thank you for this. I'm going through Googl today after hours. It lined up perfect opportunities on the 15m and 1hrI LOVE this indicator. One question, not necessarily about this indicator specifically, but more in general. Is there a command statement for TOS where when an arrow plots, it stays(for the entire length of the timeframed candle it originally plotted on), even when the conditions are no longer being met?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Repaints Best Swing Trading Indicators for ThinkorSwim

- Thread starter Montana101x

- Start date

-

- Tags

- swing

Repaints

New Indicator: Buy the Dip

Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas. Scanner, watchlist columns, and add-ons are included.

bullishbear420

New member

@BenTen Here is the backtest code for this strategy

Strategy:

Code:input agg = AggregationPeriod.FIFTEEN_MIN; input TradeSize = 100; input fastLength = 19; input slowLength = 39; def c = close(period = agg); Def Value = ExpAverage(c, fastLength) - ExpAverage(c, slowLength); def B = Value[1] < 0 and Value > 0; def S = Value[1] > 0 and Value < 0 ; AddOrder(OrderType.BUY_AUTO, condition = B, price = open[-1], TradeSize, tickcolor = Color. GREEN, arrowcolor = Color.GREEN); AddOrder(OrderType.SELL_AUTO, condition = S, price = open[-1], TradeSize, tickcolor = Color.RED, arrowcolor = Color.RED);

SPY 90 Day 1 Hr Time Frame Results:

Max trade P/L: $964.00

Total P/L: $723.98

Total order(s): 12

Thank you for the backtest capability but I was wondering if you knew how to change the aggregated period to just whatever timeframe the current chart is on?

Do you add this to the bottom of the original script or do you create a new strategy from it?@BenTen Here is the backtest code for this strategy

Strategy:

Code:input agg = AggregationPeriod.FIFTEEN_MIN; input TradeSize = 100; input fastLength = 19; input slowLength = 39; def c = close(period = agg); Def Value = ExpAverage(c, fastLength) - ExpAverage(c, slowLength); def B = Value[1] < 0 and Value > 0; def S = Value[1] > 0 and Value < 0 ; AddOrder(OrderType.BUY_AUTO, condition = B, price = open[-1], TradeSize, tickcolor = Color. GREEN, arrowcolor = Color.GREEN); AddOrder(OrderType.SELL_AUTO, condition = S, price = open[-1], TradeSize, tickcolor = Color.RED, arrowcolor = Color.RED);

SPY 90 Day 1 Hr Time Frame Results:

Max trade P/L: $964.00

Total P/L: $723.98

Total order(s): 12

This works well for me for /es and /nq for 5 min 15 min and 1 hour.This indicator was designed to trade the S&P 500 (SPY) on a weekly chart. Developer Waylock created it and AlphaInvestor added weekly aggregation.

I modified the script a bit so that you can use it to day trade and swing trade $SPY on the lower timeframe.

From backtesting, the buy and sell signals worked really well. You may want to take a second look and see if this is something that may fit your trading style. I also added alerts in the code so that ThinkorSwim will let you know when there is a new bullish or bearish signal.

Day Trading Version

Code:# Original name: Big_Hand_Arrows_On_Study_w_Agg # Script by Waylock # AlphaInvestor - 05/12/2017 - force to weekly aggregation # Modified by BenTen to work on lower timeframe. Alerts added. declare lower; input agg = AggregationPeriod.FIFTEEN_MIN; input fastLength = 19; input slowLength = 39; def c = close(period = agg); plot Value = ExpAverage(c, fastLength) - ExpAverage(c, slowLength); def Value_color = if Value > 0 then yes else no; Value.DefineColor( "ValueUp", Color.GREEN ); Value.DefineColor( "ValueDn", Color.RED ); Value.AssignValueColor( if Value_color then Value.Color( "ValueUp" ) else Value.Color( "ValueDn" ) ); plot ZeroLine = 0; Value.SetDefaultColor(Color.CYAN); ZeroLine.SetDefaultColor(Color.YELLOW); ZeroLine.HideTitle(); ZeroLine.HideBubble(); def xUndr = Value[1] < 0 and Value > 0; def xOver = Value[1] > 0 and Value < 0; plot ArrowUp = if xUndr then xOver else Double.NaN; ArrowUp.SetPaintingStrategy(PaintingStrategy.ARROW_UP); ArrowUp.SetDefaultColor(Color.YELLOW); ArrowUp.SetLineWeight(5); ArrowUp.HideTitle(); ArrowUp.HideBubble(); plot ArrowDn = if xOver then xUndr else Double.NaN; ArrowDn.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN); ArrowDn.SetDefaultColor(Color.YELLOW); ArrowDn.SetLineWeight(5); ArrowDn.HideTitle(); ArrowDn.HideBubble(); def data = Value; # Alerts Alert(ArrowUp, " ", Alert.Bar, Sound.Chimes); Alert(ArrowDn, " ", Alert.Bar, Sound.Bell); # End Study

Shareable Link: https://tos.mx/wJd6hZ

Swing Trading Version

Code:# Original name: Big_Hand_Arrows_On_Study_w_Agg # Script by Waylock # AlphaInvestor - 05/12/2017 - force to weekly aggregation # Modified by BenTen to work on lower timeframe. Alerts added. declare lower; input agg = AggregationPeriod.HOUR; input fastLength = 19; input slowLength = 39; def c = close(period = agg); plot Value = ExpAverage(c, fastLength) - ExpAverage(c, slowLength); def Value_color = if Value > 0 then yes else no; Value.DefineColor( "ValueUp", Color.GREEN ); Value.DefineColor( "ValueDn", Color.RED ); Value.AssignValueColor( if Value_color then Value.Color( "ValueUp" ) else Value.Color( "ValueDn" ) ); plot ZeroLine = 0; Value.SetDefaultColor(Color.CYAN); ZeroLine.SetDefaultColor(Color.YELLOW); ZeroLine.HideTitle(); ZeroLine.HideBubble(); def xUndr = Value[1] < 0 and Value > 0; def xOver = Value[1] > 0 and Value < 0; plot ArrowUp = if xUndr then xOver else Double.NaN; ArrowUp.SetPaintingStrategy(PaintingStrategy.ARROW_UP); ArrowUp.SetDefaultColor(Color.YELLOW); ArrowUp.SetLineWeight(5); ArrowUp.HideTitle(); ArrowUp.HideBubble(); plot ArrowDn = if xOver then xUndr else Double.NaN; ArrowDn.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN); ArrowDn.SetDefaultColor(Color.YELLOW); ArrowDn.SetLineWeight(5); ArrowDn.HideTitle(); ArrowDn.HideBubble(); def data = Value; # Alerts Alert(ArrowUp, " ", Alert.Bar, Sound.Chimes); Alert(ArrowDn, " ", Alert.Bar, Sound.Bell); # End Study

Shareable Link: https://tos.mx/VevVxf

utgamer

New member

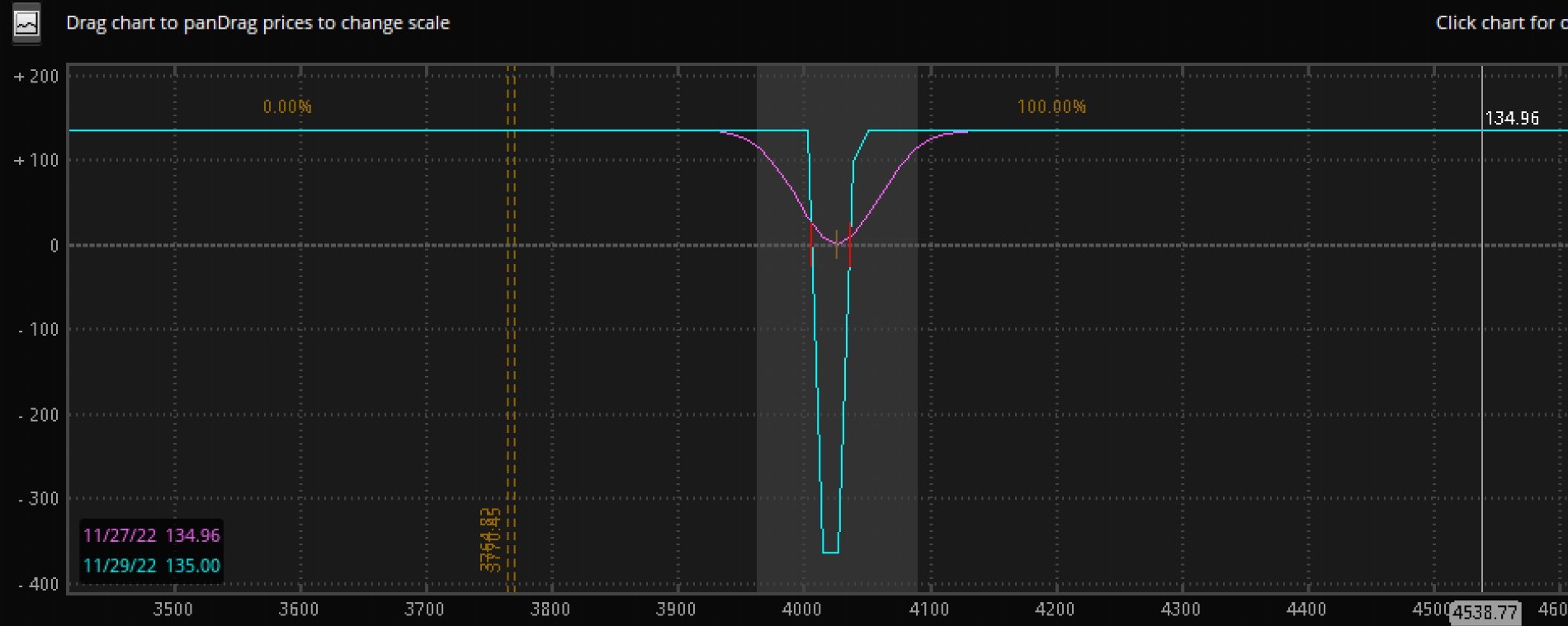

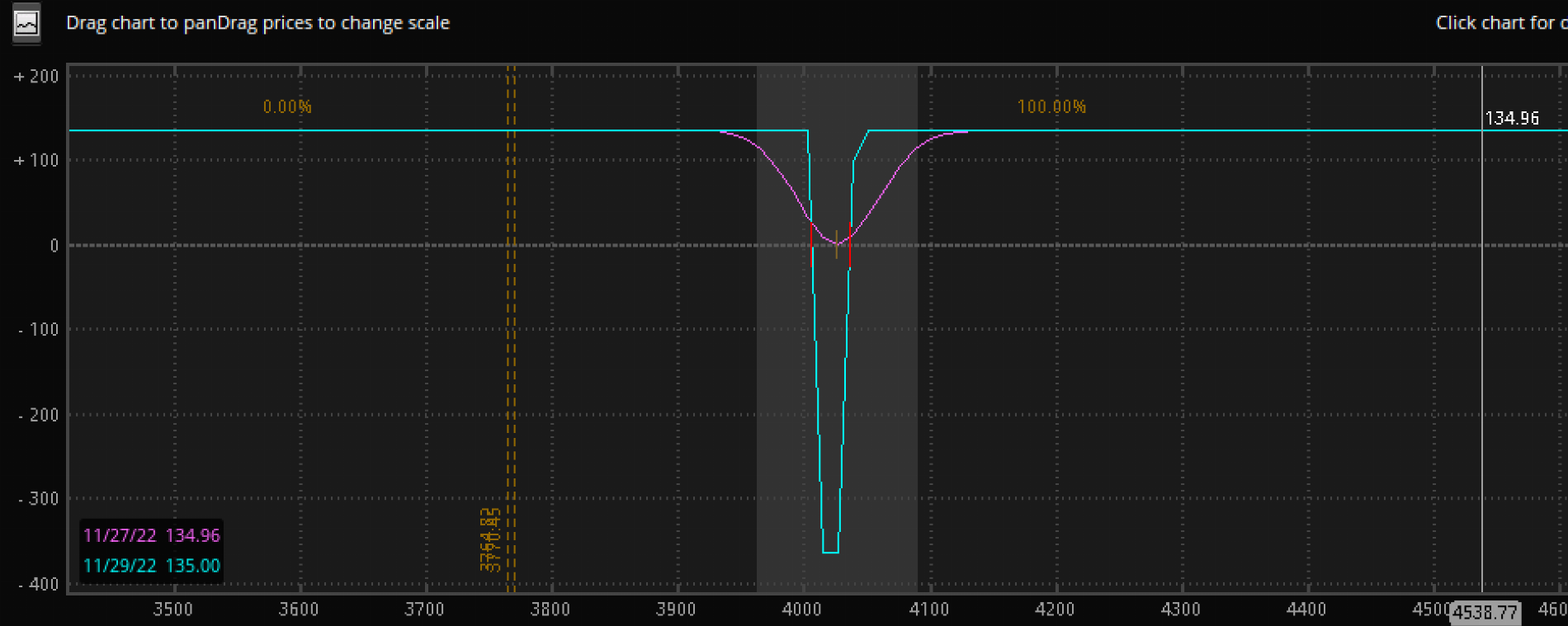

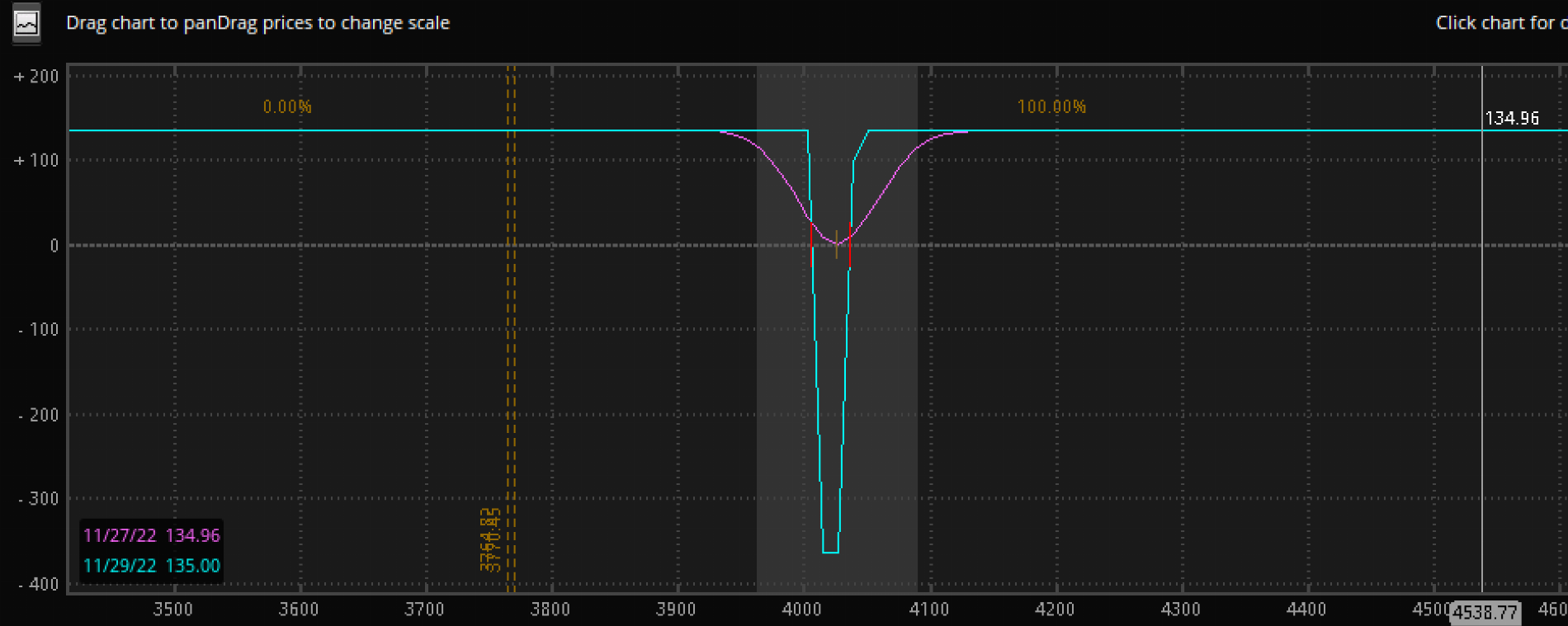

So I have a strategy that's an overnight play where I make an "inverted" iron condor on SPX.

So at 10 minutes until closing, I enter into a put debit spread and call debit spread that's 15 points away from current price at as close to 4.0 fill as I can.

For example:

SPX is at 4000 at 10 minutes until close.

I get a next day cds at 4015/4010 and I get a pds at 3985/3900 for as close to 4.0 as I can.

This is what the risk profile looks like at 3.65:

So basically I'm betting that we move 15 points on spx.

My research of 2022 has shown that we have a 84% chance of moving at least 15 points by closing time the next day.

What I really like about this play is those gaps that we've been having overnight help this play. If we have a big move in one direction, I can take my profits and be happy before it reverses and comes back down to where we started (better than OR strat below). I started off 2022 getting burned by the big reversal and being way over-extended into pcs plays.

BUT I always set up the close order as soon as the buy order fills for less profit. There's been too many times in my OR play that I use to do where we make a big move and fall back into the OR. So I'm shooting for more wins and less profit at a 10-15% profit/risk per trade. So on a typical 4.0 fill I'd probably shoot for a 4.60 close to hit that target of around $50 after fees. There have been times where it fills by 10 am the next morning if we have a decent move, others where it's close to closing. $50 profit/$400 risk is 12.5% profit/risk ratio.

My exit is losing around $100 after 1pm when the theta starts to ramp up the losses. I look at my ATR Bands and if the majority of my ATR bands are in the losing range (between 3985 and 4015 in the example) then I'll exit for a $100-$125 loss.

Some history behind this:

I use to do an Opening Range (OR) play where I get this inverted Iron condor after the opening 30 minutes where the strikes of the IC correspond to the opening 30 min high/low (always rounded inwards) . But there were days due to work being so busy that I just don't get into the play b/c I missed the breakout of the opening range. I had a strict do not take above 4.25 b/c then my break-even vs probability math didn't add up. Then there was the day trades on my margin account. In order to take profit before it dove back down into the OR, I'd have to use a day trade. So I was like why don't I just switch the play up to $15 each direction at 10 til and then I can take profit whenever b/c the play was opened the day before. I started the OR strat back in May/June and switched to this method last month. Between the two methods I've made $3000 in profits (I know chump change to a lot of y'all) with maybe 15 minutes of "trading" each day. I started off with 1K so I've gone over 300% using these two methods this year. My goal is to max out my contributions to my IRA next year with these methods. If I were to be able to code this strategy into doing it automatically and throw in a few grand into an account and just let it go, my analysis shows a 86% win rate for 10k earnings at a 4.0 fill on the Opening Range play for 2022 thusfar. Now this won't work if we start going sideways... so I feel like I need to somehow get that into my strategy.

I've only been trading for 1.75 years now so I'm constantly doing research and trying to come up with new methods to my madness. I'm hoping that these strats keep working for me b/c they're easy to do without distracting me from work.

So at 10 minutes until closing, I enter into a put debit spread and call debit spread that's 15 points away from current price at as close to 4.0 fill as I can.

For example:

SPX is at 4000 at 10 minutes until close.

I get a next day cds at 4015/4010 and I get a pds at 3985/3900 for as close to 4.0 as I can.

This is what the risk profile looks like at 3.65:

So basically I'm betting that we move 15 points on spx.

My research of 2022 has shown that we have a 84% chance of moving at least 15 points by closing time the next day.

What I really like about this play is those gaps that we've been having overnight help this play. If we have a big move in one direction, I can take my profits and be happy before it reverses and comes back down to where we started (better than OR strat below). I started off 2022 getting burned by the big reversal and being way over-extended into pcs plays.

BUT I always set up the close order as soon as the buy order fills for less profit. There's been too many times in my OR play that I use to do where we make a big move and fall back into the OR. So I'm shooting for more wins and less profit at a 10-15% profit/risk per trade. So on a typical 4.0 fill I'd probably shoot for a 4.60 close to hit that target of around $50 after fees. There have been times where it fills by 10 am the next morning if we have a decent move, others where it's close to closing. $50 profit/$400 risk is 12.5% profit/risk ratio.

My exit is losing around $100 after 1pm when the theta starts to ramp up the losses. I look at my ATR Bands and if the majority of my ATR bands are in the losing range (between 3985 and 4015 in the example) then I'll exit for a $100-$125 loss.

Some history behind this:

I use to do an Opening Range (OR) play where I get this inverted Iron condor after the opening 30 minutes where the strikes of the IC correspond to the opening 30 min high/low (always rounded inwards) . But there were days due to work being so busy that I just don't get into the play b/c I missed the breakout of the opening range. I had a strict do not take above 4.25 b/c then my break-even vs probability math didn't add up. Then there was the day trades on my margin account. In order to take profit before it dove back down into the OR, I'd have to use a day trade. So I was like why don't I just switch the play up to $15 each direction at 10 til and then I can take profit whenever b/c the play was opened the day before. I started the OR strat back in May/June and switched to this method last month. Between the two methods I've made $3000 in profits (I know chump change to a lot of y'all) with maybe 15 minutes of "trading" each day. I started off with 1K so I've gone over 300% using these two methods this year. My goal is to max out my contributions to my IRA next year with these methods. If I were to be able to code this strategy into doing it automatically and throw in a few grand into an account and just let it go, my analysis shows a 86% win rate for 10k earnings at a 4.0 fill on the Opening Range play for 2022 thusfar. Now this won't work if we start going sideways... so I feel like I need to somehow get that into my strategy.

I've only been trading for 1.75 years now so I'm constantly doing research and trying to come up with new methods to my madness. I'm hoping that these strats keep working for me b/c they're easy to do without distracting me from work.

Very interesting! I definitely will try this out with paper starting today and see how it plays out. I’ve been looking for a more risk mitigating strategy on overnight SPX condors and I hadn’t considered inverting my condors. Let me know if you figure out a way to automate it!So I have a strategy that's an overnight play where I make an "inverted" iron condor on SPX.

So at 10 minutes until closing, I enter into a put debit spread and call debit spread that's 15 points away from current price at as close to 4.0 fill as I can.

For example:

SPX is at 4000 at 10 minutes until close.

I get a next day cds at 4015/4010 and I get a pds at 3985/3900 for as close to 4.0 as I can.

This is what the risk profile looks like at 3.65:

So basically I'm betting that we move 15 points on spx.

My research of 2022 has shown that we have a 84% chance of moving at least 15 points by closing time the next day.

What I really like about this play is those gaps that we've been having overnight help this play. If we have a big move in one direction, I can take my profits and be happy before it reverses and comes back down to where we started (better than OR strat below). I started off 2022 getting burned by the big reversal and being way over-extended into pcs plays.

BUT I always set up the close order as soon as the buy order fills for less profit. There's been too many times in my OR play that I use to do where we make a big move and fall back into the OR. So I'm shooting for more wins and less profit at a 10-15% profit/risk per trade. So on a typical 4.0 fill I'd probably shoot for a 4.60 close to hit that target of around $50 after fees. There have been times where it fills by 10 am the next morning if we have a decent move, others where it's close to closing. $50 profit/$400 risk is 12.5% profit/risk ratio.

My exit is losing around $100 after 1pm when the theta starts to ramp up the losses. I look at my ATR Bands and if the majority of my ATR bands are in the losing range (between 3985 and 4015 in the example) then I'll exit for a $100-$125 loss.

Some history behind this:

I use to do an Opening Range (OR) play where I get this inverted Iron condor after the opening 30 minutes where the strikes of the IC correspond to the opening 30 min high/low (always rounded inwards) . But there were days due to work being so busy that I just don't get into the play b/c I missed the breakout of the opening range. I had a strict do not take above 4.25 b/c then my break-even vs probability math didn't add up. Then there was the day trades on my margin account. In order to take profit before it dove back down into the OR, I'd have to use a day trade. So I was like why don't I just switch the play up to $15 each direction at 10 til and then I can take profit whenever b/c the play was opened the day before. I started the OR strat back in May/June and switched to this method last month. Between the two methods I've made $3000 in profits (I know chump change to a lot of y'all) with maybe 15 minutes of "trading" each day. I started off with 1K so I've gone over 300% using these two methods this year. My goal is to max out my contributions to my IRA next year with these methods. If I were to be able to code this strategy into doing it automatically and throw in a few grand into an account and just let it go, my analysis shows a 86% win rate for 10k earnings at a 4.0 fill on the Opening Range play for 2022 thusfar. Now this won't work if we start going sideways... so I feel like I need to somehow get that into my strategy.

I've only been trading for 1.75 years now so I'm constantly doing research and trying to come up with new methods to my madness. I'm hoping that these strats keep working for me b/c they're easy to do without distracting me from work.

Hi Utgamer....1-How many DTE do you use with this method? , 2- Have you tried selling iron butterflies to increase the winning probability (but more expensive)? 3-Which method has been more profitable to you, the one at the close of the day or the one at OR?...Thank you.So I have a strategy that's an overnight play where I make an "inverted" iron condor on SPX.

So at 10 minutes until closing, I enter into a put debit spread and call debit spread that's 15 points away from current price at as close to 4.0 fill as I can.

For example:

SPX is at 4000 at 10 minutes until close.

I get a next day cds at 4015/4010 and I get a pds at 3985/3900 for as close to 4.0 as I can.

This is what the risk profile looks like at 3.65:

So basically I'm betting that we move 15 points on spx.

My research of 2022 has shown that we have a 84% chance of moving at least 15 points by closing time the next day.

What I really like about this play is those gaps that we've been having overnight help this play. If we have a big move in one direction, I can take my profits and be happy before it reverses and comes back down to where we started (better than OR strat below). I started off 2022 getting burned by the big reversal and being way over-extended into pcs plays.

BUT I always set up the close order as soon as the buy order fills for less profit. There's been too many times in my OR play that I use to do where we make a big move and fall back into the OR. So I'm shooting for more wins and less profit at a 10-15% profit/risk per trade. So on a typical 4.0 fill I'd probably shoot for a 4.60 close to hit that target of around $50 after fees. There have been times where it fills by 10 am the next morning if we have a decent move, others where it's close to closing. $50 profit/$400 risk is 12.5% profit/risk ratio.

