stockscouter87

Member

How did you seperate the time while back testing from RTH to W/ Extended hoursAny recommendations for a Daily Chart?

How did you seperate the time while back testing from RTH to W/ Extended hoursAny recommendations for a Daily Chart?

On Mobile, you have to go to studies, then click the gear icon next to the indicator name. Scroll down to MA_Min and MA_Max and click on them. Change the line of "Draw as" into a square or triangle. That's it.Thanks for getting back to me. Would you mind being a little more specific at to what to change? I'm new with scripting.

If you keep your chart as RTH or Extended, it should trade that way.@chewie76 there a way to only allow the strategy to trade during RTH or is there a way to make it to where it only trades in after hours?? I want to do some back testing with only certain hours. TIA

#Hull_SuperTrend_Trading_System

# assembled by Chewie 4/10/2022

# many thanks to all the other noted contributors to this system.

# SuperTrend Yahoo Finance Replica - Modified from Modius SuperTrend

# Modified Modius ver. by RConner7

# Modified by Barbaros to replicate look from TradingView version

# Modified by Barbaros to add EMA cross for bubbles and alerts

# Modified by Barbaros to update bar color painting

# v3.3

# Modified by Zetta_wow:

# - Add Donchian Trend Channel code to provide summary value of DTC and include in target lines

# - Added constraints to drawing target lines based on HMA, Supertrend and DTC

# - Added ability to remove drawing the Dyno lines and cloud (label and price bar coloring remain)

# - Commented out some code that didn't appear to be doing anything (leaving in for Chewie to evaluate need)

# - Made entry and target lines all start/end at the same place

# - Some general cleanup and rearranging (no effect to output)

# From the useThinkScript thread introducing Chewie's strategy:

#2. SETUP: You must see three things to define an entry position.

# 1. A top or bottom reversal signal of the Hull Moving Avg plotted with a white square (top) or white triangle (bottom).

# 2. Lower Donchian Trend Ribbon either green or red in the color of the direction you are entering the trade. (Shout out to @halcyonguy who converted this into TOS. Much appreciated, you are awesome!!!)

# 3. Break of the Super Trend indicator. (Default setting is 2.75. Feel free to adjust this if you want in the settings)

#

# HMA signal indicated by Hull_is_buy and Hull_is_sell variables

# Donchian Trend Ribbon signal indicated by DTC_is_buy and DTC_is_sell

# Supertrend signal indicated by Long and Short variables (plots)

# Don't draw entry/1x/2x/3x/4x lines unless all three match signals (buy/long or sell/short)

input Target_Bubbles = no;

input Entry_SL_Bubbles = no;

input Targetlines = yes;

input Labels = yes;

input alertON = yes;

input Bands = yes;

input AvgType = AverageType.HULL;

input STAtrMult = 2.75;

input nATR = 12;

#======== Calculate the Supertrend =====================================================

def ATR = ATR("length" = nATR, "average type" = AvgType);

def UP_Band_Basic = HL2 + (STAtrMult * ATR);

def LW_Band_Basic = HL2 + (-STAtrMult * ATR);

def UP_Band = if ((UP_Band_Basic < UP_Band[1]) or (close[1] > UP_Band[1])) then UP_Band_Basic else UP_Band[1];

def LW_Band = if ((LW_Band_Basic > LW_Band[1]) or (close[1] < LW_Band[1])) then LW_Band_Basic else LW_Band[1];

def ST = if ((ST[1] == UP_Band[1]) and (close < UP_Band)) then UP_Band

else if ((ST[1] == UP_Band[1]) and (close > Up_Band)) then LW_Band

else if ((ST[1] == LW_Band[1]) and (close > LW_Band)) then LW_Band

else if ((ST[1] == LW_Band) and (close < LW_Band)) then UP_Band

else LW_Band;

plot Long = if close > ST then ST else Double.NaN;

Long.AssignValueColor(Color.cyan);

Long.SetLineWeight(3);

plot Short = if close < ST then ST else Double.NaN;

Short.AssignValueColor(Color.magenta);

Short.SetLineWeight(3);

def LongTrigger = isNaN(Long[1]) and !isNaN(Long);

def ShortTrigger = isNaN(Short[1]) and !isNaN(Short);

plot LongDot = if LongTrigger then ST else Double.NaN;

LongDot.SetPaintingStrategy(PaintingStrategy.POINTS);

LongDot.AssignValueColor(Color.cyan);

LongDot.SetLineWeight(4);

plot ShortDot = if ShortTrigger then ST else Double.NaN;

ShortDot.SetPaintingStrategy(PaintingStrategy.POINTS);

ShortDot.AssignValueColor(Color.magenta);

ShortDot.SetLineWeight(4);

AddChartBubble(Entry_SL_Bubbles and LongTrigger, ST, "BUY", Color.GREEN, no);

AddChartBubble(Entry_SL_Bubbles and ShortTrigger, ST, "SELL", Color.RED, yes);

#Super Trend Labels

AddLabel(yes and labels and Long, "ST:LONG", color.CYAN);

AddLabel(yes and labels and Short, "ST:SHORT", color.magenta);

#======== End of Supertrend calcs =====================================================

# =====================================================================================

# Hull Moving Average Concavity and Turning Points

#

# Author: Seth Urion (Mahsume)

# Version: 2020-05-01 V4

#

# Now with support for ToS Mobile

#

declare upper;

input HMA_Length = 60;

input lookback = 3;

input arrows = no;

def price = HL2;

plot HMA = HullMovingAvg(price = price, length = HMA_Length);

def delta = HMA[1] - HMA[lookback + 1];

def delta_per_bar = delta / lookback;

def next_bar = HMA[1] + delta_per_bar;

def concavity = if HMA > next_bar then 1 else -1;

HMA.AssignValueColor(color = if concavity[1] == -1 then

if HMA > HMA[1] then color.dark_orange else color.red else

if HMA < HMA[1] then color.dark_green else color.green);

HMA.SetLineWeight(3);

#Define turning point where concavity switches directiion

plot turning_point = if concavity[1] != concavity then HMA else double.nan;

turning_point.SetLineWeight(2);

turning_point.SetPaintingStrategy(paintingStrategy = PaintingStrategy.POINTS);

turning_point.SetDefaultColor(color.white);

#Plot maximum/minimum points of HMA

# Note: the HMA[-1] term will cause repainting at the end of the chart (looks forward 1 bar)

plot MA_Max = if HMA[-1] < HMA and HMA > HMA[1] then HMA else Double.NaN;

MA_Max.SetDefaultColor(Color.WHITE);

MA_Max.SetPaintingStrategy(PaintingStrategy.SQUARES);

MA_Max.SetLineWeight(5);

plot MA_Min = if HMA[-1] > HMA and HMA < HMA[1] then HMA else Double.Nan;

MA_Min.SetDefaultColor(Color.WHITE);

MA_Min.SetPaintingStrategy(PaintingStrategy.TRIANGLES);

MA_Min.SetLineWeight(5);

#Define conditions for HMA-based alerts (see end of code)

def BuySetup = HMA > HMA[1] and HMA[1] < HMA[2];

def SellSetup = HMA < HMA[1] and HMA[1] > HMA[2];

#Plot buy/sell arrows based on HMA

# Up arrow if at a turning point and concavity is "up"

# Down arrow if at a turning point and concavity is "down"

plot sell = if arrows and turning_point and concavity == -1 then high else double.nan;

sell.SetDefaultColor(Color.DARK_ORANGE);

sell.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

sell.SetLineWeight(3);

plot buy = if arrows and turning_point and concavity == 1 then low else double.nan;

buy.SetDefaultColor(Color.CYAN);

buy.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

buy.SetLineWeight(3);

###################

#

# 2020-05-01

#

# MOBILE TOS SUPPORT

#

# Each color of the HMA needs to be a separate plot as ToS Mobile

# lacks the ability to assign colors the way ToS Desktop does.

# I recommend a plain colored HMA behind the line

# Set the line color of the HMA above to gray or some neutral

#

# CCD_D -> ConCave Down and Decreasing

# CCD_I -> ConCave Down and Increasing

# CCU_D -> ConCave Up and Decreasing

# CCU_I -> ConCave Up and Increasing

#

###################

plot CCD_D = if concavity == -1 and HMA < HMA[1] then HMA else double.nan;

CCD_D.SetDefaultColor(Color.RED);

CCD_D.SetLineWeight(1);

plot CCD_I = if concavity == -1 and HMA >= HMA[1] then HMA else double.nan;

CCD_I.SetDefaultColor(Color.DARK_ORANGE);

CCD_I.SetLineWeight(1);

plot CCU_D = if concavity == 1 and HMA <= HMA[1] then HMA else double.nan;

CCU_D.SetDefaultColor(COLOR.DARK_GREEN);

CCU_D.SetLineWeight(1);

plot CCU_I = if concavity == 1 and HMA > HMA[1] then HMA else double.nan;

CCU_I.SetDefaultColor(COLOR.GREEN);

CCU_I.SetLineWeight(1);

#======= End of mobile HMA coloring support =============================

#Hull Label

AddLabel(yes and labels and CCD_D, "HULL:SELL", color.RED);

AddLabel(yes and labels and CCU_I, "HULL:BUY", color.green);

AddLabel(yes and labels and CCU_D, "HULL:WEAK SELL", color.dark_green);

AddLabel(yes and labels and CCD_I, "HULL:WEAK BUY", color.DARK_ORANGE);

def Hull_is_buy = !IsNaN(CCD_I) or !IsNaN(CCU_I);

def Hull_is_sell = !IsNaN(CCD_D) or !IsNaN(CCU_D);

#======= End of Hull Moving Avg Calcs =================================

#============ Create Donchian Trend Ribbon values =======================================

# Donchian Trend Channel parameters

input Donchian_Channel_Period = 20; #length to calculate main trend

input DTC_Trend_Cutoff = 20; #value of sum of all trends to exceed to use for buy/sell signal

input plotDTCResult = yes;

input secondary_colors = { default yellow , green_red };

#=======================================================================

# Donchian Trend Channel calcs

# all plots have been removed leaving only the value calculations

# How it works ?

# - it calculates main trend direction by using the length that is user-defined. so you can change it as you wish

# - then it calculates trend direction for each 9 lower lengths. if you set the length = 20 then the lengths are 19, 18,...11

# - and it checks if the trend directions that came from lower lengths is same or not with main trend direction.

# - it changes the trend color of the ribbon.

# -----------------------------

def dlen = if Donchian_Channel_Period < 10 then 10 else Donchian_Channel_Period;

def na = Double.NaN;

script dchannel {

input len = 0;

def hh = Highest(high, len);

def ll = Lowest(low, len);

def trend = if BarNumber() == 1 then 0 else if close > hh[1] then 1 else if close < ll[1] then -1 else trend[1];

plot z = trend;

}

script dchannelalt {

input len = 0;

input maintrend = 0;

def hh = Highest(high, len);

def ll = Lowest(low, len);

def trend = if BarNumber() == 1 then 0 else if close > hh[1] then 1 else if close < ll[1] then -1 else trend[1];

def maincolor =

if maintrend == 1 then if trend == 1 then 2 else 1

else if maintrend == -1 then if trend == -1 then -2 else -1

else 0;

plot color = maincolor;

}

def maintrend = dchannel(dlen);

# ---------------------------------

def c01 = dchannelalt(dlen - 0, maintrend);

def c02 = dchannelalt(dlen - 1, maintrend);

def c03 = dchannelalt(dlen - 2, maintrend);

def c04 = dchannelalt(dlen - 3, maintrend);

def c05 = dchannelalt(dlen - 4, maintrend);

def c06 = dchannelalt(dlen - 5, maintrend);

def c07 = dchannelalt(dlen - 6, maintrend);

def c08 = dchannelalt(dlen - 7, maintrend);

def c09 = dchannelalt(dlen - 8, maintrend);

def c10 = dchannelalt(dlen - 9, maintrend);

# -----------------------------

# add up color numbers, to come up with a 'trend' number , 20 to -20

def colorsum = ( c01 + c02 + c03 + c04 + c05 + c06 + c07 + c08 + c09 + c10 );

# colors

# 2 - up trend - green

# 1 - up trend - dark green

# 0 no trend

# -1 - down trend - dark red

# -2 - down trend - red

def DTC_Result = if colorsum >= DTC_Trend_Cutoff then 1

else if colorsum <= -DTC_Trend_Cutoff then -1

else 0;

def seccolor;

switch (secondary_colors) {

case yellow:

seccolor = 1;

case green_red:

seccolor = 2;

}

# colors

# 2 - up trend - green

# 1 - up trend - dark green

# 0 no trend

# -1 - down trend - dark red

# -2 - down trend - red

plot DTC_Trend = if (plotDTCResult) then (0.995 * low) else na;

DTC_Trend.SetPaintingStrategy(PaintingStrategy.LINE);

DTC_Trend.SetLineWeight(3);

DTC_Trend.DefineColor("up2", Color.GREEN);

DTC_Trend.DefineColor("up1", Color.DARK_GREEN);

DTC_Trend.DefineColor("none", Color.DARK_GRAY);

DTC_Trend.DefineColor("dwn1", Color.DARK_RED);

DTC_Trend.DefineColor("dwn2", Color.RED);

DTC_Trend.DefineColor("alt1", Color.YELLOW);

DTC_Trend.AssignValueColor( if colorsum >= DTC_Trend_Cutoff then DTC_Trend.Color("up2")

else if (colorsum > 0 and colorsum < DTC_Trend_Cutoff) and seccolor == 1 then DTC_Trend.Color("alt1") else if (colorsum > 0 and colorsum < DTC_Trend_Cutoff) and seccolor == 2 then DTC_Trend.Color("up1")

else if colorsum <= -DTC_Trend_Cutoff then DTC_Trend.Color("dwn2")

else if (colorsum < 0 and colorsum > -DTC_Trend_Cutoff) and seccolor == 1 then DTC_Trend.Color("alt1") else if (colorsum < 0 and colorsum > -DTC_Trend_Cutoff) and seccolor == 2 then DTC_Trend.Color("dwn1")

else Color.GRAY);

DTC_Trend.SetHiding(!plotDTCResult);

def DTC_is_buy = if colorsum >= DTC_Trend_Cutoff then yes else no;

def DTC_is_sell = if colorsum <= -DTC_Trend_Cutoff then yes else no;

# === End of Donchian Trend Channel code ===

#Target lines

# created by chewie

#=========== Determine long stoploss, entry point, and target lines =====================

#Stop Loss = minimum point of Hull MA

def line = if IsNaN(MA_Min) then line[1] else MA_Min[0];

plot L_stoploss = if IsNaN(MA_Min) and Hull_is_buy and Long and DTC_is_buy then line else double.nan;

L_stoploss.setpaintingStrategy(paintingStrategy.LINE);

L_stoploss.setlineWeight(3);

L_stoploss.setdefaultColor(color.dark_green);

L_stoploss.hideBubble();

def LSL = (if isNaN(L_stoploss[1]) then L_stoploss else Double.NaN);

#Long Entry = final value of previous Supertrend (short)

def line4 = if IsNaN(short) then line4[1] else short[0];

plot L_Entry = if IsNaN(short) and Hull_is_buy and DTC_is_buy then line4 else double.nan;

L_Entry.setpaintingStrategy(paintingStrategy.LINE);

L_Entry.setlineWeight(3);

L_Entry.setdefaultColor(color.green);

L_Entry.hideBubble();

def LE = (if isNaN(L_Entry[1]) then L_Entry else Double.NaN);

addchartBubble(Entry_SL_Bubbles and L_stoploss, LSL,"L/SL (" + AsDollars(L_stoploss) + " : " + AsPercent((L_stoploss - L_Entry)/L_Entry) + ")",color.DARK_GREEN);

addchartBubble(Entry_SL_Bubbles and L_Entry, LE,"L/E (" + AsDollars(L_Entry) + ")",color.GREEN);

#HalfX Long

plot x1a_Long = if Targetlines and L_Entry then (L_Entry + (L_Entry - L_Stoploss)/2) else double.nan;

x1a_Long.setpaintingStrategy(paintingStrategy.dashes);

x1a_Long.setlineWeight(1);

x1a_Long.setdefaultColor(color.magenta);

x1a_Long.hideBubble();

def x1aL = (if isNaN(x1a_Long[1]) then x1a_Long else Double.NaN);

addchartBubble(Target_Bubbles and x1a_Long, x1aL,"1/2xL (" + AsDollars(x1a_Long) + " : " + AsPercent((x1a_Long - L_Entry)/L_Entry) + ")",color.magenta);

#OneX Long

plot x1_Long = if Targetlines and x1a_Long > line4 then (L_Entry +(L_Entry - L_Stoploss)) else double.nan;

x1_Long.setpaintingStrategy(paintingStrategy.dashes);

x1_Long.setlineWeight(1);

x1_Long.setdefaultColor(color.yellow);

def X1L = (if isNaN(x1_Long[1]) then x1_Long else Double.NaN);

addchartBubble(Target_Bubbles and x1_Long, x1L,"1xL (" + AsDollars(x1_Long) + " : " + AsPercent((x1_Long - L_Entry)/L_Entry) + ")",color.yellow);

#TwoX Long

plot x2_Long = if Targetlines then x1_Long + (L_Entry - L_Stoploss) else double.nan;

x2_Long.setpaintingStrategy(paintingStrategy.dashes);

x2_Long.setlineWeight(2);

x2_Long.setdefaultColor(color.light_red);

def X2L = (if isNaN(x2_Long[1]) then x2_Long else Double.NaN);

addchartBubble(Target_Bubbles and x2_Long, x2L,"2xL (" + AsDollars(x2_Long) + " : " + AsPercent((x2_Long - L_Entry)/L_Entry) + ")",color.light_red);

#ThreeX Long

plot x3_Long = if Targetlines then x2_Long + (L_Entry - L_Stoploss) else double.nan;

x3_Long.setpaintingStrategy(paintingStrategy.dashes);

x3_Long.setlineWeight(1);

x3_Long.setdefaultColor(color.cyan);

def X3L = (if isNaN(x3_Long[1]) then x3_Long else Double.NaN);

addchartBubble(Target_Bubbles and x3_Long, x3L,"3xL (" + AsDollars(x3_Long) + " : " + AsPercent((x3_Long - L_Entry)/L_Entry) + ")",color.cyan);

#FourX Long

plot x4_Long = if Targetlines then x3_Long + (L_Entry - L_Stoploss) else double.nan;

x4_Long.setpaintingStrategy(paintingStrategy.dashes);

x4_Long.setlineWeight(1);

x4_Long.setdefaultColor(color.white);

def X4L = (if isNaN(x4_Long[1]) then x4_Long else Double.NaN);

addchartBubble(Target_Bubbles and x4_Long, x4L,"4xL (" + AsDollars(x4_Long) + " : " + AsPercent((x4_Long - L_Entry)/L_Entry) + ")",color.white);

#=========== Determine short stoploss, entry point, and target lines =====================

rec line2 = if IsNaN(MA_Max) then line2[1] else MA_Max[0];

plot S_stoploss = if IsNaN(MA_MAX) and Short and Hull_is_sell and DTC_is_sell then line2 else double.nan;

S_stoploss.setpaintingStrategy(paintingStrategy.LINE);

S_stoploss.setlineWeight(3);

S_stoploss.setdefaultColor(color.dark_red);

S_stoploss.hideBubble();

def SSL = (if isNaN(S_stoploss[1]) then S_stoploss else Double.NaN);

#Short Entry

rec line3 = if IsNaN(long) then line3[1] else long[0];

plot S_Entry = if IsNaN(long) and Hull_is_sell and DTC_is_sell then line3 else double.nan;

S_Entry.setpaintingStrategy(paintingStrategy.LINE);

S_Entry.setlineWeight(3);

S_Entry.setdefaultColor(color.red);

S_Entry.hideBubble();

def SE = (if isNaN(S_Entry[1]) then S_Entry else Double.NaN);

addchartBubble(Entry_SL_Bubbles and S_stoploss, SSL,"S/SL (" + AsDollars(S_stoploss) + " : " + AsPercent((S_stoploss - S_Entry)/S_Entry) + ")",color.DARK_RED);

addchartBubble(Entry_SL_Bubbles and S_Entry, SE,"S/E (" + AsDollars(S_Entry) + ")",color.RED);

#HalfX Short

plot x1a_Short = if Targetlines and S_Entry then (S_Entry - (S_Stoploss - S_Entry)/2) else double.nan;

x1a_Short.setpaintingStrategy(paintingStrategy.dashes);

x1a_Short.setlineWeight(1);

x1a_Short.setdefaultColor(color.magenta);

x1a_Short.hideBubble();

def x1a = (if isNaN(x1a_Short[1]) then x1a_Short else Double.NaN);

addchartBubble(Target_Bubbles and x1a_Short, x1a,"1/2xS (" + AsDollars(x1a_Short) + " : " + AsPercent((x1a_Short - S_Entry)/S_Entry) + ")",color.magenta);

#OneX Short

plot x1_Short = if Targetlines and x1a_short < line3 then (S_Entry -(S_Stoploss - S_Entry)) else double.nan;

x1_Short.setpaintingStrategy(paintingStrategy.dashes);

x1_Short.setlineWeight(1);

x1_Short.setdefaultColor(color.yellow);

def X1S = (if isNaN(x1_Short[1]) then x1_Short else Double.NaN);

addchartBubble(Target_Bubbles and x1_Short, x1S,"1xS (" + AsDollars(x1_Short) + " : " + AsPercent((x1_Short - S_Entry)/S_Entry) + ")",color.yellow);

#TwoX Short

plot x2_Short = if Targetlines then x1_Short - (S_Stoploss - S_Entry) else double.nan;

x2_Short.setpaintingStrategy(paintingStrategy.dashes);

x2_Short.setlineWeight(2);

x2_Short.setdefaultColor(color.light_green);

def X2S = (if isNaN(x2_Short[1]) then x2_Short else Double.NaN);

addchartBubble(Target_Bubbles and x2_Short, x2S,"2xS (" + AsDollars(x2_Short) + " : " + AsPercent((x2_Short - S_Entry)/S_Entry) + ")",color.light_green);

#ThreeX Short

plot x3_Short = if Targetlines then x2_Short - (S_Stoploss - S_Entry) else double.nan;

x3_Short.setpaintingStrategy(paintingStrategy.dashes);

x3_Short.setlineWeight(1);

x3_Short.setdefaultColor(color.cyan);

def X3S = (if isNaN(x3_Short[1]) then x3_Short else Double.NaN);

addchartBubble(Target_Bubbles and x3_Short, x3S,"3xS (" + AsDollars(x3_Short) + " : " + AsPercent((x3_Short - S_Entry)/S_Entry) + ")",color.cyan);

