You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

/ES Futures Trading Strategy on ThinkorSwim

- Thread starter blakecmathis

- Start date

- Status

- Not open for further replies.

New Indicator: Buy the Dip

Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas. Scanner, watchlist columns, and add-ons are included.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

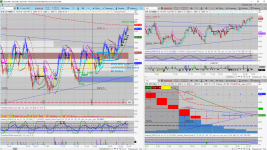

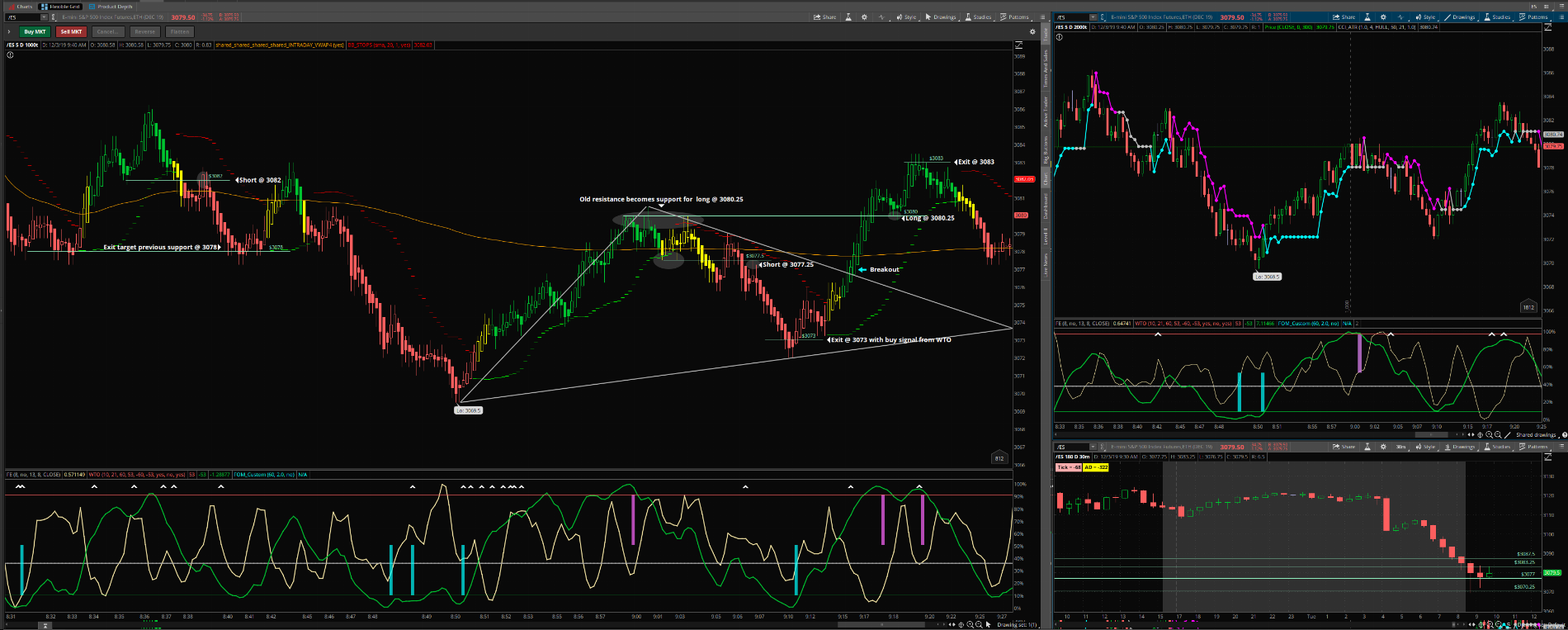

A classic trisqz after morning bottom:

1) Larger timeframe support after exhaustive move down

2) every candle closing inside first 30m candle

3) Lack of intraday catalysts

My bias is avoiding that chop(3085-3070) like plague. once the first 30m close happens outside of triangle I might go for scalp.

Also might buy at support(3065-3070) with clear confirmation . The upside target is 3100

1) Larger timeframe support after exhaustive move down

2) every candle closing inside first 30m candle

3) Lack of intraday catalysts

My bias is avoiding that chop(3085-3070) like plague. once the first 30m close happens outside of triangle I might go for scalp.

