I look for these indecision candles on a daily basis (after market close). All of them have been shared on here before but separately. I thought it would be useful just to combine them into one single indicator. Easier to scan for new pattern.

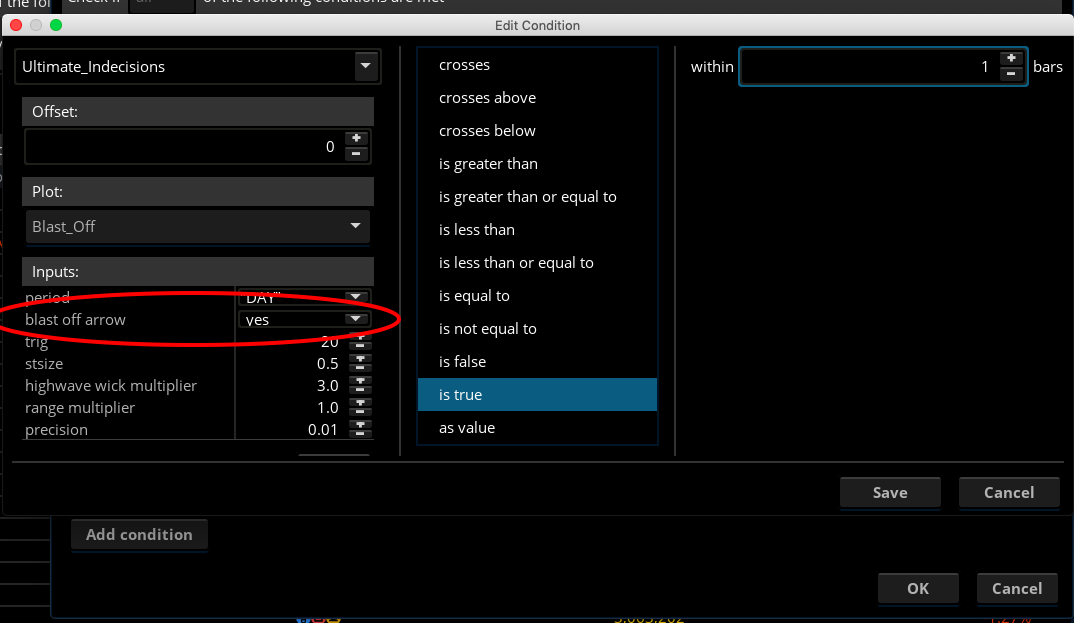

A quick note about the Blast Off pattern: I added a plot for the blast off candlestick pattern in the code. However, the arrow is turned off by default since the candle is already being highlighted in pink. That being said, when you scan for this pattern, be sure to change the setting from No to Yes otherwise, it will return no result.

- Pink candles = Blast Off pattern

- Blue up wedge at high = Spinning Top

- Yellow down wedge at low = HighWave

- Red circular point = Doji

thinkScript Code

Code:

# Ultimate Indecision Candles

# A collection of indecision candlestick patterns to help identify potential trend reversal

# Assembled by BenTen at usethinkscript.com

## Credits

#https://www.tradingview.com/script/V9Mi6eOO-CM-Blast-Off-V1-Alerts-Ready/

#https://www.tradingview.com/script/zZOCuaJN-Custom-Candle-color-Inside-Outside-candles-Highwave-Star-Patt/

#https://www.tradingview.com/script/LyNzdJVX-Spinning-Tops/

## End Credits

# Blast Off Indicator

input Period = aggregationPeriod.DAY;

input BlastOffArrow = no;

def close = close(period = Period);

def high = high(period = Period);

def open = open(period = Period);

def low = low(period = Period);

input trig = 20;

def val = absValue(close - open);

def range = high - low;

def blastOffVal = (val / range) * 100;

def trigger = trig;

def alert1 = blastOffVal < trig;

def col = blastOffVal < trig;

plot Blast_Off = if BlastOffArrow then col else double.nan;

Blast_Off.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

Blast_Off.SetDefaultColor(Color.CYAN);

Blast_Off.SetLineWeight(1);

assignPriceColor(if blastOffVal<trig then Color.MAGENTA else Color.CURRENT);

# End Blast Off

# Spinning top

input stsize = 0.5;

def spinningtop = (open > close) and((high-low)>(3* (open-close))and(((high-open)/(.001+high-low))< stsize)and(((close-low)/(.001+high-low))< stsize)) or(close>open) and((high-low)>(3* (close-open))and(((high-close)/(.001+high-low))< stsize)and(((open-low)/(.001+high-low))< stsize));

plot spinning_top = spinningtop;

spinning_top.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_UP);

spinning_top.SetDefaultColor(GetColor(1));

# End Spinnig Top

# Highwave

def Day = (high - low);

def Day_1 = (high[1] - low[1]);

def Day_2 = (high[2] - low[2]);

def Day_3 = (high[3] - low[3]);

def Day_4 = (high[4] - low[4]);

def Day_5 = (high[5] - low[5]);

def Avg = ((Day_1 + Day_2 + Day_3 + Day_4 + Day_5) / 5);

input Highwave_Wick_Multiplier = 3.0;

input Range_Multiplier = 1.0;

def Highwave = (((high - low) - (AbsValue(open - close))) > ((AbsValue(open - close)) * Highwave_Wick_Multiplier)) and((Day > (Avg* Range_Multiplier)));

plot high_wave = Highwave;

high_wave.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_DOWN);

high_wave.SetDefaultColor(GetColor(4));

# End HighWave

# Doji

input Precision = 0.01;

def doji_data = absValue(open - close) <= (high - low) * Precision;

plot doji = doji_data;

doji.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS);

doji.SetDefaultColor(GetColor(5));

# End DojiA quick note about the Blast Off pattern: I added a plot for the blast off candlestick pattern in the code. However, the arrow is turned off by default since the candle is already being highlighted in pink. That being said, when you scan for this pattern, be sure to change the setting from No to Yes otherwise, it will return no result.

Last edited: