I have an idea for an indicator but I have no idea how to go about implementing it, so I figured I'd throw out the idea and if anyone seemed interested maybe they could give it a shot and help me implement it. So the idea is for an indicator to give you signals based on the candlestick quality of the previous x number of candles including the current one.

To give you an idea of what I mean by "quality", take bullish candles for example. If the candle has a long lower wick relative to the body, I would consider that very poor. If it has a medium sized lower wick, I would consider that weak. If the lower wick is tiny I would consider that relatively good. The same works with the upper wicks on bullish candles, and you would have to factor both. For example if a candle has a long upper and lower wick then it would be a very poor quality candle (not referring to doji candles). The same logic works for bearish candles but backwards.

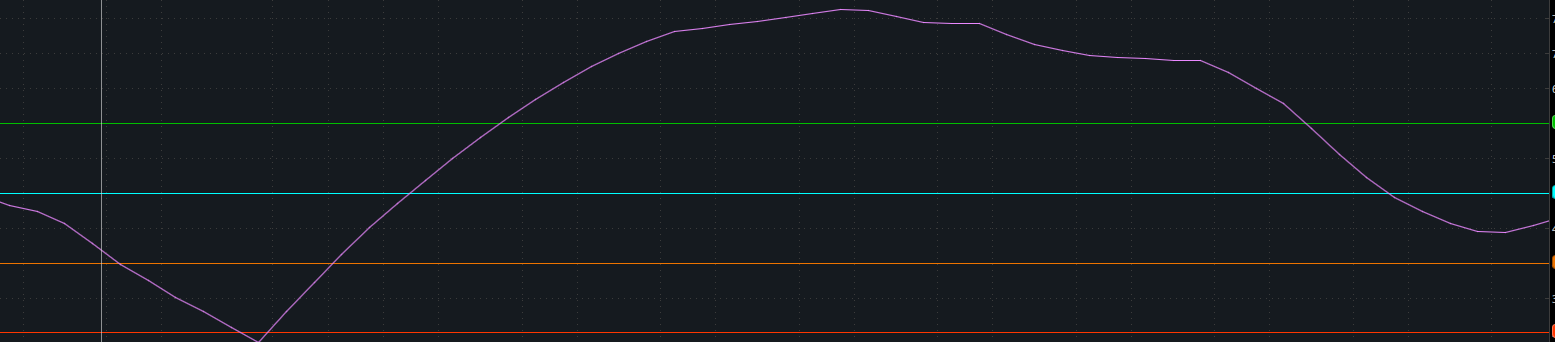

As for the signals themselves, for the "previous x candles" part of it, maybe it would take the average quality of the past candles and it would be plotted on a lower study perhaps separated by a certain number of levels like -2 for very poor, -1 for poor, 0 for average, 1 for good, 2 for great. It would look something like this: red being very poor, orange being poor, etc.

Also for the upper chart it could have colored dots beneath each candle, with each color representing a different candle strength. That's essentially the idea I have. Why I like the idea is because you can't really rely on indicators purely to trade, you kind of have to take into account price action and look at what the candles are doing. This in a roundabout way automates that in the form of an indicator. It's not the entire picture but I personally look at candle quality before I enter any trade. Please share your thoughts.

To give you an idea of what I mean by "quality", take bullish candles for example. If the candle has a long lower wick relative to the body, I would consider that very poor. If it has a medium sized lower wick, I would consider that weak. If the lower wick is tiny I would consider that relatively good. The same works with the upper wicks on bullish candles, and you would have to factor both. For example if a candle has a long upper and lower wick then it would be a very poor quality candle (not referring to doji candles). The same logic works for bearish candles but backwards.

As for the signals themselves, for the "previous x candles" part of it, maybe it would take the average quality of the past candles and it would be plotted on a lower study perhaps separated by a certain number of levels like -2 for very poor, -1 for poor, 0 for average, 1 for good, 2 for great. It would look something like this: red being very poor, orange being poor, etc.

Also for the upper chart it could have colored dots beneath each candle, with each color representing a different candle strength. That's essentially the idea I have. Why I like the idea is because you can't really rely on indicators purely to trade, you kind of have to take into account price action and look at what the candles are doing. This in a roundabout way automates that in the form of an indicator. It's not the entire picture but I personally look at candle quality before I enter any trade. Please share your thoughts.

Last edited: