You should upgrade or use an alternative browser.

Best Day Trading Strategy / Indicators For ThinkorSwim

- Thread starter Zedd

- Start date

start here:

https://usethinkscript.com/threads/where-to-start-with-thinkorswim-and-daytrading.20946/#post-152716

Daytrading / Scalping is not just about using the right indicators:

https://usethinkscript.com/threads/best-time-frame-for-trading-for-thinkorswim.12209/#post-152641

Best Indicators for daytrading and scalping:

https://usethinkscript.com/threads/what-are-the-best-indicators-in-thinkorswim.14498/#post-151586

Member's favorites:

https://usethinkscript.com/threads/...ogether-and-what-time-frames-do-you-use.9868/

Is it possible to be a profitable daytrader...

Hi @sunnybabu, I hope your trading has been profitable. All the indicators are available and you will find them here @usethinkscript.com. Just takes a little work for you to search and understand.

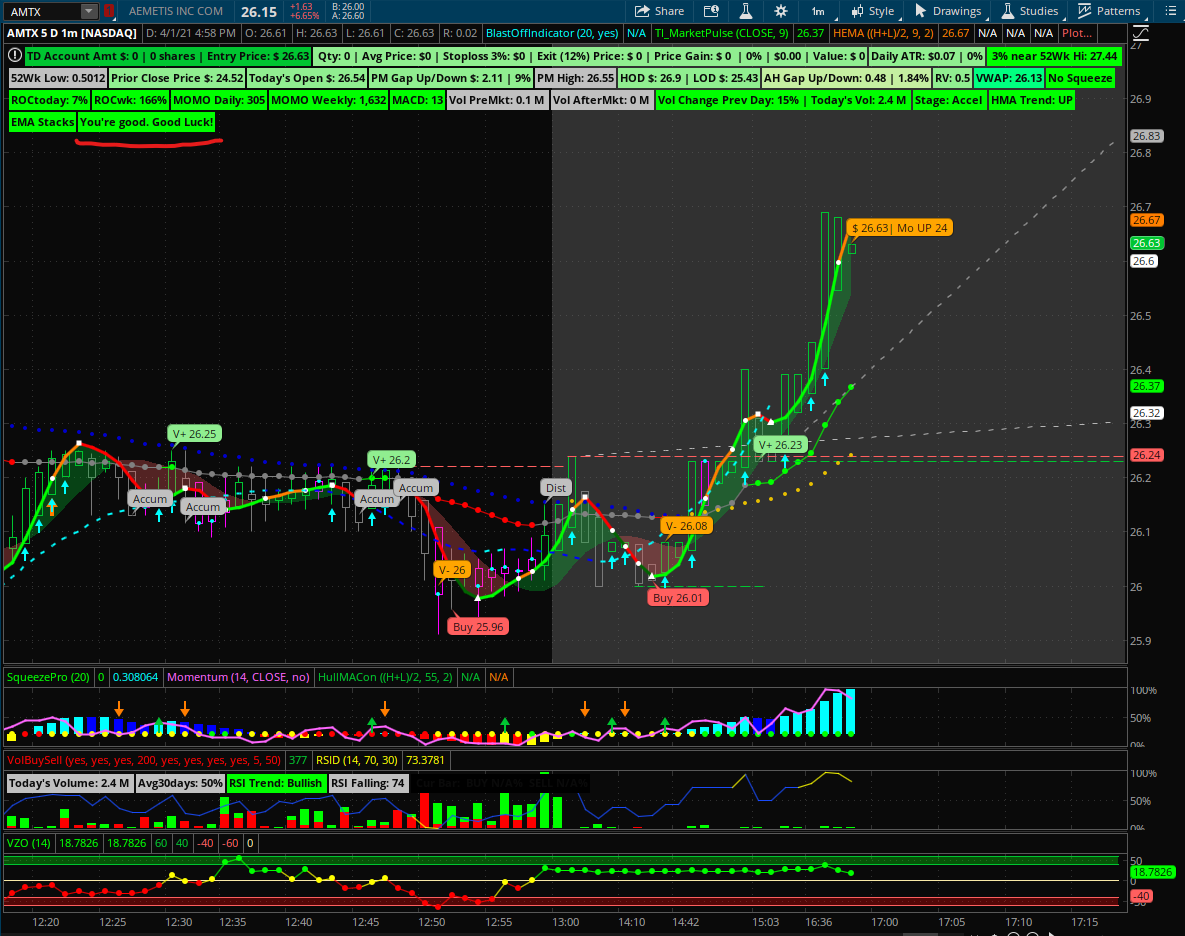

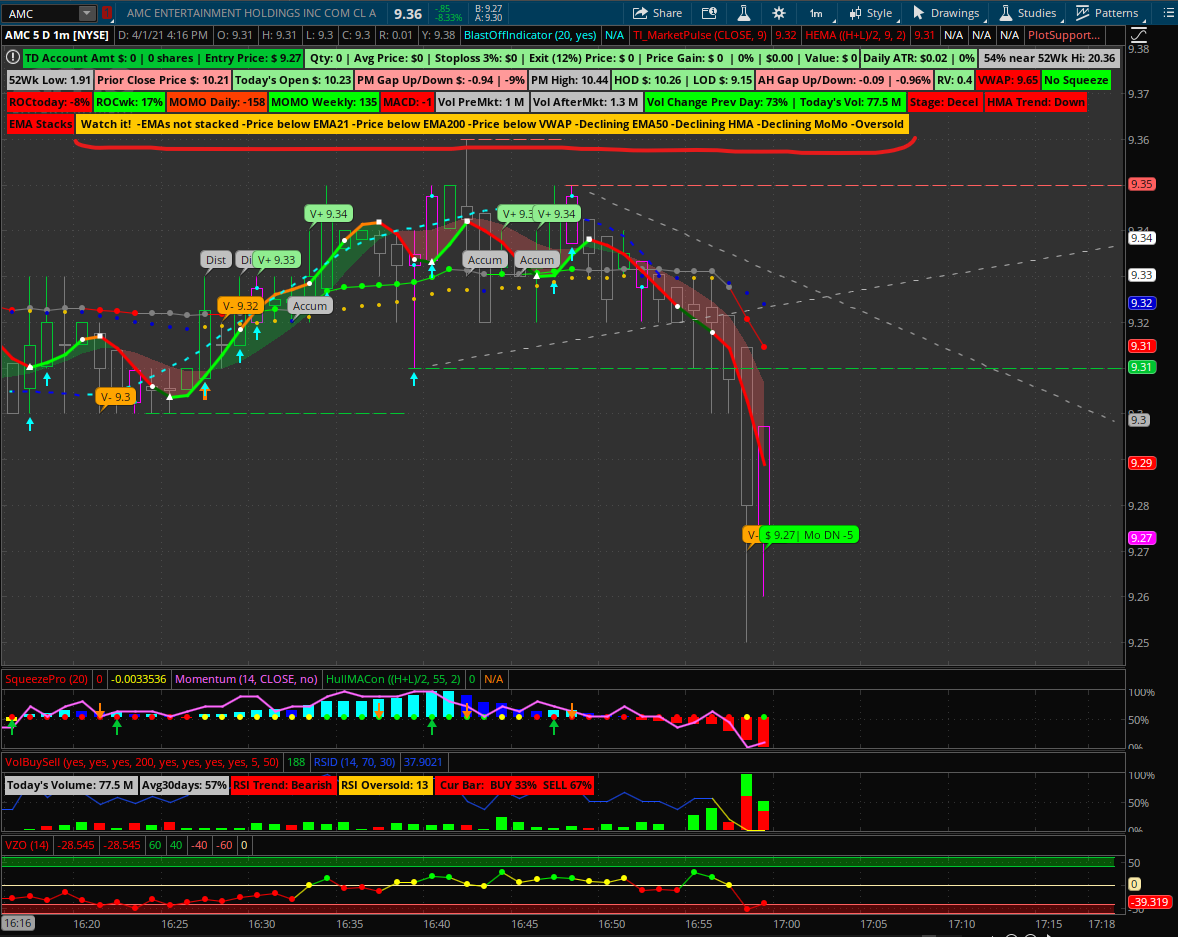

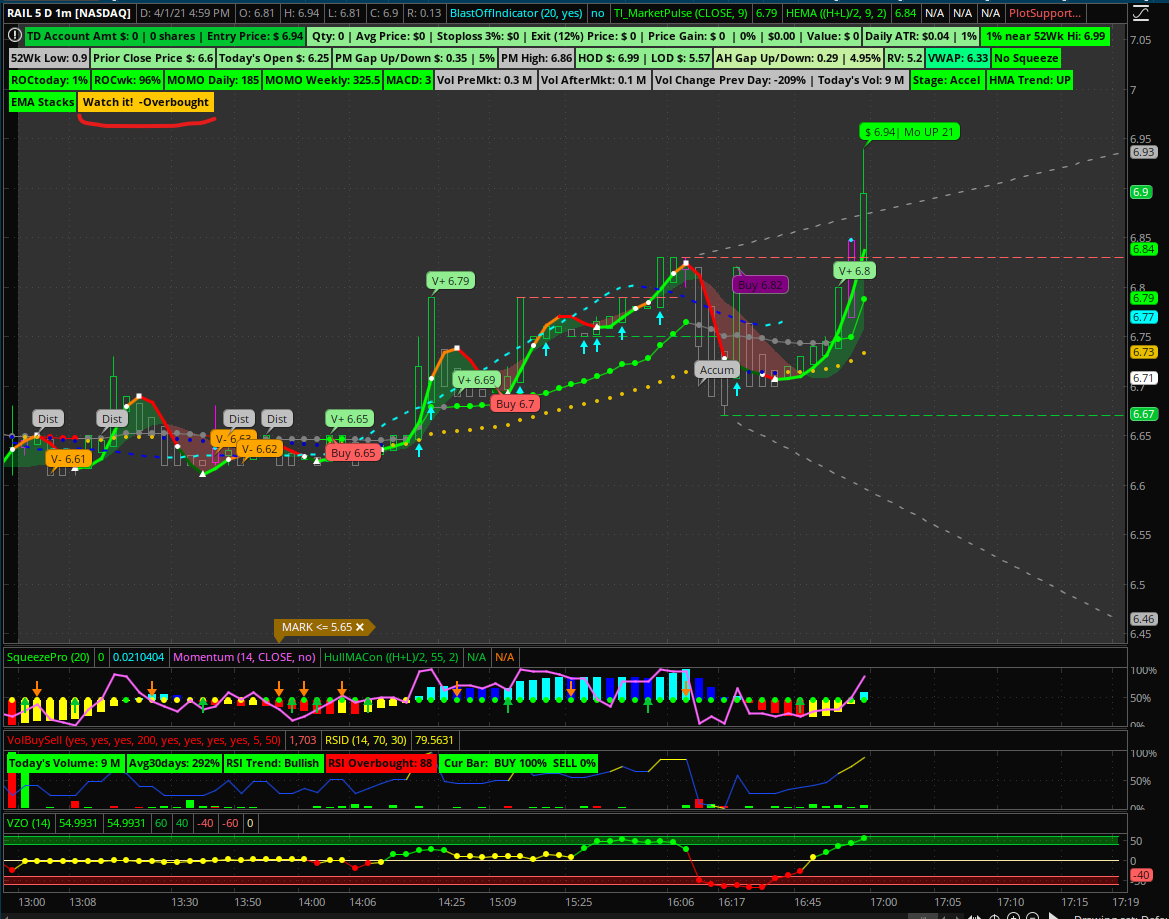

I like to keep things simple and easy systematically. Someone mentioned in the list "better entry" or "how can I avoid bad entry". Well, I wrote a script below I can share that may help all or at least the early traders. Yes, I do have a lot of indicators on my chart, but my consolidated decision (or AI) does a good job telling me to avoid entry or when certain situations to get out of the position. The label maybe will save you chart space and $$$ on all timeframes whether short or long trades. I have attached some screenshots of how it looks. I hope this helps you. Just let me know what you think and feedback or just thank you is appreciated. Good luck! @cabe1332

Code:#PosEntry & Warning Label # by cabe@1332 # Start of code ######### EMA21 - price below 21 ma def dprice = close; def dlength = 21; def ddisplace = 0; def EMA21 = MovingAverage(AverageType.eXPONENTIAL, dprice, dlength)[-ddisplace]; def v = if EMA21 > EMA21[1] then 1 else 0; ######### EMA50 - price below 50 ma def eprice = close; def elength = 50; def edisplace = 0; def EMA50 = MovingAverage(AverageType.eXPONENTIAL, eprice, elength)[-edisplace]; def x = if EMA50 > EMA50[1] then 1 else 0; ######### EMA200 - price below 200 ma - losing stock don't buy def fprice = close; def flength = 200; def fdisplace = 0; def EMA200 = MovingAverage(AverageType.eXPONENTIAL, fprice, flength)[-fdisplace]; def t = if EMA200 > EMA200[1] then 1 else 0; ############ HMA def hprice = close; def hlength = 20; def displace = 0; def HMA = MovingAverage(AverageType.HULL, hprice, hlength)[-displace]; def y = if HMA > HMA[1] then 1 else 0; ############ EMAs Stacked - a must for a good setup and entry def stackedUp = MovAvgExponential("length" = 8)."AvgExp" is greater than MovAvgExponential("length" = 21)."AvgExp" and MovAvgExponential("length" = 21)."AvgExp" is greater than MovAvgExponential("length" = 34)."AvgExp" and MovAvgExponential("length" = 34)."AvgExp" is greater than MovAvgExponential("length" = 55)."AvgExp" and MovAvgExponential("length" = 55)."AvgExp" is greater than MovAvgExponential("length" = 89)."AvgExp"; def e = if stackedUp then 1 else 0; ####### TTM_Squeeze - momo must be light blue def H = reference TTM_Squeeze().Histogram; def tt = if H > 0 and H > H[1] then 1 else 0; #VWAPvalue def vwapValue = reference VWAP(); def vw = if close > vwapValue then 1 else 0; ############ RSI def rsilength = 5; def rsi = reference RSI(length = rsilength)."RSI"; def rsioversold = if rsi < 20 then 1 else 0; def rsioverbought = if rsi > 80 then 1 else 0; def r = if rsioversold or rsioverbought then 1 else 0; ############ Label def z = if tt== 1 and x == 1 and y == 1 and e and 1 and r == 0 and t == 1 and vw == 1 then 1 else 0; addlabel(yes, if z == 1 then "You're good. Good Luck!" else " Watch it! " + (if e == 0 then "-EMAs not stacked " else "") + (if v == 0 then "-Price below EMA21 " else "") + (if t == 0 then "-Price below EMA200 " else "") + (if vw == 0 then "-Price below VWAP " else "")+ (if x == 0 then "-Declining EMA50 " else "") + (if y == 0 then "-Declining HMA " else "") + (if tt == 0 then "-Declining MoMo " else "") + (if rsioversold == 1 then "-Oversold " else "") + (if rsioverbought == 1 then "-Overbought " else ""), if z == 1 then color.green else color.orange); #End of code

Thank you for the explanation and label! I was curious if you were willing to share your workspace so we could try more of the labels and indicators? Would love to try them out on SPX options. Thank you so much!

https://usethinkscript.com/threads/cabe1332-commonly-used-chart-indicators-for-thinkorswim.8853/Thank you for the explanation and label! I was curious if you were willing to share your workspace so we could try more of the labels and indicators? Would love to try them out on SPX options. Thank you so much!

STS Cyber Rogue

New member

Hello. I know this is from a while back but can you suggest some other "non-lagging," indicators?@murkr Nothing will be able to predict the market perfectly. Keep that in mind

I always recommend people to start drawing trendlines, support, and resistance. I think it's a good starting place to get a feel of the chart, know your price levels, and understanding where price may likely to bounce or reverse from. For S/R, you must know how to draw them yourself, here is an excellent introduction post. There are various videos on YouTube regarding this subject as well.

VWAP is a great indicator; it's non-lagging and gives you an overall trend pretty well. It can also be used for counter-trend trading.

Price and volume! Study those two in depth and you'll have a much better understanding of technical analysis. After all, most indicators are based off of or are deviations of those two things.Hello. I know this is from a while back but can you suggest some other "non-lagging," indicators?

