What:

I started my day trading journey around four years ago. After all ups and downs, I am still not consistently profitable.

Why:

The reason I started day trading was that one day, I wanted to replace this with my full time job. As an analytical person, I have put lot of research and even 0.5% daily profit is good enough for me to sustain my family needs.

How:

I only do regular long and short trading. I don’t do options. I have tried all indicators and strategies in this forum. I researched so many YouTube videos. I have analyzed countless hours of charts. After all of that, I am nowhere near consistent profitability. In fact, I am 35% down in my account from where I started.

Where do I stand now:

Currently I have no study/strategy that I can rely on. I am at the point where I started questioning my self if day trading is for me or I should leave this for good. Am I chasing a mirage that doesn’t exist ? Does consistent profitable day trading exists ?

I've been giving some thoughts to your post, and probably should leave well enough alone, but here is some of my thinking FWIW?

Fifteen years ago, as I was pondering my future retirement, I knew I needed something to keep me busy or go crazy in the process. The stock market came to mind. Talking to a friend one day about the market he said he had a friend who always says

“I don’t want to own stocks, I only trade options.” He gave me his name and phone number and the two of us became friends.

He told me that options will provide a better return “

if you know what you’re doing.” The “if you know what you’re doing” was a key part of the conversation as I learned very quickly.

To make a long story short, I spent the next several years learning everything I could about options (and am still learning). I would hate to put a dollar figure on the amount of money spent through the learning process although it was certainly less than my prior professional education. I am still a Lifetime member of four trading organizations who give daily trades but I haven’t checked on them in several months. ThinkOrSwim has been my trading platform from the start. I also took a course in thinkscript to help better understand the indicators and their makeup.

I joined the options club after moving here to The Villages, Florida and when our leader needed major surgery, he asked me to cover for him. Four years of teaching was my greatest learning tool. When my wife said “enough already” I found the usethinkscript site which has allowed me to continue sharing some of my thoughts and learning from others. It’s the old moniker that

“when you share with someone else both of you have more”.

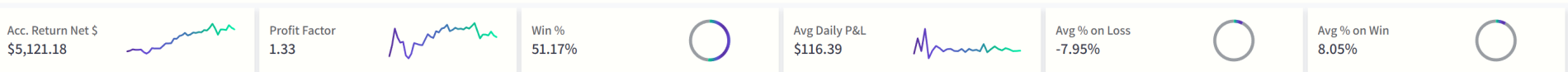

All of that being probably unnecessarily said my trading style is options only. As my friend originally said “I don’t want to trade stocks, I only want to trade options” and I’m glad he told me those words. There is no holy grail in trading either stocks or options and I have learned a lot from the school of hard knocks but education has helped me get into that group of options trades whose wins are greater than their losses (and I do have losses).

Success lies in the use of good charting, good indicators, and not thinking I know what the market is going to do next. Even the market itself gives a 50/50 chance of going either way from current price.

I understand your frustration. It is hard to be consistently profitable! You stated that you don’t trade options? UseThinkScript is a good place to learn. Most of the individuals posting on this site are either learning and/or sharing what they have learned mostly through trial and error. There are many styles of charting on this site. Find a style that fits your eye. With my dental background I am a visual person. If I open a chart and cannot immediately see what is taking place visually then I move on. Some charts have so many lines I get a headache trying to figure it out. My thoughts have always been “IF YOU CAN’T SEE IT, WHY TRADE IT!”

Every stock moves only three ways and you called yourself a day trader. Since all stocks make the same movements there is little (or no) reason to be scanning? Pick a couple of stocks (or ETFs) and trade them every day. If I were day trading just stocks I would do the same. Trade its ups and downs.

Friday SNOW opened around 225.80, produced immediate short signals, and fell to 218.22, a 7.5 point drop which would have yielded a stock loss of $7.50, or an option Put trade ATM of $379. SNOW changed direction on my chart about six times during the day using my 10 minute chart. Another stock SHOP changed direction three times and ALAB three tradeable times.

My thesis is: pick two or three stocks and trade their movements throughout the day. On the stocks mentioned I made my trades a week out as I don’t like 0 DTE (Days Until Expiration) and I’m not greedy on profits. I would rather have smaller consistent profits than looking for home runs.

Give options a try. You might learn to like them?