Hi guys -

I joined this forum and it was very helpful. Thanks for all the contributors from leader board especially “Ben”. Lot of useful info in forum.

I am new to stocks trading and its been 1 month so far I started trading stocks. I tried different ways from different stock alerts providers to buy/sell stocks, but they are not much helpful or not even close to info I learnt from this group.

So far - I learnt about when to buy/sell stocks, based on indicators strategies provided in this forum. But sometimes the stocks I sold will take a swing on same day with in minutes or hours and rise to even more profits.I feel bad for selling early.

I really appreciate your help pls. I am interested in Day Trading @BenTen @tomsk @horserider @markos or anyone who can help me with my request pls.

I joined this forum and it was very helpful. Thanks for all the contributors from leader board especially “Ben”. Lot of useful info in forum.

I am new to stocks trading and its been 1 month so far I started trading stocks. I tried different ways from different stock alerts providers to buy/sell stocks, but they are not much helpful or not even close to info I learnt from this group.

So far - I learnt about when to buy/sell stocks, based on indicators strategies provided in this forum. But sometimes the stocks I sold will take a swing on same day with in minutes or hours and rise to even more profits.I feel bad for selling early.

- I am curious to know if there is any script that can hint me about stock possibly go further up based on patterns or study?

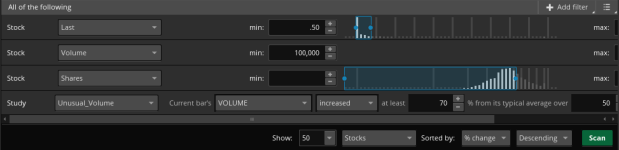

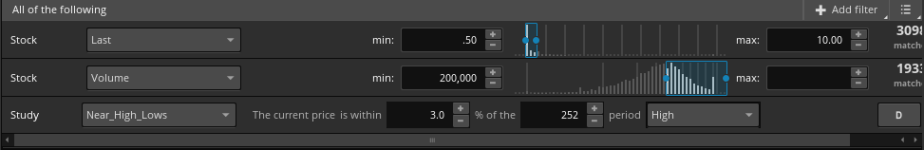

- Most of my time goes away by researching what stocks to buy. I have multiple scanners/filters in my TOS platform which I got, but its little confusing to go over all the scanners I have and identifying each stock and doing research on each of the stock from each of the scanner/filter list. Is there a best scanner script that can help me to identify stocks that can take best swing or best gap up along with labels or indicators pls? This will help me a lot as beginner.

I really appreciate your help pls. I am interested in Day Trading @BenTen @tomsk @horserider @markos or anyone who can help me with my request pls.