Also might buy at support(3065-3070) with clear confirmation . The upside target is 3100

blakecmathis

Well-known member

Looks like we're winding up for a big move out the 85-70 range

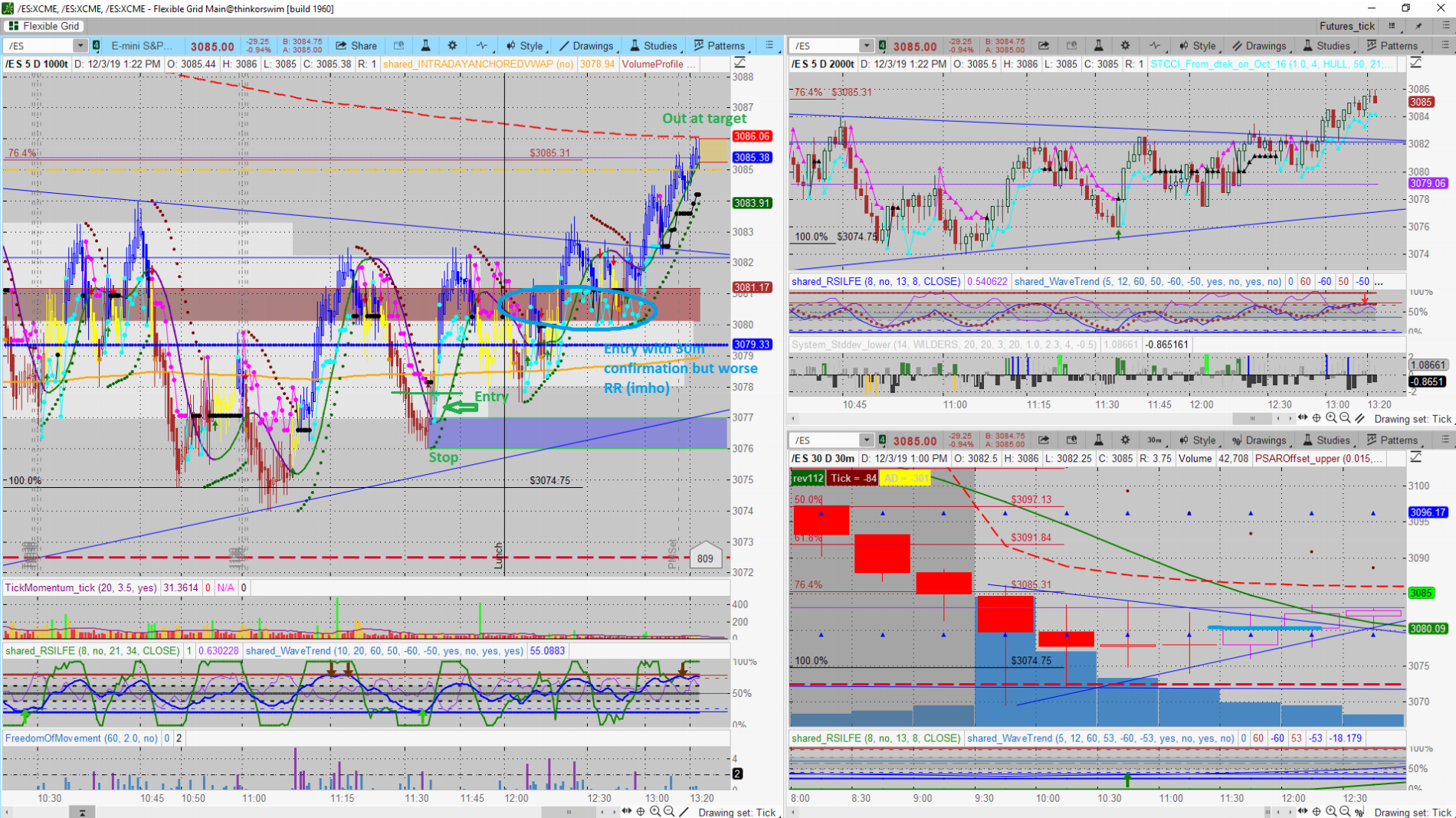

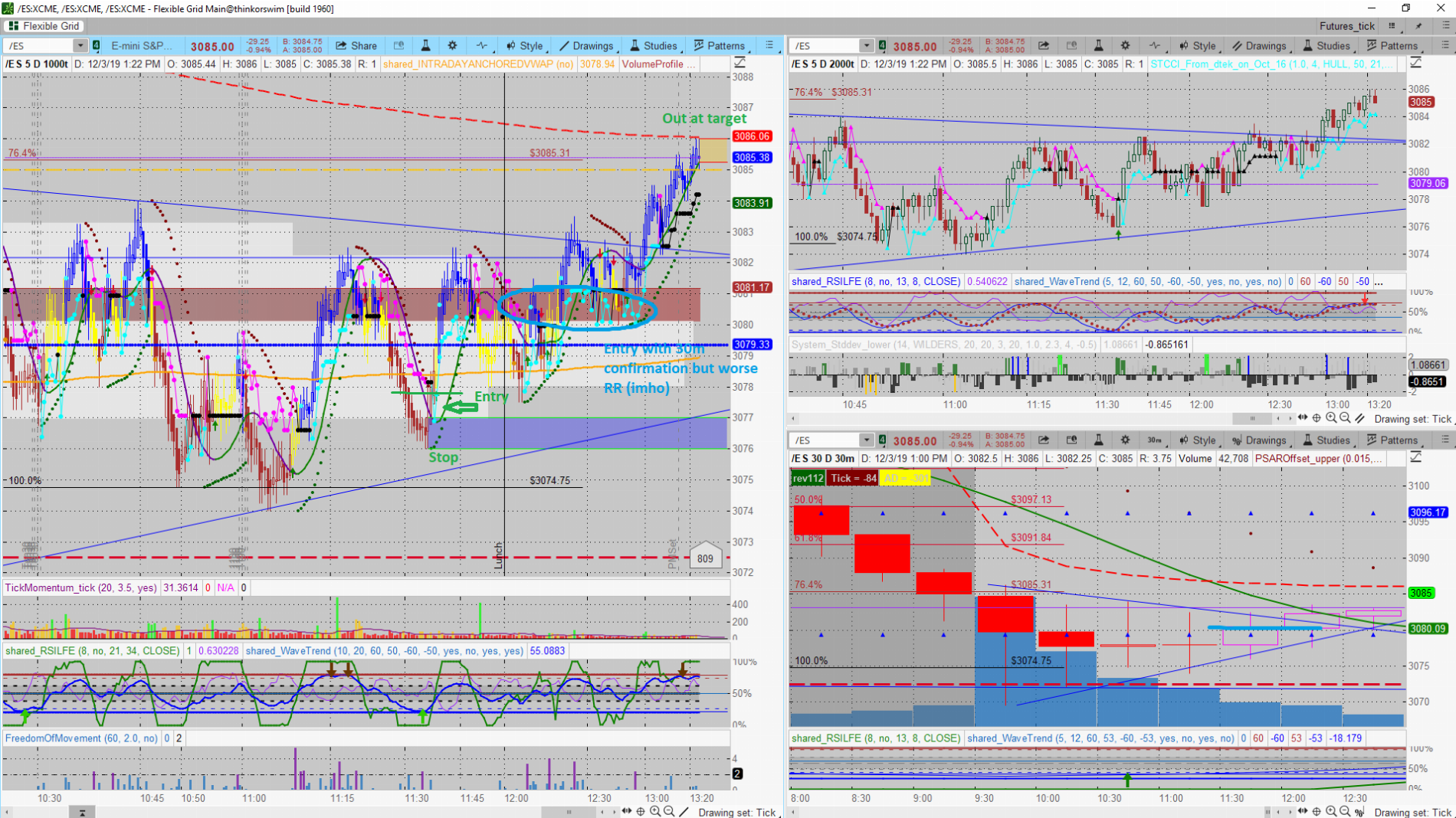

Trisqz play analysis:

I did not wait for super clear 30m confirmation as I felt like earlier entry provided better RR

My exit was also conservative. - trying to take profits before being stopped out and see how it works

p.s. now with 20/20 hindsight trailing it on psar stop would have netted 3 points more. - management is hardest thing to learn

I did not wait for super clear 30m confirmation as I felt like earlier entry provided better RR

My exit was also conservative. - trying to take profits before being stopped out and see how it works

p.s. now with 20/20 hindsight trailing it on psar stop would have netted 3 points more. - management is hardest thing to learn

Attachments

Last edited by a moderator:

blakecmathis

Well-known member

My play was nearly identical to yours man but I ended up getting in on that first pull back @ 3082.50

blakecmathis

Well-known member

blakecmathis

Well-known member

blakecmathis

Well-known member

@skynetgen Think the top is around 3102?

For today maybe .3105 - absolute max. But i think 3095 might been it. Personally was not playing the PM ( doing swing management)@skynetgen Think the top is around 3102?

vwap close looks like natural magnet

Last edited:

blakecmathis

Well-known member

seems you are VERY rightDisagree. Ill write more detailed analysis later, but there is more to market than just AD

what time zone are you in?Trisqz play analysis:

I did not wait for super clear 30m confirmation as I felt like earlier entry provided better RR

My exit was also conservative. - trying to take profits before being stopped out and see how it works

p.s. now with 20/20 hindsight trailing it on psar stop would have netted 3 points more. - management is hardest thing to learn

Attachments

Blake, new here, long time TOS user, what do you look for to enter your trades?I didn't open a position until the afternoon due to the fact that I hadn't traded a single contract since last Tuesday. Felt a little out of sync I guess I don't know how else to explain it. Just wanted to kinda sit back and see how the morning panned out. Anyways here's my action from today.