HiLet me add that the same script can be used to scan high probability entries, see below. Add your price and volume and the script below as a study filter into your scan at any aggregation and timeframe. Let me know if that helps. Good luck! @cabe1332.

Code:#Scan for good probability entry # by cabe@1332 # Start of code ######### EMA21 - price below 21 ma def dprice = close; def dlength = 21; def ddisplace = 0; def EMA21 = MovingAverage(AverageType.eXPONENTIAL, dprice, dlength)[-ddisplace]; def v = if EMA21 > EMA21[1] then 1 else 0; ######### EMA50 - price below 50 ma def eprice = close; def elength = 50; def edisplace = 0; def EMA50 = MovingAverage(AverageType.eXPONENTIAL, eprice, elength)[-edisplace]; def x = if EMA50 > EMA50[1] then 1 else 0; ######### EMA200 - price below 200 ma - losing stock don't buy def fprice = close; def flength = 200; def fdisplace = 0; def EMA200 = MovingAverage(AverageType.eXPONENTIAL, fprice, flength)[-fdisplace]; def t = if EMA200 > EMA200[1] then 1 else 0; ############ HMA def hprice = close; def hlength = 20; def displace = 0; def HMA = MovingAverage(AverageType.HULL, hprice, hlength)[-displace]; def y = if HMA > HMA[1] then 1 else 0; ############ EMAs Stacked - a must for a good setup and entry def stackedUp = MovAvgExponential("length" = 8)."AvgExp" is greater than MovAvgExponential("length" = 21)."AvgExp" and MovAvgExponential("length" = 21)."AvgExp" is greater than MovAvgExponential("length" = 34)."AvgExp" and MovAvgExponential("length" = 34)."AvgExp" is greater than MovAvgExponential("length" = 55)."AvgExp" and MovAvgExponential("length" = 55)."AvgExp" is greater than MovAvgExponential("length" = 89)."AvgExp"; def e = if stackedUp then 1 else 0; ####### TTM_Squeeze - momo must be light blue def H = reference TTM_Squeeze().Histogram; def tt = if H > 0 and H > H[1] then 1 else 0; #VWAPvalue def vwapValue = reference VWAP(); def vw = if close > vwapValue then 1 else 0; ############ RSI def rsilength = 5; def rsi = reference RSI(length = rsilength)."RSI"; def rsioversold = if rsi < 20 then 1 else 0; def rsioverbought = if rsi > 80 then 1 else 0; def r = if rsioversold or rsioverbought then 1 else 0; ############ plot plot z = if tt== 1 and x == 1 and y == 1 and e == 1 and v == 1 and r == 0 and t == 1 and vw == 1 then 1 else 0; #End of code

@cabe1332 Can you share the link for this setup please?

The script you are asking for is attached to your question.

afmiller1953

New member

As far as I know most all indicators and i include VWAP are lagging to a degree. The only ones going forward are trend lines and support/resistance lines which is why most professionals don't utilize a lot if any indicators other than VWAP (because it's used by so many people they realize it's importance in price movement). Multiple time frame windows open, watching darkpool action, options actions etc. are resources for all.Hello. I know this is from a while back but can you suggest some other "non-lagging," indicators?

Cabe, I am not sure what the indicator looks like??? Is it just the labels(s)? How would I use it? Thanks so much and sorry if my Q's seem ridiculous... JoeHi @sunnybabu, I hope your trading has been profitable. All the indicators are available and you will find them here @usethinkscript.com. Just takes a little work for you to search and understand.

I like to keep things simple and easy systematically. Someone mentioned in the list "better entry" or "how can I avoid bad entry". Well, I wrote a script below I can share that may help all or at least the early traders. Yes, I do have a lot of indicators on my chart, but my consolidated decision (or AI) does a good job telling me to avoid entry or when certain situations to get out of the position. The label maybe will save you chart space and $$$ on all timeframes whether short or long trades. I have attached some screenshots of how it looks. I hope this helps you. Just let me know what you think and feedback or just thank you is appreciated. Good luck! @cabe1332

Code:#PosEntry & Warning Label # by cabe@1332 # Start of code ######### EMA21 - price below 21 ma def dprice = close; def dlength = 21; def ddisplace = 0; def EMA21 = MovingAverage(AverageType.eXPONENTIAL, dprice, dlength)[-ddisplace]; def v = if EMA21 > EMA21[1] then 1 else 0; ######### EMA50 - price below 50 ma def eprice = close; def elength = 50; def edisplace = 0; def EMA50 = MovingAverage(AverageType.eXPONENTIAL, eprice, elength)[-edisplace]; def x = if EMA50 > EMA50[1] then 1 else 0; ######### EMA200 - price below 200 ma - losing stock don't buy def fprice = close; def flength = 200; def fdisplace = 0; def EMA200 = MovingAverage(AverageType.eXPONENTIAL, fprice, flength)[-fdisplace]; def t = if EMA200 > EMA200[1] then 1 else 0; ############ HMA def hprice = close; def hlength = 20; def displace = 0; def HMA = MovingAverage(AverageType.HULL, hprice, hlength)[-displace]; def y = if HMA > HMA[1] then 1 else 0; ############ EMAs Stacked - a must for a good setup and entry def stackedUp = MovAvgExponential("length" = 8)."AvgExp" is greater than MovAvgExponential("length" = 21)."AvgExp" and MovAvgExponential("length" = 21)."AvgExp" is greater than MovAvgExponential("length" = 34)."AvgExp" and MovAvgExponential("length" = 34)."AvgExp" is greater than MovAvgExponential("length" = 55)."AvgExp" and MovAvgExponential("length" = 55)."AvgExp" is greater than MovAvgExponential("length" = 89)."AvgExp"; def e = if stackedUp then 1 else 0; ####### TTM_Squeeze - momo must be light blue def H = reference TTM_Squeeze().Histogram; def tt = if H > 0 and H > H[1] then 1 else 0; #VWAPvalue def vwapValue = reference VWAP(); def vw = if close > vwapValue then 1 else 0; ############ RSI def rsilength = 5; def rsi = reference RSI(length = rsilength)."RSI"; def rsioversold = if rsi < 20 then 1 else 0; def rsioverbought = if rsi > 80 then 1 else 0; def r = if rsioversold or rsioverbought then 1 else 0; ############ Label def z = if tt== 1 and x == 1 and y == 1 and e and 1 and r == 0 and t == 1 and vw == 1 then 1 else 0; addlabel(yes, if z == 1 then "You're good. Good Luck!" else " Watch it! " + (if e == 0 then "-EMAs not stacked " else "") + (if v == 0 then "-Price below EMA21 " else "") + (if t == 0 then "-Price below EMA200 " else "") + (if vw == 0 then "-Price below VWAP " else "")+ (if x == 0 then "-Declining EMA50 " else "") + (if y == 0 then "-Declining HMA " else "") + (if tt == 0 then "-Declining MoMo " else "") + (if rsioversold == 1 then "-Oversold " else "") + (if rsioverbought == 1 then "-Overbought " else ""), if z == 1 then color.green else color.orange); #End of code

Cabe, thanks. How do you use/interpret Dans_Squeeze Arrows indicator? Thanks. Joe

Please provide a link to the post or paste the script that you are referring to. The label that you were asking about has no arrows.

@BonBon I happened to come across your thread and it looks amazing! Thanks for the contribution. I was able to get it loaded on TOS and I was able to profit using swing Hi Lo. However, Zigzag lags and I saw in one of your comments that you had modified it to show it just before the trend reversal. You also asked to look at post #265 and I added that but that is just the swing hi lo. Could you possibly post the tweaked code or point me to it?? THANKS SO MUCH!!@Daughters Keeper thank you for referring to the thread. I made several updates to the code since the first post and other indicators were added to confirm buy and sell signals.

@rogtrader this is the link to the thread. Please ensure you read the entire thread and comments and review the resources(page 5). I hope this helps.

https://usethinkscript.com/threads/completed-heikin_ashi-indicator.5251/

As are reminder always do your own diligence and have a trading plan.

Disclaimer- this is how I use my HA_smoothing indicator and MTF within my trading plan. It works for me. Everyone needs to find what works for them. This indicator is not the holy grail but I have found that combined with fundamentals and technicals it can take away some indecisiveness and keep one in the trade longer. On the flip side it can get you out of a trade and decrease the risk.

Frustration, Depression, overconfidence, FOMO, Fear of Loss are the range of emotions you experience while trading. Forget finding the perfect indicator or combination there of. The reason indicators look like they are predictive is because they follow data thats already happened. Everyday is a new story, hindsight is 20/20 and the future is uncertain. Follow these Five Truths that are stated in the Book Trading in the Zone by Mark Douglas.I feel like I've tried 20 indicators (not at once) and even with backtesting and strict entry requirements, my trades are 50/50.

I feel mesmerized by indicators that look like they predict the market perfectly, but when I try to use them it doesn't work out that well. Even being strict, using various indicators to help with entry/exits.

Every time I looked at some professional's charts from a picture taken from a trading desk they always have very little indicators. It looks like some sort of EMA/SMA cross, VWAP, volume, multiple time frames from a single stock, and the news bar.

So if these people doing 100K+ a month are using so little then what is their edge?

There must be so many different edges out there. If you are a successful trader, can you share your edge?

example: I scalp /ES on the 3m when RSI is below 30 and see a bump in volume. or I trade options verticle spreads with a %70 delta.

I just cant find my edge and its frustrating. I've been at this for over a year.. every day... I tried Futures now im trying to learn options.

1. Anything can happen.

2. You don't need to know what is going to happen next in order to make money.

3. There is a random distribution between wins and losses for any given set of variables that define and edge.

4. An Edge is nothing more than an indication of a higher probability of one thing happening over another.

5. Every moment in the market is unique.

Mr_Wheeler

Active member

The other problem is that you need to know of potential price driving action ahead of time.

Then you shouldn't trade for the sake of trading which pressures you into making mistakes.

Lastly don't be a penny pincher regarding getting out of bad trades. If you're a few dollars from breaking even after being down several hundred or thousand dollars then it's alright to take a 10 dollar loss so that you can close your trade, your stock trading program, and get away from the computer for a week or so.

If you're feeling bitter about a trade then you should get out when you can. Trillions of dollars are traded each day.

nguyen36858

New member

Your question was moved here. These 5 pages will give you a start.Hi All, what indicators do you recommend for day trading?

How to search for answers to any additional questions:

https://usethinkscript.com/threads/search-the-forum.12626/

I'll go first and post my indicators and strategy. I have been on this website for about a year now have successfully made $10,000 only last month starting my account from $1,500 using 4 indicators posted on here. I call them the big 4. Ehlers, anchored momentum, ak trend, and zscore. My strategy is simple. I wait until 3 out 4 of the indicators are either bullish or bearish to take on a trade.

https://usethinkscript.com/threads/chart-setup-w-no-name.14711/

Over the years I have used other indicators as well but lost. So, I am wondering what others have used to successfully day trade.

Ramisegal

Active member

Can someone share me with a day trading strategy that has worked for them. I have tried many strategies and used many indicators but ended up losing trades or the strategy didn't work good enough backtesting.

Hi Zed, This a strategy I am putting together and currently backtesting. so far it seems to have good results in all time frames.

https://usethinkscript.com/threads/...trend-ver2-chart-setup-for-thinkorswim.14658/

like you i was hoping to find here a buy/sell indicator that has shown better backtesting results.

Grid with all indicators and strategy

http://tos.mx/Z4IBkmS

The first link appearing above isn't working. Can you check it and repost?Hi Zed, This a strategy I am putting together and currently backtesting. so far it seems to have good results in all time frames.

https://usethinkscript.com/threads/...chart-setup-for-thinkorswim.14368/post-120770

like you i was hoping to find here a buy/sell indicator that has shown better backtesting results.

Grid with all indicators and strategy

http://tos.mx/Z4IBkmS

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Similar threads

-

-

-

When target price is met start a trail stop order - what's the best way to set this up?

- Started by Grayfox87

- Replies: 1

-

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

-

-

When target price is met start a trail stop order - what's the best way to set this up?

- Started by Grayfox87

- Replies: 1

-

-

Similar threads

-

-

-

When target price is met start a trail stop order - what's the best way to set this up?

- Started by Grayfox87

- Replies: 1

-

-

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/