The Automatic Quadrant Lines is a trading strategy upper indicator that projects where price might go in the future. Use weekly/daily/4 hr chart for swing trading. Use 30 min or less for day trading. This indicator shows you the long entry and long target. It shows you a short entry and short target. In the indicator, L/E is Long Entry, and S/E is Short Entry. The targets show the price in the chart bubble. There is a break down target line (dark green) that indicates if price breaks lower than the support line, this is where price may break down to. The indicator includes an up and down arrow that indicates when price breaks through the Long or Short Entry line. There are also alerts built in when the arrows appear.

Long strategy lines are dashed and have a (2) weight while short strategy are solid and single weighted lines.

(NOTE: If price breaks down or up from the dark red support and resistance lines, a new set of lines will appear. There are no guarantees price will hit the target.)

Here are some examples.

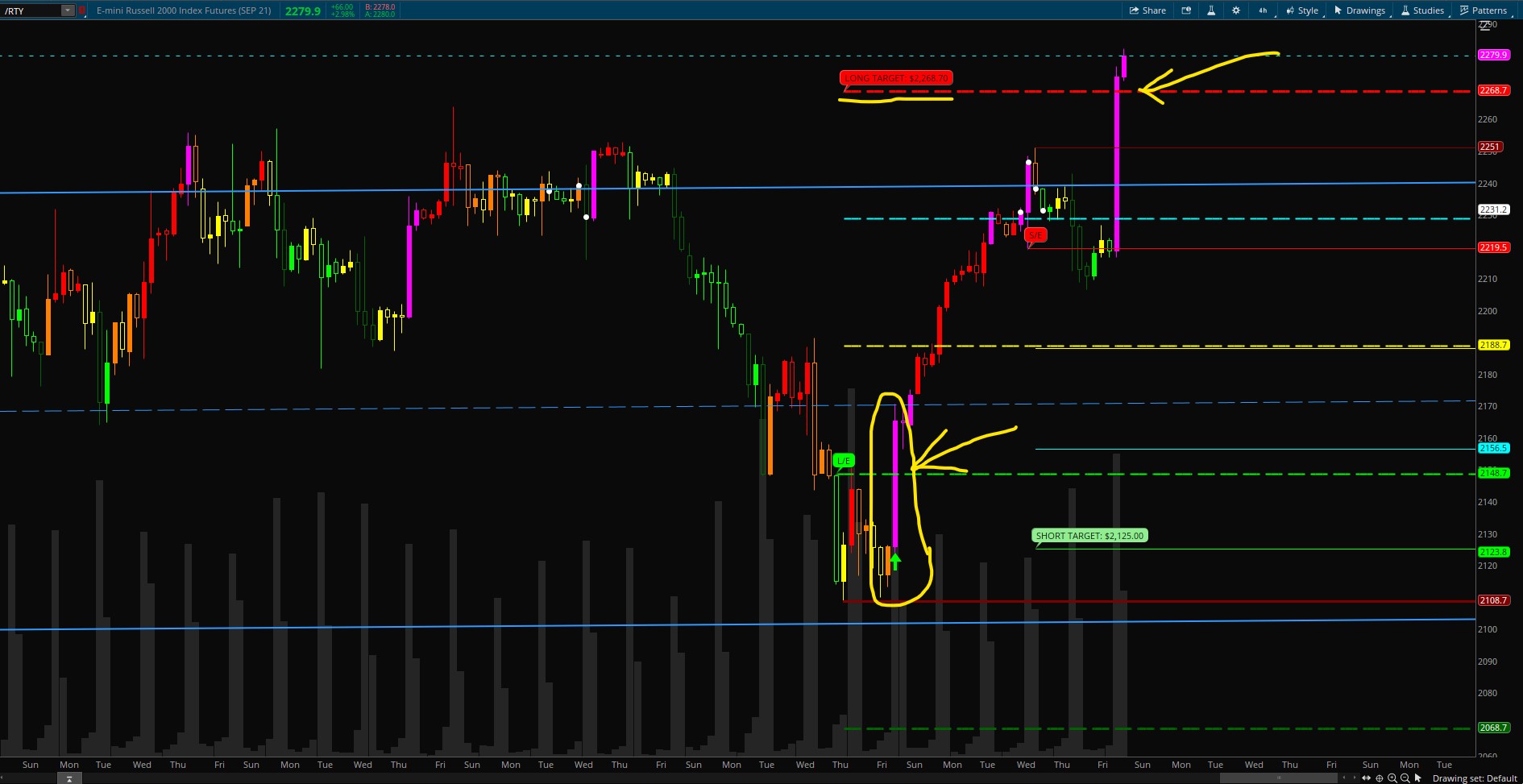

/RTY on 4 hr chart.

/ES on 15m chart. Price broke above target on FED news.

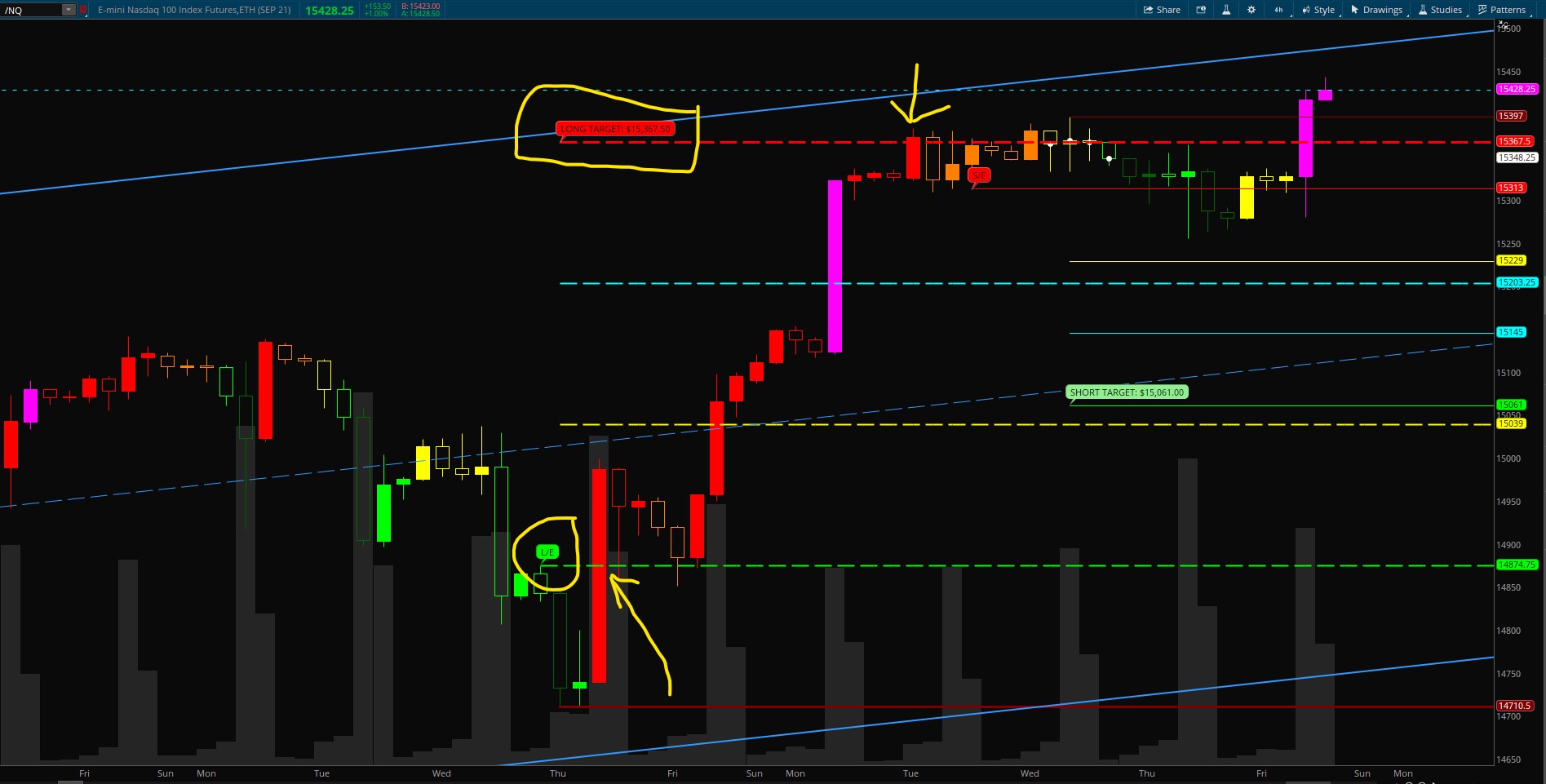

/NQ on 4 hr chart. Hit target.

