@Jim Klopp

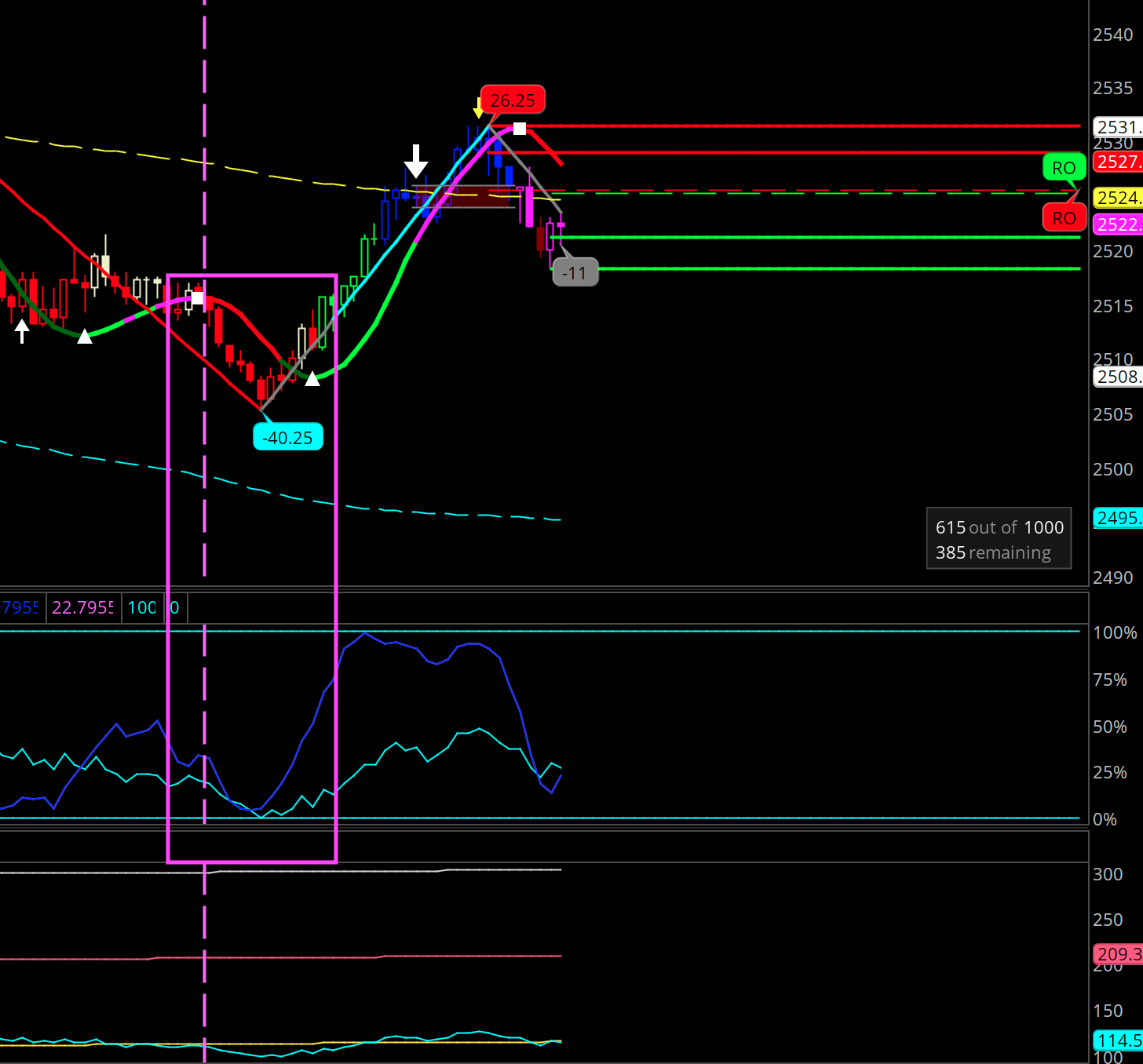

Tried this... but the pointers look weird. Anyone can assist... to improve.

======================

declare lower;

def data = if close > close[1] then close - Min(close[1], low) else if close < close[1] then close - Max(close[1], high) else 0;

plot AccDist = TotalSum(data);

AccDist.SetDefaultColor(GetColor(1));

def price = accdist;

input deviations = 1.68;

input fullRange = Yes;

input length = 20;

input widthOfChannel = 80.0;

plot MiddleLR;

if (fullRange)

then {

MiddleLR = InertiaAll(price);

} else {

MiddleLR = InertiaAll(price, length);

}

def dist = HighestAll(AbsValue(MiddleLR - price)) * (widthOfChannel / 100.0);

plot UpperLR = MiddleLR + dist;

plot LowerLR = MiddleLR - dist;

def upsign = price <= LowerLR ;

def downsign = price >= UpperLR ;

plot signalup = upsign;

signalup.SetDefaultColor(Color.White);

signalup.SetPaintingStrategy(PaintingStrategy.POINTS);

plot signaldown = downsign;

signaldown.SetDefaultColor(Color.Red);

signaldown.SetPaintingStrategy(PaintingStrategy.POINTS);