Attachments

blakecmathis

Well-known member

@JML Before the opening bell I go back and look at the price action from the previous day as well as the action in post-market. I mark up any specific price points (support and resistance) that might come into play. I also do this all day long. If you look at the screenshots I've posted in this thread I've got probably 10-20 price points marked throughout the day. I do this so that when ES is trading in a specific range I don't have to frantically look back and try to spot a good price point for entry/exit. That could be with pull backs or getting in at the top/bottom of a new trend. So thats how I define the actual price point of my entries. ES trades differently than most instruments. There are patterns here that if you attempted to trade elsewhere you might get your bacon cooked. I try not to trade against the trend unless I'm 100% confident in the play, even then generally not a good idea. With the indicators I'm running right now it's a very simple and clean setup. Basically looking for FE bottomed out, sell/buy signal from the Wave Trend Oscillator, and confirmation from the CCI on the 2000t to indicate that the previous trend is over or if its just a continuation (cyan to purple, purple to cyan, etc.) Ideally I like to enter on the first pull back, but who doesn't? Lately I've been playing a lot of triangles which is pretty straightforward. For me, time of day is extremely important. Big moves happen on the hour and half hour. Most importantly though man I'm just paying extremely close attention to price action which I think is the most valuable tool a trader can have and utilize.

you should write a book! thanks for explanation@JML Before the opening bell I go back and look at the price action from the previous day as well as the action in post-market. I mark up any specific price points (support and resistance) that might come into play. I also do this all day long. If you look at the screenshots I've posted in this thread I've got probably 10-20 price points marked throughout the day. I do this so that when ES is trading in a specific range I don't have to frantically look back and try to spot a good price point for entry/exit. That could be with pull backs or getting in at the top/bottom of a new trend. So thats how I define the actual price point of my entries. ES trades differently than most instruments. There are patterns here that if you attempted to trade elsewhere you might get your bacon cooked. I try not to trade against the trend unless I'm 100% confident in the play, even then generally not a good idea. With the indicators I'm running right now it's a very simple and clean setup. Basically looking for FE bottomed out, sell/buy signal from the Wave Trend Oscillator, and confirmation from the CCI on the 2000t to indicate that the previous trend is over or if its just a continuation (cyan to purple, purple to cyan, etc.) Ideally I like to enter on the first pull back, but who doesn't? Lately I've been playing a lot of triangles which is pretty straightforward. For me, time of day is extremely important. Big moves happen on the hour and half hour. Most importantly though man I'm just paying extremely close attention to price action which I think is the most valuable tool a trader can have and utilize.

blakecmathis

Well-known member

Haha that might be a stretch man. I've learned a lot from traders on this forum like @skynetgen @horserider @tomsk and @BenTen. And for me its not even the indicators. Its the experience and knowledge that other people have who have been trading much much longer than I have. Market breadth, market internals, MTF analysis, time of day. These are just a few examples of the things I have learned from the great dudes on this site.

blakecmathis

Well-known member

In my honest opinion 90% of every YouTube video out there about day trading is BS. If you were really that successful at trading, why would you need to supplement your income with revenue from making videos? You would be drinking mai tais on the beach in Maui. The members of this site have nothing to gain from helping people out. I truly believe all of us here want to see everyone succeed, stick it to wall street, and be the 5-10 percent of traders who actually prevail over the markets.

i have a question. how do you draw this trend lines, when i try its snaps to somewhere else. in the settings it shows non . it only happens tick chart though.

thank you

thank you

Pretty solid day so far

Attachments

blakecmathis

Well-known member

@muztem I have my draw settings set to "snap to tick"

thank you but you cant make it longer then where price candle ends. so are you drawing after price reached there?

- Status

- Not open for further replies.

Similar threads

-

/ES Futures, /GC, and even FX Trading strategy For ThinkOrSwim

- Started by tradebyday

- Replies: 38

-

-

Futures strategy: Wide Ranging Days In ThinkOrSwim

- Started by danB

- Replies: 33

-

-

Verniman strategy for /ES Futures Entry signals For ThinkOrSwim

- Started by STB

- Replies: 41

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1496

Online

Similar threads

-

/ES Futures, /GC, and even FX Trading strategy For ThinkOrSwim

- Started by tradebyday

- Replies: 38

-

-

Futures strategy: Wide Ranging Days In ThinkOrSwim

- Started by danB

- Replies: 33

-

-

Verniman strategy for /ES Futures Entry signals For ThinkOrSwim

- Started by STB

- Replies: 41

Similar threads

-

/ES Futures, /GC, and even FX Trading strategy For ThinkOrSwim

- Started by tradebyday

- Replies: 38

-

-

Futures strategy: Wide Ranging Days In ThinkOrSwim

- Started by danB

- Replies: 33

-

-

Verniman strategy for /ES Futures Entry signals For ThinkOrSwim

- Started by STB

- Replies: 41

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.