armybender

Active member

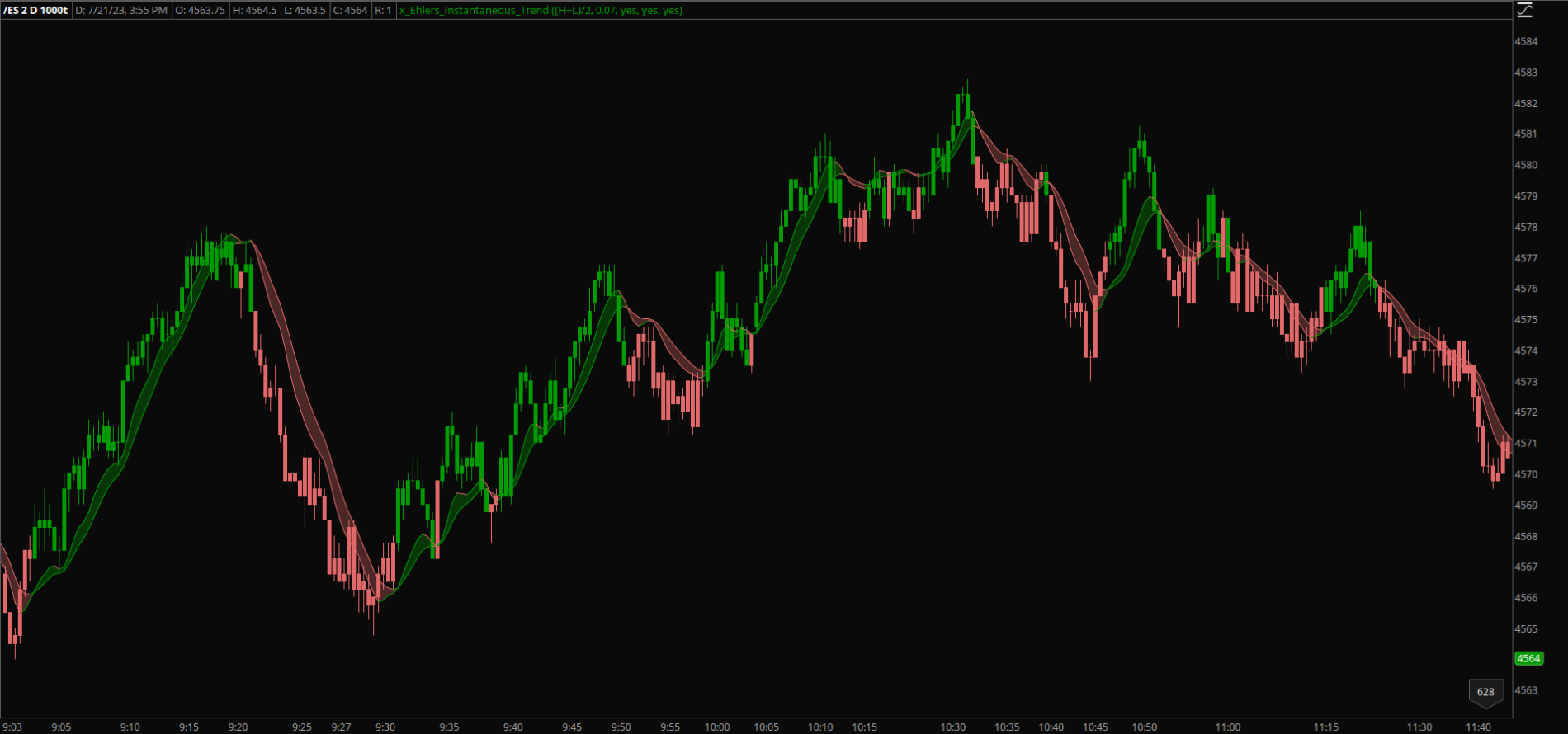

I converted the LazyBear Ehler's Instantaneous Trend. This is used in another study on this forum, but it is not available as a standalone study, so I thought I would add it.

Full disclosure - I don't use this study, but found the math interesting and decided to study it a bit, so I converted it into a ToS study.

Full disclosure - I don't use this study, but found the math interesting and decided to study it a bit, so I converted it into a ToS study.

Ruby:

#Ehlers Instantaneous Trend [LazyBear]

#Converted from https://www.tradingview.com/script/DaHLcICg-Ehlers-Instantaneous-Trend-LazyBear/

#DECLARATIONS

declare upper;

#USER INPUTS

input price = hl2;

input alpha = 0.07;

input fillTrend = no;

input colorBars = no;

input showCloud = no;

### GLOBAL COLOR DEFINITIONS

DefineGlobalColor("Green", CreateColor(0, 155, 0));

DefineGlobalColor("Red", CreateColor(225, 105, 105));

DefineGlobalColor("Gray", CreateColor(181, 181, 181));

#CALCULATIONS

def alpha2 = Power(alpha, 2);

def it = ( alpha - ( ( alpha2 ) / 4.0 ) ) * price + 0.5 * alpha2 * price[1] - ( alpha - 0.75 * alpha2 ) * price[2] + 2 * ( 1 - alpha ) * ( if IsNaN( it[1] ) then ( ( price + 2 * price[1] + price[2] ) / 4.0 ) else it[1] ) - ( 1 - alpha ) * ( 1 - alpha ) * ( if IsNaN( it[2] ) then ( ( price + 2 * price[1] + price[2] ) / 4.0 ) else it[2] );

def lag = 2.0 * it - if IsNaN(it[2]) then 0 else it[2];

#PLOTS

plot instTrend = it;

plot instTrendLag = 2.0 * it - (if IsNaN(it[2]) then 0 else it[2]);

#CLOUDS

AddCloud(if showCloud then instTrendLag else Double.NaN, instTrend, GlobalColor("Green"), GlobalColor("Red"));

#BAR COLORING

AssignPriceColor(

if colorBars then

if it > it[1] then GlobalColor("Green")

else if it < it[1] then GlobalColor("Red")

else GlobalColor("Gray")

else Color.CURRENT

);

#FORMATTING

instTrend.AssignValueColor(

if it > it[1] then GlobalColor("Green")

else if it < it[1] then GlobalColor("Red")

else GlobalColor("Gray")

);

instTrend.HideTitle();

instTrend.HideBubble();

instTrend.SetLineWeight(1);

instTrendLag.AssignValueColor(

if lag > lag[1] then GlobalColor("Green")

else if lag < lag[1] then GlobalColor("Red")

else GlobalColor("Gray")

);

instTrendLag.HideTitle();

instTrendLag.HideBubble();

instTrendLag.SetLineWeight(1);

Last edited: