Has anyone been able to successfully get any of these strategies to work in the orders condition wizard?

if so what did you have to do to get to work properly?

if so what did you have to do to get to work properly?

This strategy is too complex for the condition wizard.Has anyone been able to successfully get any of these strategies to work in the orders condition wizard?

if so what did you have to do to get to work properly?

I will post the link soon as I get around my computer…. Also HR buy sell is Horserider buy sell volume indicator I just changed the histogram to a line for the sell volume to get it to work in mobile.Hi HODL-Lay-HE-hoo!:

Can you please share HR Buy/Sell volume indicator?

Thanks

Madhu

Oooh ok so by previous resistance I would say to use the yellow line from the C3 max spark study (YHextLineOB - is the yellow line) So I have added code for an arrow to plot when the wick crosses the line then pulls back below… need to mess with it some more then I’ll post it. I am currently making the same concept but using the supply demand zones with the yellow - light green line inside the zone as it seems that it will yield better results.Thank you for that info, I have been looking at the scripts here, these scripts are amazing! im looking for the breakout above previous resistance after price runs up at least 30% then pulls back, as its either approaching that previous high or pushing through it an alert would be awesome, not sure if a volume surge confirmation use would be possible but that pretty much what im looking to do, I havent found it in these codes yet but im still testing them. there are so many great codes here some of which I have thought about using together, i hoping to be able to figure out how to auto trade if can get the right results

#--- C3_MAX_SPARK --- #

# Created by Christopher84 06/30/2022

# Based off of the Confirmation Candles Study. Main difference is that CC Candles weigh factors of positive

# and negative price movement to create the Consensus_Level. The Consensus_Level is considered positive if

# above zero and negative if below zero.

# --- HORSERIDER VOLUME --- #

# Show total volume in gray. Buying volume in green. Sell Volume in red.

# Volume average is gray line.

# Specified percent over average volume is cyan triangles.

# Horserider 12/30/2019 derived from some already existing studies.

# hiVolume indicator

# source: http://tinboot.blogspot.com

# author: allen everhart

# --- TRIPLE EXHAUSTION --- #

# Requested by @Chence27 from criteria listed here https://usethinkscript.com/threads/triple-exhaustion-indicator.9001/

# Removing the header Credit credits and description is not permitted, any modification needs to be shared.

# V 1.0 : @cos251 - Initial release per request from www.usethinkscript.com forum thread:

# : https://usethinkscript.com/threads/triple-exhaustion-indicator.9001/

# V 1.1 : @chence27 - modifcations to better approximate original study

# --- BULL_BEAR V5 --- #

#Bull_Bear_Candles+Label Created by Christopher84

#Created 10/21/2022

# Show SELL and BUY Volume and percentage.

# Referencing credit to Horserider script at https://usethinkscript.com/threads/volume-buy-sell-indicator-with-hot-percent-for-thinkorswim.389/

# Nomak 02/21/2020

declare upper;

input timeframe = AggregationPeriod.Day;

input ColoredCandlesOn = yes;

input BulgeLengthV = 20;

input SqueezeLengthV = 20;

input BulgeLengthV2 = 20;

input SqueezeLengthV2 = 20;

def Vol = volume(period = timeframe);

def at_High = high(period = timeframe);

def at_Open = open(period = timeframe);

def at_Close = close(period = timeframe);

def at_Low = low(period = timeframe);

def Vol1 = volume(period = timeframe);

def at_High1 = high(period = timeframe);

def at_Open1 = open(period = timeframe);

def at_Close1 = close(period = timeframe);

def at_Low1 = low(period = timeframe);

# Buy_Volume forumla is volume * (close_price minus low_price) / (High_price minus low_price)

def Buy_Volume = RoundUp(Vol * (at_Close - at_Low) / (at_High - at_Low));

def Buy_percent = RoundUp((Buy_Volume / Vol) * 100);

#Buy_percent.SetPaintingStrategy(PaintingStrategy.LINE);

#Buy_percent.SetLineWeight(1);

#Buy_percent.SetDefaultColor(Color.GREEN);

#Sell_Volume forumla is volume * (High_price minus Close_price) / (High_price minus Low_price)

def Sell_Volume = RoundDown(Vol1 * (at_High1 - at_Close1) / (at_High1 - at_Low1));

def Sell_percent = RoundUp((Sell_Volume / Vol1) * 100);

#Sell_percent.SetPaintingStrategy(PaintingStrategy.LINE);

#Sell_percent.SetLineWeight(1);

#Sell_percent.SetDefaultColor(Color.RED);

AddLabel(yes, "BuyVol " + Buy_Volume, Color.GREEN);

AddLabel(yes, "SellVol " + Sell_Volume, Color.RED);

AddLabel(yes, "Buy % " + Buy_percent, Color.GREEN);

AddLabel(yes, "Sell % " + Sell_percent, Color.RED);

#################################################################################

input price = close;

input length_V5 = 10;

input agperiod1 = {"1 min", "2 min", "3 min", default "5 min", "10 min", "15 min", "30 min", "1 hour", "2 hours", "4 hours", "Day", "Week", "Month"};

input agperiod2 = {"1 min", "2 min", "3 min", "5 min",default "10 min", "15 min", "30 min", "1 hour", "2 hours", "4 hours", "Day", "Week", "Month"};

plot avg = ExpAverage(close(period = agperiod1), length_V5);

def height = avg - avg[length_V5];

avg.SetStyle(Curve.SHORT_DASH);

avg.SetLineWeight(1);

def UP_V5 = avg[1] < avg;

def DOWN_V5 = avg[1] > avg;

Avg.AssignValueColor(if UP_V5 then Color.LIGHT_GREEN else if DOWN_V5 then Color.RED else Color.YELLOW);

plot avg2 = ExpAverage(close(period = agperiod2), length_V5);

def height2 = avg2 - avg2[length_V5];

avg2.SetStyle(Curve.SHORT_DASH);

avg2.SetLineWeight(1);

def UP2_V5 = avg2[1] < avg2;

def DOWN2_V5 = avg2[1] > avg2;

Avg2.AssignValueColor(if UP2_V5 then Color.LIGHT_GREEN else if DOWN2_V5 then Color.RED else Color.YELLOW);

#AddCloud(avg2, avg, Color.LIGHT_RED, Color.CURRENT);

#AddCloud(avg, avg2, Color.LIGHT_GREEN, Color.CURRENT);

def Condition1UP = avg > avg2;

def Condition1DN = avg < avg2;

def Condition2UP = Buy_percent > 50;

def Condition2DN = Buy_percent < 50;

def BullUP = Condition1UP + Condition2UP;

def BearDN = Condition1DN + Condition2DN;

def Bull_Bear = if Condition1UP==1 and Condition2UP == 1 then 1 else if Condition1DN == 1 and Condition2DN == 1 then -1 else 0;

def priceColor_V5 = if ((avg[1]<avg) and (avg2[1]<avg2)) then 1

else if((avg[1]>avg) and (avg2[1]>avg2)) then -1

else priceColor_V5[1];

AssignPriceColor(if ColoredCandlesOn and (priceColor_V5==1) then Color.GREEN else if ColoredCandlesOn and (priceColor_V5==-1) then Color.RED else Color.Gray);

#Label

AddLabel(yes, if Condition1UP==1 and Condition2UP == 1 then "Very Bullish" else if Condition1DN == 1 and Condition2DN == 1 then "Very Bearish" else if ((avg[1] > avg) and (avg > avg2) and (Buy_percent > 50)) then "Bullish Retracement" else if ((avg[1] < avg) and (avg < avg2) and (Buy_percent < 50)) then "Bearish Retracement" else "CHOP", if Condition1UP==1 and Condition2UP == 1 then Color.GREEN else if Condition1DN == 1 and Condition2DN == 1 then Color.RED else Color.GRAY);

# --- End Bull_Bear Code ---#

# --- C3 MAX INPUTS --- #

#input Price = CLOSE;

#input ShortLength1 = 5;

#input ShortLength2 = 14;

#input ShortLength3 = 5;

#input LongLength1 = 12;

#input LongLength2 = 55;

#input LongLength3 = 7;

input Color_Candles = yes;

# --- Changed Inputs to "def" so they will not show in settings ---

def ShortLength1 = 5;

def ShortLength2 = 14;

def ShortLength3 = 5;

def LongLength1 = 12;

def LongLength2 = 55;

def LongLength3 = 7;

# --- HORSERIDER VOLUME INPUTS ---

input Show30DayAvg = yes;

input ShowTodayVolume = yes;

input ShowPercentOf30DayAvg = yes;

input UnusualVolumePercent = 200;

input Show30BarAvg = yes;

input ShowCurrentBar = yes;

input ShowPercentOf30BarAvg = yes;

input ShowSellVolumePercent = yes;

input length_3 = 20;

input type_HV = { default SMP, EXP } ;

input length1_3 = 20 ;

input hotPct = 100.0 ;

# --- HORSERIDER DEF ---

def O_3 = open;

def H_3 = high;

def C_3 = close;

def L_3 = low;

def V_3 = volume;

def buying = V_3 * (C_3 - L_3) / (H_3 - L_3);

def selling = V_3 * (H_3 - C_3) / (H_3 - L_3);

def volLast30DayAvg = (volume(period = "DAY")[1] + volume(period = "DAY")[2] + volume(period = "DAY")[3] + volume(period = "DAY")[4] + volume(period = "DAY")[5] + volume(period = "DAY")[6] + volume(period = "DAY")[7] + volume(period = "DAY")[8] + volume(period = "DAY")[9] + volume(period = "DAY")[10] + volume(period = "DAY")[11] + volume(period = "DAY")[12] + volume(period = "DAY")[13] + volume(period = "DAY")[14] + volume(period = "DAY")[15] + volume(period = "DAY")[16] + volume(period = "DAY")[17] + volume(period = "DAY")[18] + volume(period = "DAY")[19] + volume(period = "DAY")[20] + volume(period = "DAY")[21] + volume(period = "DAY")[22] + volume(period = "DAY")[23] + volume(period = "DAY")[24] + volume(period = "DAY")[25] + volume(period = "DAY")[26] + volume(period = "DAY")[27] + volume(period = "DAY")[28] + volume(period = "DAY")[29] + volume(period = "DAY")[30]) / 30;

def today = volume(period = "DAY");

def percentOf30Day = Round((today / volLast30DayAvg) * 100, 0);

def avg30Bars = (volume[1] + volume[2] + volume[3] + volume[4] + volume[5] + volume[6] + volume[7] + volume[8] + volume[9] + volume[10] + volume[11] + volume[12] + volume[13] + volume[14] + volume[15] + volume[16] + volume[17] + volume[18] + volume[19] + volume[20] + volume[21] + volume[22] + volume[23] + volume[24] + volume[25] + volume[26] + volume[27] + volume[28] + volume[29] + volume[30]) / 30;

def curVolume = volume;

def percentOf30Bar = Round((curVolume / avg30Bars) * 100, 0);

def SellVolPercent = Round((selling / volume) * 100, 0);

def ma = if type_HV == type_HV.SMP then SimpleMovingAvg(volume, length_3) else MovAvgExponential(volume, length_3);

# --- HORSERIDER STUDY --- LABELS ---

AddLabel(Show30DayAvg, "30 Day Avg: " + Round(volLast30DayAvg, 0), Color.LIGHT_GRAY);

AddLabel(ShowTodayVolume, "Day: " + today, (if percentOf30Day >= UnusualVolumePercent then Color.GREEN else if percentOf30Day >= 100 then Color.ORANGE else Color.LIGHT_GRAY));

AddLabel(ShowPercentOf30DayAvg, percentOf30Day + "%", (if percentOf30Day >= UnusualVolumePercent then Color.GREEN else if percentOf30Day >= 100 then Color.ORANGE else Color.WHITE) );

AddLabel(Show30BarAvg, "30 Bar Avg: " + Round(avg30Bars, 0), Color.LIGHT_GRAY);

AddLabel(ShowCurrentBar, "1 Bar: " + curVolume, (if percentOf30Bar >= UnusualVolumePercent then Color.GREEN else if percentOf30Bar >= 100 then Color.ORANGE else Color.LIGHT_GRAY));

AddLabel(ShowPercentOf30BarAvg, percentOf30Bar + "%", (if percentOf30Bar >= UnusualVolumePercent then Color.GREEN else if percentOf30Bar >= 100 then Color.ORANGE else Color.WHITE) );

AddLabel(ShowSellVolumePercent, "1 Bar Sell %: " + SellVolPercent, (if SellVolPercent > 51 then Color.RED else if SellVolPercent < 49 then Color.GREEN else Color.ORANGE));

# --- TRIPLE EXHAUSTION STUDY --- INPUTS ---

#input over_bought_3x = 80;

#input over_sold_3x = 20;

#input KPeriod_3x = 10;

#input DPeriod_3x = 10;

#input priceH_3x = high;

#input priceL_3x = low;

#input priceC_3x = close;

input averageType_3x = AverageType.SIMPLE;

input length_3x = 1000;

#input paintBars_3x = no;

input showLabels_3x = yes;

# --- Changed Inputs to "def" so they will not show in settings ---

def over_bought_3x = 80;

def over_sold_3x = 20;

def KPeriod_3x = 10;

def DPeriod_3x = 10;

def priceH_3x = high;

def priceL_3x = low;

def priceC_3x = close;

# --- TRIPLE EXHAUSTION STUDY --- DEF --- INDICATORS - StochasticSlow / MACD / MACD StDev / DMI+/-

def SlowK_3x = reference StochasticFull(over_bought_3x, over_sold_3x, KPeriod_3x, DPeriod_3x, priceH_3x, priceL_3x, priceC_3x, 3, averageType_3x).FullK;

def MACD_3x = reference MACD()."Value";

def priceMean_3x = Average(MACD_3x, length_3x);

def MACD_stdev_3x = (MACD_3x - priceMean_3x) / StDev(MACD_3x, length_3x);

def dPlus_3x = reference DMI()."DI+";

def dMinus_3x = reference DMI()."DI-";

def sellerRegular = SlowK_3x < 20 and MACD_stdev_3x < -1 and dPlus_3x < 15;

def sellerExtreme = SlowK_3x < 20 and MACD_stdev_3x < -2 and dPlus_3x < 15;

def buyerRegular = SlowK_3x > 80 and MACD_stdev_3x > 1 and dMinus_3x < 15;

def buyerExtreme = SlowK_3x > 80 and MACD_stdev_3x > 2 and dMinus_3x < 15;

# --- TRIPLE EXHAUSTION STUDY --- ARROWS ---

plot RegularBuy = if sellerRegular[1] and !sellerRegular then low else Double.NaN;

RegularBuy.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

RegularBuy.SetDefaultColor(Color.GREEN);

plot RegularSell = if buyerRegular[1] and !buyerRegular then high else Double.NaN;

RegularSell.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

RegularSell.SetDefaultColor(Color.RED);

#Addverticalline ((Regularsell),"",Color.red);

#Addverticalline ((Regularbuy),"", Color.Green);

# --- PLD STUDY --- #

# --- PLD STUDY INPUTS ---

input length_PLD = 5;

input displace_PLD = -11;

input showBreakoutSignals_PLD = yes;

#input ColoredCandlesOn_PLD = no;

#input BulgeLengthPrice_PLD = 5;

#input SqueezeLengthPrice_PLD = 5;

# --- Changed Inputs to "def" so they will not show in settings ---

def BulgeLengthPrice_PLD = 5;

def SqueezeLengthPrice_PLD = 5;

# --- PLD DEF ---

plot PLD = ExpAverage(Price[-displace_PLD], length_PLD);

def UpperBand_PLD = Highest(PLD, BulgeLengthPrice_PLD);

def LowerBand_PLD = Lowest(PLD, SqueezeLengthPrice_PLD);

#plot UpSignal_PLD = Price crosses above UpperBand_PLD;

#plot DownSignal_PLD = Price crosses below LowerBand_PLD;

# --- PLD up signal when V5 bull_Bear C3 Bull_Bear

plot UpSignal_PLD = Price crosses above UpperBand_PLD and Bullup ;

plot DownSignal_PLD = Price crosses below LowerBand_PLD;

UpSignal_PLD.SetHiding(!showBreakoutSignals_PLD);

DownSignal_PLD.SetHiding(!showBreakoutSignals_PLD);

PLD.SetDefaultColor(GetColor(1));

UpSignal_PLD.SetDefaultColor(Color.UPTICK);

UpSignal_PLD.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

DownSignal_PLD.SetDefaultColor(Color.DOWNTICK);

DownSignal_PLD.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

def LongEnter = (Price crosses above UpperBand_PLD);

def LongExit = (Price crosses below LowerBand_PLD);

# --- CONFIRMATION NEAR TERM LEVELS STUDY ---

def displace2_2 = 0;

def factorK2_2 = 2.0;

def lengthK2_2 = 20;

input averageType2_2 = AverageType.SIMPLE;

def trueRangeAverageType2_2 = AverageType.SIMPLE;

def BulgeLengthPrice2 = 20;

def SqueezeLengthPrice2 = 20;

def shift2_2 = factorK2_2 * MovingAverage(trueRangeAverageType2_2 , TrueRange(high, close, low), lengthK2_2 );

def averageK2_2 = MovingAverage(averageType2_2 , Price , lengthK2_2 );

def Upper_BandK2_2 = averageK2_2 [-displace2_2 ] + shift2_2 [-displace2_2 ];

def Lower_BandK2_2 = averageK2_2 [-displace2_2 ] - shift2_2 [-displace2_2 ];

def conditionK2 = (Upper_BandK2_2 [1] < Upper_BandK2_2 ) and (Lower_BandK2_2 [1] < Lower_BandK2_2 );

def conditionK3 = (Upper_BandK2_2 [1] > Upper_BandK2_2 ) and (Lower_BandK2_2 [1] > Lower_BandK2_2 );

# --- C3 MAX STUDY ---

# Momentum Oscillators

def MS = Average(Average(Price, ShortLength1) - Average(Price, ShortLength2), ShortLength3);

def MS2 = Average(Average(Price, LongLength1) - Average(Price, LongLength2), LongLength3);

# Wave A

def MSGreens = If (MS >= 0, MS, 0);

def MSReds = If (MS < 0, MS, 0);

# Wave C

def MS2Blues = If (MS2 >= 0, MS2, 0);

def MS2Yellows = If (MS2 < 0, MS2, 0);

def MayhemBullish = MSGreens > MSGreens[1] and MS2Blues > MS2Blues[1];

def MayhemBearish = MSReds < MSReds[1] and MS2Yellows < MS2Yellows[1];

def MS_Pos = MSGreens;

def MS_Neg = MSReds;

def MS2_Pos = MS2Blues;

def MS2_Neg = MS2Yellows;

# Squeeze Indicator

#input length = 20;

#input nK = 1.5;

#input nBB = 2.0;

# --- Changed Inputs to "def" so they will not show in settings ---

def length = 20;

def nK = 1.5;

def nBB = 2.0;

def BBHalfWidth = StDev(Price, length);

def KCHalfWidth = nK * Average(TrueRange(high, close, low), length);

def isSqueezed = nBB * BBHalfWidth / KCHalfWidth < 1;

def BBS_Ind = If(isSqueezed, 0, Double.NaN);

# Bollinger Resolution

def BBSMA = Average(Price, length);

def BBSMAL = BBSMA + (-nBB * BBHalfWidth);

def BBSMAU = BBSMA + (nBB * BBHalfWidth);

def PerB = RoundUp((Price - BBSMAL) / (BBSMAU - BBSMAL) * 100, 0);

AddLabel(yes, Concat("%B: ", PerB), if PerB < 0 then Color.YELLOW else if PerB > 0 and PerB[1] < 0 then Color.GREEN else Color.WHITE);

# Parabolic SAR Signal

input accelerationFactor = 0.0275;

input accelerationLimit = 0.2;

def SAR = ParabolicSAR(accelerationFactor = accelerationFactor, accelerationLimit = accelerationLimit);

def bearishCross = Crosses(SAR, Price, CrossingDirection.ABOVE);

def signalDown = bearishCross;#If(bearishCross, 0, Double.NaN);

def bullishCross = Crosses(SAR, Price, CrossingDirection.BELOW);

def signalUp = bullishCross;#If(bullishCross, 0, Double.NaN);

def UP = bullishCross;

def DOWN = bearishCross;

def priceColor = if UP then 1 else if DOWN then -1 else priceColor[1];

# OB_OS_Levels_v5 by Christopher84 12/10/2021

input BarsUsedForRange = 2;

input BarsRequiredToRemainInRange = 2;

input TargetMultiple = 0.5;

input ColorPrice = yes;

input HideTargets = no;

input HideBalance = no;

input HideBoxLines = no;

input HideCloud = no;

input HideLabels = no;

#Squeeze Dots Created 04/28/2021 by Christopher84

#input ATRPeriod = 5;

#input ATRFactor = 2.0;

# --- Changed Inputs to "def" so they will not show in settings ---

def ATRPeriod = 5;

def ATRFactor = 2.0;

def HiLo = Min(high - low, 1.5 * Average(high - low, ATRPeriod));

def HRef = if low <= high[1] then high - close[1] else (high - close[1]) - 0.5 * (low - high[1]);

def LRef = if high >= low[1] then close[1] - low else (close[1] - low) - 0.5 * (low[1] - high);

input trailType = {default modified, unmodified};

def trueRange;

switch (trailType) {

case modified:

trueRange = Max(HiLo, Max(HRef, LRef));

case unmodified:

trueRange = TrueRange(high, close, low);

}

input averageType = AverageType.SIMPLE;

input firstTrade = {default long, short};

def loss = ATRFactor * MovingAverage(averageType, trueRange, ATRPeriod);

def state = {default init, long, short};

def trail;

switch (state[1]) {

case init:

if (!IsNaN(loss)) {

switch (firstTrade) {

case long:

state = state.long;

trail = close - loss;

case short:

state = state.short;

trail = close + loss;

}

} else {

state = state.init;

trail = Double.NaN;

}

case long:

if (close > trail[1]) {

state = state.long;

trail = Max(trail[1], close - loss);

} else {

state = state.short;

trail = close + loss;

}

case short:

if (close < trail[1]) {

state = state.short;

trail = Min(trail[1], close + loss);

} else {

state = state.long;

trail = close - loss;

}

}

def TrailingStop = trail;

def H = Highest(TrailingStop, 12);

def L = Lowest(TrailingStop, 12);

def BulgeLengthPrice = 100;

def SqueezeLengthPrice = 100;

def BandwidthC3 = (H - L);

def IntermResistance2 = Highest(BandwidthC3, BulgeLengthPrice);

def IntermSupport2 = Lowest(BandwidthC3, SqueezeLengthPrice);

def sqzTrigger = BandwidthC3 <= IntermSupport2;

def sqzLevel = if !sqzTrigger[1] and sqzTrigger then hl2

else if !sqzTrigger then Double.NaN

else sqzLevel[1];

plot Squeeze_Alert = sqzLevel;

Squeeze_Alert.SetPaintingStrategy(PaintingStrategy.POINTS);

Squeeze_Alert.SetLineWeight(3);

Squeeze_Alert.SetDefaultColor(Color.YELLOW);

#-----------------------------

#Yellow Candle_height (OB_OS)

#-----------------------------

def displace = 0;

def factorK2 = 3.25;

def lengthK2 = 20;

def price1 = open;

def trueRangeAverageType = AverageType.SIMPLE;

def ATR_length = 15;

def SMA_lengthS = 6;

#input ATRPeriod2 = 5;

#input ATRFactor2 = 1.5;

# --- Changed Inputs to "def" so they will not show in settings ---

def ATRPeriod2 = 5;

def ATRFactor2 = 1.5;

def HiLo2 = Min(high - low, 1.5 * Average(high - low, ATRPeriod));

def HRef2 = if low <= high[1]

then high - close[1]

else (high - close[1]) - 0.5 * (low - high[1]);

def LRef2 = if high >= low[1]

then close[1] - low

else (close[1] - low) - 0.5 * (low[1] - high);

def loss2 = ATRFactor2 * MovingAverage(averageType, trueRange, ATRPeriod2);

def multiplier_factor = 1.25;

def valS = Average(Price, SMA_lengthS);

def average_true_range = Average(TrueRange(high, close, low), length = ATR_length);

def Upper_BandS = valS[-displace] + multiplier_factor * average_true_range[-displace];

def Middle_BandS = valS[-displace];

def Lower_BandS = valS[-displace] - multiplier_factor * average_true_range[-displace];

def shiftK2 = factorK2 * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), lengthK2);

def averageK2 = MovingAverage(averageType, Price, lengthK2);

def AvgK2 = averageK2[-displace];

def Upper_BandK2 = averageK2[-displace] + shiftK2[-displace];

def Lower_BandK2 = averageK2[-displace] - shiftK2[-displace];

def condition_BandRevDn = (Upper_BandS > Upper_BandK2);

def condition_BandRevUp = (Lower_BandS < Lower_BandK2);

def fastLength = 12;

def slowLength = 26;

def MACDLength = 9;

input MACD_AverageType = {SMA, default EMA};

def fastEMA = ExpAverage(Price, fastLength);

def slowEMA = ExpAverage(Price, slowLength);

def Value;

def Avg1;

switch (MACD_AverageType) {

case SMA:

Value = Average(Price, fastLength) - Average(Price, slowLength);

Avg1 = Average(Value, MACDLength);

case EMA:

Value = fastEMA - slowEMA;

Avg1 = ExpAverage(Value, MACDLength);

}

def Diff = Value - Avg1;

def MACDLevel = 0.0;

def Level = MACDLevel;

def condition1 = Value[1] <= Value;

def condition1D = Value[1] > Value;

#RSI

def RSI_length = 14;

def RSI_AverageType = AverageType.WILDERS;

def RSI_OB = 70;

def RSI_OS = 30;

def NetChgAvg = MovingAverage(RSI_AverageType, Price - Price[1], RSI_length);

def TotChgAvg = MovingAverage(RSI_AverageType, AbsValue(Price - Price[1]), RSI_length);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

def RSI = 50 * (ChgRatio + 1);

def condition2 = (RSI[3] < RSI) is true or (RSI >= 80) is true;

def condition2D = (RSI[3] > RSI) is true or (RSI < 20) is true;

def conditionOB1 = RSI > RSI_OB;

def conditionOS1 = RSI < RSI_OS;

#MFI

def MFI_Length = 14;

def MFIover_Sold = 20;

def MFIover_Bought = 80;

def movingAvgLength = 1;

def MoneyFlowIndex = Average(MoneyFlow(high, close, low, volume, MFI_Length), movingAvgLength);

def MFIOverBought = MFIover_Bought;

def MFIOverSold = MFIover_Sold;

def condition3 = (MoneyFlowIndex[2] < MoneyFlowIndex) is true or (MoneyFlowIndex > 85) is true;

def condition3D = (MoneyFlowIndex[2] > MoneyFlowIndex) is true or (MoneyFlowIndex < 20) is true;

def conditionOB2 = MoneyFlowIndex > MFIover_Bought;

def conditionOS2 = MoneyFlowIndex < MFIover_Sold;

#Forecast

def na = Double.NaN;

def MidLine = 50;

def Momentum = MarketForecast().Momentum;

def NearT = MarketForecast().NearTerm;

def Intermed = MarketForecast().Intermediate;

def FOB = 80;

def FOS = 20;

def upperLine = 110;

def condition4 = (Intermed[1] <= Intermed) or (NearT >= MidLine);

def condition4D = (Intermed[1] > Intermed) or (NearT < MidLine);

def conditionOB3 = Intermed > FOB;

def conditionOS3 = Intermed < FOS;

def conditionOB4 = NearT > FOB;

def conditionOS4 = NearT < FOS;

#Change in Price

def lengthCIP = 5;

def CIP = (Price - Price[1]);

def AvgCIP = ExpAverage(CIP[-displace], lengthCIP);

def CIP_UP = AvgCIP > AvgCIP[1];

def CIP_DOWN = AvgCIP < AvgCIP[1];

def condition5 = CIP_UP;

def condition5D = CIP_DOWN;

#EMA_1

def EMA_length = 8;

def AvgExp = ExpAverage(Price[-displace], EMA_length);

def condition6 = (Price >= AvgExp) and (AvgExp[2] <= AvgExp);

def condition6D = (Price < AvgExp) and (AvgExp[2] > AvgExp);

#EMA_2

def EMA_2length = 20;

def displace2 = 0;

def AvgExp2 = ExpAverage(Price[-displace2], EMA_2length);

def condition7 = (Price >= AvgExp2) and (AvgExp2[2] <= AvgExp);

def condition7D = (Price < AvgExp2) and (AvgExp2[2] > AvgExp);

#DMI Oscillator

def DMI_length = 5;#Typically set to 10

input DMI_averageType = AverageType.WILDERS;

def diPlus = DMI(DMI_length, DMI_averageType)."DI+";

def diMinus = DMI(DMI_length, DMI_averageType)."DI-";

def Osc = diPlus - diMinus;

def Hist = Osc;

def ZeroLine = 0;

def condition8 = Osc >= ZeroLine;

def condition8D = Osc < ZeroLine;

#Trend_Periods

def TP_fastLength = 3;#Typically 7

def TP_slowLength = 4;#Typically 15

def Periods = Sign(ExpAverage(close, TP_fastLength) - ExpAverage(close, TP_slowLength));

def condition9 = Periods > 0;

def condition9D = Periods < 0;

#Polarized Fractal Efficiency

def PFE_length = 5;#Typically 10

def smoothingLength = 2.5;#Typically 5

def PFE_diff = close - close[PFE_length - 1];

def val = 100 * Sqrt(Sqr(PFE_diff) + Sqr(PFE_length)) / Sum(Sqrt(1 + Sqr(close - close[1])), PFE_length - 1);

def PFE = ExpAverage(if PFE_diff > 0 then val else -val, smoothingLength);

def UpperLevel = 50;

def LowerLevel = -50;

def condition10 = PFE > 0;

def condition10D = PFE < 0;

def conditionOB5 = PFE > UpperLevel;

def conditionOS5 = PFE < LowerLevel;

#Bollinger Bands Percent_B

input BBPB_averageType = AverageType.SIMPLE;

def BBPB_length = 20;#Typically 20

def Num_Dev_Dn = -2.0;

def Num_Dev_up = 2.0;

def BBPB_OB = 100;

def BBPB_OS = 0;

def upperBand = BollingerBands(Price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).UpperBand;

def lowerBand = BollingerBands(Price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).LowerBand;

def PercentB = (Price - lowerBand) / (upperBand - lowerBand) * 100;

def HalfLine = 50;

def UnitLine = 100;

def condition11 = PercentB > HalfLine;

def condition11D = PercentB < HalfLine;

def conditionOB6 = PercentB > BBPB_OB;

def conditionOS6 = PercentB < BBPB_OS;

def condition12 = (Upper_BandS[1] <= Upper_BandS) and (Lower_BandS[1] <= Lower_BandS);

def condition12D = (Upper_BandS[1] > Upper_BandS) and (Lower_BandS[1] > Lower_BandS);

#Klinger Histogram

def Klinger_Length = 13;

def KVOsc = KlingerOscillator(Klinger_Length).KVOsc;

def KVOH = KVOsc - Average(KVOsc, Klinger_Length);

def condition13 = (KVOH > 0);

def condition13D = (KVOH < 0);

#Projection Oscillator

def ProjectionOsc_length = 30;#Typically 10

def MaxBound = HighestWeighted(high, ProjectionOsc_length, LinearRegressionSlope(price = high, length = ProjectionOsc_length));

def MinBound = LowestWeighted(low, ProjectionOsc_length, LinearRegressionSlope(price = low, length = ProjectionOsc_length));

def ProjectionOsc_diff = MaxBound - MinBound;

def PROSC = if ProjectionOsc_diff != 0 then 100 * (close - MinBound) / ProjectionOsc_diff else 0;

def PROSC_OB = 80;

def PROSC_OS = 20;

def condition14 = PROSC > 50;

def condition14D = PROSC < 50;

def conditionOB7 = PROSC > PROSC_OB;

def conditionOS7 = PROSC < PROSC_OS;

#Trend Confirmation Calculator

#Confirmation_Factor range 1-15.

input Confirmation_Factor = 7;

#Use for testing conditions individually. Remove # from line below and change Confirmation_Factor to 1.

#def Agreement_Level = condition1;

def Agreement_LevelOB = 12;

def Agreement_LevelOS = 2;

def factorK = 2.0;

def lengthK = 20;

def shift = factorK * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), lengthK);

def averageK = MovingAverage(averageType, Price, lengthK);

def AvgK = averageK[-displace];

def Upper_BandK = averageK[-displace] + shift[-displace];

def Lower_BandK = averageK[-displace] - shift[-displace];

def conditionK1UP = Price >= Upper_BandK;

def conditionK2UP = (Upper_BandK[1] < Upper_BandK) and (Lower_BandK[1] < Lower_BandK);

def conditionK3DN = (Upper_BandK[1] > Upper_BandK) and (Lower_BandK[1] > Lower_BandK);

def conditionK4DN = Price < Lower_BandK;

def Agreement_Level = condition1 + condition2 + condition3 + condition4 + condition5 + condition6 + condition7 + condition8 + condition9 + condition10 + condition11 + condition12 + condition13 + condition14 + conditionK1UP + conditionK2UP;

def Agreement_LevelD = (condition1D + condition2D + condition3D + condition4D + condition5D + condition6D + condition7D + condition8D + condition9D + condition10D + condition11D + condition12D + condition13D + condition14D + conditionK3DN + conditionK4DN);

def Consensus_Level = Agreement_Level - Agreement_LevelD;

def UP2 = Consensus_Level >= 10;

def DOWN2 = Consensus_Level < -10;

def priceColor2 = if UP2 then 1

else if DOWN2 then -1

else priceColor2[1];

def Consensus_Level_OB = 10;

def Consensus_Level_OS = -10;

#Super_OB/OS Signal

def OB_Level = conditionOB1 + conditionOB2 + conditionOB3 + conditionOB4 + conditionOB5 + conditionOB6 + conditionOB7;

def OS_Level = conditionOS1 + conditionOS2 + conditionOS3 + conditionOS4 + conditionOS5 + conditionOS6 + conditionOS7;

def Consensus_Line = OB_Level - OS_Level;

def Zero_Line = 0;

def Super_OB = 4;

def Super_OS = -4;

def DOWN_OB = (Agreement_Level > Agreement_LevelOB) and (Consensus_Line > Super_OB) and (Consensus_Level > Consensus_Level_OB);

def UP_OS = (Agreement_Level < Agreement_LevelOS) and (Consensus_Line < Super_OS) and (Consensus_Level < Consensus_Level_OS);

def OS_Buy = UP_OS;

def OB_Sell = DOWN_OB;

def neutral = Consensus_Line < Super_OB and Consensus_Line > Super_OS;

input use_line_limits = yes;#Yes, plots line from/to; No, plot line across entire chart

input linefrom = 100;#Hint linefrom: limits how far line plots in candle area

input lineto = 12;#Hint lineto: limits how far into expansion the line will plot

def YHOB = if Color_Candles and ((price1 > Upper_BandS) and (condition_BandRevDn)) then high else Double.NaN;

def YHOS = if Color_Candles and ((price1 < Lower_BandS) and (condition_BandRevUp)) then high else Double.NaN;

def YLOB = if Color_Candles and ((price1 > Upper_BandS) and (condition_BandRevDn)) then low else Double.NaN;

def YLOS = if Color_Candles and ((price1 < Lower_BandS) and (condition_BandRevUp)) then low else Double.NaN;

#extend midline of yellow candle

plot YCOB = if !IsNaN(YHOB) then hl2 else Double.NaN;

YCOB.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

YCOB.SetDefaultColor(Color.GREEN);

def YHextOB = if IsNaN(YCOB) then YHextOB[1] else YCOB;

plot YHextlineOB = YHextOB;

YHextlineOB.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

YHextlineOB.SetDefaultColor(Color.ORANGE);

YHextlineOB.SetLineWeight(2);

plot YCOS = if !IsNaN(YHOS) then hl2 else Double.NaN;

YCOS.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

YCOS.SetDefaultColor(Color.GREEN);

def YHextOS = if IsNaN(YCOS) then YHextOS[1] else YCOS;

plot YHextlineOS = YHextOS;

YHextlineOS.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

YHextlineOS.SetDefaultColor(Color.LIGHT_GREEN);

YHextlineOS.SetLineWeight(2);

def YC = Color_Candles and priceColor2 == 1 and price1 > Upper_BandS and condition_BandRevDn;

#Additional Signals

input showCloud = yes;

#AddCloud(if showCloud and condition_BandRevUp then Lower_BandK2 else Double.NaN, Lower_BandS, Color.LIGHT_GREEN, Color.CURRENT);

#AddCloud(if showCloud and condition_BandRevDn then Upper_BandS else Double.NaN, Upper_BandK2, Color.LIGHT_RED, Color.CURRENT);

# Identify Consolidation

def HH = Highest(high[1], BarsUsedForRange);

def LL = Lowest(low[1], BarsUsedForRange);

def maxH = Highest(HH, BarsRequiredToRemainInRange);

def maxL = Lowest(LL, BarsRequiredToRemainInRange);

def HHn = if maxH == maxH[1] or maxL == maxL then maxH else HHn[1];

def LLn = if maxH == maxH[1] or maxL == maxL then maxL else LLn[1];

def Bh = if high <= HHn and HHn == HHn[1] then HHn else Double.NaN;

def Bl = if low >= LLn and LLn == LLn[1] then LLn else Double.NaN;

def CountH = if IsNaN(Bh) or IsNaN(Bl) then 2 else CountH[1] + 1;

def CountL = if IsNaN(Bh) or IsNaN(Bl) then 2 else CountL[1] + 1;

def ExpH = if BarNumber() == 1 then Double.NaN else

if CountH[-BarsRequiredToRemainInRange] >= BarsRequiredToRemainInRange then HHn[-BarsRequiredToRemainInRange] else

if high <= ExpH[1] then ExpH[1] else Double.NaN;

def ExpL = if BarNumber() == 1 then Double.NaN else

if CountL[-BarsRequiredToRemainInRange] >= BarsRequiredToRemainInRange then LLn[-BarsRequiredToRemainInRange] else

if low >= ExpL[1] then ExpL[1] else Double.NaN;

# Plot the High and Low of the Box; Paint Cloud

def BoxHigh = if ((DOWN_OB) or (Upper_BandS crosses above Upper_BandK2) or (condition_BandRevDn) and (high > high[1]) and ((Price > Upper_BandK2) or (Price > Upper_BandS))) then Highest(ExpH) else Double.NaN;#if (DOWN_OB > 3) then Highest(ExpH) else if (Condition_BandRevDn and (price > AvgExp) and (High > High[1])) then Highest(ExpH) else Double.NaN;

def BoxLow = if (DOWN_OB) or ((Upper_BandS crosses above Upper_BandK2)) then Lowest(low) else Double.NaN;#if (DOWN_OB crosses above 3) then Lowest(low) else if ((Upper_BandS crosses above Upper_BandK2)) then Lowest(ExpH) else Double.NaN;#if ((DOWN_OB) or (Condition_BandRevDn and (price < price[1]))) then Highest(ExpL) else Double.NaN;

def BoxHigh2 = if ((UP_OS) or ((Lower_BandS crosses below Lower_BandK2))) then Highest(ExpH) else Double.NaN; #if (UP_OS) then Highest(ExpH) else if ((Lower_BandS crosses below Lower_BandK2)) then Highest(ExpH) else Double.NaN;

def BH2 = if !IsNaN(BoxHigh2) then high else Double.NaN;

def BH2ext = if IsNaN(BH2) then BH2ext[1] else BH2;

def BH2extline = BH2ext;

plot H_BH2extline = Lowest(BH2extline, 1);

H_BH2extline.SetDefaultColor(Color.GREEN);

def BoxLow2 = if ((UP_OS) or (Lower_BandS crosses below Lower_BandK2) or (condition_BandRevUp) and (low < low[1]) and ((Price < Lower_BandK2) or (Price < Lower_BandS))) or ((UP_OS[1]) and (low < low[1])) then Lowest(low) else Double.NaN;#if (UP_OS) then Lowest(low) else if (Condition_BandRevUp and (price < AvgExp) and (Low < Low[1])) then Lowest(low) else Double.NaN;

# extend the current YCHigh line to the right edge of the chart

def BH1 = if !IsNaN(BoxHigh) then high else Double.NaN;

def BH1ext = if IsNaN(BH1) then BH1ext[1] else BH1;

def BH1extline = BH1ext;

def BL1 = if !IsNaN(BoxLow) then low else Double.NaN;

def BL1ext = if IsNaN(BL1) then BL1ext[1] else BL1;

plot BL1extline = BL1ext;

BL1extline.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

BL1extline.SetDefaultColor(Color.RED);

BL1extline.SetLineWeight(1);

def BL2 = if !IsNaN(BoxLow2) then low else Double.NaN;

def BL2ext = if IsNaN(BL2) then BL2ext[1] else BL2;

plot BL2extline = BL2ext;

BL2extline.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

BL2extline.SetDefaultColor(Color.GREEN);

BL2extline.SetLineWeight(1);

plot H_BH1extline = Highest(BH1extline, 1);

H_BH1extline.SetDefaultColor(Color.RED);

plot L_BL1extline = Highest(BL1extline, 1);

L_BL1extline.SetDefaultColor(Color.RED);

plot L_BL2extline = Lowest(BL2extline, 1);

L_BL2extline.SetDefaultColor(Color.GREEN);

# --- BREAKOUT CODE --- #

# Price crosses level and the opposite crossing happend within x number of bars

def bn = BarNumber();

def na_1 = Double.NaN;

input bars_back = 5;

########### ADD CODE TO DETERMINE LEVELS ###########

############ SUPPORT FROM C3 MAX STUDY #############

# def support = ... some price level

def support_YHextOS = YHextlineOS;

def support_YHextOB = YHextlineOB;

def support_BH1ext = H_BH1EXTLINE;

def support_BL2ext = L_BL2EXTLINE;

def support_PLD = ExpAverage(Price[-displace_PLD], length_PLD);

############# INPUT FOR TESTING ONLY ##############

input support_level = 50;

########### CONVERT CONSTANT TO VAR ############

# def support = if bn == 1 then support_level else support[1];

#def support_YHextOS = if bn == 1 then support_level else support_YHextOS[1];

#def support_YHextOB = if bn == 1 then support_level else support_YHextOB[1];

input show_ref_line = no;

# plot y = if show_ref_line then support else na_1;

#plot y = if show_ref_line then support_YHextOS else na;

#plot y_2 = if show_ref_line then support_YHextOB else na_1;

########### CHOOSE WICK, BODY, or CLOSE ###########

input candle_levels = {default "wick" , "body" , "close"};

def highx;

def lowx;

switch (candle_levels) {

case "wick":

highx = high;

lowx = low;

case "body":

highx = Max(open, close);

lowx = Min(open, close);

case "close":

highx = close;

lowx = close;

}

########### LABELS ############

AddLabel(1, "crossing levels " + candle_levels , Color.YELLOW);

AddLabel(1, "bars back " + bars_back, Color.YELLOW);

# use wicks or body data or close

def crossdwnbn = if bn == 1 then 0 else if highx[1] > support_YHextOS[1] and lowx < support_YHextOS then bn else crossdwnbn[1];

def crossupbn = if bn == 1 then 0 else if lowx[1] < support_YHextOS[1] and highx > support_YHextOS then bn else crossupbn[1];

def crossdwnbn_1 = if bn == 1 then 0 else if highx[1] > support_YHextOB[1] and lowx < support_YHextOB then bn else crossdwnbn_1[1];

def crossupbn_1 = if bn == 1 then 0 else if lowx[1] < support_YHextOB[1] and highx > support_YHextOB then bn else crossupbn_1[1];

def crossdwnbn_2 = if bn == 1 then 0 else if highx[1] > support_BH1ext[1] and lowx < support_BH1ext then bn else crossdwnbn_2[1];

def crossupbn_2 = if bn == 1 then 0 else if lowx[1] < support_BH1ext[1] and highx > support_BH1ext then bn else crossupbn_2[1];

def crossdwnbn_3 = if bn == 1 then 0 else if highx[1] > support_BL2ext[1] and lowx < support_BL2ext then bn else crossdwnbn_3[1];

def crossupbn_3 = if bn == 1 then 0 else if lowx[1] < support_BL2ext[1] and highx > support_BL2ext then bn else crossupbn_3[1];

def crossdwnbn_4 = if bn == 1 then 0 else if highx[1] > support_PLD[1] and lowx < support_PLD then bn else crossdwnbn_4[1];

def crossupbn_4 = if bn == 1 then 0 else if lowx[1] < support_PLD[1] and highx > support_PLD then bn else crossupbn_4[1];

#def crossdwnbn_3 = if bn == 1 then 0 else if highx[1] > support_BL2ext[1] and lowx < support_BL2ext then bn else crossdwnbn_3[1];

#def crossupbn_3 = if bn == 1 then 0 else if lowx[1] < support_BL2ext[1] and highx > support_BL2ext then bn else crossupbn_3[1];

#def crossdwnbn_3 = if bn == 1 then 0 else if highx[1] > support_BL2ext[1] and lowx < support_BL2ext then bn else crossdwnbn_3[1];

#def crossupbn_3 = if bn == 1 then 0 else if lowx[1] < support_BL2ext[1] and highx > support_BL2ext then bn else crossupbn_3[1];

########### GETTIN CROSSED-UP ###########

# dip then rise, within len bars

#def support_BH1ext = BoxHigh;

#def support_BL2ext = BoxLow;

def up2_0 = if

bn > bars_back

and

( (crossupbn - crossdwnbn) <= bars_back and (crossupbn - crossdwnbn) > 0 )

and

crossupbn == bn

and

Sum(up2_0[1], (bars_back - 1)) == 0

then 1 else 0;

def Down2_0 = if

bn > bars_back

and

( (crossdwnbn - crossupbn) <= bars_back and (crossdwnbn - crossupbn) > 0 )

and

crossdwnbn == bn

and

Sum(Down2_0[1], (bars_back - 1)) == 0

then 1 else 0;

def up2_1 = if

bn > bars_back

and

( (crossupbn_1 - crossdwnbn_1) <= bars_back and (crossupbn_1 - crossdwnbn_1) > 0 )

and

crossupbn_1 == bn

and

Sum(up2_1[1], (bars_back - 1)) == 0

then 1 else 0;

def Down2_1 = if

bn > bars_back

and

( (crossdwnbn_1 - crossupbn_1) <= bars_back and (crossdwnbn_1 - crossupbn_1) > 0 )

and

crossdwnbn_1 == bn

and

Sum(Down2_1[1], (bars_back - 1)) == 0

then 1 else 0;

def up2_2 = if

bn > bars_back

and

( (crossupbn_2 - crossdwnbn_2) <= bars_back and (crossupbn_2 - crossdwnbn_2) > 0 )

and

crossupbn_2 == bn

and

Sum(up2_2[1], (bars_back - 1)) == 0

then 1 else 0;

def Down2_2 = if

bn > bars_back

and

( (crossdwnbn_2 - crossupbn_2) <= bars_back and (crossdwnbn_2 - crossupbn_2) > 0 )

and

crossdwnbn_2 == bn

and

Sum(Down2_2[1], (bars_back - 1)) == 0

then 1 else 0;

def up2_3 = if

bn > bars_back

and

( (crossupbn_3 - crossdwnbn_3) <= bars_back and (crossupbn_3 - crossdwnbn_3) > 0 )

and

crossupbn_3 == bn

and

Sum(up2_3[1], (bars_back - 1)) == 0

then 1 else 0;

def Down2_3 = if

bn > bars_back

and

( (crossdwnbn_3 - crossupbn_3) <= bars_back and (crossdwnbn_3 - crossupbn_3) > 0 )

and

crossdwnbn_3 == bn

and

Sum(Down2_3[1], (bars_back - 1)) == 0

then 1 else 0;

def up2_4 = if

bn > bars_back

and

( (crossupbn_4 - crossdwnbn_4) <= bars_back and (crossupbn_4 - crossdwnbn_4) > 0 )

and

crossupbn_4 == bn

and

Sum(up2_4[1], (bars_back - 1)) == 0

then 1 else 0;

def Down2_4 = if

bn > bars_back

and

( (crossdwnbn_4 - crossupbn_4) <= bars_back and (crossdwnbn_4 - crossupbn_4) > 0 )

and

crossdwnbn_4 == bn

and

Sum(Down2_4[1], (bars_back - 1)) == 0

then 1 else 0;

########### ARROWS ###########

input arrow_size = 2;

plot zup_0 = up2_0;

zup_0.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

zup_0.SetDefaultColor(Color.Yellow);

zup_0.SetLineWeight(arrow_size);

plot zdwn_0 = Down2_0;

zdwn_0.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

zdwn_0.SetDefaultColor(Color.Yellow);

zdwn_0.SetLineWeight(arrow_size);

plot zup_1 = up2_1;

zup_1.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

zup_1.SetDefaultColor(Color.Red);

zup_1.SetLineWeight(arrow_size);

#Def Zdwn_A = Down2_1 and avg > avg2 within 1 bars;

#plot zdwn_1 = Zdwn_A;

plot zdwn_1 = Down2_1;

zdwn_1.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

zdwn_1.SetDefaultColor(Color.Orange);

zdwn_1.SetLineWeight(arrow_size);

plot zup_2 = up2_2;

zup_2.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

zup_2.SetDefaultColor(Color.Magenta);

zup_2.SetLineWeight(arrow_size);

plot zdwn_2 = Down2_2;

zdwn_2.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

zdwn_2.SetDefaultColor(Color.Blue);

zdwn_2.SetLineWeight(arrow_size);

plot zup_3 = up2_3;

zup_3.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

zup_3.SetDefaultColor(Color.Dark_Green);

zup_3.SetLineWeight(arrow_size);

plot zdwn_3 = Down2_3;

zdwn_3.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

zdwn_3.SetDefaultColor(Color.White);

zdwn_3.SetLineWeight(arrow_size);

plot zup_4 = up2_4;

zup_4.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

zup_4.SetDefaultColor(Color.cyan);

zup_4.SetLineWeight(arrow_size);

plot zdwn_4 = Down2_4;

zdwn_4.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

zdwn_4.SetDefaultColor(Color.White);

zdwn_4.SetLineWeight(arrow_size);

########### TEST VARIABLES ###########

input test_crossing_bubbles = no;

AddChartBubble(test_crossing_bubbles and crossdwnbn == bn, high, bn, Color.RED, no);

AddChartBubble(test_crossing_bubbles and crossupbn == bn, low, bn, Color.GREEN, yes);

AddCloud(if !HideCloud then BH1extline else Double.NaN, BL1extline, Color.RED, Color.GRAY);

AddCloud(if !HideCloud then BH2extline else Double.NaN, BL2extline, Color.GREEN, Color.GRAY);

script WMA_Smooth {

input price_WMA = hl2;

plot smooth = (4 * price_WMA

+ 3 * price_WMA[1]

+ 2 * price_WMA[2]

+ price_WMA[3]) / 10;

}

script Phase_Accumulation {

# This is Ehler's Phase Accumulation code. It has a full cycle delay.

# However, it computes the correction factor to a very high degree.

input price_WMA = hl2;

rec Smooth;

rec Detrender;

rec Period;

rec Q1;

rec I1;

rec I1p;

rec Q1p;

rec Phase1;

rec Phase;

rec DeltaPhase;

rec DeltaPhase1;

rec InstPeriod1;

rec InstPeriod;

def CorrectionFactor;

if BarNumber() <= 5

then {

Period = 0;

Smooth = 0;

Detrender = 0;

CorrectionFactor = 0;

Q1 = 0;

I1 = 0;

Q1p = 0;

I1p = 0;

Phase = 0;

Phase1 = 0;

DeltaPhase1 = 0;

DeltaPhase = 0;

InstPeriod = 0;

InstPeriod1 = 0;

} else {

CorrectionFactor = 0.075 * Period[1] + 0.54;

# Smooth and detrend my smoothed signal:

Smooth = WMA_Smooth(price_WMA);

Detrender = ( 0.0962 * Smooth

+ 0.5769 * Smooth[2]

- 0.5769 * Smooth[4]

- 0.0962 * Smooth[6] ) * CorrectionFactor;

# Compute Quadrature and Phase of Detrended signal:

Q1p = ( 0.0962 * Detrender

+ 0.5769 * Detrender[2]

- 0.5769 * Detrender[4]

- 0.0962 * Detrender[6] ) * CorrectionFactor;

I1p = Detrender[3];

# Smooth out Quadrature and Phase:

I1 = 0.15 * I1p + 0.85 * I1p[1];

Q1 = 0.15 * Q1p + 0.85 * Q1p[1];

# Determine Phase

if I1 != 0

then {

# Normally, ATAN gives results from -pi/2 to pi/2.

# We need to map this to circular coordinates 0 to 2pi

if Q1 >= 0 and I1 > 0

then { # Quarant 1

Phase1 = ATan(AbsValue(Q1 / I1));

} else if Q1 >= 0 and I1 < 0

then { # Quadrant 2

Phase1 = Double.Pi - ATan(AbsValue(Q1 / I1));

} else if Q1 < 0 and I1 < 0

then { # Quadrant 3

Phase1 = Double.Pi + ATan(AbsValue(Q1 / I1));

} else { # Quadrant 4

Phase1 = 2 * Double.Pi - ATan(AbsValue(Q1 / I1));

}

} else if Q1 > 0

then { # I1 == 0, Q1 is positive

Phase1 = Double.Pi / 2;

} else if Q1 < 0

then { # I1 == 0, Q1 is negative

Phase1 = 3 * Double.Pi / 2;

} else { # I1 and Q1 == 0

Phase1 = 0;

}

# Convert phase to degrees

Phase = Phase1 * 180 / Double.Pi;

if Phase[1] < 90 and Phase > 270

then {

# This occurs when there is a big jump from 360-0

DeltaPhase1 = 360 + Phase[1] - Phase;

} else {

DeltaPhase1 = Phase[1] - Phase;

}

# Limit our delta phases between 7 and 60

if DeltaPhase1 < 7

then {

DeltaPhase = 7;

} else if DeltaPhase1 > 60

then {

DeltaPhase = 60;

} else {

DeltaPhase = DeltaPhase1;

}

# Determine Instantaneous period:

InstPeriod1 =

-1 * (fold i = 0 to 40 with v=0 do

if v < 0 then

v

else if v > 360 then

-i

else

v + GetValue(DeltaPhase, i, 41));

if InstPeriod1 <= 0

then {

InstPeriod = InstPeriod[1];

} else {

InstPeriod = InstPeriod1;

}

Period = 0.25 * InstPeriod + 0.75 * Period[1];

}

plot DC = Period;

}

script Ehler_MAMA {

input price_WMA = hl2;

input FastLimit = 0.5;

input SlowLimit = 0.05;

rec Period;

rec Period_raw;

rec Period_cap;

rec Period_lim;

rec Smooth;

rec Detrender;

rec I1;

rec Q1;

rec jI;

rec jQ;

rec I2;

rec Q2;

rec I2_raw;

rec Q2_raw;

rec Phase;

rec DeltaPhase;

rec DeltaPhase_raw;

rec alpha;

rec alpha_raw;

rec Re;

rec Im;

rec Re_raw;

rec Im_raw;

rec SmoothPeriod;

rec vmama;

rec vfama;

def CorrectionFactor = Phase_Accumulation(price_WMA).CorrectionFactor;

if BarNumber() <= 5

then {

Smooth = 0;

Detrender = 0;

Period = 0;

Period_raw = 0;

Period_cap = 0;

Period_lim = 0;

I1 = 0;

Q1 = 0;

I2 = 0;

Q2 = 0;

jI = 0;

jQ = 0;

I2_raw = 0;

Q2_raw = 0;

Re = 0;

Im = 0;

Re_raw = 0;

Im_raw = 0;

SmoothPeriod = 0;

Phase = 0;

DeltaPhase = 0;

DeltaPhase_raw = 0;

alpha = 0;

alpha_raw = 0;

vmama = 0;

vfama = 0;

} else {

# Smooth and detrend my smoothed signal:

Smooth = WMA_Smooth(price_WMA);

Detrender = ( 0.0962 * Smooth

+ 0.5769 * Smooth[2]

- 0.5769 * Smooth[4]

- 0.0962 * Smooth[6] ) * CorrectionFactor;

Q1 = ( 0.0962 * Detrender

+ 0.5769 * Detrender[2]

- 0.5769 * Detrender[4]

- 0.0962 * Detrender[6] ) * CorrectionFactor;

I1 = Detrender[3];

jI = ( 0.0962 * I1

+ 0.5769 * I1[2]

- 0.5769 * I1[4]

- 0.0962 * I1[6] ) * CorrectionFactor;

jQ = ( 0.0962 * Q1

+ 0.5769 * Q1[2]

- 0.5769 * Q1[4]

- 0.0962 * Q1[6] ) * CorrectionFactor;

# This is the complex conjugate

I2_raw = I1 - jQ;

Q2_raw = Q1 + jI;

I2 = 0.2 * I2_raw + 0.8 * I2_raw[1];

Q2 = 0.2 * Q2_raw + 0.8 * Q2_raw[1];

Re_raw = I2 * I2[1] + Q2 * Q2[1];

Im_raw = I2 * Q2[1] - Q2 * I2[1];

Re = 0.2 * Re_raw + 0.8 * Re_raw[1];

Im = 0.2 * Im_raw + 0.8 * Im_raw[1];

# Compute the phase

if Re != 0 and Im != 0

then {

Period_raw = 2 * Double.Pi / ATan(Im / Re);

} else {

Period_raw = 0;

}

if Period_raw > 1.5 * Period_raw[1]

then {

Period_cap = 1.5 * Period_raw[1];

} else if Period_raw < 0.67 * Period_raw[1] {

Period_cap = 0.67 * Period_raw[1];

} else {

Period_cap = Period_raw;

}

if Period_cap < 6

then {

Period_lim = 6;

} else if Period_cap > 50

then {

Period_lim = 50;

} else {

Period_lim = Period_cap;

}

Period = 0.2 * Period_lim + 0.8 * Period_lim[1];

SmoothPeriod = 0.33 * Period + 0.67 * SmoothPeriod[1];

if I1 != 0

then {

Phase = ATan(Q1 / I1);

} else if Q1 > 0

then { # Quadrant 1:

Phase = Double.Pi / 2;

} else if Q1 < 0

then { # Quadrant 4:

Phase = -Double.Pi / 2;

} else { # Both numerator and denominator are 0.

Phase = 0;

}

DeltaPhase_raw = Phase[1] - Phase;

if DeltaPhase_raw < 1

then {

DeltaPhase = 1;

} else {

DeltaPhase = DeltaPhase_raw;

}

alpha_raw = FastLimit / DeltaPhase;

if alpha_raw < SlowLimit

then {

alpha = SlowLimit;

} else {

alpha = alpha_raw;

}

vmama = alpha * price_WMA + (1 - alpha) * vmama[1];

vfama = 0.5 * alpha * vmama + (1 - 0.5 * alpha) * vfama[1];

}

plot MAMA = vmama;

plot FAMA = vfama;

}

input price2 = hl2;

input FastLimit = 0.5;

input SlowLimit = 0.05;

def MAMA = Ehler_MAMA(price2, FastLimit, SlowLimit).MAMA;

def FAMA = Ehler_MAMA(price2, FastLimit, SlowLimit).FAMA;

def Crossing = Crosses((MAMA < FAMA), yes);

#Crossing.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

def Crossing1 = Crosses((MAMA > FAMA), yes);

#Crossing1.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

# --- C3 MAX --- LABELS ---

AddLabel(yes, Concat("MAMA: ", Concat("",

if MAMA > FAMA then "Bull" else "Bear")),

if MAMA > FAMA then Color.GREEN else Color.RED);

# --- C3 MAX --- C3 MF LINE ---

#plot C3_MF_Line = (MAMA + FAMA) / 2;

#C3_MF_Line.SetPaintingStrategy(PaintingStrategy.LINE);

#C3_MF_Line.SetLineWeight(3);

#C3_MF_Line.AssignValueColor(if Color_Candles and ((priceColor2 == 1) and (price1 > Upper_BandS) and (condition_BandRevDn)) then Color.YELLOW else if Color_Candles and ((priceColor2 == -1) and (price1 < Lower_BandS) and (condition_BandRevUp)) then Color.YELLOW else if Color_Candles and priceColor2 == -1 then Color.RED else if Color_Candles and (priceColor2 == 1) then Color.GREEN else Color.CURRENT);

#def C3_MF_UP = C3_MF_Line > C3_MF_Line[1];

#def C3_MF_DN = C3_MF_Line < C3_MF_Line[1];