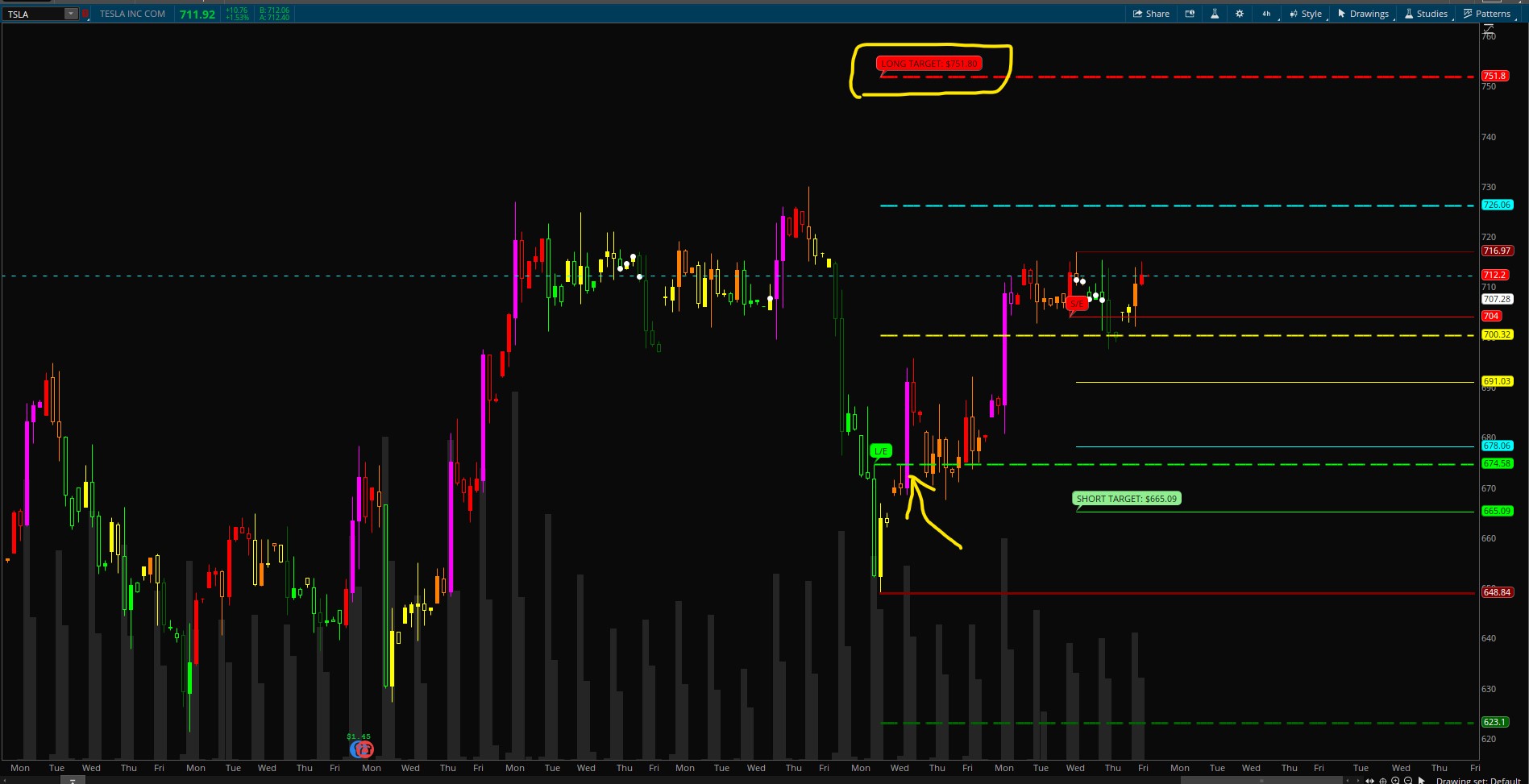

Tesla on 4 hr chart. Above the 50% line. Target at $751.80.

/SI on 10 min chart. Hit target.

Shareable Link:

http://tos.mx/2pnajoG

Long Entry Scan Alert

http://tos.mx/3Jppd0g

Short Entry Scan Alert

http://tos.mx/KGlOVLi

CODE:

Long strategy lines are dashed and have a (2) weight while short strategy are solid and single weighted lines.

(NOTE: If price breaks down or up from the dark red support and resistance lines, a new set of lines will appear. There are no guarantees price will hit the target.)

Here are some examples.

/RTY on 4 hr chart.

/ES on 15m chart. Price broke above target on FED news.

/NQ on 4 hr chart. Hit target.

Tesla on 4 hr chart. Above the 50% line. Target at $751.80.

/SI on 10 min chart. Hit target.

Shareable Link:

http://tos.mx/2pnajoG

Long Entry Scan Alert

http://tos.mx/3Jppd0g

Short Entry Scan Alert

http://tos.mx/KGlOVLi

CODE:

Code:

#Automatic Quadrant Lines

#based on Mobius's Fractal Pivot Strategy

#developed by Chewie76 on 8/27/2021

# User Inputs

input n = 20;

input FractalEnergyLength = 8;

input FractalEnergyThreshold = .68;

input AtrMult = .70;

input nATR = 4;

input AvgType = AverageType.HULL;

input LabelsOn = yes;

input AlertsOn = yes;

# Variables

def o = open;

def h = high;

def l = low;

def c = close;

def bar = BarNumber();

def TS = TickSize();

def nan = double.nan;

def ATR = Round((MovingAverage(AvgType, TrueRange(h, c, l), nATR)) / TS, 0) * TS;

def risk = if Between(c, 0, 1500)

then ATR

else if Between(c, 1500, 3500)

then 2

else if Between(c, 3500, 5500)

then 4

else 6;

def FE = Log(Sum((Max(h, c[1]) - Min(l, c[1])), FractalEnergyLength) /

(Highest(h, FractalEnergyLength) - Lowest(l, FractalEnergyLength)))

/ Log(FractalEnergyLength);

# Parent Aggregation Pivot High

# Pivot High Variables

def p_hh = fold i = 1 to n + 1

with p = 1

while p

do h > GetValue(h, -1);

def p_PivotH = if (bar > n and

h == Highest(h, n) and

p_hh)

then h

else NaN;

def p_PHValue = if !IsNaN(p_PivotH)

then p_PivotH

else p_PHValue[1];

def p_PHBar = if !IsNaN(p_PivotH)

then bar

else nan;

# Pivot High and Pivot High Exit Variables

# Pivot High Variables

def hh = fold ii = 1 to n + 1

with pp = 1

while pp

do h > GetValue(h, -1);

def PivotH = if (bar > n and

h == Highest(h, n) and

hh)

then h

else Double.NaN;

def PHValue = if !IsNaN(PivotH)

then PivotH

else PHValue[1];

def PHBar = if !IsNaN(PivotH)

then bar

else nan;

# Pivot High Exit Variables

def PHExit = if (bar > n and

h == Highest(h, n) and

hh)

then if l[1] < l

then l[1]

else fold r = 0 to 20

with a = NaN

while IsNaN(a)

do if GetValue(l[1], r) < l

then GetValue(l[1], r)

else NaN

else Double.NaN;

def PHExitValue = if !IsNaN(PHExit)

then PHExit

else PHExitValue[1];

def PHExitBar = if (bar > n and

h == Highest(h, n) and

hh)

then if l[1] < l

then bar - 1

else fold d = 0 to 20

with y = NaN

while IsNaN(y)

do if GetValue(l[1], d) < l

then GetValue(bar - 1, d)

else NaN

else NaN;

# Pivot Low and Pivot Low Entry Variables

# Parent Pivot Low Variables

def p_ll = fold j = 1 to n + 1

with q = 1

while q

do l < GetValue(l, -1);

def p_PivotL = if (bar > n and

l == Lowest(l, n) and

p_ll)

then l

else NaN;

def p_PLValue = if !IsNaN(p_PivotL)

then p_PivotL

else p_PLValue[1];

def p_PLBar = if !IsNaN(p_PivotL)

then bar

else nan;

# Pivot Low Variables

def ll = fold jj = 1 to n + 1

with qq = 1

while qq

do l < GetValue(l, -1);

def PivotL = if (bar > n and

l == Lowest(l, n) and

ll)

then l

else NaN;

def PLValue = if !IsNaN(PivotL)

then PivotL

else PLValue[1];

def PLBar = if !IsNaN(PivotL)

then bar

else nan;

# Pivot Low Entry Variables

def PLEntry = if (bar > n and

l == Lowest(l, n) and

ll)

then if h[1] > h

then h[1]

else fold t = 0 to 20

with w = NaN

while IsNaN(w)

do if GetValue(h[1], t) > h

then GetValue(h[1], t)

else NaN

else NaN;

def PLEntryValue = if !IsNaN(PLEntry)

then PLEntry

else PLEntryValue[1];

def PLEntryBar = if (bar > n and

l == Lowest(l, n) and

ll)

then if h[1] > h

then bar - 1

else fold u = 0 to 20

with z = NaN

while IsNaN(z)

do if GetValue(h[1], u) > h

then GetValue(bar - 1, u)

else NaN

else NaN;

# Plots

plot R1 = if bar >= HighestAll(PHBar)

then HighestAll(if isNaN(close[-1])

then PHValue

else nan)

else nan;

R1.SetDefaultColor(Color.dark_red);

R1.SetLineWeight(1);

plot ShortEntry = if bar >= HighestAll(PHexitBar)

then HighestAll(if isNaN(close[-1])

then PHExitValue

else nan)

else nan;

ShortEntry.SetDefaultColor(Color.red);

def SE =(if isNaN(ShortEntry[1]) then ShortEntry else Double.NaN);

addchartBubble(LabelsOn and ShortEntry, SE,"S/E",color.red);

plot S1 = if bar >= HighestAll(PLBar)

then HighestAll(if isNaN(c[-1])

then PLValue

else nan)

else nan;

S1.SetDefaultColor(Color.dark_red);

S1.SetLineWeight(3);

plot LongEntry = if bar >= HighestAll(PLEntryBar)

then HighestAll(if isNaN(c[-1])

then PLEntryValue

else nan)

else nan;

LongEntry.SetDefaultColor(Color.GREEN);

LongEntry.SetStyle(Curve.long_DASH);

LongEntry.SetLineWeight(2);

def LE =(if isNaN(LongEntry[1]) then LongEntry else Double.NaN);

addchartBubble(LabelsOn and LongEntry, LE,"L/E",color.green);

plot UpArrow = if c crosses above LongEntry and FE > .5

then l

else Double.NaN;

UpArrow.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

UpArrow.SetLineWeight(5);

UpArrow.SetDefaultColor(Color.GREEN);

plot DnArrow = if c crosses below ShortEntry and ((FE > .618)

or (FE < .382))

then h

else Double.NaN;

DnArrow.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

DnArrow.SetLineWeight(5);

DnArrow.SetDefaultColor(Color.RED);

plot Fifty = (LongEntry - S1) + LongEntry;

Fifty.setdefaultcolor(color.yellow);

Fifty.SetStyle(Curve.long_DASH);

Fifty.setlineweight(2);

plot SeventyFive = (LongEntry - S1) + Fifty;

SeventyFive.setdefaultcolor(color.cyan);

SeventyFive.SetStyle(Curve.long_DASH);

SeventyFive.setlineweight(2);

plot Target = (LongEntry - S1) + SeventyFive;

Target.setdefaultcolor(color.red);

Target.SetStyle(Curve.long_DASH);

Target.setlineweight(3);

def LT =(if isNaN(TARGET[1]) then Target else Double.NaN);

addchartBubble(LabelsOn and Target, LT,"LONG TARGET: " + asDollars(LT),color.red);

plot BreakDownTarget = S1 -(LongEntry - S1);

BreakDownTarget.setdefaultcolor(color.dark_Green);

BreakDownTarget.SetStyle(Curve.long_DASH);

BreakDownTarget.setlineweight(3);

plot S_Fifty = ShortEntry - (R1 - ShortEntry);

S_Fifty.setdefaultcolor(color.yellow);

S_Fifty.setlineweight(1);

plot S_SeventyFive = S_Fifty - (R1 - ShortEntry);

S_SeventyFive.setdefaultcolor(color.cyan);

S_SeventyFive.setlineweight(1);

plot S_ShortTarget = S_SeventyFive - (R1 - ShortEntry);

S_ShortTarget.setdefaultcolor(color.green);

S_ShortTarget.setlineweight(1);

def ST =(if isNaN(S_ShortTarget[1]) then S_ShortTarget else Double.NaN);

addchartBubble(LabelsOn and S_ShortTarget, ST,"SHORT TARGET: " + asDollars(ST),color.light_green);

# Alerts

Alert(AlertsOn and UpArrow, " ", Alert.Bar, Sound.ding);

Alert(AlertsOn and DnArrow, " ", Alert.Bar, Sound.ding);

Last edited: