You should upgrade or use an alternative browser.

Camarilla Pivot Points for ThinkOrSwim

- Thread starter zeek

- Start date

-

- Tags

- supportxresistance

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

input aggregationPeriod = AggregationPeriod.DAY;

input length = 1;

input displace = -1;

input showOnlyLastPeriod = no;

def PH = high(period = aggregationPeriod)[1];

def PL = low(period = aggregationPeriod)[1];

#def PC = close(period = aggregationPeriod)[1];

input start = 1945;

input marketClose = 2000;

def closeCounter = SecondsTillTime(marketClose) >= 0 and SecondsFromTime(start) >= 0;

rec PC = if closecounter and !isnan(close) then close else PC[1];

plot R5;

plot R4;

plot R3;

plot R2;

plot R1;

plot S1;

plot S2;

plot S3;

plot S4;

plot S5;

R1 = PC + (PH-PL)*1.1/12;

R2 = PC + (PH-PL)*1.1/6;

R3 = PC + (PH-PL)*1.1/4;

R4 = PC + (PH-PL)*1.1/2;

R5 = (PH/PL)* PC;

S1 = PC - (PH-PL)*1.1/12;

S2 = PC - (PH-PL)*1.1/6;

S3 = PC - (PH-PL)*1.1/4;

S4 = PC - (PH-PL)*1.1/2;

S5 = PC - (R5 - PC);

R5.SetDefaultColor(GetColor(5));

R4.SetDefaultColor(GetColor(5));

R3.SetDefaultColor(GetColor(5));

R2.SetDefaultColor(GetColor(5));

R1.SetDefaultColor(GetColor(5));

S1.SetDefaultColor(GetColor(6));

S2.SetDefaultColor(GetColor(6));

S3.SetDefaultColor(GetColor(6));

S4.SetDefaultColor(GetColor(6));

S5.SetDefaultColor(GetColor(6));

R5.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

R4.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

R3.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

R2.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

R1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

S1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

S2.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

S3.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

S4.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

s5.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

R5.SetStyle(Curve.SHORT_DASH);

R4.SetStyle(Curve.SHORT_DASH);

R3.SetStyle(Curve.SHORT_DASH);

R2.SetStyle(Curve.SHORT_DASH);

R1.SetStyle(Curve.SHORT_DASH);

S1.SetStyle(Curve.SHORT_DASH);

S2.SetStyle(Curve.SHORT_DASH);

S3.SetStyle(Curve.SHORT_DASH);

S4.SetStyle(Curve.SHORT_DASH);

S5.SetStyle(Curve.SHORT_DASH);

bjjspiderguard

New member

For example I would like a scanner that could tell me pre-market what stocks are between :

plot R5 = (highValue / lowValue) * closeValue;

plot R4 = closeValue + range * (1.1) / 2;

If there is any way this could be done this would be extremely helpful. It doesn't have to be Thinkorswim only, maybe another platform can do it. Thank you very much.

Read more here --> https://usethinkscript.com/threads/camarilla-pivot-points-for-tos.696/#post-52940

bafna.abhishek

New member

bafna.abhishek

New member

But above site does only for Indian stock market. Can this be created? Let me know.

bafna.abhishek

New member

1) Todays camarilla H3 > Next Day camarilla H3

2) Todays camarilla L3 > Next Day camarilla L3

Logic:

Latest Close + (Latest High - Latest Low) * 0.275 < 1 Day ago Close + (1 Day ago Close - 1 day ago Low) * 0.275

Latest Close - (Latest High - Latest Low) * 0.275 > 1 Day ago Close + (1 Day ago Close - 1 day ago Low) * 0.275

Request someone to please put it in for scan.

Hope this helps. Let me know and i can provide any more information if needed.

Awaiting for positive reply.

Thanks.

bafna.abhishek

New member

I am looking for scanner which can scan stock on below.

Yes, I can provide the logic and it could be very easy for someone who has good knowledge on scans/scripts.

Concept:

1) Todays camarilla H3 > Next Day camarilla H3

2) Todays camarilla L3 > Next Day camarilla L3

Definitions:

Latest close = Days close/Close

Latest High = Days High/ High

Latest Low = Days low/Low

Logic:

Latest Close + (Latest High - Latest Low) * 0.275 < 1 Day ago Close + (1 Day ago Close - 1 day ago Low) * 0.275

Latest Close - (Latest High - Latest Low) * 0.275 > 1 Day ago Close + (1 Day ago Close - 1 day ago Low) * 0.275

Request someone to please put it in for scan.

Hope this helps. Let me know and i can provide any more information if needed.

PS from Trading View:

sopen = security(ticker, res1, open[1], barmerge.gaps_off, barmerge.lookahead_on)

shigh = security(ticker, res1, high[1], barmerge.gaps_off, barmerge.lookahead_on)

slow = security(ticker, res1, low[1], barmerge.gaps_off, barmerge.lookahead_on)

sclose = security(ticker, res1, close[1], barmerge.gaps_off, barmerge.lookahead_on)

sPrice = security(ticker, res2, close)

r = shigh-slow

//Calculate pivots

pivot = (shigh + slow + sclose) / 3

pivotBottom = (shigh + slow ) / 2

pivotTop = (pivot - pivotBottom) + pivot

h3=sclose + r*(1.1/4)

h4=sclose + r*(1.1/2)

h5=(shigh/slow)*sclose

l3=sclose - r*(1.1/4)

l4=sclose - r*(1.1/2)

l5=sclose - (h5-sclose)Awaiting for positive reply.

Thanks.

thealphabreed

Member

- choose the painting strategy (line, dots, triangles)

- choose whether or not to show the labels and price

The Camarilla Pivot Points study in Thinkorswim does not plot lines, nor does it show the labels (S1...S2...etc.) Can someone modify the study so I can

- choose the painting strategy (line, dots, triangles)

- choose whether or not to show the labels and price

The following has inputs to choose the painting strategy, hide_s1_r1 plots , show bubbles and within the bubbles whether to show the price.

Ruby:

Ruby:# # TD Ameritrade IP Company, Inc. (c) 2013-2021 # input aggregationPeriod = {default "DAY", "WEEK", "MONTH"}; input length = 25; input hide_s1_r1 = yes; input lines = {default dashes, points, triangles, horizontal, squares}; input showbubbles_description = yes; input showpricebubble = yes; Assert(length > 0, "'length' should be positive: " + length); def yyyymmdd = GetYYYYMMDD(); def month = GetYear() * 12 + GetMonth(); def day_number = DaysFromDate(First(yyyymmdd)) + GetDayOfWeek(First(yyyymmdd)); def period; switch (aggregationPeriod) { case DAY: period = CountTradingDays(Min(First(yyyymmdd), yyyymmdd), yyyymmdd) - 1; case WEEK: period = Floor(day_number / 7); case MONTH: period = Floor(month - First(month)); } def count = CompoundValue(1, if period != period[1] then (count[1] + period - period[1]) % length else count[1], 0); def start = CompoundValue(1, count < count[1] + period - period[1], yes); def highValue = if start then Highest(high(period = aggregationPeriod), length)[1] else if highValue[1] != 0 then highValue[1] else Double.NaN; def lowValue = if start then Lowest(low(period = aggregationPeriod), length)[1] else if lowValue[1] != 0 then lowValue[1] else Double.NaN; def closeValue = if start then close(period = aggregationPeriod)[1] else closeValue[1]; def range = highValue - lowValue; plot R5 = (highValue / lowValue) * closeValue; plot R4 = closeValue + range * (1.1) / 2; plot R3 = closeValue + range * (1.1) / 4; plot R2 = closeValue + range * (1.1) / 6; plot R1 = closeValue + range * (1.1) / 12; plot S1 = closeValue - range * (1.1) / 12; plot S2 = closeValue - range * (1.1) / 6; plot S3 = closeValue - range * (1.1) / 4; plot S4 = closeValue - range * (1.1) / 2; plot S5 = (closeValue - (R5 - closeValue)); R1.SetHiding(hide_s1_r1); S1.SetHiding(hide_s1_r1); R5.SetDefaultColor(GetColor(5)); R4.SetDefaultColor(GetColor(5)); R3.SetDefaultColor(GetColor(5)); R2.SetDefaultColor(GetColor(5)); R1.SetDefaultColor(GetColor(5)); S1.SetDefaultColor(GetColor(6)); S2.SetDefaultColor(GetColor(6)); S3.SetDefaultColor(GetColor(6)); S4.SetDefaultColor(GetColor(6)); S5.SetDefaultColor(GetColor(6)); def paintingStrategy = if lines == lines.points then PaintingStrategy.POINTS else if lines == lines.triangles then PaintingStrategy.TRIANGLES else if lines == lines.dashes then PaintingStrategy.DASHES else if lines == lines.horizontal then PaintingStrategy.HORIZONTAL else PaintingStrategy.SQUARES; R5.SetPaintingStrategy(paintingStrategy); R4.SetPaintingStrategy(paintingStrategy); R3.SetPaintingStrategy(paintingStrategy); R2.SetPaintingStrategy(paintingStrategy); R1.SetPaintingStrategy(paintingStrategy); S1.SetPaintingStrategy(paintingStrategy); S2.SetPaintingStrategy(paintingStrategy); S3.SetPaintingStrategy(paintingStrategy); S4.SetPaintingStrategy(paintingStrategy); S5.SetPaintingStrategy(paintingStrategy); #Bubbles to describe Pivot Levels input bubblemover = 8; def n = bubblemover; def n1 = n + 1; def StartPlot = if showbubbles_description == yes then (IsNaN(close[n]) and !IsNaN(close[n1])) else Double.NaN; AddChartBubble(StartPlot, R5[n1], "R5 " + (if showpricebubble then AsText(R5[n1]) else ""), Color.RED, if close[n1] > R5[n1] then no else yes); AddChartBubble(StartPlot, R4[n1], "R4 " + (if showpricebubble then AsText(R4[n1]) else ""), Color.RED, if close[n1] > R4[n1] then no else yes); AddChartBubble(StartPlot, R3[n1], "R3 " + (if showpricebubble then AsText(R3[n1]) else ""), Color.RED, if close[n1] > R3[n1] then no else yes); AddChartBubble(StartPlot, R2[n1], "R2 " + (if showpricebubble then AsText(R2[n1]) else ""), Color.RED, if close[n1] > R2[n1] then no else yes); AddChartBubble(StartPlot and hide_s1_r1 == no, R1[n1], "R1 " + (if showpricebubble then AsText(R1[n1]) else ""), Color.RED, if close[n1] > R1[n1] then no else yes); AddChartBubble(StartPlot, S5[n1], "S5 " + (if showpricebubble then AsText(S5[n1]) else ""), Color.GREEN, if close[n1] > S5[n1] then no else yes); AddChartBubble(StartPlot, S4[n1], "S4 " + (if showpricebubble then AsText(S4[n1]) else ""), Color.GREEN, if close[n1] > S4[n1] then no else yes); AddChartBubble(StartPlot, S3[n1], "S3 " + (if showpricebubble then AsText(S3[n1]) else ""), Color.GREEN, if close[n1] > S3[n1] then no else yes); AddChartBubble(StartPlot, S2[n1], "S2 " + (if showpricebubble then AsText(S2[n1]) else ""), Color.GREEN, if close[n1] > S2[n1] then no else yes); AddChartBubble(StartPlot and hide_s1_r1 == no, S1[n1], "S1 " + (if showpricebubble then AsText(S1[n1]) else ""), Color.GREEN, if close[n1] > S1[n1] then no else yes); R1.HideBubble(); R2.HideBubble(); R3.HideBubble(); R4.HideBubble(); R5.HideBubble(); S1.HideBubble(); S2.HideBubble(); S3.HideBubble(); S4.HideBubble(); S5.HideBubble();

thealphabreed

Member

Thanks bro.The following has inputs to choose the painting strategy, hide_s1_r1 plots , show bubbles and within the bubbles whether to show the price.

I tried using this. It still does not show the labels on the 15min chart

It shows bubbles (labels at the lines). If you are wanting labels at the top of the chart, it is now an option in the code below.Thanks bro.

I tried using this. It still does not show the labels

Ruby:# # TD Ameritrade IP Company, Inc. (c) 2013-2021 # input aggregationPeriod = {default "DAY", "WEEK", "MONTH"}; input length = 25; input hide_s1_r1 = yes; input lines = {default dashes, points, triangles, horizontal, squares}; input showbubbles_description = yes; input showpricebubble = yes; input showlabels = yes; Assert(length > 0, "'length' should be positive: " + length); def yyyymmdd = GetYYYYMMDD(); def month = GetYear() * 12 + GetMonth(); def day_number = DaysFromDate(First(yyyymmdd)) + GetDayOfWeek(First(yyyymmdd)); def period; switch (aggregationPeriod) { case DAY: period = CountTradingDays(Min(First(yyyymmdd), yyyymmdd), yyyymmdd) - 1; case WEEK: period = Floor(day_number / 7); case MONTH: period = Floor(month - First(month)); } def count = CompoundValue(1, if period != period[1] then (count[1] + period - period[1]) % length else count[1], 0); def start = CompoundValue(1, count < count[1] + period - period[1], yes); def highValue = if start then Highest(high(period = aggregationPeriod), length)[1] else if highValue[1] != 0 then highValue[1] else Double.NaN; def lowValue = if start then Lowest(low(period = aggregationPeriod), length)[1] else if lowValue[1] != 0 then lowValue[1] else Double.NaN; def closeValue = if start then close(period = aggregationPeriod)[1] else closeValue[1]; def range = highValue - lowValue; plot R5 = (highValue / lowValue) * closeValue; plot R4 = closeValue + range * (1.1) / 2; plot R3 = closeValue + range * (1.1) / 4; plot R2 = closeValue + range * (1.1) / 6; plot R1 = closeValue + range * (1.1) / 12; plot S1 = closeValue - range * (1.1) / 12; plot S2 = closeValue - range * (1.1) / 6; plot S3 = closeValue - range * (1.1) / 4; plot S4 = closeValue - range * (1.1) / 2; plot S5 = (closeValue - (R5 - closeValue)); R1.SetHiding(hide_s1_r1); S1.SetHiding(hide_s1_r1); R5.SetDefaultColor(GetColor(5)); R4.SetDefaultColor(GetColor(5)); R3.SetDefaultColor(GetColor(5)); R2.SetDefaultColor(GetColor(5)); R1.SetDefaultColor(GetColor(5)); S1.SetDefaultColor(GetColor(6)); S2.SetDefaultColor(GetColor(6)); S3.SetDefaultColor(GetColor(6)); S4.SetDefaultColor(GetColor(6)); S5.SetDefaultColor(GetColor(6)); def paintingStrategy = if lines == lines.points then PaintingStrategy.POINTS else if lines == lines.triangles then PaintingStrategy.TRIANGLES else if lines == lines.dashes then PaintingStrategy.DASHES else if lines == lines.horizontal then PaintingStrategy.HORIZONTAL else PaintingStrategy.SQUARES; R5.SetPaintingStrategy(paintingStrategy); R4.SetPaintingStrategy(paintingStrategy); R3.SetPaintingStrategy(paintingStrategy); R2.SetPaintingStrategy(paintingStrategy); R1.SetPaintingStrategy(paintingStrategy); S1.SetPaintingStrategy(paintingStrategy); S2.SetPaintingStrategy(paintingStrategy); S3.SetPaintingStrategy(paintingStrategy); S4.SetPaintingStrategy(paintingStrategy); S5.SetPaintingStrategy(paintingStrategy); #Labels Addlabel(showlabels, "R5 " + AsText(R5), Color.RED); Addlabel(showlabels, "R4 " + AsText(R4), Color.RED); Addlabel(showlabels, "R3 " + AsText(R3), Color.RED); Addlabel(showlabels, "R2 " + AsText(R2), Color.RED); Addlabel(showlabels, "R1 " + AsText(R1), Color.RED); Addlabel(showlabels, "S5 " + AsText(S5), Color.GREEN); Addlabel(showlabels, "S4 " + AsText(S4), Color.GREEN); Addlabel(showlabels, "S3 " + AsText(S3), Color.GREEN); Addlabel(showlabels, "S2 " + AsText(S2), Color.GREEN); Addlabel(showlabels, "S1 " + AsText(S1), Color.GREEN); #Bubbles to describe Pivot Levels input bubblemover = 8; def n = bubblemover; def n1 = n + 1; def StartPlot = if showbubbles_description == yes then (IsNaN(close[n]) and !IsNaN(close[n1])) else Double.NaN; AddChartBubble(StartPlot, R5[n1], "R5 " + (if showpricebubble then AsText(R5[n1]) else ""), Color.RED, if close[n1] > R5[n1] then no else yes); AddChartBubble(StartPlot, R4[n1], "R4 " + (if showpricebubble then AsText(R4[n1]) else ""), Color.RED, if close[n1] > R4[n1] then no else yes); AddChartBubble(StartPlot, R3[n1], "R3 " + (if showpricebubble then AsText(R3[n1]) else ""), Color.RED, if close[n1] > R3[n1] then no else yes); AddChartBubble(StartPlot, R2[n1], "R2 " + (if showpricebubble then AsText(R2[n1]) else ""), Color.RED, if close[n1] > R2[n1] then no else yes); AddChartBubble(StartPlot and hide_s1_r1 == no, R1[n1], "R1 " + (if showpricebubble then AsText(R1[n1]) else ""), Color.RED, if close[n1] > R1[n1] then no else yes); AddChartBubble(StartPlot, S5[n1], "S5 " + (if showpricebubble then AsText(S5[n1]) else ""), Color.GREEN, if close[n1] > S5[n1] then no else yes); AddChartBubble(StartPlot, S4[n1], "S4 " + (if showpricebubble then AsText(S4[n1]) else ""), Color.GREEN, if close[n1] > S4[n1] then no else yes); AddChartBubble(StartPlot, S3[n1], "S3 " + (if showpricebubble then AsText(S3[n1]) else ""), Color.GREEN, if close[n1] > S3[n1] then no else yes); AddChartBubble(StartPlot, S2[n1], "S2 " + (if showpricebubble then AsText(S2[n1]) else ""), Color.GREEN, if close[n1] > S2[n1] then no else yes); AddChartBubble(StartPlot and hide_s1_r1 == no, S1[n1], "S1 " + (if showpricebubble then AsText(S1[n1]) else ""), Color.GREEN, if close[n1] > S1[n1] then no else yes); R1.HideBubble(); R2.HideBubble(); R3.HideBubble(); R4.HideBubble(); R5.HideBubble(); S1.HideBubble(); S2.HideBubble(); S3.HideBubble(); S4.HideBubble(); S5.HideBubble();

here is a 15m chart of GME with the bubbles showing.

thealphabreed

Member

It is working. I had to increase "number of bars to the right" setting to 10It works for me. Make sure you the right expansion is set enough to display the bubble/label. You can also move the bubbles right/left at the bubblemover input.

here is a 15m chart of GME with the bubbles showing.

Hello there! I know you are a brilliant coder! I am trying to create a condition for Cam study and I am having a hard time doing it. Condition: if price OPENs at 9:30am EST between S3 and S4 (open of the first candle of the day) then a candle which crosses above S3 gets a "buy" bubble (it can happen anytime between 9:30am and 4pm). I want to display a "buy" bubble only ONCE if that condition is met meaning if a candle gets a bubble then no other candles after will get a bubble again even if their CLOSE crosses above S3 again so it will not overcrowd the chart with bubbles.It works for me. Make sure your right expansion is set wide enough to display the bubble/label. You can also move the bubbles right/left at the bubblemover input.

here is a 15m chart of GME with the bubbles showing.

#first part would be your cam study

#then I added time condition 9:30am -16:00 (I don't want to display any bubbles during pre-market or after hours)

def sessionopen= 930;

def sessionclose=1600;

def secondsFromOpen = SecondsFromTime(sessionOpen);

def secondsUntilClose = SecondsTillTime(sessionClose);

def MarketOpen = if SecondsFromTime(0930) >= 0 and SecondsTillTime(1600) >= 0 then 1 else 0;

#now I was trying to create a condition: a. "open" of the day between S3 and S4

# b. 9:30am-4pm (time between this study is valid)

# c. candle crosses above S3

def buy = S3 > open(period = aggregationPeriod.DAY)> S4 and MarketOpen and (close crosses above S3);

addchartbubble(buy,low,"Buy",color.green, no);

what did I do wrong? or it should be if....then condition?! or maybe my market "open" condition is not correct ?

I would appreciate your help!

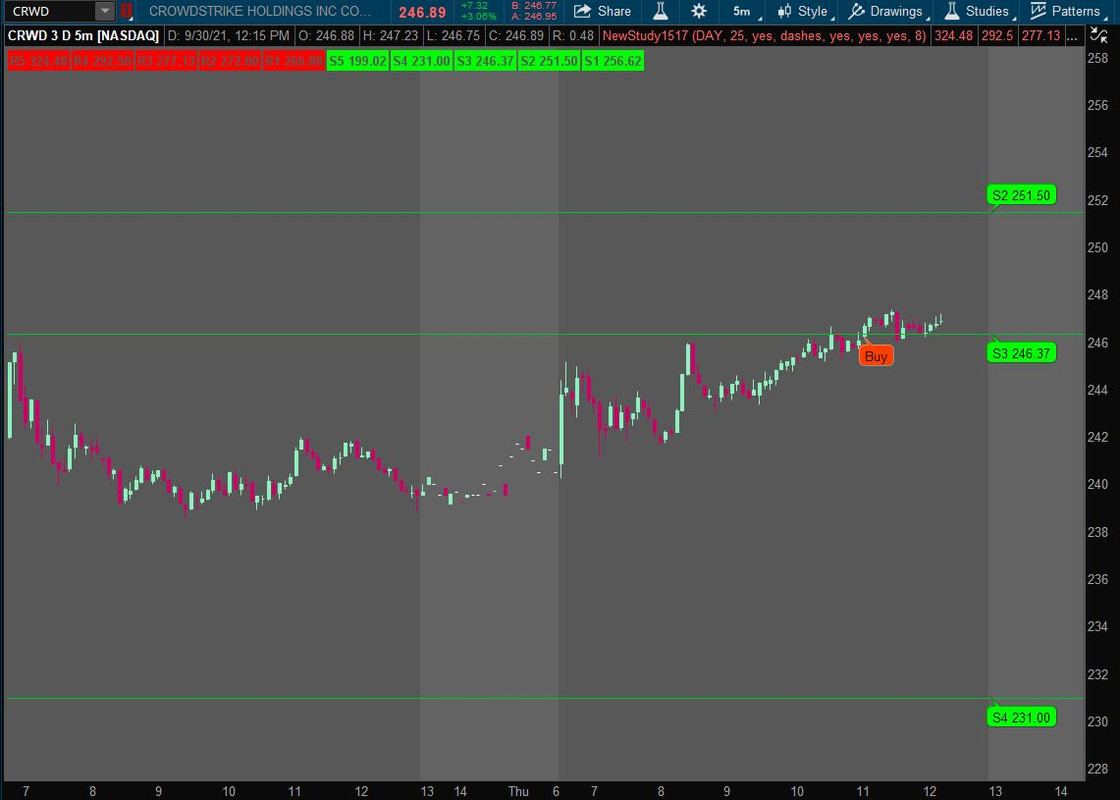

Example could be CRWD from today on 3D 5min chart

Hello there! I know you are a brilliant coder! I am trying to create a condition for Cam study and I am having a hard time doing it. Condition: if price OPENs at 9:30am EST between S3 and S4 (open of the first candle of the day) then a candle which crosses above S3 gets a "buy" bubble (it can happen anytime between 9:30am and 4pm). I want to display a "buy" bubble only ONCE if that condition is met meaning if a candle gets a bubble then no other candles after will get a bubble again even if their CLOSE crosses above S3 again so it will not overcrowd the chart with bubbles.

#first part would be your cam study

#then I added time condition 9:30am -16:00 (I don't want to display any bubbles during pre-market or after hours)

def sessionopen= 930;

def sessionclose=1600;

def secondsFromOpen = SecondsFromTime(sessionOpen);

def secondsUntilClose = SecondsTillTime(sessionClose);

def MarketOpen = if SecondsFromTime(0930) >= 0 and SecondsTillTime(1600) >= 0 then 1 else 0;

#now I was trying to create a condition: a. "open" of the day between S3 and S4

# b. 9:30am-4pm (time between this study is valid)

# c. candle crosses above S3

def buy = S3 > open(period = aggregationPeriod.DAY)> S4 and MarketOpen and (close crosses above S3);

addchartbubble(buy,low,"Buy",color.green, no);

what did I do wrong? or it should be if....then condition?! or maybe my market "open" condition is not correct ?

I would appreciate your help!

Example could be CRWD from today on 3D 5min chart

Try adding this to the code

Ruby:

Ruby:#S3 Buy Bubble ----------------------------------------------------------- def sessionopen= 930; def sessionclose=1600; def secondsFromOpen = SecondsFromTime(sessionOpen); def secondsUntilClose = SecondsTillTime(sessionClose); def MarketOpen = if getday() == getlastday() and SecondsFromTime(0930) >= 0 and SecondsTillTime(1600) >= 0 then 1 else 0; def cond1 = Between(open(period = aggregationPeriod), S4, S3) and marketopen; def cond2 = if isnan(cond2[1]) and cond1 and close crosses above S3 then 1 else cond2[1] + 1; AddChartBubble(cond2 == 1, low, "Buy", Color.LIGHT_RED, no);

You are AWESOMEEEEEEE! It works! I really appreciate it! I was losing my mind trying to figure it out.Try adding this to the code

p.s The only thing, I think, I shot myself in the foot was this piece of code:

def MarketOpen = if getday() == getlastday() and SecondsFromTime(0930) >= 0 and SecondsTillTime(1600) >= 0 then 1 else 0;

It is only plotting bubbles strictly for today's session and I cannot see any bubbles for previous days. If I remove getday() == getlastday() ...do you think it will solve it? or what would be the proper way to do it?

def MarketOpen = if SecondsFromTime(0930) >= 0 and SecondsTillTime(1600) >= 0 then 1 else 0;

Similar threads

-

-

-

Pivot Pivots Confirmation with Trading Levels For ThinkOrSwim

- Started by J007RMC

- Replies: 10

-

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

-

-

Pivot Pivots Confirmation with Trading Levels For ThinkOrSwim

- Started by J007RMC

- Replies: 10

-

-

Similar threads

-

-

-

Pivot Pivots Confirmation with Trading Levels For ThinkOrSwim

- Started by J007RMC

- Replies: 10

-

-

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/