jonshank62

New member

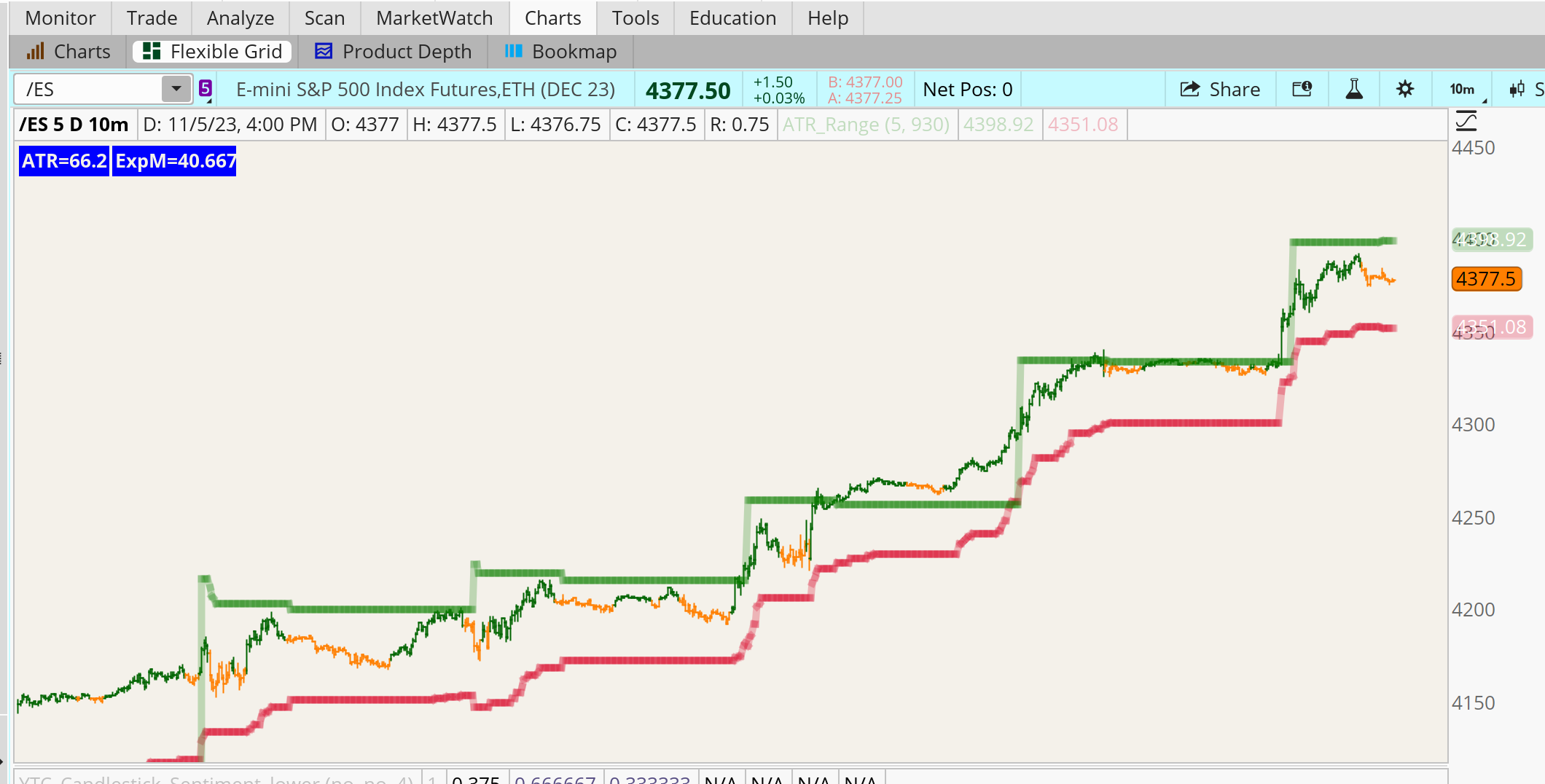

I use this code to help determine a stocks daily move and find it very accurate.

It is most accurate when used in the context of a stocks move from high to low

or vice versa not necessarily from the open.

