#// This source code is subject to the terms of the Mozilla Publi

#// © Beardy_Fred

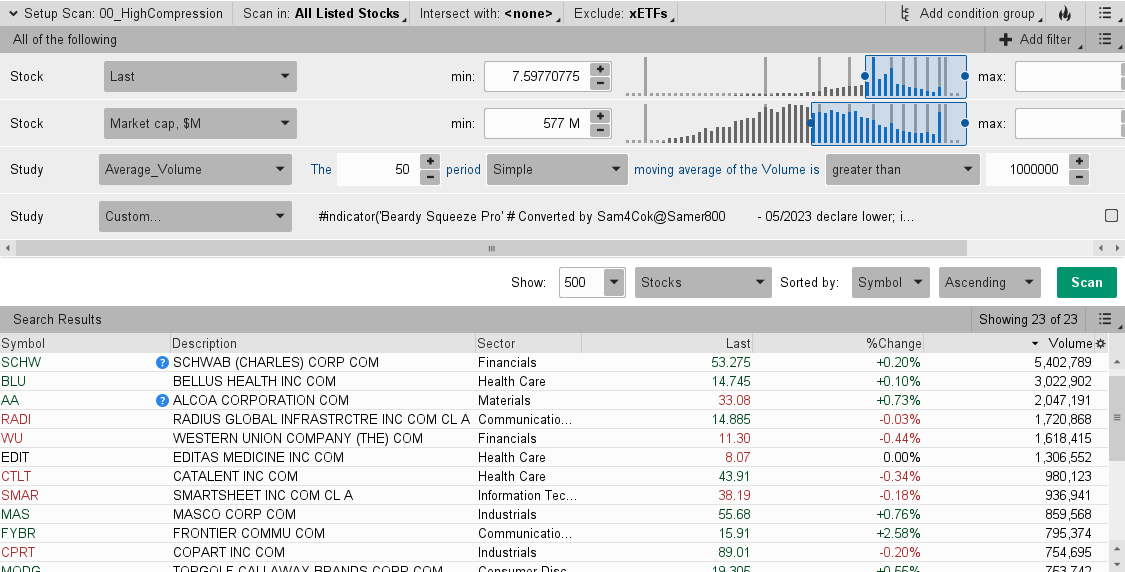

#indicator('Beardy Squeeze Pro', shorttitle='Squeeze', overlay=false, precision=2)

# Converted and mod By Sam4Cok@Samer800 - 10 / 2023

# Update - Added Divergences - 08/2024

declare lower;

input enabelAlerts = yes;

input alertSound = {default "NoSound", "Ding", "Bell", "Chimes", "Ring"};

input alertType = Alert.BAR;

input showLabel = yes;

input colorBars = {Default "On Squeeze", "On Momentum", "Don't Color Bars"};

input movAvgType = AverageType.SIMPLE;

input source = close;

input length = 20;#, "TTM Squeeze Length")

input threshold = 1.0;

input BB_mult = 2.0;#, "Bollinger Band STD Multiplier")

input KC_mult_high = 1.0;#, "Keltner Channel #1")

input KC_mult_mid = 1.5;#, "Keltner Channel #2")

input KC_mult_low = 2.0;#, "Keltner Channel #3")

def na = Double.NaN;

def last = isNaN(close);

def pos = Double.POSITIVE_INFINITY;

def neg = Double.NEGATIVE_INFINITY;

def sqzBar = colorBars==colorBars."On Squeeze";

def momBar = colorBars==colorBars."On Momentum";

#--Colors

DefineGlobalColor("upGrow", CreateColor(0,188,212));

DefineGlobalColor("upFall", CreateColor(41,98,255));

DefineGlobalColor("dnGrow", CreateColor(255,235,59));

DefineGlobalColor("dnFall", CreateColor(255,82,82));

DefineGlobalColor("noSq", CreateColor(76,175,80));

DefineGlobalColor("loSq", Color.DARK_GRAY); #Color.GRAY);#CreateColor(54,58,69));

DefineGlobalColor("hiSq", Color.MAGENTA); #Color.RED); #CreateColor(255,82,82));

DefineGlobalColor("midSq",Color.PLUM); #CreateColor(255,152,0));

#//BOLLINGER BANDS

def BB_basis = MovingAverage(movAvgType, source, length);

def dev = BB_mult * StDev(source, length);

def BB_upper = BB_basis + dev;

def BB_lower = BB_basis - dev;

#//KELTNER CHANNELS

def KC_basis = BB_basis;#ta.sma(close, length)

def tr = TrueRange(high, close, low);

def devKC = MovingAverage(movAvgType, tr, length);

def KC_upper_high = KC_basis + devKC * KC_mult_high;

def KC_lower_high = KC_basis - devKC * KC_mult_high;

def KC_upper_mid = KC_basis + devKC * KC_mult_mid;

def KC_lower_mid = KC_basis - devKC * KC_mult_mid;

def KC_upper_low = KC_basis + devKC * KC_mult_low;

def KC_lower_low = KC_basis - devKC * KC_mult_low;

#//SQUEEZE CONDITIONS

def NoSqz = BB_lower < KC_lower_low or BB_upper > KC_upper_low; # //NO SQUEEZE: GREEN

def LowSqz = BB_lower >= KC_lower_low or BB_upper <= KC_upper_low; # //LOW COMPRESSION: BLACK

def MidSqz = BB_lower >= KC_lower_mid or BB_upper <= KC_upper_mid; # //MID COMPRESSION: RED

def HighSqz = BB_lower >= KC_lower_high or BB_upper <= KC_upper_high; # //HIGH COMPRESSION: ORANGE

#//MOMENTUM OSCILLATOR

def hh = Highest(high, length);

def ll = Lowest(low, length);

def hlAvg = (hh + ll + KC_basis) / 3;

def mom = Inertia(source - hlAvg, length);

#//MOMENTUM HISTOGRAM COLOR

def mom_col = if mom > 0 then

if mom > mom[1] then 2 else 1 else

if mom > mom[1] then -2 else - 1;

#//SQUEEZE DOTS COLOR

def sq_col = if HighSqz then 3 else

if MidSqz then 2 else

if LowSqz then 1 else 0;

#//PLOTS

plot sqLine = if last then na else 0; # 'SQZ'

plot momHist = mom; # 'MOM'

sqLine.SetLineWeight(2);

sqLine.SetPaintingStrategy(paintingStrategy.POINTS);

sqLine.AssignValueColor(if sq_col==3 then GlobalColor("hiSq") else

if sq_col==2 then GlobalColor("midSq") else

if sq_col==1 then GlobalColor("loSq") else GlobalColor("noSq"));

momHist.SetPaintingStrategy(paintingStrategy.SQUARED_HISTOGRAM);

momHist.AssignValueColor(if mom_col== 2 then GlobalColor("upGrow") else

if mom_col== 1 then GlobalColor("upFall") else

if mom_col==-2 then GlobalColor("dnGrow") else GlobalColor("dnFall"));

#-- Label

AddLabel(showLabel and sq_col==3, "HIGH COMPRESSION", GlobalColor("hiSq"));

AddLabel(showLabel and sq_col==2, "MID COMPRESSION", GlobalColor("midSq"));

AddLabel(showLabel and sq_col==1, "LOW COMPRESSION", GlobalColor("loSq"));

AddLabel(showLabel and sq_col==0, "NO SQUEEZE", GlobalColor("noSq"));

#-- Bar Color

AssignPriceColor(if !momBar then Color.CURRENT else

if mom_col== 2 then GlobalColor("upGrow") else

if mom_col== 1 then GlobalColor("upFall") else

if mom_col==-2 then GlobalColor("dnGrow") else GlobalColor("dnFall"));

AssignPriceColor(if !sqzBar then Color.CURRENT else

if sq_col==3 then GlobalColor("hiSq") else

if sq_col==2 then GlobalColor("midSq") else

if sq_col==1 then GlobalColor("loSq") else GlobalColor("noSq"));

AddCloud(if mom>= threshold then pos else na, neg, Color.DARK_GREEN);

AddCloud(if mom<=-threshold then pos else na, neg, Color.DARK_RED);

#-- END of CODE

#----Div-----------

input showDivergences = yes;

input LookBackRight = 5; # "Pivot Lookback Right"

input LookBackLeft = 5; # "Pivot Lookback Left"

input MaxLookback = 60; # "Max of Lookback Range"

input MinLookback = 5; # "Min of Lookback Range"

def divSrc = mom;

def h = high;

def l = low;

Script Pivot {

input series = close;

input leftBars = 10;

input rightBars = 10;

input isHigh = yes;

def na = Double.NaN;

def HH = series == Highest(series, leftBars + 1);

def LL = series == Lowest(series, leftBars + 1);

def pivotRange = (leftBars + rightBars + 1);

def leftEdgeValue = if series[pivotRange] ==0 then na else series[pivotRange];

def pvtCond = !isNaN(series) and leftBars > 0 and rightBars > 0 and !isNaN(leftEdgeValue);

def barIndexH = if pvtCond then

fold i = 1 to rightBars + 1 with p=1 while p do

series > GetValue(series, - i) else na;

def barIndexL = if pvtCond then

fold j = 1 to rightBars + 1 with q=1 while q do

series < GetValue(series, - j) else na;

def PivotPoint;

if isHigh {

PivotPoint = if HH and barIndexH then series else na;

} else {

PivotPoint = if LL and barIndexL then series else na;

}

plot pvt = PivotPoint;

}

#_inRange(cond) =>

script _inRange {

input cond = yes;

input rangeUpper = 60;

input rangeLower = 5;

def bars = if cond then 0 else bars[1] + 1;

def inrange = (rangeLower <= bars) and (bars <= rangeUpper);

plot retrun = inRange;

}

def pl_ = pivot(divSrc,LookBackLeft, LookBackRight, no);

def ph_ = pivot(divSrc,LookBackLeft, LookBackRight, yes);

def pl = !isNaN(pl_);

def ph = !isNaN(ph_);

def pll = lowest(divSrc,LookBackLeft +1);

def phh = highest(divSrc,LookBackLeft+1);

def sll = lowest(l, LookBackLeft +1);

def shh = highest(h, LookBackLeft+1);

#-- Pvt Low

def plStart = if pl then yes else plStart[1];

def plFound = if (plStart and pl) then 1 else 0;

def vlFound1 = if plFound then divSrc else vlFound1[1];

def vlFound_ = if vlFound1!=vlFound1[1] then vlFound1[1] else vlFound_[1];

def vlFound = if !vlFound_ then pll else vlFound_;

def plPrice1 = if plFound then l else plPrice1[1];

def plPrice_ = if plPrice1!=plPrice1[1] then plPrice1[1] else plPrice_[1];

def plPrice = if !plPrice_ then sll else plPrice_;

#-- Pvt High

def phStart = if ph then yes else phStart[1];

def phFound = if (phStart and ph) then 1 else 0;

def vhFound1 = if phFound then divSrc else vhFound1[1];

def vhFound_ = if vhFound1!=vhFound1[1] then vhFound1[1] else vhFound_[1];

def vhFound = if !vhFound_ then phh else vhFound_;

def phPrice1 = if phFound then h else phPrice1[1];

def phPrice_ = if phPrice1!=phPrice1[1] then phPrice1[1] else phPrice_[1];

def phPrice = if !phPrice_ then shh else phPrice_;

#// Regular Bullish

def inRangePl = _inRange(plFound[1],MaxLookback,MinLookback);

def oscHL = divSrc > vlFound and inRangePl;

def priceLL = l < plPrice and divSrc < 0;

def bullCond = plFound and oscHL and priceLL;

#// Regular Bearish

def inRangePh = _inRange(phFound[1],MaxLookback,MinLookback);

def oscLH = divSrc < vhFound and inRangePh;

def priceHH = h > phPrice and divSrc > 0;

def bearCond = phFound and oscLH and priceHH;

#------ Bubbles

def bullBub = showDivergences and bullCond;

def bearBub = showDivergences and bearCond;

addchartbubble(bullBub, divSrc, "R", Color.GREEN, no);

addchartbubble(bearBub, divSrc, "R", Color.RED, yes);

##### Lines

def bar = BarNumber();

#-- Bear Line

def lastPhBar = if ph then bar else lastPhBar[1];

def prePhBar = if lastPhBar!=lastPhBar[1] then lastPhBar[1] else prePhBar[1];

def priorPHBar = if bearCond then prePhBar else priorPHBar[1];

#-- Bull Line

def lastPlBar = if pl then bar else lastPlBar[1];

def prePlBar = if lastPlBar!=lastPlBar[1] then lastPlBar[1] else prePlBar[1];

def priorPLBar = if bullCond then prePlBar else priorPLBar[1];

def lastBullBar = if bullCond then bar else lastBullBar[1];

def lastBearBar = if bearCond then bar else lastBearBar[1];

def HighPivots = ph and bar >= HighestAll(priorPHBar) and bar <= HighestAll(lastBearBar);

def LowPivots = pl and bar >= HighestAll(priorPLBar) and bar <= HighestAll(lastBullBar);

def pivotHigh = if HighPivots then divSrc else na;

def pivotLow = if LowPivots then divSrc else na;

plot PlotHline = if showDivergences then pivotHigh else na;

PlotHline.EnableApproximation();

PlotHline.SetDefaultColor(Color.RED);

plot PlotLline = if showDivergences then pivotLow else na;

PlotLline.EnableApproximation();

PlotLline.SetDefaultColor(Color.GREEN);

#---- Alerts

Alert(enabelAlerts and bullCond, "Bullish Div", alertType, alertSound);

Alert(enabelAlerts and bearCond, "Bearish Div", alertType, alertSound);

#-- END of CODE