#FourX Short

plot x4_Short = if Targetlines then x3_Short - (S_Stoploss - S_Entry) else double.nan;

x4_Short.setpaintingStrategy(paintingStrategy.dashes);

x4_Short.setlineWeight(1);

x4_Short.setdefaultColor(color.white);

def X4S = (if isNaN(x4_Short[1]) then x4_Short else Double.NaN);

addchartBubble(Target_Bubbles and x4_Short, x4S,"4xS (" + AsDollars(x4_Short) + " : " + AsPercent((x4_Short - S_Entry)/S_Entry) + ")",color.white);

#=================================================================

#LinearRegCh100 RegressionDivergence - Trigger Lines - Trend Cross

# From Lizard Indicators Link: https://www.lizardindicators.com/trigger-lines-cross-vs-thrust/

# Line #1 - Fast = LinReg (80)

# Line #2 - Slow = EXPEMA[LinReg (80)]

input LinRegLength = 80;

input EMAlength = 20;

input ColorOn = yes; #Color price bars based on linear reg

input ShowDynoLines = yes;

#Definitions

def price1 = close;

def displace = 0;

def LinReg = Inertia(price1[-displace], LinRegLength);

def EMA_LR = ExpAverage(LinReg[-displace], EMAlength);

def Body = (open + close)/2;

# Defining Long/Short Filters (these instructions determine entries / exits)

# Entry Requirements

def Long_Entry = close > LinReg and close > EMA_LR and body > LinReg and body > EMA_LR and close > high[1] and body > body[1];

# LinReg > LinReg[1] and

def Long_Stay_In = close > LinReg and close > EMA_LR;

def Long_Exit = (close < LinReg or close < EMA_LR) or Long_Stay_In == 0;

def Long_State = If Long_Entry then 1 else if Long_Exit then 0 else Long_State[1];

def Long1 = Long_State;

# Exit Requirements

def Short_Entry = close < LinReg and close < EMA_LR and body < LinReg and body < EMA_LR and close < low[1] and body < body[1];

# LinReg < LinReg[1] and

def Short_Stay_In = close < LinReg and close < EMA_LR;

def Short_Exit = (close > LinReg or close > EMA_LR) or Short_Stay_In == 0;

def Short_State = If Short_Entry then 1 else if Short_Exit then 0 else Short_State[1];

def Short1 = Short_State;

#Adding plot lines for Linear Regression averages

plot LR = if ShowDynoLines then LinReg else double.NaN;

LR.SetDefaultColor(CreateColor(0, 130, 255));

LR.setlineweight(1);

plot EMA_LinReg = if ShowDynoLines then EMA_LR else double.NaN;

EMA_LinReg.SetDefaultColor(CreateColor(255, 215,0));

EMA_LinReg.setlineweight(2);

#Add cloud between linear reg and EMA of lin reg lines

DefineGlobalColor("Bullish", Color.dark_Green);

DefineGlobalColor("Bearish", Color.dark_Red);

AddCloud(EMA_LinReg, LR, GlobalColor("Bearish"), GlobalColor("Bullish"));

#DYNO Label

AddLabel(yes and labels and Short1, "DYNO:BEARISH", color.RED);

AddLabel(yes and labels and Long1, "DYNO:BULLISH", color.green);

AddLabel(yes and labels and Long1 == Short1, "DYNO:NEUTRAL", color.YELLOW);

#Regression Bands

input deviations = 1.618; #set your deviation units here.

input length = 500; #set your channel lookback period here.

def stdDeviation = StDevAll(price, length);

plot HighBand = if Bands then EMA_LinReg + deviations * stdDeviation else double.nan;

HighBand.SetDefaultColor(Color.red);

plot LowBand = if Bands then EMA_LinReg - deviations * stdDeviation else double.nan;

LowBand.SetDefaultColor(Color.green);

DefineGlobalColor("Bullish", Color.light_green);

DefineGlobalColor("Bearish", Color.light_RED);

# Coloring Bars

AssignPriceColor(if ColorON and Long_State then Color.GREEN else if ColorON and Short_State then Color.RED else Color.Yellow);

#==========End Dyno / Lin Reg Section ============================

#========= Plot Long Moving Average ==============================

input lengthAvgEXP = 200;

plot AvgExp = ExpAverage(price[-displace], lengthAvgExp);

AvgExp.SetDefaultColor(Color.white);

AvgExp.setlineweight(2);

#========== End Long Moving Average =============================

###################

#

# ALERTS

#

###################

Alert(alertON and LongTrigger, "Long Entry", Alert.BAR, Sound.Ding);

Alert(alertON and ShortTrigger, "Short Entry", Alert.BAR, Sound.Ding);

Alert(alertON and Buysetup, "HULL Buy", Alert.BAR, Sound.Bell);

Alert(alertON and Sellsetup, "HULL Sell", Alert.BAR, Sound.Bell);

Alert(alertON and high > highband, "Short Band", Alert.BAR, Sound.Ding);

Alert(alertON and low < lowband, "Long Band", Alert.BAR, Sound.Ding);Looks GREAT!! Question: I use the DTC set at 10. Is there a way to make your line turn yellow when the shaded areas go below 40? I added a blue line at 40 on lower indicator. It indicates when trend is weak and could reverse, as in these examples.Greetings all. I like the overall approach of Chewie's script, but, to be honest, the original version presented in the original post is a bit "busy" to me. There are also a few things that I consider glitches - primarily the way the entry lines and target lines didn't align. So, I wanted to offer an updated script that kept the spirit of Chewie's method but simplified the presentation some.

I've made the following changes to the code:

1) Added Donchian Trend Channel code. Item 2.2 in Chewie's OP says the Donchian Trend Ribbon should be red or green in the direction of your trade. I had already created code that generated a summary value of the DTR to use in an upper study, so I move that to this script. There are several inputs associated with this code:

2) Added constraints to drawing target lines based on HMA, Supertrend and DTC. Per Chewie's OP, all three of these indicators should be in buy or sell mode before entering the trade. So, I made it so that the entry and target lines won't appear unless that's true.

- Donchian_Channel_Period = 20; #length to calculate main trend - regular input from the lower study

- secondary_colors = { default yellow , green_red } - regular input from the lower study

- DTC_Trend_Cutoff = 20 - the summary code adds up the color values of each of the DTR lengths. This value is the limit of that summation used to determine if the trend is green, yellow (neutral) or red. A value of 20 means the entire trend ribbon has to be the same color. Lower values allow some yellow values to be included. Experiment with the values to see what works for you.

- plotDTCResult = yes - turns the plot of the summary line on or off. Mostly used for debugging my code. If you're looking for the cleanest chart, set to "No".

3) Added ability to remove drawing the Dyno lines and cloud (label and price bar coloring remain). The Dyno lines didn't seem to be used in determining buy/sell conditions, so I just added an input to allow you to turn off the plot of the lines/cloud to clean up the chart.

4) Commented out some code that didn't appear to be doing anything. Looks like it might have been left over from a previous iteration of the code (leaving in for Chewie to evaluate if it's actually needed - see lines 36-37, 54-58 and 150).

5) Made entry and target lines all start/end at the same place. Just some cleanup to the code so that all of these lines appear consistently.

6) Some general cleanup and rearranging (no effect to output)

Here's the updated script:

Code:#Hull_SuperTrend_Trading_System # assembled by Chewie 4/10/2022 # many thanks to all the other noted contributors to this system. # SuperTrend Yahoo Finance Replica - Modified from Modius SuperTrend # Modified Modius ver. by RConner7 # Modified by Barbaros to replicate look from TradingView version # Modified by Barbaros to add EMA cross for bubbles and alerts # Modified by Barbaros to update bar color painting # v3.3 # Modified by Zetta_wow: # - Add Donchian Trend Channel code to provide summary value of DTC and include in target lines # - Added constraints to drawing target lines based on HMA, Supertrend and DTC # - Added ability to remove drawing the Dyno lines and cloud (label and price bar coloring remain) # - Commented out some code that didn't appear to be doing anything (leaving in for Chewie to evaluate need) # - Made entry and target lines all start/end at the same place # - Some general cleanup and rearranging (no effect to output) # From the useThinkScript thread introducing Chewie's strategy: #2. SETUP: You must see three things to define an entry position. # 1. A top or bottom reversal signal of the Hull Moving Avg plotted with a white square (top) or white triangle (bottom). # 2. Lower Donchian Trend Ribbon either green or red in the color of the direction you are entering the trade. (Shout out to @halcyonguy who converted this into TOS. Much appreciated, you are awesome!!!) # 3. Break of the Super Trend indicator. (Default setting is 2.75. Feel free to adjust this if you want in the settings) # # HMA signal indicated by Hull_is_buy and Hull_is_sell variables # Donchian Trend Ribbon signal indicated by DTC_is_buy and DTC_is_sell # Supertrend signal indicated by Long and Short variables (plots) # Don't draw entry/1x/2x/3x/4x lines unless all three match signals (buy/long or sell/short) input Target_Bubbles = no; input Entry_SL_Bubbles = no; input Targetlines = yes; input Labels = yes; input alertON = yes; input Bands = yes; #input EMA1 = 10; #Inputs for unused code below #input EMA2 = 20; #Inputs for unused code below input AvgType = AverageType.HULL; input STAtrMult = 2.75; input nATR = 12; #======== Calculate the Supertrend ===================================================== def ATR = ATR("length" = nATR, "average type" = AvgType); def UP_Band_Basic = HL2 + (STAtrMult * ATR); def LW_Band_Basic = HL2 + (-STAtrMult * ATR); def UP_Band = if ((UP_Band_Basic < UP_Band[1]) or (close[1] > UP_Band[1])) then UP_Band_Basic else UP_Band[1]; def LW_Band = if ((LW_Band_Basic > LW_Band[1]) or (close[1] < LW_Band[1])) then LW_Band_Basic else LW_Band[1]; def ST = if ((ST[1] == UP_Band[1]) and (close < UP_Band)) then UP_Band else if ((ST[1] == UP_Band[1]) and (close > Up_Band)) then LW_Band else if ((ST[1] == LW_Band[1]) and (close > LW_Band)) then LW_Band else if ((ST[1] == LW_Band) and (close < LW_Band)) then UP_Band else LW_Band; #======== This code doesn't do anything that gets used elsewhere ======================== #def EMA1Val = MovAvgExponential(close, EMA1); #def EMA2Val = MovAvgExponential(close, EMA2); #def EMADirection = if EMA1Val > EMA2Val then 1 else if EMA1Val < EMA2Val then -1 else 0; #======================================================================================= plot Long = if close > ST then ST else Double.NaN; Long.AssignValueColor(Color.cyan); Long.SetLineWeight(3); plot Short = if close < ST then ST else Double.NaN; Short.AssignValueColor(Color.magenta); Short.SetLineWeight(3); def LongTrigger = isNaN(Long[1]) and !isNaN(Long); def ShortTrigger = isNaN(Short[1]) and !isNaN(Short); plot LongDot = if LongTrigger then ST else Double.NaN; LongDot.SetPaintingStrategy(PaintingStrategy.POINTS); LongDot.AssignValueColor(Color.cyan); LongDot.SetLineWeight(4); plot ShortDot = if ShortTrigger then ST else Double.NaN; ShortDot.SetPaintingStrategy(PaintingStrategy.POINTS); ShortDot.AssignValueColor(Color.magenta); ShortDot.SetLineWeight(4); AddChartBubble(Entry_SL_Bubbles and LongTrigger, ST, "BUY", Color.GREEN, no); AddChartBubble(Entry_SL_Bubbles and ShortTrigger, ST, "SELL", Color.RED, yes); #Super Trend Labels AddLabel(yes and labels and Long, "ST:LONG", color.CYAN); AddLabel(yes and labels and Short, "ST:SHORT", color.magenta); #======== End of Supertrend calcs ===================================================== # ===================================================================================== # Hull Moving Average Concavity and Turning Points # # Author: Seth Urion (Mahsume) # Version: 2020-05-01 V4 # # Now with support for ToS Mobile # declare upper; input HMA_Length = 60; input lookback = 3; input arrows = no; def price = HL2; plot HMA = HullMovingAvg(price = price, length = HMA_Length); def delta = HMA[1] - HMA[lookback + 1]; def delta_per_bar = delta / lookback; def next_bar = HMA[1] + delta_per_bar; def concavity = if HMA > next_bar then 1 else -1; HMA.AssignValueColor(color = if concavity[1] == -1 then if HMA > HMA[1] then color.dark_orange else color.red else if HMA < HMA[1] then color.dark_green else color.green); HMA.SetLineWeight(3); #Define turning point where concavity switches directiion plot turning_point = if concavity[1] != concavity then HMA else double.nan; turning_point.SetLineWeight(2); turning_point.SetPaintingStrategy(paintingStrategy = PaintingStrategy.POINTS); turning_point.SetDefaultColor(color.white); #Plot maximum/minimum points of HMA # Note: the HMA[-1] term will cause repainting at the end of the chart (looks forward 1 bar) plot MA_Max = if HMA[-1] < HMA and HMA > HMA[1] then HMA else Double.NaN; MA_Max.SetDefaultColor(Color.WHITE); MA_Max.SetPaintingStrategy(PaintingStrategy.SQUARES); MA_Max.SetLineWeight(5); plot MA_Min = if HMA[-1] > HMA and HMA < HMA[1] then HMA else Double.Nan; MA_Min.SetDefaultColor(Color.WHITE); MA_Min.SetPaintingStrategy(PaintingStrategy.TRIANGLES); MA_Min.SetLineWeight(5); #Define conditions for HMA-based alerts (see end of code) def BuySetup = HMA > HMA[1] and HMA[1] < HMA[2]; def SellSetup = HMA < HMA[1] and HMA[1] > HMA[2]; #Plot buy/sell arrows based on HMA # Up arrow if at a turning point and concavity is "up" # Down arrow if at a turning point and concavity is "down" plot sell = if arrows and turning_point and concavity == -1 then high else double.nan; sell.SetDefaultColor(Color.DARK_ORANGE); sell.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN); sell.SetLineWeight(3); plot buy = if arrows and turning_point and concavity == 1 then low else double.nan; buy.SetDefaultColor(Color.CYAN); buy.SetPaintingStrategy(PaintingStrategy.ARROW_UP); buy.SetLineWeight(3); #def divergence = HMA - next_bar; #this term isn't used anywhere else ################### # # 2020-05-01 # # MOBILE TOS SUPPORT # # Each color of the HMA needs to be a separate plot as ToS Mobile # lacks the ability to assign colors the way ToS Desktop does. # I recommend a plain colored HMA behind the line # Set the line color of the HMA above to gray or some neutral # # CCD_D -> ConCave Down and Decreasing # CCD_I -> ConCave Down and Increasing # CCU_D -> ConCave Up and Decreasing # CCU_I -> ConCave Up and Increasing # ################### plot CCD_D = if concavity == -1 and HMA < HMA[1] then HMA else double.nan; CCD_D.SetDefaultColor(Color.RED); CCD_D.SetLineWeight(1); plot CCD_I = if concavity == -1 and HMA >= HMA[1] then HMA else double.nan; CCD_I.SetDefaultColor(Color.DARK_ORANGE); CCD_I.SetLineWeight(1); plot CCU_D = if concavity == 1 and HMA <= HMA[1] then HMA else double.nan; CCU_D.SetDefaultColor(COLOR.DARK_GREEN); CCU_D.SetLineWeight(1); plot CCU_I = if concavity == 1 and HMA > HMA[1] then HMA else double.nan; CCU_I.SetDefaultColor(COLOR.GREEN); CCU_I.SetLineWeight(1); #======= End of mobile HMA coloring support ============================= #Hull Label AddLabel(yes and labels and CCD_D, "HULL:SELL", color.RED); AddLabel(yes and labels and CCU_I, "HULL:BUY", color.green); AddLabel(yes and labels and CCU_D, "HULL:WEAK SELL", color.dark_green); AddLabel(yes and labels and CCD_I, "HULL:WEAK BUY", color.DARK_ORANGE); def Hull_is_buy = !IsNaN(CCD_I) or !IsNaN(CCU_I); def Hull_is_sell = !IsNaN(CCD_D) or !IsNaN(CCU_D); #============ Create Donchian Trend Ribbon values ======================================= # Donchian Trend Channel parameters input Donchian_Channel_Period = 20; #length to calculate main trend input DTC_Trend_Cutoff = 20; #value of sum of all trends to exceed to use for buy/sell signal input plotDTCResult = yes; input secondary_colors = { default yellow , green_red }; #======================================================================= # Donchian Trend Channel calcs # all plots have been removed leaving only the value calculations # How it works ? # - it calculates main trend direction by using the length that is user-defined. so you can change it as you wish # - then it calculates trend direction for each 9 lower lengths. if you set the length = 20 then the lengths are 19, 18,...11 # - and it checks if the trend directions that came from lower lengths is same or not with main trend direction. # - it changes the trend color of the ribbon. # ----------------------------- def dlen = if Donchian_Channel_Period < 10 then 10 else Donchian_Channel_Period; def na = Double.NaN; script dchannel { input len = 0; def hh = Highest(high, len); def ll = Lowest(low, len); def trend = if BarNumber() == 1 then 0 else if close > hh[1] then 1 else if close < ll[1] then -1 else trend[1]; plot z = trend; } script dchannelalt { input len = 0; input maintrend = 0; def hh = Highest(high, len); def ll = Lowest(low, len); def trend = if BarNumber() == 1 then 0 else if close > hh[1] then 1 else if close < ll[1] then -1 else trend[1]; def maincolor = if maintrend == 1 then if trend == 1 then 2 else 1 else if maintrend == -1 then if trend == -1 then -2 else -1 else 0; plot color = maincolor; } def maintrend = dchannel(dlen); # --------------------------------- def c01 = dchannelalt(dlen - 0, maintrend); def c02 = dchannelalt(dlen - 1, maintrend); def c03 = dchannelalt(dlen - 2, maintrend); def c04 = dchannelalt(dlen - 3, maintrend); def c05 = dchannelalt(dlen - 4, maintrend); def c06 = dchannelalt(dlen - 5, maintrend); def c07 = dchannelalt(dlen - 6, maintrend); def c08 = dchannelalt(dlen - 7, maintrend); def c09 = dchannelalt(dlen - 8, maintrend); def c10 = dchannelalt(dlen - 9, maintrend); # ----------------------------- # add up color numbers, to come up with a 'trend' number , 20 to -20 def colorsum = ( c01 + c02 + c03 + c04 + c05 + c06 + c07 + c08 + c09 + c10 ); # colors # 2 - up trend - green # 1 - up trend - dark green # 0 no trend # -1 - down trend - dark red # -2 - down trend - red def DTC_Result = if colorsum >= DTC_Trend_Cutoff then 1 else if colorsum <= -DTC_Trend_Cutoff then -1 else 0; def seccolor; switch (secondary_colors) { case yellow: seccolor = 1; case green_red: seccolor = 2; } # colors # 2 - up trend - green # 1 - up trend - dark green # 0 no trend # -1 - down trend - dark red # -2 - down trend - red plot DTC_Trend = if (plotDTCResult) then (0.995 * low) else na; DTC_Trend.SetPaintingStrategy(PaintingStrategy.LINE); DTC_Trend.SetLineWeight(3); DTC_Trend.DefineColor("up2", Color.GREEN); DTC_Trend.DefineColor("up1", Color.DARK_GREEN); DTC_Trend.DefineColor("none", Color.DARK_GRAY); DTC_Trend.DefineColor("dwn1", Color.DARK_RED); DTC_Trend.DefineColor("dwn2", Color.RED); DTC_Trend.DefineColor("alt1", Color.YELLOW); DTC_Trend.AssignValueColor( if colorsum >= DTC_Trend_Cutoff then DTC_Trend.Color("up2") else if (colorsum > 0 and colorsum < DTC_Trend_Cutoff) and seccolor == 1 then DTC_Trend.Color("alt1") else if (colorsum > 0 and colorsum < DTC_Trend_Cutoff) and seccolor == 2 then DTC_Trend.Color("up1") else if colorsum <= -DTC_Trend_Cutoff then DTC_Trend.Color("dwn2") else if (colorsum < 0 and colorsum > -DTC_Trend_Cutoff) and seccolor == 1 then DTC_Trend.Color("alt1") else if (colorsum < 0 and colorsum > -DTC_Trend_Cutoff) and seccolor == 2 then DTC_Trend.Color("dwn1") else Color.GRAY); DTC_Trend.SetHiding(!plotDTCResult); def DTC_is_buy = if colorsum >= DTC_Trend_Cutoff then yes else no; def DTC_is_sell = if colorsum <= -DTC_Trend_Cutoff then yes else no; # === End of Donchian Trend Channel code === #Target lines # created by chewie #=========== Determine long stoploss, entry point, and target lines ===================== #Stop Loss = minimum point of Hull MA def line = if IsNaN(MA_Min) then line[1] else MA_Min[0]; plot L_stoploss = if IsNaN(MA_Min) and Hull_is_buy and Long and DTC_is_buy then line else double.nan; L_stoploss.setpaintingStrategy(paintingStrategy.LINE); L_stoploss.setlineWeight(3); L_stoploss.setdefaultColor(color.dark_green); L_stoploss.hideBubble(); def LSL = (if isNaN(L_stoploss[1]) then L_stoploss else Double.NaN); addchartBubble(Entry_SL_Bubbles and L_stoploss, LSL,"L/SL",color.DARK_GREEN); #Long Entry = final value of previous Supertrend (short) def line4 = if IsNaN(short) then line4[1] else short[0]; plot L_Entry = if IsNaN(short) and Hull_is_buy and DTC_is_buy then line4 else double.nan; L_Entry.setpaintingStrategy(paintingStrategy.LINE); L_Entry.setlineWeight(3); L_Entry.setdefaultColor(color.green); L_Entry.hideBubble(); def LE = (if isNaN(L_Entry[1]) then L_Entry else Double.NaN); addchartBubble(Entry_SL_Bubbles and L_Entry, LE,"L/E",color.GREEN); #HalfX Long plot x1a_Long = if Targetlines and L_Entry then (L_Entry + (L_Entry - L_Stoploss)/2) else double.nan; x1a_Long.setpaintingStrategy(paintingStrategy.dashes); x1a_Long.setlineWeight(1); x1a_Long.setdefaultColor(color.magenta); x1a_Long.hideBubble(); def x1aL = (if isNaN(x1a_Long[1]) then x1a_Long else Double.NaN); addchartBubble(Target_Bubbles and x1a_Long, x1aL,"1/2xL",color.magenta); #OneX Long plot x1_Long = if Targetlines and x1a_Long > line4 then (L_Entry +(L_Entry - L_Stoploss)) else double.nan; x1_Long.setpaintingStrategy(paintingStrategy.dashes); x1_Long.setlineWeight(1); x1_Long.setdefaultColor(color.yellow); def X1L = (if isNaN(x1_Long[1]) then x1_Long else Double.NaN); addchartBubble(Target_Bubbles and x1_Long, x1L,"1xL",color.yellow); #TwoX Long plot x2_Long = if Targetlines then x1_Long + (L_Entry - L_Stoploss) else double.nan; x2_Long.setpaintingStrategy(paintingStrategy.dashes); x2_Long.setlineWeight(2); x2_Long.setdefaultColor(color.light_red); def X2L = (if isNaN(x2_Long[1]) then x2_Long else Double.NaN); addchartBubble(Target_Bubbles and x2_Long, x2L,"2xL",color.light_red); #ThreeX Long plot x3_Long = if Targetlines then x2_Long + (L_Entry - L_Stoploss) else double.nan; x3_Long.setpaintingStrategy(paintingStrategy.dashes); x3_Long.setlineWeight(1); x3_Long.setdefaultColor(color.cyan); def X3L = (if isNaN(x3_Long[1]) then x3_Long else Double.NaN); addchartBubble(Target_Bubbles and x3_Long, x3L,"3xL",color.cyan); #FourX Long plot x4_Long = if Targetlines then x3_Long + (L_Entry - L_Stoploss) else double.nan; x4_Long.setpaintingStrategy(paintingStrategy.dashes); x4_Long.setlineWeight(1); x4_Long.setdefaultColor(color.white); def X4L = (if isNaN(x4_Long[1]) then x4_Long else Double.NaN); addchartBubble(Target_Bubbles and x4_Long, x4L,"4xL",color.white); #=========== Determine short stoploss, entry point, and target lines ===================== rec line2 = if IsNaN(MA_Max) then line2[1] else MA_Max[0]; plot S_stoploss = if IsNaN(MA_MAX) and Short and Hull_is_sell and DTC_is_sell then line2 else double.nan; S_stoploss.setpaintingStrategy(paintingStrategy.LINE); S_stoploss.setlineWeight(3); S_stoploss.setdefaultColor(color.dark_red); S_stoploss.hideBubble(); def SSL = (if isNaN(S_stoploss[1]) then S_stoploss else Double.NaN); addchartBubble(Entry_SL_Bubbles and S_stoploss, SSL,"S/SL",color.DARK_RED); #Short Entry rec line3 = if IsNaN(long) then line3[1] else long[0]; plot S_Entry = if IsNaN(long) and Hull_is_sell and DTC_is_sell then line3 else double.nan; S_Entry.setpaintingStrategy(paintingStrategy.LINE); S_Entry.setlineWeight(3); S_Entry.setdefaultColor(color.red); S_Entry.hideBubble(); def SE = (if isNaN(S_Entry[1]) then S_Entry else Double.NaN); addchartBubble(Entry_SL_Bubbles and S_Entry, SE,"S/E",color.RED); #HalfX Short plot x1a_Short = if Targetlines and S_Entry then (S_Entry - (S_Stoploss - S_Entry)/2) else double.nan; x1a_Short.setpaintingStrategy(paintingStrategy.dashes); x1a_Short.setlineWeight(1); x1a_Short.setdefaultColor(color.magenta); x1a_Short.hideBubble(); def x1a = (if isNaN(x1a_Short[1]) then x1a_Short else Double.NaN); addchartBubble(Target_Bubbles and x1a_Short, x1a,"1/2xS",color.magenta); #OneX Short plot x1_Short = if Targetlines and x1a_short < line3 then (S_Entry -(S_Stoploss - S_Entry)) else double.nan; x1_Short.setpaintingStrategy(paintingStrategy.dashes); x1_Short.setlineWeight(1); x1_Short.setdefaultColor(color.yellow); def X1S = (if isNaN(x1_Short[1]) then x1_Short else Double.NaN); addchartBubble(Target_Bubbles and x1_Short, x1S,"1xS",color.yellow); #TwoX Short plot x2_Short = if Targetlines then x1_Short - (S_Stoploss - S_Entry) else double.nan; x2_Short.setpaintingStrategy(paintingStrategy.dashes); x2_Short.setlineWeight(2); x2_Short.setdefaultColor(color.light_green); def X2S = (if isNaN(x2_Short[1]) then x2_Short else Double.NaN); addchartBubble(Target_Bubbles and x2_Short, x2S,"2xS",color.light_green); #ThreeX Short plot x3_Short = if Targetlines then x2_Short - (S_Stoploss - S_Entry) else double.nan; x3_Short.setpaintingStrategy(paintingStrategy.dashes); x3_Short.setlineWeight(1); x3_Short.setdefaultColor(color.cyan); def X3S = (if isNaN(x3_Short[1]) then x3_Short else Double.NaN); addchartBubble(Target_Bubbles and x3_Short, x3S,"3xS",color.cyan); #FourX Short plot x4_Short = if Targetlines then x3_Short - (S_Stoploss - S_Entry) else double.nan; x4_Short.setpaintingStrategy(paintingStrategy.dashes); x4_Short.setlineWeight(1); x4_Short.setdefaultColor(color.white); def X4S = (if isNaN(x4_Short[1]) then x4_Short else Double.NaN); addchartBubble(Target_Bubbles and x4_Short, x4S,"4xS",color.white); #================================================================= #LinearRegCh100 RegressionDivergence - Trigger Lines - Trend Cross # From Lizard Indicators Link: https://www.lizardindicators.com/trigger-lines-cross-vs-thrust/ # Line #1 - Fast = LinReg (80) # Line #2 - Slow = EXPEMA[LinReg (80)] input LinRegLength = 80; input EMAlength = 20; input ColorOn = yes; #Color price bars based on linear reg input ShowDynoLines = yes; #Definitions def price1 = close; def displace = 0; def LinReg = Inertia(price1[-displace], LinRegLength); def EMA_LR = ExpAverage(LinReg[-displace], EMAlength); def Body = (open + close)/2; # Defining Long/Short Filters (these instructions determine entries / exits) # Entry Requirements def Long_Entry = close > LinReg and close > EMA_LR and body > LinReg and body > EMA_LR and close > high[1] and body > body[1]; # LinReg > LinReg[1] and def Long_Stay_In = close > LinReg and close > EMA_LR; def Long_Exit = (close < LinReg or close < EMA_LR) or Long_Stay_In == 0; def Long_State = If Long_Entry then 1 else if Long_Exit then 0 else Long_State[1]; def Long1 = Long_State; # Exit Requirements def Short_Entry = close < LinReg and close < EMA_LR and body < LinReg and body < EMA_LR and close < low[1] and body < body[1]; # LinReg < LinReg[1] and def Short_Stay_In = close < LinReg and close < EMA_LR; def Short_Exit = (close > LinReg or close > EMA_LR) or Short_Stay_In == 0; def Short_State = If Short_Entry then 1 else if Short_Exit then 0 else Short_State[1]; def Short1 = Short_State; #Adding plot lines for Linear Regression averages plot LR = if ShowDynoLines then LinReg else double.NaN; LR.SetDefaultColor(CreateColor(0, 130, 255)); LR.setlineweight(1); plot EMA_LinReg = if ShowDynoLines then EMA_LR else double.NaN; EMA_LinReg.SetDefaultColor(CreateColor(255, 215,0)); EMA_LinReg.setlineweight(2); #Add cloud between linear reg and EMA of lin reg lines DefineGlobalColor("Bullish", Color.dark_Green); DefineGlobalColor("Bearish", Color.dark_Red); AddCloud(EMA_LinReg, LR, GlobalColor("Bearish"), GlobalColor("Bullish")); #DYNO Label AddLabel(yes and labels and Short1, "DYNO:BEARISH", color.RED); AddLabel(yes and labels and Long1, "DYNO:BULLISH", color.green); AddLabel(yes and labels and Long1 == Short1, "DYNO:NEUTRAL", color.YELLOW); #Regression Bands input deviations = 1.618; #set your deviation units here. input length = 500; #set your channel lookback period here. def stdDeviation = StDevAll(price, length); plot HighBand = if Bands then EMA_LinReg + deviations * stdDeviation else double.nan; HighBand.SetDefaultColor(Color.red); plot LowBand = if Bands then EMA_LinReg - deviations * stdDeviation else double.nan; LowBand.SetDefaultColor(Color.green); DefineGlobalColor("Bullish", Color.light_green); DefineGlobalColor("Bearish", Color.light_RED); # Coloring Bars AssignPriceColor(if ColorON and Long_State then Color.GREEN else if ColorON and Short_State then Color.RED else Color.Yellow); #==========End Dyno / Lin Reg Section ============================ #========= Plot Long Moving Average ============================== input lengthAvgEXP = 200; plot AvgExp = ExpAverage(price[-displace], lengthAvgExp); AvgExp.SetDefaultColor(Color.white); AvgExp.setlineweight(2); #========== End Long Moving Average ============================= ################### # # ALERTS # ################### Alert(alertON and LongTrigger, "Long Entry", Alert.BAR, Sound.Ding); Alert(alertON and ShortTrigger, "Short Entry", Alert.BAR, Sound.Ding); Alert(alertON and Buysetup, "HULL Buy", Alert.BAR, Sound.Bell); Alert(alertON and Sellsetup, "HULL Sell", Alert.BAR, Sound.Bell); Alert(alertON and high > highband, "Short Band", Alert.BAR, Sound.Ding); Alert(alertON and low < lowband, "Long Band", Alert.BAR, Sound.Ding);

1) If you change the value of the "dtc trend cutoff" in the inputs, I think it will mostly get you what you're looking for. Example below shows the same timeframe as yours with a trend cutoff value of 19. You can try lower values to adjust the sensitivity. The result isn't explicitly what you're trying to do, but the result is pretty close.Looks GREAT!! Question: I use the DTC set at 10. Is there a way to make your line turn yellow when the shaded areas go below 40? I added a blue line at 40 on lower indicator. It indicates when trend is weak and could reverse, as in these examples.

Ok, I like what you've done here. Great! Also, the other lines of code you grayed out are not needed. I think it was from aspects of other indicators that didn't add value to this strategy and I didn't remove them completely. Thanks.1) If you change the value of the "dtc trend cutoff" in the inputs, I think it will mostly get you what you're looking for. Example below shows the same timeframe as yours with a trend cutoff value of 19. You can try lower values to adjust the sensitivity. The result isn't explicitly what you're trying to do, but the result is pretty close.

2) The value of 40 on the trend ribbon doesn't have any intrinsic meaning. It's just the location of the plot of the 3rd longest trend (8 days in the case where the DTC period is 10 - I expanded the DTC plot on the image above so you can see the individual rows plotted; they start with the longest at the bottom and work up). If you really want to go yellow on any bar where any trend below (below in length - above on the chart) the selected trend (number 3 in this case) is shaded, I can work on adding an alternative summary method that does that. Shouldn't be too difficult. I was thinking of some other mods to the DTC code that I'd like to add, also (like being able to do every other length, i.e. 20, 18, 16, etc), so I could add that in at the same time.

Thanks for us!Greetings all. I like the overall approach of Chewie's script, but, to be honest, the original version presented in the original post is a bit "busy" to me. There are also a few things that I consider glitches - primarily the way the entry lines and target lines didn't align. So, I wanted to offer an updated script that kept the spirit of Chewie's method but simplified the presentation some.

I've made the following changes to the code:

1) Added Donchian Trend Channel code. Item 2.2 in Chewie's OP says the Donchian Trend Ribbon should be red or green in the direction of your trade. I had already created code that generated a summary value of the DTR to use in an upper study, so I move that to this script. There are several inputs associated with this code:

2) Added constraints to drawing target lines based on HMA, Supertrend and DTC. Per Chewie's OP, all three of these indicators should be in buy or sell mode before entering the trade. So, I made it so that the entry and target lines won't appear unless that's true.

- Donchian_Channel_Period = 20; #length to calculate main trend - regular input from the lower study

- secondary_colors = { default yellow , green_red } - regular input from the lower study

- DTC_Trend_Cutoff = 20 - the summary code adds up the color values of each of the DTR lengths. This value is the limit of that summation used to determine if the trend is green, yellow (neutral) or red. A value of 20 means the entire trend ribbon has to be the same color. Lower values allow some yellow values to be included. Experiment with the values to see what works for you.

- plotDTCResult = yes - turns the plot of the summary line on or off. Mostly used for debugging my code. If you're looking for the cleanest chart, set to "No".

3) Added ability to remove drawing the Dyno lines and cloud (label and price bar coloring remain). The Dyno lines didn't seem to be used in determining buy/sell conditions, so I just added an input to allow you to turn off the plot of the lines/cloud to clean up the chart.

4) Commented out some code that didn't appear to be doing anything. Looks like it might have been left over from a previous iteration of the code (leaving in for Chewie to evaluate if it's actually needed - see lines 36-37, 54-58 and 150).

5) Made entry and target lines all start/end at the same place. Just some cleanup to the code so that all of these lines appear consistently.

6) Some general cleanup and rearranging (no effect to output)

Here's the updated script:

Code:#Hull_SuperTrend_Trading_System # assembled by Chewie 4/10/2022 # many thanks to all the other noted contributors to this system. # SuperTrend Yahoo Finance Replica - Modified from Modius SuperTrend # Modified Modius ver. by RConner7 # Modified by Barbaros to replicate look from TradingView version # Modified by Barbaros to add EMA cross for bubbles and alerts # Modified by Barbaros to update bar color painting # v3.3 # Modified by Zetta_wow: # - Add Donchian Trend Channel code to provide summary value of DTC and include in target lines # - Added constraints to drawing target lines based on HMA, Supertrend and DTC # - Added ability to remove drawing the Dyno lines and cloud (label and price bar coloring remain) # - Commented out some code that didn't appear to be doing anything (leaving in for Chewie to evaluate need) # - Made entry and target lines all start/end at the same place # - Some general cleanup and rearranging (no effect to output) # From the useThinkScript thread introducing Chewie's strategy: #2. SETUP: You must see three things to define an entry position. # 1. A top or bottom reversal signal of the Hull Moving Avg plotted with a white square (top) or white triangle (bottom). # 2. Lower Donchian Trend Ribbon either green or red in the color of the direction you are entering the trade. (Shout out to @halcyonguy who converted this into TOS. Much appreciated, you are awesome!!!) # 3. Break of the Super Trend indicator. (Default setting is 2.75. Feel free to adjust this if you want in the settings) # # HMA signal indicated by Hull_is_buy and Hull_is_sell variables # Donchian Trend Ribbon signal indicated by DTC_is_buy and DTC_is_sell # Supertrend signal indicated by Long and Short variables (plots) # Don't draw entry/1x/2x/3x/4x lines unless all three match signals (buy/long or sell/short) input Target_Bubbles = no; input Entry_SL_Bubbles = no; input Targetlines = yes; input Labels = yes; input alertON = yes; input Bands = yes; #input EMA1 = 10; #Inputs for unused code below #input EMA2 = 20; #Inputs for unused code below input AvgType = AverageType.HULL; input STAtrMult = 2.75; input nATR = 12; #======== Calculate the Supertrend ===================================================== def ATR = ATR("length" = nATR, "average type" = AvgType); def UP_Band_Basic = HL2 + (STAtrMult * ATR); def LW_Band_Basic = HL2 + (-STAtrMult * ATR); def UP_Band = if ((UP_Band_Basic < UP_Band[1]) or (close[1] > UP_Band[1])) then UP_Band_Basic else UP_Band[1]; def LW_Band = if ((LW_Band_Basic > LW_Band[1]) or (close[1] < LW_Band[1])) then LW_Band_Basic else LW_Band[1]; def ST = if ((ST[1] == UP_Band[1]) and (close < UP_Band)) then UP_Band else if ((ST[1] == UP_Band[1]) and (close > Up_Band)) then LW_Band else if ((ST[1] == LW_Band[1]) and (close > LW_Band)) then LW_Band else if ((ST[1] == LW_Band) and (close < LW_Band)) then UP_Band else LW_Band; #======== This code doesn't do anything that gets used elsewhere ======================== #def EMA1Val = MovAvgExponential(close, EMA1); #def EMA2Val = MovAvgExponential(close, EMA2); #def EMADirection = if EMA1Val > EMA2Val then 1 else if EMA1Val < EMA2Val then -1 else 0; #======================================================================================= plot Long = if close > ST then ST else Double.NaN; Long.AssignValueColor(Color.cyan); Long.SetLineWeight(3); plot Short = if close < ST then ST else Double.NaN; Short.AssignValueColor(Color.magenta); Short.SetLineWeight(3); def LongTrigger = isNaN(Long[1]) and !isNaN(Long); def ShortTrigger = isNaN(Short[1]) and !isNaN(Short); plot LongDot = if LongTrigger then ST else Double.NaN; LongDot.SetPaintingStrategy(PaintingStrategy.POINTS); LongDot.AssignValueColor(Color.cyan); LongDot.SetLineWeight(4); plot ShortDot = if ShortTrigger then ST else Double.NaN; ShortDot.SetPaintingStrategy(PaintingStrategy.POINTS); ShortDot.AssignValueColor(Color.magenta); ShortDot.SetLineWeight(4); AddChartBubble(Entry_SL_Bubbles and LongTrigger, ST, "BUY", Color.GREEN, no); AddChartBubble(Entry_SL_Bubbles and ShortTrigger, ST, "SELL", Color.RED, yes); #Super Trend Labels AddLabel(yes and labels and Long, "ST:LONG", color.CYAN); AddLabel(yes and labels and Short, "ST:SHORT", color.magenta); #======== End of Supertrend calcs ===================================================== # ===================================================================================== # Hull Moving Average Concavity and Turning Points # # Author: Seth Urion (Mahsume) # Version: 2020-05-01 V4 # # Now with support for ToS Mobile # declare upper; input HMA_Length = 60; input lookback = 3; input arrows = no; def price = HL2; plot HMA = HullMovingAvg(price = price, length = HMA_Length); def delta = HMA[1] - HMA[lookback + 1]; def delta_per_bar = delta / lookback; def next_bar = HMA[1] + delta_per_bar; def concavity = if HMA > next_bar then 1 else -1; HMA.AssignValueColor(color = if concavity[1] == -1 then if HMA > HMA[1] then color.dark_orange else color.red else if HMA < HMA[1] then color.dark_green else color.green); HMA.SetLineWeight(3); #Define turning point where concavity switches directiion plot turning_point = if concavity[1] != concavity then HMA else double.nan; turning_point.SetLineWeight(2); turning_point.SetPaintingStrategy(paintingStrategy = PaintingStrategy.POINTS); turning_point.SetDefaultColor(color.white); #Plot maximum/minimum points of HMA # Note: the HMA[-1] term will cause repainting at the end of the chart (looks forward 1 bar) plot MA_Max = if HMA[-1] < HMA and HMA > HMA[1] then HMA else Double.NaN; MA_Max.SetDefaultColor(Color.WHITE); MA_Max.SetPaintingStrategy(PaintingStrategy.SQUARES); MA_Max.SetLineWeight(5); plot MA_Min = if HMA[-1] > HMA and HMA < HMA[1] then HMA else Double.Nan; MA_Min.SetDefaultColor(Color.WHITE); MA_Min.SetPaintingStrategy(PaintingStrategy.TRIANGLES); MA_Min.SetLineWeight(5); #Define conditions for HMA-based alerts (see end of code) def BuySetup = HMA > HMA[1] and HMA[1] < HMA[2]; def SellSetup = HMA < HMA[1] and HMA[1] > HMA[2]; #Plot buy/sell arrows based on HMA # Up arrow if at a turning point and concavity is "up" # Down arrow if at a turning point and concavity is "down" plot sell = if arrows and turning_point and concavity == -1 then high else double.nan; sell.SetDefaultColor(Color.DARK_ORANGE); sell.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN); sell.SetLineWeight(3); plot buy = if arrows and turning_point and concavity == 1 then low else double.nan; buy.SetDefaultColor(Color.CYAN); buy.SetPaintingStrategy(PaintingStrategy.ARROW_UP); buy.SetLineWeight(3); #def divergence = HMA - next_bar; #this term isn't used anywhere else ################### # # 2020-05-01 # # MOBILE TOS SUPPORT # # Each color of the HMA needs to be a separate plot as ToS Mobile # lacks the ability to assign colors the way ToS Desktop does. # I recommend a plain colored HMA behind the line # Set the line color of the HMA above to gray or some neutral # # CCD_D -> ConCave Down and Decreasing # CCD_I -> ConCave Down and Increasing # CCU_D -> ConCave Up and Decreasing # CCU_I -> ConCave Up and Increasing # ################### plot CCD_D = if concavity == -1 and HMA < HMA[1] then HMA else double.nan; CCD_D.SetDefaultColor(Color.RED); CCD_D.SetLineWeight(1); plot CCD_I = if concavity == -1 and HMA >= HMA[1] then HMA else double.nan; CCD_I.SetDefaultColor(Color.DARK_ORANGE); CCD_I.SetLineWeight(1); plot CCU_D = if concavity == 1 and HMA <= HMA[1] then HMA else double.nan; CCU_D.SetDefaultColor(COLOR.DARK_GREEN); CCU_D.SetLineWeight(1); plot CCU_I = if concavity == 1 and HMA > HMA[1] then HMA else double.nan; CCU_I.SetDefaultColor(COLOR.GREEN); CCU_I.SetLineWeight(1); #======= End of mobile HMA coloring support ============================= #Hull Label AddLabel(yes and labels and CCD_D, "HULL:SELL", color.RED); AddLabel(yes and labels and CCU_I, "HULL:BUY", color.green); AddLabel(yes and labels and CCU_D, "HULL:WEAK SELL", color.dark_green); AddLabel(yes and labels and CCD_I, "HULL:WEAK BUY", color.DARK_ORANGE); def Hull_is_buy = !IsNaN(CCD_I) or !IsNaN(CCU_I); def Hull_is_sell = !IsNaN(CCD_D) or !IsNaN(CCU_D); #============ Create Donchian Trend Ribbon values ======================================= # Donchian Trend Channel parameters input Donchian_Channel_Period = 20; #length to calculate main trend input DTC_Trend_Cutoff = 20; #value of sum of all trends to exceed to use for buy/sell signal input plotDTCResult = yes; input secondary_colors = { default yellow , green_red }; #======================================================================= # Donchian Trend Channel calcs # all plots have been removed leaving only the value calculations # How it works ? # - it calculates main trend direction by using the length that is user-defined. so you can change it as you wish # - then it calculates trend direction for each 9 lower lengths. if you set the length = 20 then the lengths are 19, 18,...11 # - and it checks if the trend directions that came from lower lengths is same or not with main trend direction. # - it changes the trend color of the ribbon. # ----------------------------- def dlen = if Donchian_Channel_Period < 10 then 10 else Donchian_Channel_Period; def na = Double.NaN; script dchannel { input len = 0; def hh = Highest(high, len); def ll = Lowest(low, len); def trend = if BarNumber() == 1 then 0 else if close > hh[1] then 1 else if close < ll[1] then -1 else trend[1]; plot z = trend; } script dchannelalt { input len = 0; input maintrend = 0; def hh = Highest(high, len); def ll = Lowest(low, len); def trend = if BarNumber() == 1 then 0 else if close > hh[1] then 1 else if close < ll[1] then -1 else trend[1]; def maincolor = if maintrend == 1 then if trend == 1 then 2 else 1 else if maintrend == -1 then if trend == -1 then -2 else -1 else 0; plot color = maincolor; } def maintrend = dchannel(dlen); # --------------------------------- def c01 = dchannelalt(dlen - 0, maintrend); def c02 = dchannelalt(dlen - 1, maintrend); def c03 = dchannelalt(dlen - 2, maintrend); def c04 = dchannelalt(dlen - 3, maintrend); def c05 = dchannelalt(dlen - 4, maintrend); def c06 = dchannelalt(dlen - 5, maintrend); def c07 = dchannelalt(dlen - 6, maintrend); def c08 = dchannelalt(dlen - 7, maintrend); def c09 = dchannelalt(dlen - 8, maintrend); def c10 = dchannelalt(dlen - 9, maintrend); # ----------------------------- # add up color numbers, to come up with a 'trend' number , 20 to -20 def colorsum = ( c01 + c02 + c03 + c04 + c05 + c06 + c07 + c08 + c09 + c10 ); # colors # 2 - up trend - green # 1 - up trend - dark green # 0 no trend # -1 - down trend - dark red # -2 - down trend - red def DTC_Result = if colorsum >= DTC_Trend_Cutoff then 1 else if colorsum <= -DTC_Trend_Cutoff then -1 else 0; def seccolor; switch (secondary_colors) { case yellow: seccolor = 1; case green_red: seccolor = 2; } # colors # 2 - up trend - green # 1 - up trend - dark green # 0 no trend # -1 - down trend - dark red # -2 - down trend - red plot DTC_Trend = if (plotDTCResult) then (0.995 * low) else na; DTC_Trend.SetPaintingStrategy(PaintingStrategy.LINE); DTC_Trend.SetLineWeight(3); DTC_Trend.DefineColor("up2", Color.GREEN); DTC_Trend.DefineColor("up1", Color.DARK_GREEN); DTC_Trend.DefineColor("none", Color.DARK_GRAY); DTC_Trend.DefineColor("dwn1", Color.DARK_RED); DTC_Trend.DefineColor("dwn2", Color.RED); DTC_Trend.DefineColor("alt1", Color.YELLOW); DTC_Trend.AssignValueColor( if colorsum >= DTC_Trend_Cutoff then DTC_Trend.Color("up2") else if (colorsum > 0 and colorsum < DTC_Trend_Cutoff) and seccolor == 1 then DTC_Trend.Color("alt1") else if (colorsum > 0 and colorsum < DTC_Trend_Cutoff) and seccolor == 2 then DTC_Trend.Color("up1") else if colorsum <= -DTC_Trend_Cutoff then DTC_Trend.Color("dwn2") else if (colorsum < 0 and colorsum > -DTC_Trend_Cutoff) and seccolor == 1 then DTC_Trend.Color("alt1") else if (colorsum < 0 and colorsum > -DTC_Trend_Cutoff) and seccolor == 2 then DTC_Trend.Color("dwn1") else Color.GRAY); DTC_Trend.SetHiding(!plotDTCResult); def DTC_is_buy = if colorsum >= DTC_Trend_Cutoff then yes else no; def DTC_is_sell = if colorsum <= -DTC_Trend_Cutoff then yes else no; # === End of Donchian Trend Channel code === #Target lines # created by chewie #=========== Determine long stoploss, entry point, and target lines ===================== #Stop Loss = minimum point of Hull MA def line = if IsNaN(MA_Min) then line[1] else MA_Min[0]; plot L_stoploss = if IsNaN(MA_Min) and Hull_is_buy and Long and DTC_is_buy then line else double.nan; L_stoploss.setpaintingStrategy(paintingStrategy.LINE); L_stoploss.setlineWeight(3); L_stoploss.setdefaultColor(color.dark_green); L_stoploss.hideBubble(); def LSL = (if isNaN(L_stoploss[1]) then L_stoploss else Double.NaN); addchartBubble(Entry_SL_Bubbles and L_stoploss, LSL,"L/SL",color.DARK_GREEN); #Long Entry = final value of previous Supertrend (short) def line4 = if IsNaN(short) then line4[1] else short[0]; plot L_Entry = if IsNaN(short) and Hull_is_buy and DTC_is_buy then line4 else double.nan; L_Entry.setpaintingStrategy(paintingStrategy.LINE); L_Entry.setlineWeight(3); L_Entry.setdefaultColor(color.green); L_Entry.hideBubble(); def LE = (if isNaN(L_Entry[1]) then L_Entry else Double.NaN); addchartBubble(Entry_SL_Bubbles and L_Entry, LE,"L/E",color.GREEN); #HalfX Long plot x1a_Long = if Targetlines and L_Entry then (L_Entry + (L_Entry - L_Stoploss)/2) else double.nan; x1a_Long.setpaintingStrategy(paintingStrategy.dashes); x1a_Long.setlineWeight(1); x1a_Long.setdefaultColor(color.magenta); x1a_Long.hideBubble(); def x1aL = (if isNaN(x1a_Long[1]) then x1a_Long else Double.NaN); addchartBubble(Target_Bubbles and x1a_Long, x1aL,"1/2xL",color.magenta); #OneX Long plot x1_Long = if Targetlines and x1a_Long > line4 then (L_Entry +(L_Entry - L_Stoploss)) else double.nan; x1_Long.setpaintingStrategy(paintingStrategy.dashes); x1_Long.setlineWeight(1); x1_Long.setdefaultColor(color.yellow); def X1L = (if isNaN(x1_Long[1]) then x1_Long else Double.NaN); addchartBubble(Target_Bubbles and x1_Long, x1L,"1xL",color.yellow); #TwoX Long plot x2_Long = if Targetlines then x1_Long + (L_Entry - L_Stoploss) else double.nan; x2_Long.setpaintingStrategy(paintingStrategy.dashes); x2_Long.setlineWeight(2); x2_Long.setdefaultColor(color.light_red); def X2L = (if isNaN(x2_Long[1]) then x2_Long else Double.NaN); addchartBubble(Target_Bubbles and x2_Long, x2L,"2xL",color.light_red); #ThreeX Long plot x3_Long = if Targetlines then x2_Long + (L_Entry - L_Stoploss) else double.nan; x3_Long.setpaintingStrategy(paintingStrategy.dashes); x3_Long.setlineWeight(1); x3_Long.setdefaultColor(color.cyan); def X3L = (if isNaN(x3_Long[1]) then x3_Long else Double.NaN); addchartBubble(Target_Bubbles and x3_Long, x3L,"3xL",color.cyan); #FourX Long plot x4_Long = if Targetlines then x3_Long + (L_Entry - L_Stoploss) else double.nan; x4_Long.setpaintingStrategy(paintingStrategy.dashes); x4_Long.setlineWeight(1); x4_Long.setdefaultColor(color.white); def X4L = (if isNaN(x4_Long[1]) then x4_Long else Double.NaN); addchartBubble(Target_Bubbles and x4_Long, x4L,"4xL",color.white); #=========== Determine short stoploss, entry point, and target lines ===================== rec line2 = if IsNaN(MA_Max) then line2[1] else MA_Max[0]; plot S_stoploss = if IsNaN(MA_MAX) and Short and Hull_is_sell and DTC_is_sell then line2 else double.nan; S_stoploss.setpaintingStrategy(paintingStrategy.LINE); S_stoploss.setlineWeight(3); S_stoploss.setdefaultColor(color.dark_red); S_stoploss.hideBubble(); def SSL = (if isNaN(S_stoploss[1]) then S_stoploss else Double.NaN); addchartBubble(Entry_SL_Bubbles and S_stoploss, SSL,"S/SL",color.DARK_RED); #Short Entry rec line3 = if IsNaN(long) then line3[1] else long[0]; plot S_Entry = if IsNaN(long) and Hull_is_sell and DTC_is_sell then line3 else double.nan; S_Entry.setpaintingStrategy(paintingStrategy.LINE); S_Entry.setlineWeight(3); S_Entry.setdefaultColor(color.red); S_Entry.hideBubble(); def SE = (if isNaN(S_Entry[1]) then S_Entry else Double.NaN); addchartBubble(Entry_SL_Bubbles and S_Entry, SE,"S/E",color.RED); #HalfX Short plot x1a_Short = if Targetlines and S_Entry then (S_Entry - (S_Stoploss - S_Entry)/2) else double.nan; x1a_Short.setpaintingStrategy(paintingStrategy.dashes); x1a_Short.setlineWeight(1); x1a_Short.setdefaultColor(color.magenta); x1a_Short.hideBubble(); def x1a = (if isNaN(x1a_Short[1]) then x1a_Short else Double.NaN); addchartBubble(Target_Bubbles and x1a_Short, x1a,"1/2xS",color.magenta); #OneX Short plot x1_Short = if Targetlines and x1a_short < line3 then (S_Entry -(S_Stoploss - S_Entry)) else double.nan; x1_Short.setpaintingStrategy(paintingStrategy.dashes); x1_Short.setlineWeight(1); x1_Short.setdefaultColor(color.yellow); def X1S = (if isNaN(x1_Short[1]) then x1_Short else Double.NaN); addchartBubble(Target_Bubbles and x1_Short, x1S,"1xS",color.yellow); #TwoX Short plot x2_Short = if Targetlines then x1_Short - (S_Stoploss - S_Entry) else double.nan; x2_Short.setpaintingStrategy(paintingStrategy.dashes); x2_Short.setlineWeight(2); x2_Short.setdefaultColor(color.light_green); def X2S = (if isNaN(x2_Short[1]) then x2_Short else Double.NaN); addchartBubble(Target_Bubbles and x2_Short, x2S,"2xS",color.light_green); #ThreeX Short plot x3_Short = if Targetlines then x2_Short - (S_Stoploss - S_Entry) else double.nan; x3_Short.setpaintingStrategy(paintingStrategy.dashes); x3_Short.setlineWeight(1); x3_Short.setdefaultColor(color.cyan); def X3S = (if isNaN(x3_Short[1]) then x3_Short else Double.NaN); addchartBubble(Target_Bubbles and x3_Short, x3S,"3xS",color.cyan); #FourX Short plot x4_Short = if Targetlines then x3_Short - (S_Stoploss - S_Entry) else double.nan; x4_Short.setpaintingStrategy(paintingStrategy.dashes); x4_Short.setlineWeight(1); x4_Short.setdefaultColor(color.white); def X4S = (if isNaN(x4_Short[1]) then x4_Short else Double.NaN); addchartBubble(Target_Bubbles and x4_Short, x4S,"4xS",color.white); #================================================================= #LinearRegCh100 RegressionDivergence - Trigger Lines - Trend Cross # From Lizard Indicators Link: https://www.lizardindicators.com/trigger-lines-cross-vs-thrust/ # Line #1 - Fast = LinReg (80) # Line #2 - Slow = EXPEMA[LinReg (80)] input LinRegLength = 80; input EMAlength = 20; input ColorOn = yes; #Color price bars based on linear reg input ShowDynoLines = yes; #Definitions def price1 = close; def displace = 0; def LinReg = Inertia(price1[-displace], LinRegLength); def EMA_LR = ExpAverage(LinReg[-displace], EMAlength); def Body = (open + close)/2; # Defining Long/Short Filters (these instructions determine entries / exits) # Entry Requirements def Long_Entry = close > LinReg and close > EMA_LR and body > LinReg and body > EMA_LR and close > high[1] and body > body[1]; # LinReg > LinReg[1] and def Long_Stay_In = close > LinReg and close > EMA_LR; def Long_Exit = (close < LinReg or close < EMA_LR) or Long_Stay_In == 0; def Long_State = If Long_Entry then 1 else if Long_Exit then 0 else Long_State[1]; def Long1 = Long_State; # Exit Requirements def Short_Entry = close < LinReg and close < EMA_LR and body < LinReg and body < EMA_LR and close < low[1] and body < body[1]; # LinReg < LinReg[1] and def Short_Stay_In = close < LinReg and close < EMA_LR; def Short_Exit = (close > LinReg or close > EMA_LR) or Short_Stay_In == 0; def Short_State = If Short_Entry then 1 else if Short_Exit then 0 else Short_State[1]; def Short1 = Short_State; #Adding plot lines for Linear Regression averages plot LR = if ShowDynoLines then LinReg else double.NaN; LR.SetDefaultColor(CreateColor(0, 130, 255)); LR.setlineweight(1); plot EMA_LinReg = if ShowDynoLines then EMA_LR else double.NaN; EMA_LinReg.SetDefaultColor(CreateColor(255, 215,0)); EMA_LinReg.setlineweight(2); #Add cloud between linear reg and EMA of lin reg lines DefineGlobalColor("Bullish", Color.dark_Green); DefineGlobalColor("Bearish", Color.dark_Red); AddCloud(EMA_LinReg, LR, GlobalColor("Bearish"), GlobalColor("Bullish")); #DYNO Label AddLabel(yes and labels and Short1, "DYNO:BEARISH", color.RED); AddLabel(yes and labels and Long1, "DYNO:BULLISH", color.green); AddLabel(yes and labels and Long1 == Short1, "DYNO:NEUTRAL", color.YELLOW); #Regression Bands input deviations = 1.618; #set your deviation units here. input length = 500; #set your channel lookback period here. def stdDeviation = StDevAll(price, length); plot HighBand = if Bands then EMA_LinReg + deviations * stdDeviation else double.nan; HighBand.SetDefaultColor(Color.red); plot LowBand = if Bands then EMA_LinReg - deviations * stdDeviation else double.nan; LowBand.SetDefaultColor(Color.green); DefineGlobalColor("Bullish", Color.light_green); DefineGlobalColor("Bearish", Color.light_RED); # Coloring Bars AssignPriceColor(if ColorON and Long_State then Color.GREEN else if ColorON and Short_State then Color.RED else Color.Yellow); #==========End Dyno / Lin Reg Section ============================ #========= Plot Long Moving Average ============================== input lengthAvgEXP = 200; plot AvgExp = ExpAverage(price[-displace], lengthAvgExp); AvgExp.SetDefaultColor(Color.white); AvgExp.setlineweight(2); #========== End Long Moving Average ============================= ################### # # ALERTS # ################### Alert(alertON and LongTrigger, "Long Entry", Alert.BAR, Sound.Ding); Alert(alertON and ShortTrigger, "Short Entry", Alert.BAR, Sound.Ding); Alert(alertON and Buysetup, "HULL Buy", Alert.BAR, Sound.Bell); Alert(alertON and Sellsetup, "HULL Sell", Alert.BAR, Sound.Bell); Alert(alertON and high > highband, "Short Band", Alert.BAR, Sound.Ding); Alert(alertON and low < lowband, "Long Band", Alert.BAR, Sound.Ding);

Is there an updated code for us to use?Ok, I like what you've done here. Great! Also, the other lines of code you grayed out are not needed. I think it was from aspects of other indicators that didn't add value to this strategy and I didn't remove them completely. Thanks.

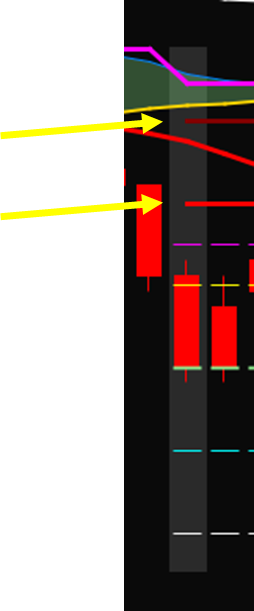

Are you referring to something like this, where the entry and stop loss lines seem to start at the midpoint of the bar, and the 1/2x, 1x, etc lines start at the beginning of the bar?Thanks for us!

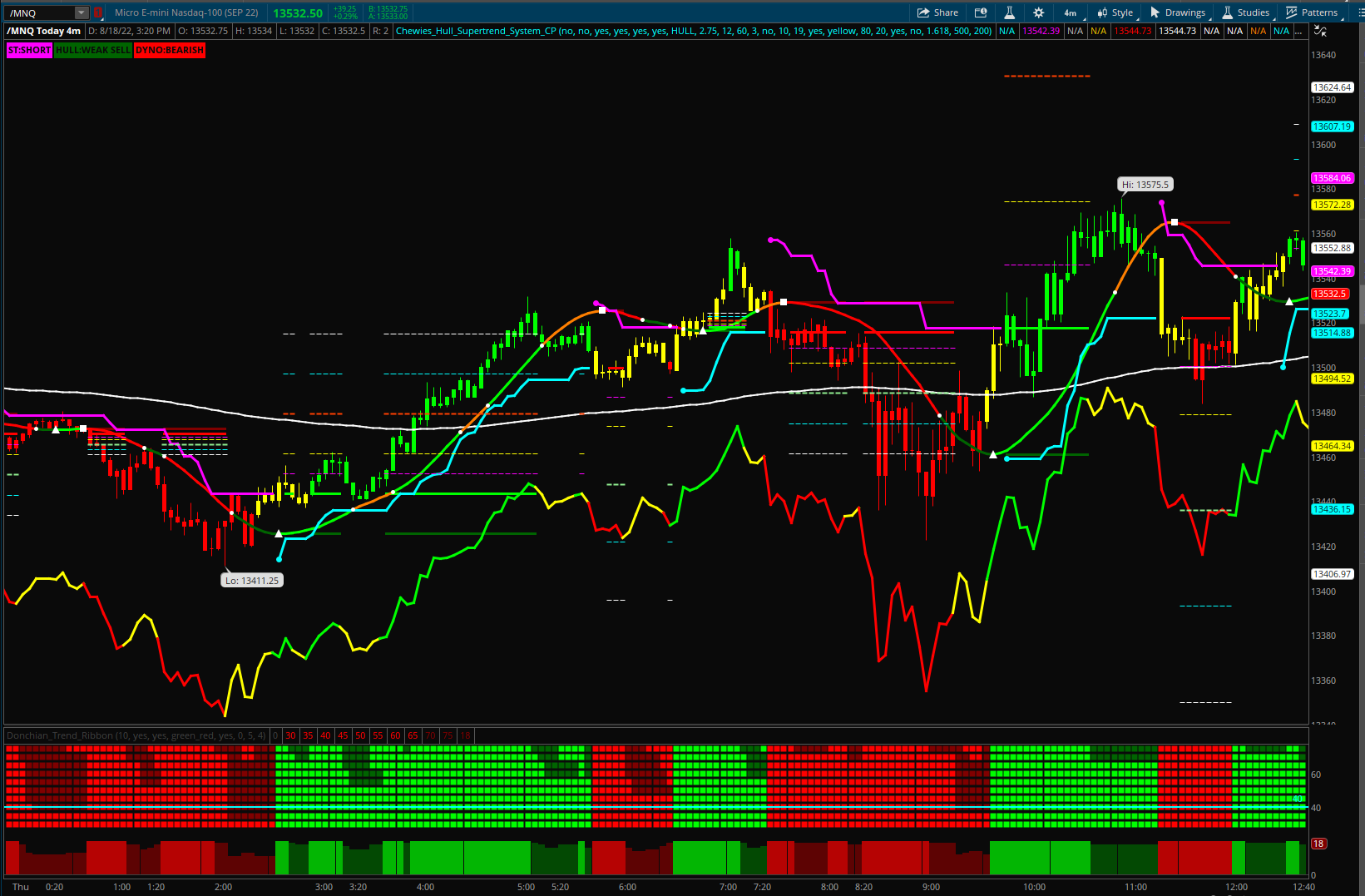

Something I have noticed is the Short/Long Entry does not line up with the candles like the original script from chewie. 4m ES today had some misalignment.

The code posted in my first post has the code that Chewie and I have been discussing. I haven't made any changes to it, yet (Chewie seemed ok with it, and Robster021 may have found something that will need to be fixed, but nothing done yet).Is there an updated code for us to use?

Hi, trying to figure out how to add images - but I'm referring to 8/18 at 9.24 and 12.40 on the 4min TF on /ES. Another one but not so bad at 14.52.Are you referring to something like this, where the entry and stop loss lines seem to start at the midpoint of the bar, and the 1/2x, 1x, etc lines start at the beginning of the bar?

If so, I see that in Chewie's original code too. Here's an example of nearly the same place in the day with his code (note the 2x line is offset):

I think it's just the way that TOS draws the lines with the different styles. Seems like the solid lines begin at the midpoint of the bar, while the dashed lines start at the left edge. They're all actually on the same bar - it just looks funny.

If it's something else that you're seeing, please give me a time of day to look at, so I can try to track it down better.

What settings are you using for the various inputs? When I add my modified version of the script with default inputs, the 9:24 bar is in the middle of an existing trade, and there's no trade on at 12:40 or 14:52 (I guess another important question is what time zone are you in? My display is based on CDT, so if you're somewhere else, I need to adjust.)Hi, trying to figure out how to add images - but I'm referring to 8/18 at 9.24 and 12.40 on the 4min TF on /ES. Another one but not so bad at 14.52.

I'm using EST market hours zone - easiest to reference.What settings are you using for the various inputs? When I add my modified version of the script with default inputs, the 9:24 bar is in the middle of an existing trade, and there's no trade on at 12:40 or 14:52 (I guess another important question is what time zone are you in? My display is based on CDT, so if you're somewhere else, I need to adjust.)

Here's the thread with instructions for posting images: https://usethinkscript.com/threads/how-to-insert-image-in-a-post-thread.277/

Here you go - Time is EST on ES 4min yesterday 8/18:What settings are you using for the various inputs? When I add my modified version of the script with default inputs, the 9:24 bar is in the middle of an existing trade, and there's no trade on at 12:40 or 14:52 (I guess another important question is what time zone are you in? My display is based on CDT, so if you're somewhere else, I need to adjust.)

Here's the thread with instructions for posting images: https://usethinkscript.com/threads/how-to-insert-image-in-a-post-thread.277/