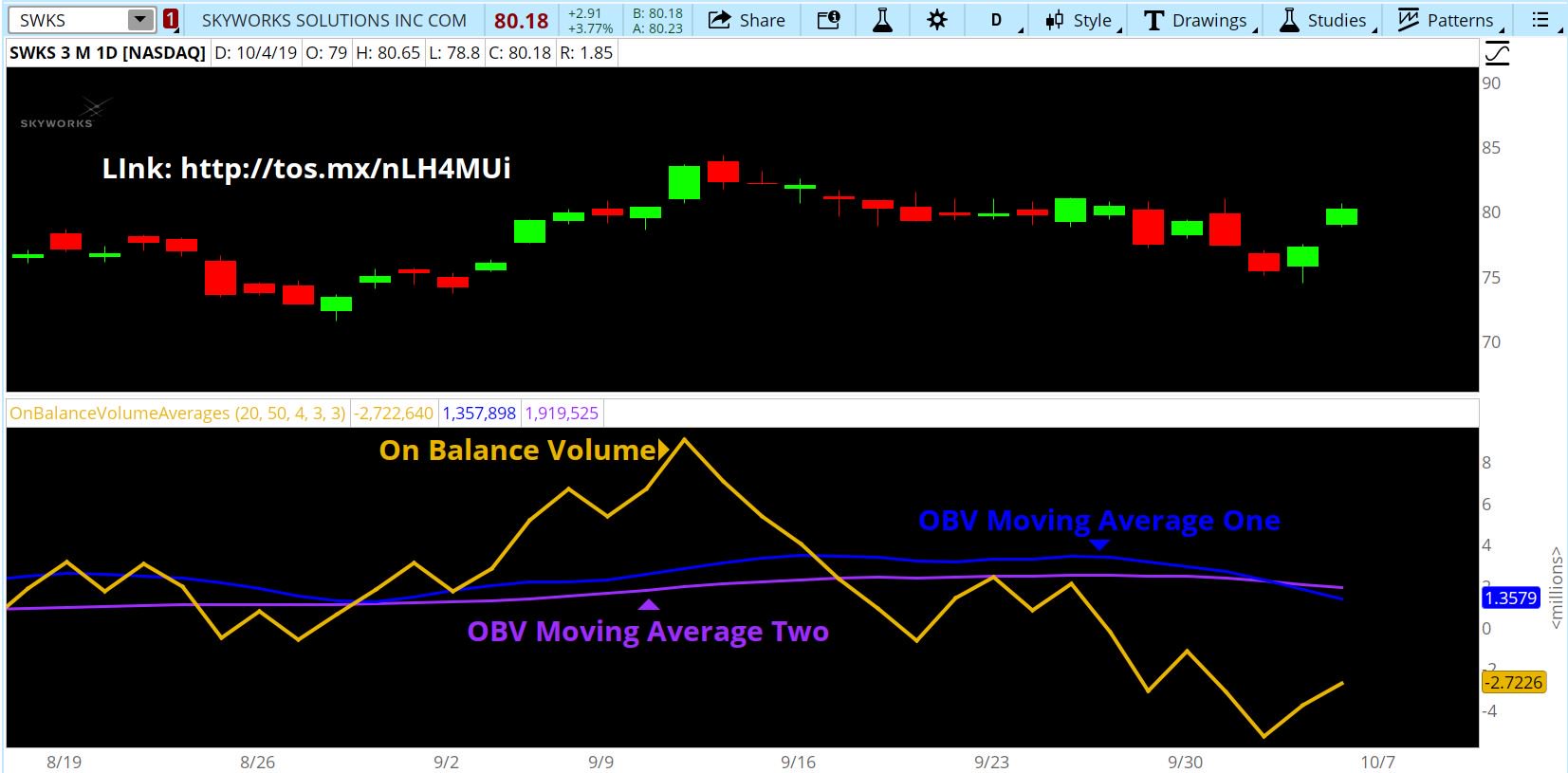

This indicator consists of the On Balance Volume (OBV) indicator along with two custom moving averages of the standard OBV. It was shared by Ken Rose (@KRose_TDA).

Before using this, be sure to watch the following video, so you get an understanding of how it works.

thinkScript Code

Code:

#Follow @KRose_TDA on twitter for updates to this and other scripts

#this script provides 2 moving averages of the study chosen

#default study in OnBalanceVolume Volume

declare lower;

#place the study desired after reference in the line below you must include the brackets "()"

#Initial study is OnBalanceVolume

plot MyStudy = reference OnBalanceVolume();

MyStudy.SetDefaultColor(GetColor(4));

input Moving_Averge_One_Length = 20;

input Moving_Averge_Two_Length = 50;

Input Line_Weight_MyStudy = 4;

Input Line_Weight_Moving_Average_One = 3;

Input Line_Weight_Moving_Average_Two = 3;

MyStudy.setlineWeight(Line_Weight_MyStudy);

plot MaOne = Average(mystudy, Moving_Averge_One_Length);

MaOne.SetDefaultColor(GetColor(6));

MaOne.setlineWeight(Line_Weight_Moving_Average_One);

Plot MaTwo = Average(mystudy, Moving_Averge_Two_Length);

MaTwo.SetDefaultColor(GetColor(8));

MaTwo.setlineWeight(Line_Weight_Moving_Average_Two);Shareable Link

https://tos.mx/nLH4MUiBefore using this, be sure to watch the following video, so you get an understanding of how it works.