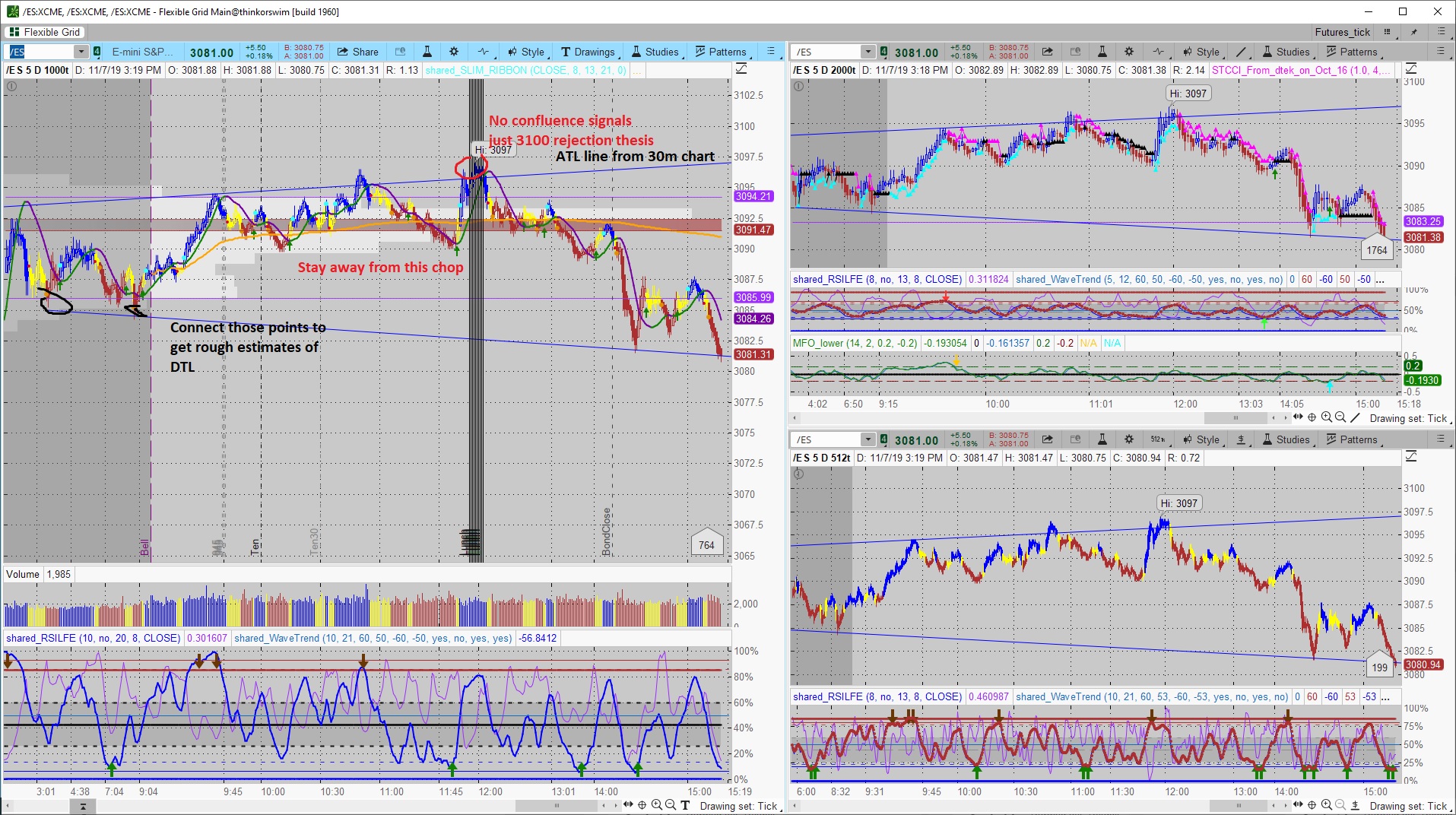

Heikin Ashi on the 512t and 100t. Regular old candles on the 1600. Sometimes I'll roll a 3200t chart in there to get a glimpse of the bigger picture. I shared the grid I'm running towards the top of this post. Should be able to just open it up in TOS.