My exit is losing around $100 after 1pm when the theta starts to ramp up the losses. I look at my ATR Bands and if the majority of my ATR bands are in the losing range (between 3985 and 4015 in the example) then I'll exit for a $100-$125 loss.

Some history behind this:

I use to do an Opening Range (OR) play where I get this inverted Iron condor after the opening 30 minutes where the strikes of the IC correspond to the opening 30 min high/low (always rounded inwards) . But there were days due to work being so busy that I just don't get into the play b/c I missed the breakout of the opening range. I had a strict do not take above 4.25 b/c then my break-even vs probability math didn't add up. Then there was the day trades on my margin account. In order to take profit before it dove back down into the OR, I'd have to use a day trade. So I was like why don't I just switch the play up to $15 each direction at 10 til and then I can take profit whenever b/c the play was opened the day before. I started the OR strat back in May/June and switched to this method last month. Between the two methods I've made $3000 in profits (I know chump change to a lot of y'all) with maybe 15 minutes of "trading" each day. I started off with 1K so I've gone over 300% using these two methods this year. My goal is to max out my contributions to my IRA next year with these methods. If I were to be able to code this strategy into doing it automatically and throw in a few grand into an account and just let it go, my analysis shows a 86% win rate for 10k earnings at a 4.0 fill on the Opening Range play for 2022 thusfar. Now this won't work if we start going sideways... so I feel like I need to somehow get that into my strategy.

I've only been trading for 1.75 years now so I'm constantly doing research and trying to come up with new methods to my madness. I'm hoping that these strats keep working for me b/c they're easy to do without distracting me from work.

I took this and modified it some more. I added a "fast" line and made arrows where they cross. Plus I added an UPPER indicator that you can select which line you want to use for coloring candles. Take a peek. LOWER indicator. http://tos.mx/obuKmsY UPPER indicator. http://tos.mx/wRvdhTDHey guys,

Trying to give back here a little. I modified this strategy to be compatible with mobile. It will work on whatever period you have it on. I work full time and having a screen in front of me is impossible. My plan is to set alerts and use this specifically for stocks on a higher time frame for swing trading options. 1 hour or 4 hour agg. I don't have it coded to add arrows or alerts, modified the period to whatever current period you have it on in the mobile app. Hope this helps someone.

Code:# Original name: Big_Hand_Arrows_On_Study_w_Agg # Script by Waylock # AlphaInvestor - 05/12/2017 - force to weekly aggregation # Modified by BenTen to work on lower timeframe. Alerts added. #Modified by Jim C for Mobile and standard period declare lower; input fastLength = 19; input slowLength = 39; def c = close; plot Value = ExpAverage(c, fastLength) - ExpAverage(c, slowLength); def Value_color = if Value > 0 then yes else no; Value.DefineColor( "ValueUp", Color.GREEN ); Value.DefineColor( "ValueDn", Color.RED ); Value.AssignValueColor( if Value_color then Value.Color( "ValueUp" ) else Value.Color( "ValueDn" ) ); plot ZeroLine = 0; Value.SetDefaultColor(Color.CYAN); ZeroLine.SetDefaultColor(Color.YELLOW); ZeroLine.HideTitle(); ZeroLine.HideBubble(); def xUndr = Value[1] < 0 and Value > 0; def xOver = Value[1] > 0 and Value < 0; plot ArrowUp = if xUndr then xOver else Double.NaN; ArrowUp.SetPaintingStrategy(PaintingStrategy.ARROW_UP); ArrowUp.SetDefaultColor(Color.YELLOW); ArrowUp.SetLineWeight(5); ArrowUp.HideTitle(); ArrowUp.HideBubble(); plot ArrowDn = if xOver then xUndr else Double.NaN; ArrowDn.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN); ArrowDn.SetDefaultColor(Color.YELLOW); ArrowDn.SetLineWeight(5); ArrowDn.HideTitle(); ArrowDn.HideBubble(); def data = Value; # Alerts Alert(ArrowUp, " ", Alert.Bar, Sound.Chimes); Alert(ArrowDn, " ", Alert.Bar, Sound.Bell); # End Study

I'm trying to use it for the SPY but looking back a few days on the 1 hour chart there are a lot of false or bad signals. Are you paring the indicator with anything else?This works well for me for /es and /nq for 5 min 15 min and 1 hour.

utgamer

New member

1. I do 1 DTE on the CR, 0 DTE on the OR.Hi Utgamer....1-How many DTE do you use with this method? , 2- Have you tried selling iron butterflies to increase the winning probability (but more expensive)? 3-Which method has been more profitable to you, the one at the close of the day or the one at OR?...Thank you.

2. I have tried turning these into butterflies, but it requires more movement and harder to actually turn these into Flys. When I switched to the CR, I was able to close the trade for profit without using day trade and without requiring more of a move in a FLY. So I take less profit, but win more and lose a lot less.

3. So with OR i'm 29-5 for $1200 and on the CR I'm 16-2 for $400. I think it's too early to say which is more profitable. Still rather new. I think part of the problem on the CR is i'm closing it out and losing $5 per close in fees, with the CR I'd let it expire or Fly it... Another CON on the OR is that you don't always get a fill, whereas CR I have only missed a fill 2-3 times. With the OR you let it expire and can lose up to around $400... but with the CR you exit if you're looking flat on the day for $100 or so... I don't know which I like better yet.. they both have pros and cons.