#def priceColor9 = if C3_MF_UP then 1

# else if C3_MF_DN then -1

# else priceColor9[1];

def MF_UP = FAMA < MAMA;

def MF_DN = FAMA > MAMA;

def priceColor10 = if MF_UP then 1

else if MF_DN then -1

else priceColor10[1];

input extension_length_limited_to = 10;

def lastbar = if IsNaN(close[-1]) and !IsNaN(close) then BarNumber() else Double.NaN;

#def inertline = InertiaAll(C3_MF_Line, 2);

#def EXT_C3_MF = if !IsNaN(close()) then inertline else EXT_C3_MF[1] + ((EXT_C3_MF[1] - EXT_C3_MF[2]) / (2 - 1));

#plot extension = if BarNumber() <= HighestAll(lastbar) + extension_length_limited_to then EXT_C3_MF else Double.NaN;

#extension.SetDefaultColor(Color.WHITE);

####################################################################################################################################################

#EMA_Candles

#Created by Christopher84 11/30/2021

input showBreakoutSignals = no;

input length8 = 10;

input length9 = 35;

input show_ema_cloud = yes;

plot AvgExp8 = ExpAverage(Price[-displace], length8);

def UPD = AvgExp8[1] < AvgExp8;

AvgExp8.SetStyle(Curve.SHORT_DASH);

plot AvgExp9 = ExpAverage(Price[-displace], length9);

def UPW = AvgExp9[1] < AvgExp9;

AvgExp9.SetStyle(Curve.SHORT_DASH);

def Below = AvgExp8 < AvgExp9;

def Spark = UPD + UPW + Below;

def UPEMA = AvgExp8[1] < AvgExp8;

def DOWNEMA = AvgExp8[1] > AvgExp8;

AvgExp8.AssignValueColor(if UPEMA then Color.LIGHT_GREEN else if DOWNEMA then Color.RED else Color.YELLOW);

def UPEMA2 = AvgExp9[1] < AvgExp9;

def DOWNEMA2 = AvgExp9[1] > AvgExp9;

AvgExp9.AssignValueColor(if UPEMA2 then Color.LIGHT_GREEN else if DOWNEMA2 then Color.RED else Color.YELLOW);

AddCloud(if show_ema_cloud and (AvgExp9 > AvgExp8) then AvgExp9 else Double.NaN, AvgExp8, Color.LIGHT_RED, Color.CURRENT);

AddCloud(if show_ema_cloud and (AvgExp8 > AvgExp9) then AvgExp8 else Double.NaN, AvgExp9, Color.LIGHT_GREEN, Color.CURRENT);

def UP8 = UPEMA and UPEMA2;

def DOWN8 = DOWNEMA and DOWNEMA2;

def priceColor8 = if UP8 then 1

else if DOWN8 then -1

else 0;

def UP11 = UPEMA;

def DOWN11 = DOWNEMA;

def priceColor11 = if UP11 then 1

else if DOWN11 then -1

else 0;

def UP12 = UPEMA2;

def DOWN12 = DOWNEMA2;

def priceColor12 = if UP12 then 1

else if DOWN12 then -1

else 0;

def UpCalc = (priceColor == 1) + (priceColor2 == 1) + (priceColor8 == 1) + (priceColor10 == 1);

def StrongUpCalc = (priceColor == 1) + (priceColor2 == 1) + (priceColor10 == 1) + (priceColor12 == 1);# + (priceColor12 == 1);

def CandleColor = if (priceColor2 == 1) and (Spark >= 2) then 1

else if (priceColor2 == -1) and (Spark < 2) then -1

#else if ((PriceColor8[2] == 1) and (PriceColor8 == 1)) then 1

#else if ((PriceColor8[2] == -1) and (PriceColor8 == -1))then -1

#else if (priceColor2 == 1) then 1

#else if (priceColor2 == -1) then -1

else 0;

#AssignPriceColor(if Color_Candles and (CandleColor == 1) then Color.GREEN else if Color_Candles and (CandleColor == -1) then Color.RED else Color.GRAY);

plot SparkUP = (Spark == 3) and (CandleColor == 1);

SparkUP.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

SparkUP.AssignValueColor(Color.LIGHT_GREEN);

plot SparkDN = (Spark == 0) and (CandleColor == -1);

SparkDN.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

SparkDN.AssignValueColor(Color.RED);

#--- CONFIRMATION LEVELS --- PLOT ---

plot NearTResistance = Highest(Price, BulgeLengthPrice2);

NearTResistance.AssignValueColor(if (conditionK2) then Color.GREEN else if (conditionK3) then Color.RED else Color.GRAY);

NearTResistance.SetStyle(Curve.SHORT_DASH);

plot NearTSupport = Lowest(Price, SqueezeLengthPrice2);

NearTSupport.AssignValueColor(if (conditionK2) then Color.GREEN else if (conditionK3) then Color.RED else Color.GRAY);

NearTSupport.SetStyle(Curve.SHORT_DASH);

#--- CONFIRMATION LEVELS --- DEF ---

def Buy = UP_OS;

def Sell = DOWN_OB;

def conditionLTB = (conditionK2UP and (Consensus_Level < 0));

def conditionLTS = (conditionK3DN and (Consensus_Level > 0));

def conditionBO = ((Upper_BandS[1] < Upper_BandS) and (Lower_BandS[1] < Lower_BandS)) and ((Upper_BandK[1] < Upper_BandK) and (Lower_BandK[1] < Lower_BandK));

def conditionBD = ((Upper_BandS[1] > Upper_BandS) and (Lower_BandS[1] > Lower_BandS) and (Upper_BandK[1] > Upper_BandK) and (Lower_BandK[1] > Lower_BandK));

def MomentumUP = Consensus_Level[1] < Consensus_Level;

def MomentumDOWN = Consensus_Level[1] > Consensus_Level;

def Squeeze_Signal = !IsNaN(Squeeze_Alert);

def conditionOB = (Consensus_Level >= 12) and (Consensus_Line >= 4);

def conditionOS = (Consensus_Level <= -12) and (Consensus_Line <= -3);

AddLabel(yes, if conditionLTB then "BULLISH LTB" else if conditionLTS then "BEARISH LTS" else if conditionK2UP then "TREND_BULLISH" else if conditionK3DN then "TREND_BEARISH" else "TREND_CONSOLIDATION", if conditionLTB then Color.GREEN else if conditionLTS then Color.RED else if conditionK2UP then Color.WHITE else if conditionK3DN then Color.DARK_GRAY else Color.GRAY);

AddLabel(yes, if conditionBD then "BREAKDOWN" else if conditionBO then "BREAKOUT" else "NO_BREAK", if conditionBD then Color.RED else if conditionBO then Color.GREEN else Color.GRAY);

AddLabel(yes, if (Spark == 3) then "SPARK UP = " + Round(Spark, 1) else if (Spark == 0) then "SPARK DOWN = " + Round(Spark, 1) else "SPARK = " + Round(Spark, 1), if (Spark == 3) then Color.YELLOW else if (Spark == 2) then Color.GREEN else if (Spark == 0) then Color.RED else Color.GRAY);

AddLabel(yes, "SQUEEZE ALERT", if Squeeze_Signal then Color.YELLOW else Color.GRAY);

AddLabel(yes, if MomentumUP then "Consensus_Increasing = " + Round(Consensus_Level, 1) else if MomentumUP or MomentumDOWN and conditionOB then "Consensus_OVERBOUGHT = " + Round(Consensus_Level, 1) else if MomentumDOWN then "Consensus_Decreasing = " + Round(Consensus_Level, 1) else if MomentumUP or MomentumDOWN and conditionOS then "Consensus_OVERSOLD = " + Round(Consensus_Level, 1) else "Consensus = " + Round(Consensus_Level, 1), if conditionOB then Color.RED else if conditionOS then Color.GREEN else Color.GRAY);

# --- VERTICLE LINE DAILY ---

AddVerticalLine(( GetDay() <> GetDay()[1]), "", Color.DARK_GRAY, Curve.SHORT_DASH);

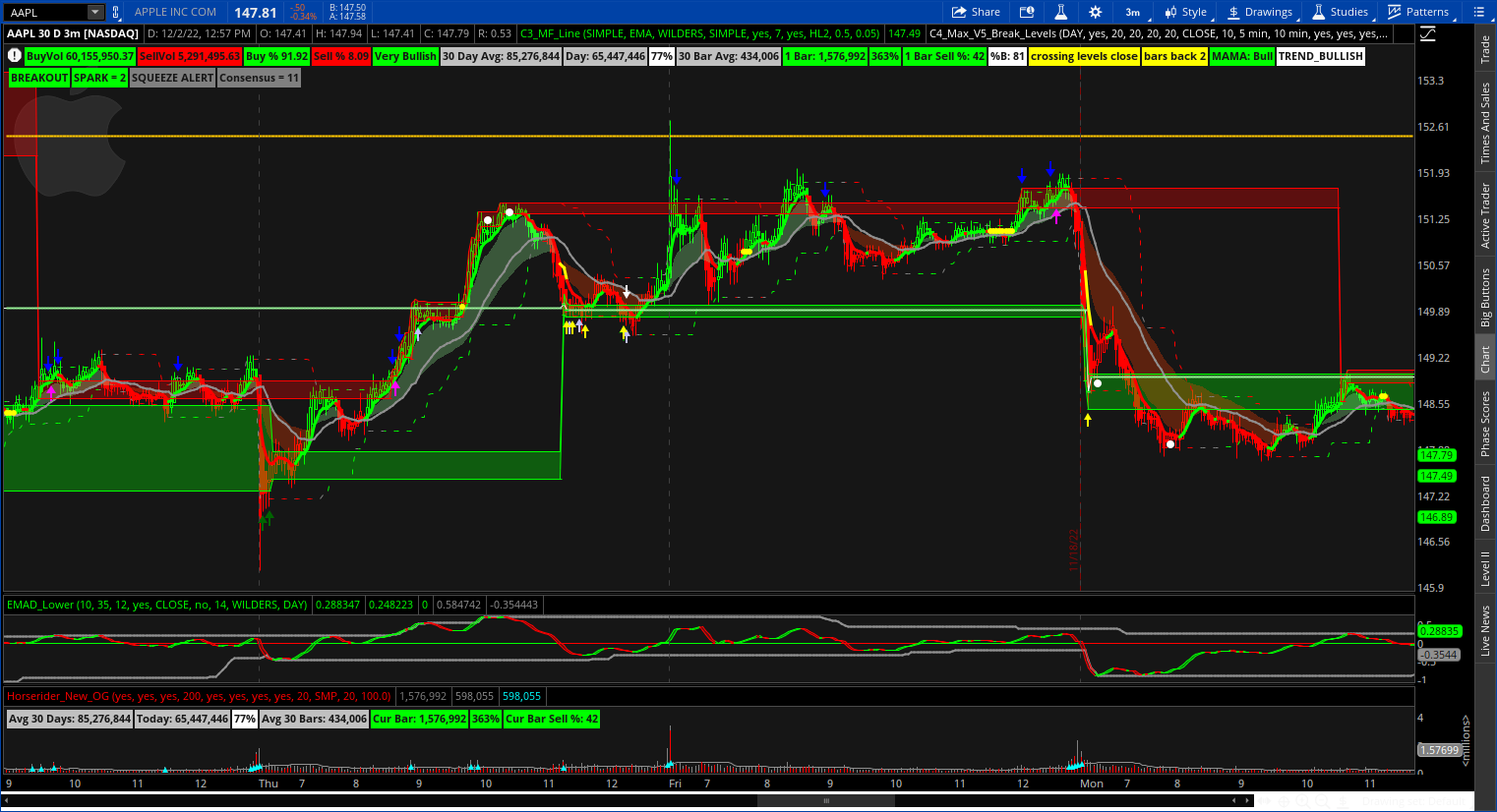

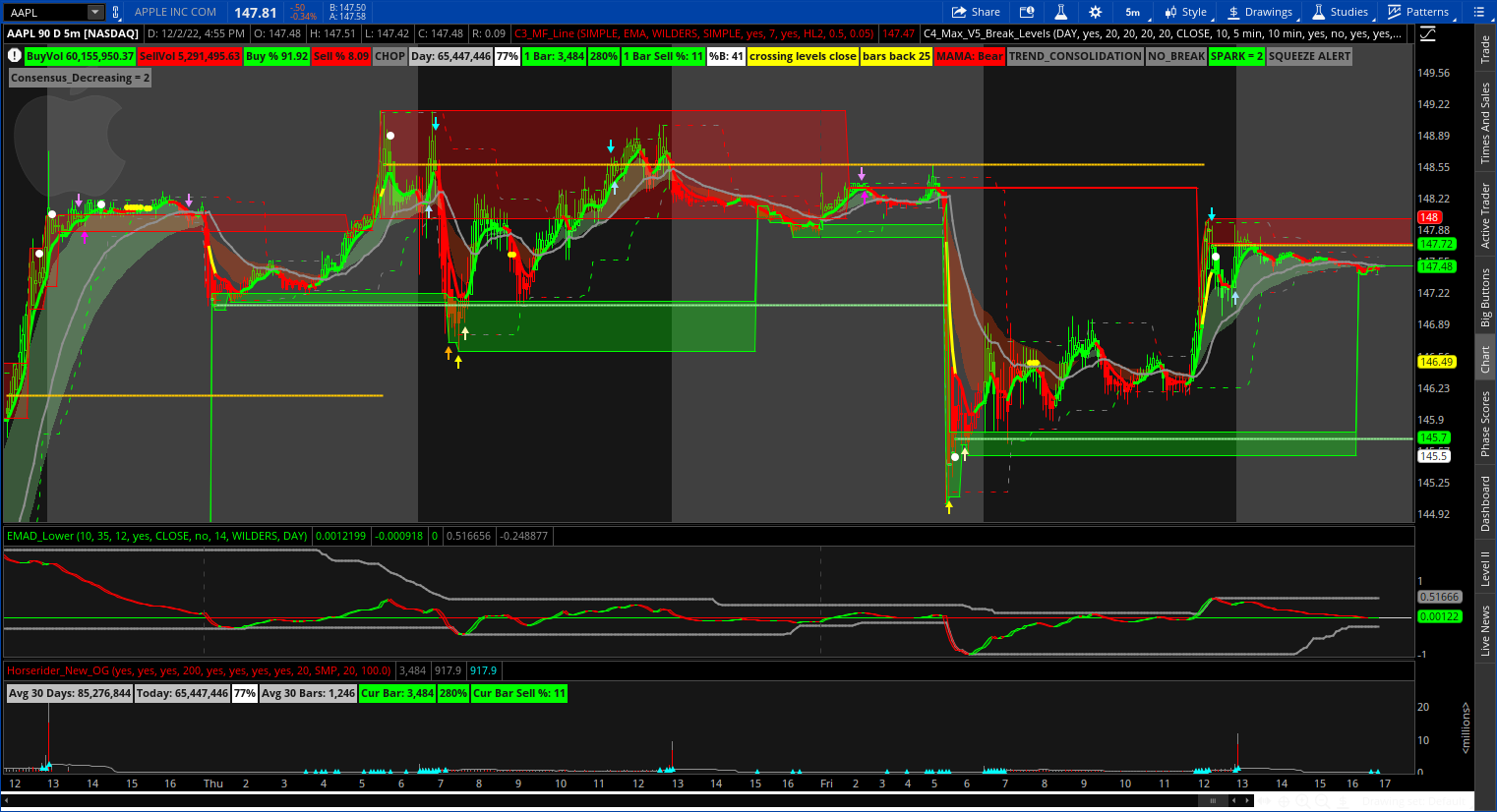

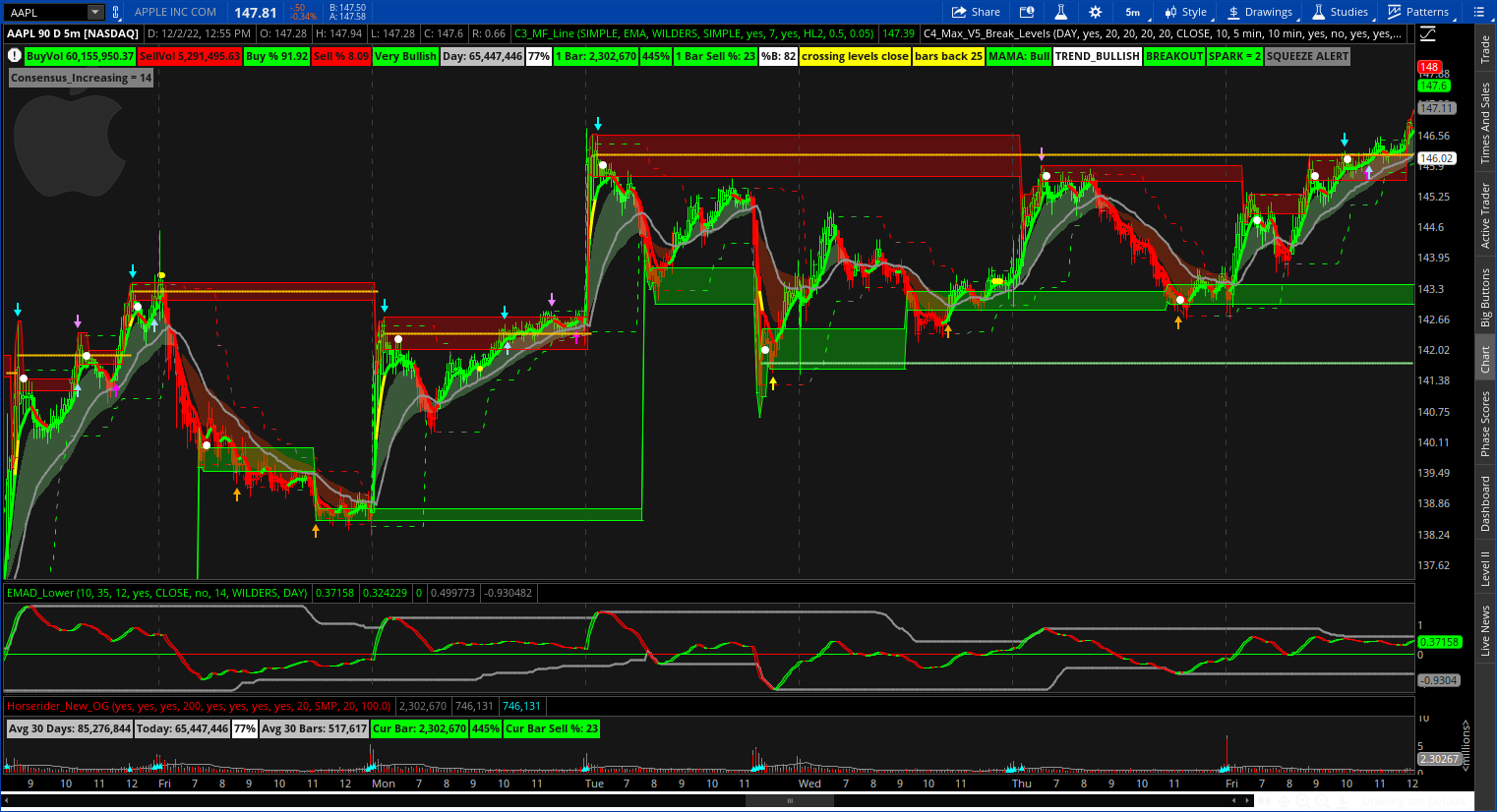

#--- END ---Thank you @HODL-Lay-HE-hoo! so many great scripts on this thread. the combination link you shared for me only gives me clouds, still pretty cool seeing it shows resistance / Supply and support / demand, it doesnt give me green and yellow lines for actual breakout levels as mentioned in your post, also not overly important, but im also not getting labels, I looked through the script and im not finding any errors so im not sure whats wrong on my end, you can see picture of what im getting from link to the picture@Break Trader

Ok so here is the rough draft basically it uses the Yellow line and light green line and the Top Supply and bottom Demand zone lines. Whichever line is used to plot an arrow if the wick, body, close of a candle crosses the line and the opposite happened within X bars back (need to figure out the study I took that code from)

Currently trying to figure out if it’s possible to stop the arrows from plotting while the price is wrapping up or down… hmmm?

Not sure it will end up being useful but worth a shot

It plots arrows galore its just a rough draft so just test it if you want.

Code for break levels its around line 800 or so

http://tos.mx/CPpMWMw