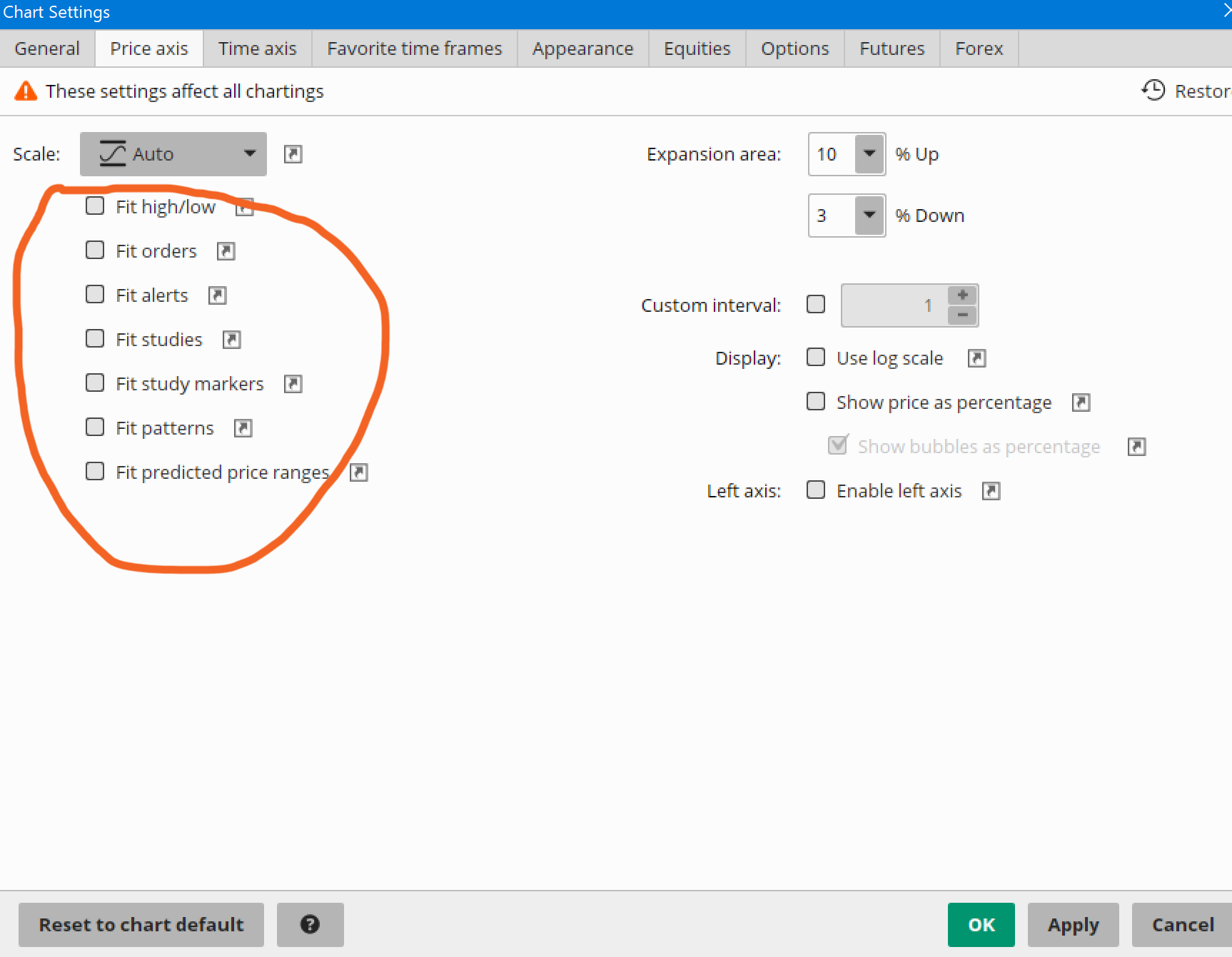

Is their a good way to turn this into a study ?.

input ATRLength = 5;

def ATR = Round(AvgTrueRange(high, close, low, ATRLength), 2);

def iv = Round(close() * (imp_Volatility()/15.87), 3);

addLabel(yes,concat("ATR=", ATR), color.Blue);

addLabel(yes,concat("ExpM=", iv), color.Blue);

It is most accurate when used in the context of a stocks move from high to low

or vice versa not necessarily from the open.

Is their a good way to turn this into a study ?.

input ATRLength = 5;

def ATR = Round(AvgTrueRange(high, close, low, ATRLength), 2);

def iv = Round(close() * (imp_Volatility()/15.87), 3);

addLabel(yes,concat("ATR=", ATR), color.Blue);

addLabel(yes,concat("ExpM=", iv), color.Blue);