Thank you ! I'll start paper trading both.1. I do 1 DTE on the CR, 0 DTE on the OR.

2. I have tried turning these into butterflies, but it requires more movement and harder to actually turn these into Flys. When I switched to the CR, I was able to close the trade for profit without using day trade and without requiring more of a move in a FLY. So I take less profit, but win more and lose a lot less.

3. So with OR i'm 29-5 for $1200 and on the CR I'm 16-2 for $400. I think it's too early to say which is more profitable. Still rather new. I think part of the problem on the CR is i'm closing it out and losing $5 per close in fees, with the CR I'd let it expire or Fly it... Another CON on the OR is that you don't always get a fill, whereas CR I have only missed a fill 2-3 times. With the OR you let it expire and can lose up to around $400... but with the CR you exit if you're looking flat on the day for $100 or so... I don't know which I like better yet.. they both have pros and cons.

Thanks.

utgamer

New member

May the market ever be in your favor! I got $100 on Friday and $85 today, but lost twice last week if I'm being honest. About 140 loss each time. But the math/probabilities still hold in the favor of it.Thank you ! I'll start paper trading both.

Thanks.

Would you use this on the 5 minute time frame?This indicator was designed to trade the S&P 500 (SPY) on a weekly chart. Developer Waylock created it and AlphaInvestor added weekly aggregation.

I modified the script a bit so that you can use it to day trade and swing trade $SPY on the lower timeframe.

From backtesting, the buy and sell signals worked really well. You may want to take a second look and see if this is something that may fit your trading style. I also added alerts in the code so that ThinkorSwim will let you know when there is a new bullish or bearish signal.

Day Trading Version

Code:# Original name: Big_Hand_Arrows_On_Study_w_Agg # Script by Waylock # AlphaInvestor - 05/12/2017 - force to weekly aggregation # Modified by BenTen to work on lower timeframe. Alerts added. declare lower; input agg = AggregationPeriod.FIFTEEN_MIN; input fastLength = 19; input slowLength = 39; def c = close(period = agg); plot Value = ExpAverage(c, fastLength) - ExpAverage(c, slowLength); def Value_color = if Value > 0 then yes else no; Value.DefineColor( "ValueUp", Color.GREEN ); Value.DefineColor( "ValueDn", Color.RED ); Value.AssignValueColor( if Value_color then Value.Color( "ValueUp" ) else Value.Color( "ValueDn" ) ); plot ZeroLine = 0; Value.SetDefaultColor(Color.CYAN); ZeroLine.SetDefaultColor(Color.YELLOW); ZeroLine.HideTitle(); ZeroLine.HideBubble(); def xUndr = Value[1] < 0 and Value > 0; def xOver = Value[1] > 0 and Value < 0; plot ArrowUp = if xUndr then xOver else Double.NaN; ArrowUp.SetPaintingStrategy(PaintingStrategy.ARROW_UP); ArrowUp.SetDefaultColor(Color.YELLOW); ArrowUp.SetLineWeight(5); ArrowUp.HideTitle(); ArrowUp.HideBubble(); plot ArrowDn = if xOver then xUndr else Double.NaN; ArrowDn.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN); ArrowDn.SetDefaultColor(Color.YELLOW); ArrowDn.SetLineWeight(5); ArrowDn.HideTitle(); ArrowDn.HideBubble(); def data = Value; # Alerts Alert(ArrowUp, " ", Alert.Bar, Sound.Chimes); Alert(ArrowDn, " ", Alert.Bar, Sound.Bell); # End Study

Shareable Link: https://tos.mx/wJd6hZ

Swing Trading Version

Code:# Original name: Big_Hand_Arrows_On_Study_w_Agg # Script by Waylock # AlphaInvestor - 05/12/2017 - force to weekly aggregation # Modified by BenTen to work on lower timeframe. Alerts added. declare lower; input agg = AggregationPeriod.HOUR; input fastLength = 19; input slowLength = 39; def c = close(period = agg); plot Value = ExpAverage(c, fastLength) - ExpAverage(c, slowLength); def Value_color = if Value > 0 then yes else no; Value.DefineColor( "ValueUp", Color.GREEN ); Value.DefineColor( "ValueDn", Color.RED ); Value.AssignValueColor( if Value_color then Value.Color( "ValueUp" ) else Value.Color( "ValueDn" ) ); plot ZeroLine = 0; Value.SetDefaultColor(Color.CYAN); ZeroLine.SetDefaultColor(Color.YELLOW); ZeroLine.HideTitle(); ZeroLine.HideBubble(); def xUndr = Value[1] < 0 and Value > 0; def xOver = Value[1] > 0 and Value < 0; plot ArrowUp = if xUndr then xOver else Double.NaN; ArrowUp.SetPaintingStrategy(PaintingStrategy.ARROW_UP); ArrowUp.SetDefaultColor(Color.YELLOW); ArrowUp.SetLineWeight(5); ArrowUp.HideTitle(); ArrowUp.HideBubble(); plot ArrowDn = if xOver then xUndr else Double.NaN; ArrowDn.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN); ArrowDn.SetDefaultColor(Color.YELLOW); ArrowDn.SetLineWeight(5); ArrowDn.HideTitle(); ArrowDn.HideBubble(); def data = Value; # Alerts Alert(ArrowUp, " ", Alert.Bar, Sound.Chimes); Alert(ArrowDn, " ", Alert.Bar, Sound.Bell); # End Study

Shareable Link: https://tos.mx/VevVxf

I figured he meant 5 min, 10 min, 15 min.I modified the script a bit so that you can use it to day trade and swing trade $SPY on the lower timeframe.

TraderJane

New member

Hey all,

I have not been doing very well day trading. I have been scalping and intraday trading. I would really like to get a grasp of this but thinking I may be better suited to swing trade over a few days to a week or so. Anyway, Can someone recommend an indicator or strategy that can help me with this endeavor? Oh, I do not have a lot of money so I need to trade options. I think.

I have not been doing very well day trading. I have been scalping and intraday trading. I would really like to get a grasp of this but thinking I may be better suited to swing trade over a few days to a week or so. Anyway, Can someone recommend an indicator or strategy that can help me with this endeavor? Oh, I do not have a lot of money so I need to trade options. I think.

@antwerks

Entering a trade at a reasonable price is often the easy part (thanks to BTD study) - the real challenge lies in knowing when to close the position. I frequently find myself selling too early, whether it's after recovering from a loss back to breakeven or taking a small profit, only to watch the price continue climbing and regret not holding longer.

I’m always on the lookout for a reliable study or setup that provides clear signals for booking profits. While VIP members have access to the Take Profit indicator, I’ve found it less effective for short-term trading. My primary focus is swing trading, where I buy long-dated options but typically exit within two weeks.

One common issue I’ve noticed with RSI is that, in a strong uptrend, it can remain in the overbought zone for an extended period—without necessarily indicating an imminent price drop. This makes it challenging to use RSI alone as an exit signal.

Through this community, I’ve learned a lot and tested various indicators. Many work well in trending markets, but I’ve refined my approach to focus on BTD Conservative for swing trading and ATR support and resistance. This strategy has been effective, but as I mentioned earlier, I still struggle with exiting trades too soon.

Have you experienced similar challenges? What strategies or indicators do you rely on for timing exits in swing trading? Also, I tried your study but noticed it consistently shows a score of 0 on the 2-minute chart—any thoughts on that?

It appears you are attempting to daytrade but for a longer time-period.

Swing trading is about choosing instruments with strong financials, good volatility, high liquidity and an overall trend of higher highs and higher lows that have dipped (due to temporary market pullbacks) enough to present an attractive potential profit.

Think of yourself as a hobo jumping on a fast-moving freight train headed for a perfect designation that had to temporarily slow down due to slow-moving traffic ahead.

BUT make sure, it is a "temporary slow-down". Don't buy into basement dwellers. Look for entry once price has risen above support, and is showing buyer interest (volume, momentum, etc… on your middle timeframe), and has a confirmed trend on your lower timeframe.

The premise of swing trading is that the instrument will stay in motion with the same speed and direction unless acted upon by an external catalyst. No one has proven Newton wrong, yet!

If you are trading an instrument that is correlated to the market; your oscillators are reflecting the vacillation in that market. Yes, if the entire energy sector is showing weakness; you absolutely should investigate if an external catalyst is ending your energy stock trade. But jumping out based on a fluctuation signal from an oscillator or trend indicator, which might not be pertinent to your sector or your instrument; is not a good exit strategy for swing traders.

Hitting that attractive potential profit or your pre-drawn resistance level, your stop-loss or passing down through your support or the appearance of an external catalyst that didn't exist previously, or you didn't take into account, that is threatening your trade are the swing trader exit points.

The hobo does not jump off his free ride, because of temporary congestion points. He chose his train because it has a history of long rides, he looked at the schedule and knows where the train will hit the next large population point and have to slow down or stop. He stays on until then unless hit by a train imbediment.

Keep in mind, that many of the strategies and discussions on this forum are for day traders.

Whereas swing traders never ever look at 2min charts nor micromanage their trades.

Long-time Swing Trader @BenTen said it best:

https://usethinkscript.com/threads/...same-return-as-day-trading.21045/#post-153274

Here is an example of analyzing a swing trade chart:

https://usethinkscript.com/threads/swing-trade-example.21159/

BenTen's Watchlist + Setup + Trade Recaps

Get access to Ben's watchlist, swing trading strategy, ThinkorSwim setup, and trade examples.

Similar threads

-

Best % Gap Long/Short Plays (Works Pre-Market) for ThinkorSwim

- Started by Townsend

- Replies: 31

-

-

Repaints Trading Divergence Monster Laguerre + Inertia For ThinkOrSwim

- Started by MagicBlueBalls

- Replies: 15

-

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1386

Online

Similar threads

-

Best % Gap Long/Short Plays (Works Pre-Market) for ThinkorSwim

- Started by Townsend

- Replies: 31

-

-

Repaints Trading Divergence Monster Laguerre + Inertia For ThinkOrSwim

- Started by MagicBlueBalls

- Replies: 15

-

-

Similar threads

-

Best % Gap Long/Short Plays (Works Pre-Market) for ThinkorSwim

- Started by Townsend

- Replies: 31

-

-

Repaints Trading Divergence Monster Laguerre + Inertia For ThinkOrSwim

- Started by MagicBlueBalls

- Replies: 15

-

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.