@rogtrader So, I read through the same six pages of this thread that you did. And found out, the same as you, that the scanner in the 1st thread has been a problem. Greater minds than mine have not been able to get it to yield results. So, that script is not going to happen.

On to the other scanner scripts in this thread:

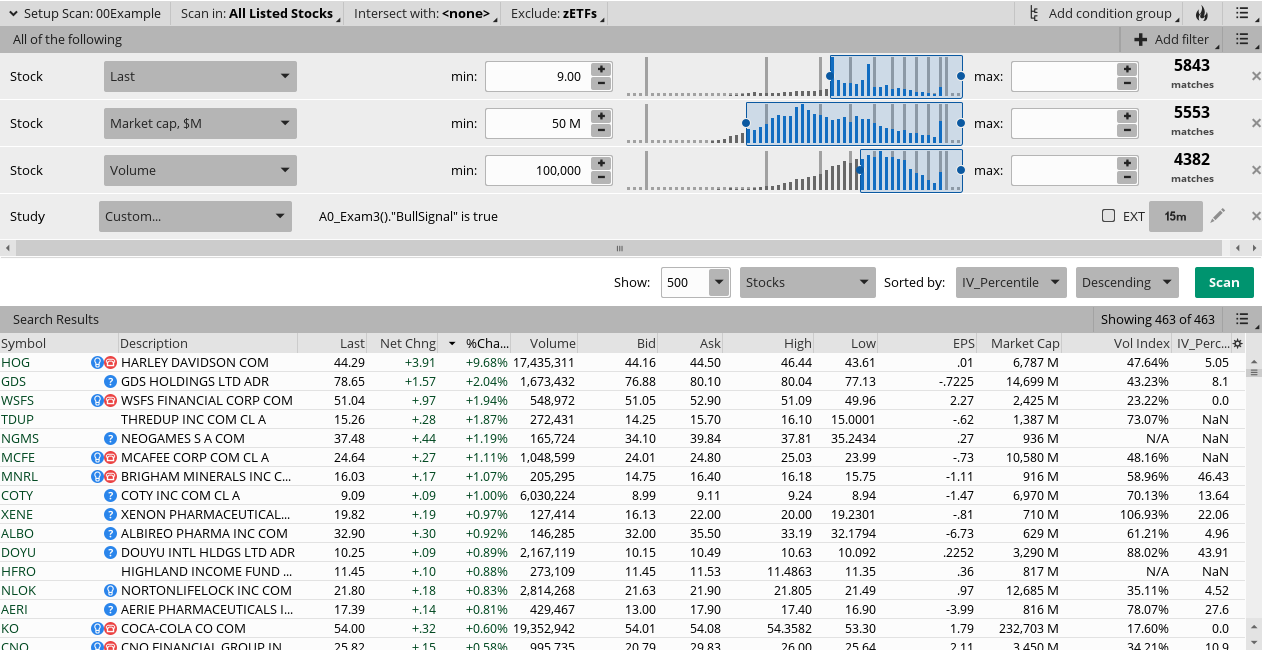

Posters seem to be happy with @jcga1981 scanner. On the positive side, it yields results. On the negative, I have no idea if it is what you are looking for.

Lastly, there is @Pensar scanner. I didn't test it. And @Pensar is not able to provide much info on it so if you decide to use either of these scanners, test with caution.

As @rad14733 stated, in the future, minimally, it is important to reference the post# for the study, scan, watchlist that you are referencing.

On to the other scanner scripts in this thread:

Posters seem to be happy with @jcga1981 scanner. On the positive side, it yields results. On the negative, I have no idea if it is what you are looking for.

Lastly, there is @Pensar scanner. I didn't test it. And @Pensar is not able to provide much info on it so if you decide to use either of these scanners, test with caution.

As @rad14733 stated, in the future, minimally, it is important to reference the post# for the study, scan, watchlist that you are referencing.

Last edited: