You should upgrade or use an alternative browser.

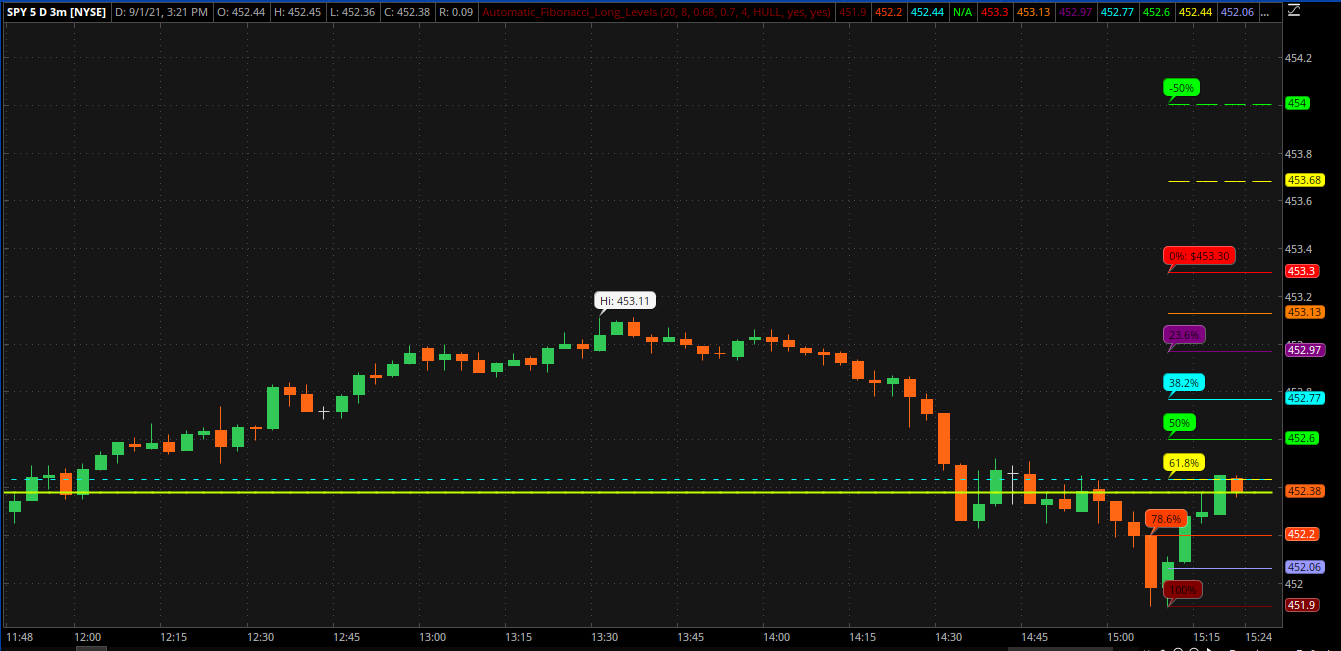

Automatic Quadrant Lines for ThinkorSwim

- Thread starter chewie76

- Start date

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Quick questions

Cyan line= what does it represent ?

Yellow line= What does is represent?

Seems like support and registant ?

Thanks in advance

Stay humble stay blessed

Cyan is the 75% line, yellow is 50%.@chewie76 Thank you so much for your hard work and to share with the community. I'm using your script on a 30 and 1 hour chart to view target but I trade on a 2-minute chart for scalp. It was on point !!

Quick questions

Cyan line= what does it represent ?

Yellow line= What does is represent?

Seems like support and registant ?

Thanks in advance

Stay humble stay blessed

It resets on a pullback.does this reset once it hits the target ?

Should be possible, I have not built them before.@chewie76 thank you for this code. Is it possible to build a strategy out of it and see the p/l please?

Here is an example of a daily scan for up arrow. http://tos.mx/hkEJN7iCan you show how to scan if price cross above the Long entry please?

Also, how many days is the price expected to reach the Long Target?

If I see a Short Entry before the stock reaches the Long Target, then is it time to exit?

Thank you very much.

Long entry and green arrow are the same. Take the trade at the long entry. There is no guarantee price will hit the long target, so you have to monitor the trade. I would set a stop loss to protect any profits. If it drops below the long target, get out of the trade.@chewie76 I just downloaded this script and it looks very promising. Can you please let me know the difference between the Long Entry vs the green up arrow? In other words, at which point is it good to make a (long) trade?

Also, how many days is the price expected to reach the Long Target?

If I see a Short Entry before the stock reaches the Long Target, then is it time to exit?

Thank you very much.

Thanks for this Chewie. Will this work with options trading as well? Taking into consideration ‘time decay’. Just trying to know where to put stop losses. Was thinking below L/ELong entry and green arrow are the same. Take the trade at the long entry. There is no guarantee price will hit the long target, so you have to monitor the trade. I would set a stop loss to protect any profits. If it drops below the long target, get out of the trade.

I have not checked if it works on option charts. On a stock chart, if it goes below the L/E, then that's a good stop loss. I prefer to sell options instead of buying them.Thanks for this Chewie. Will this work with options trading as well? Taking into consideration ‘time decay’. Just trying to know where to put stop losses. Was thinking below L/E

I use extended trading sessions. I don't experience long load times.Is it normal to have incredibly long load times??

And, for futures should Globex/over night data be used or just the cash session?

Supposed to be price level. It works well on the mobile, but the desktop looks delayed. TOS has some issue with how the code works.@chewie76 I am learning about your script and it's a great script. Quick question about Priceline, I see it moves up and down. What does it represent?

Thank you

Supposed to be price level. It works well on the mobile, but the desktop looks delayed. TOS has some issue with how the code works.

Yeah, it lags terribly due to HighestAll()... I disable the plot and just use the Line At Price code from Mobius which is here in the forums... It may not span the entire chart but I don't really need it to...

I added Mobius's alternative to one of my fib indicators since both long and short are using it and I'm getting the exact same result.Yeah, it lags terribly due to HighestAll()... I disable the plot and just use the Line At Price code from Mobius which is here in the forums... It may not span the entire chart but I don't really need it to...

I'm using this code with an input barsback. What am I doing wrong?Odd... I added it while I still had the original in place and the original stayed motionless while the alternate was moving with price action... Notice the lime colored line from the alternate...

def c2 = if !IsNaN(close) and IsNaN(close[-1])

then close

else c2[1];

plot priceLine = if isNaN(close[-barsBack])

then c2[-barsBack]

else Double.NaN;

Edited at add: And those are the only two indicators on the chart...

Similar threads

-

Automatic Long and Short Fibonacci Level Indicators for ThinkorSwim

- Started by chewie76

- Replies: 42

-

Automatic patterns studies, Bull, Bear, Bullish only & Bearish only For ThinkOrSwim

- Started by mourningwood4521

- Replies: 8

-

Previous Day High/Low/Close + Premarket High/Low + High/Low/Open of Day + ATR Lines for ThinkorSwim

- Started by Wiinii

- Replies: 107

-

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

Automatic Long and Short Fibonacci Level Indicators for ThinkorSwim

- Started by chewie76

- Replies: 42

-

Automatic patterns studies, Bull, Bear, Bullish only & Bearish only For ThinkOrSwim

- Started by mourningwood4521

- Replies: 8

-

Previous Day High/Low/Close + Premarket High/Low + High/Low/Open of Day + ATR Lines for ThinkorSwim

- Started by Wiinii

- Replies: 107

-

-

Similar threads

-

Automatic Long and Short Fibonacci Level Indicators for ThinkorSwim

- Started by chewie76

- Replies: 42

-

Automatic patterns studies, Bull, Bear, Bullish only & Bearish only For ThinkOrSwim

- Started by mourningwood4521

- Replies: 8

-

Previous Day High/Low/Close + Premarket High/Low + High/Low/Open of Day + ATR Lines for ThinkorSwim

- Started by Wiinii

- Replies: 107

-

-

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/