blakecmathis

Well-known member

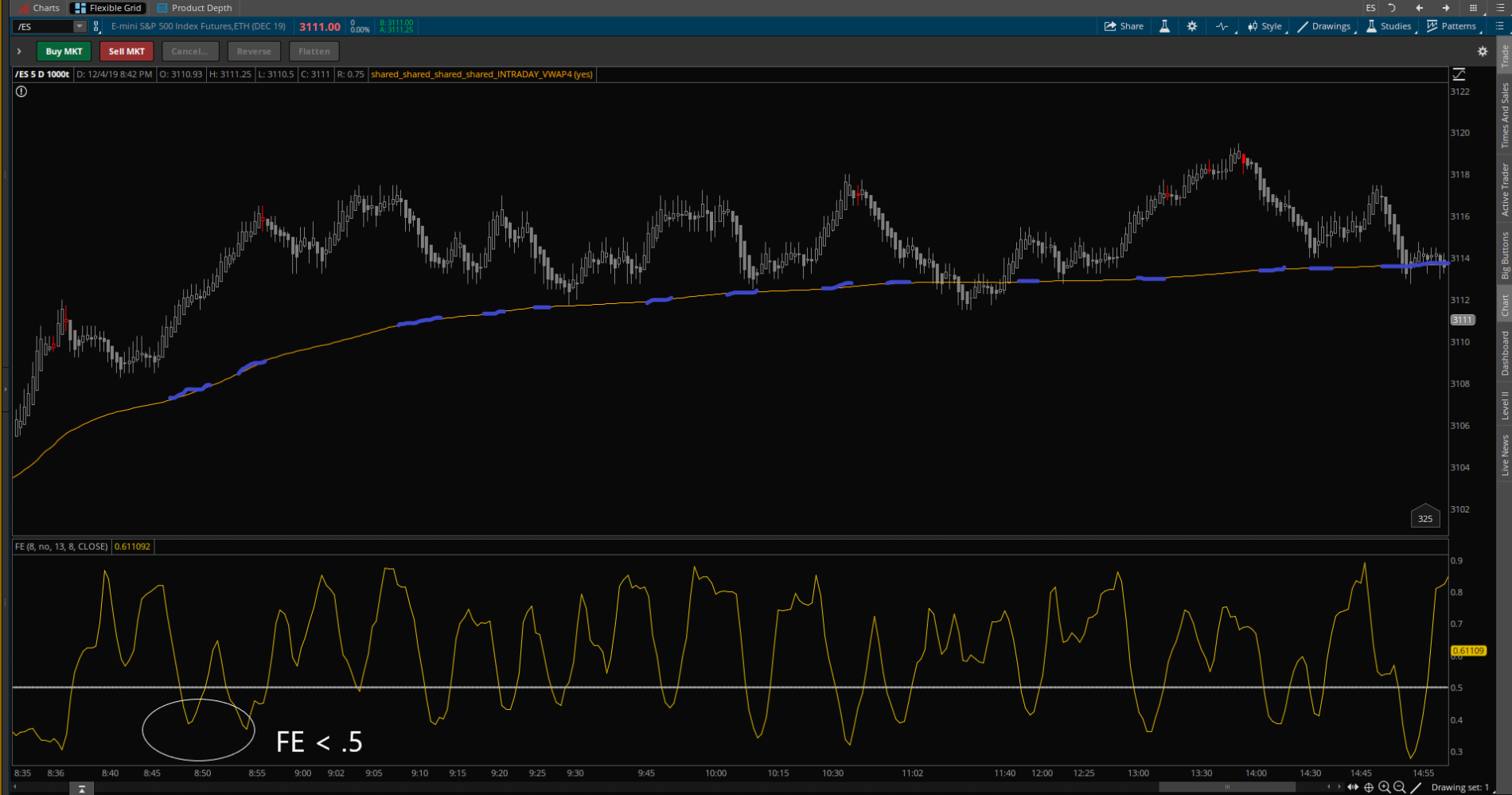

I know this sounds crazy but hear me out. I would like to color code the intraday VWAP according to Fractal Energy. When FE falls below .5, I would like the VWAP to be Color A and then Color B for all other levels. Essentially the same way a Hull MA shifts colors. I've attempted to recreate what I am searching for in the screenshot below. When FE falls below .5, VWAP changes to blue. Tried to do it myself but couldn't find a solution (I have no idea what I'm doing). I really hope this is possible. Any help is greatly appreciated

I have already merged the two here: https://tos.mx/6XSCJKd

I have already merged the two here: https://tos.mx/6XSCJKd

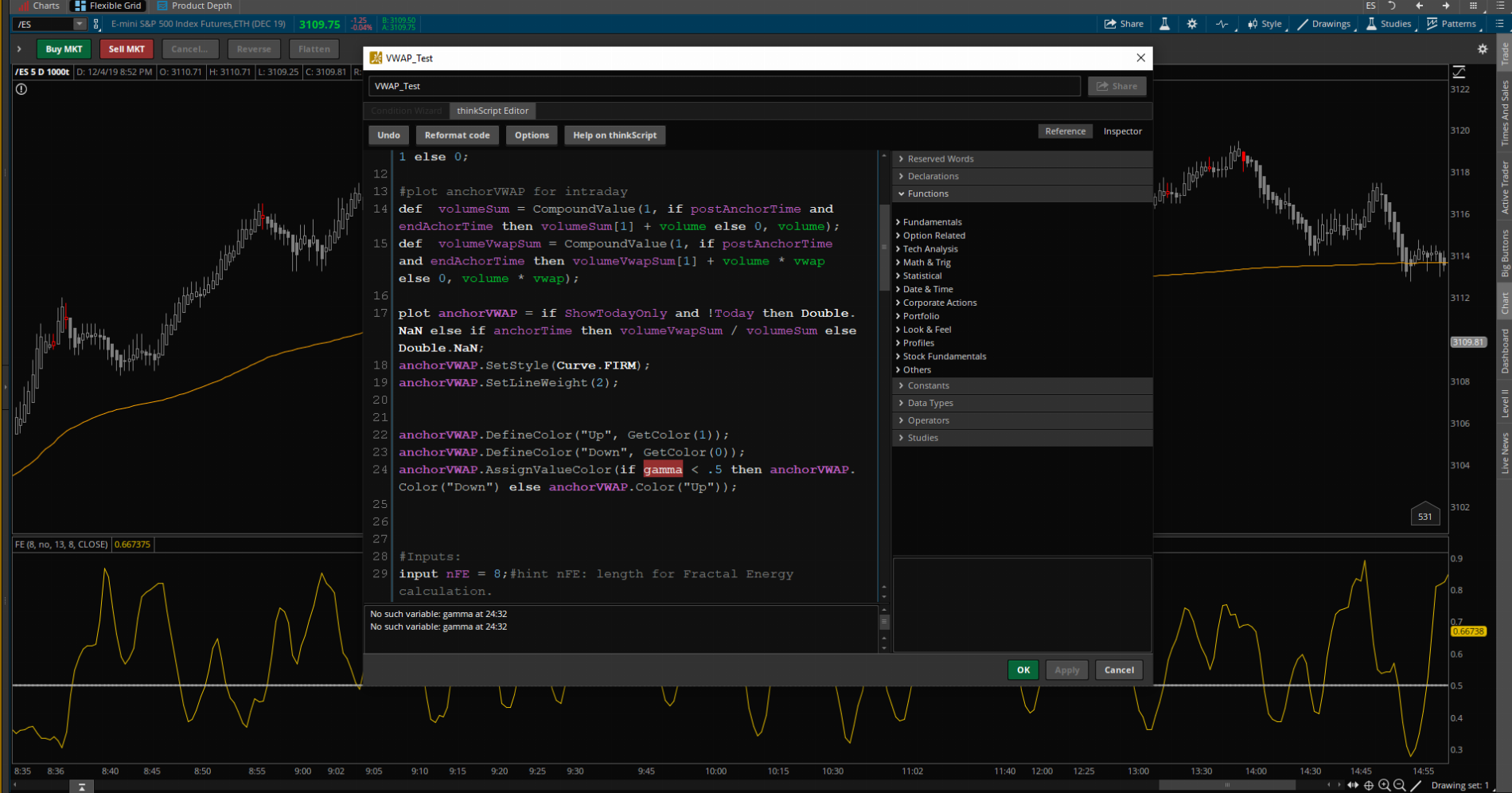

Code:

#yakBro intraday anchoredVWAP excluding extended hours volume 2019

declare upper;

def anchorTime = 0930;

def anchorEnd = 1600;

input ShowTodayOnly = yes;

def Today = if GetDay() == GetLastDay() then 1 else 0;

def postAnchorTime = if SecondsFromTime(anchorTime) >= 0 then 1 else 0;

def endAchorTime = if SecondsTillTime(anchorEnd) >= 0 then 1 else 0;

#plot anchorVWAP for intraday

def volumeSum = CompoundValue(1, if postAnchorTime and endAchorTime then volumeSum[1] + volume else 0, volume);

def volumeVwapSum = CompoundValue(1, if postAnchorTime and endAchorTime then volumeVwapSum[1] + volume * vwap else 0, volume * vwap);

plot anchorVWAP = if ShowTodayOnly and !Today then Double.NaN else if anchorTime then volumeVwapSum / volumeSum else Double.NaN;

anchorVWAP.SetStyle(Curve.FIRM);

anchorVWAP.SetLineWeight(2);

anchorVWAP.DefineColor("Up", GetColor(1));

anchorVWAP.DefineColor("Down", GetColor(0));

anchorVWAP.AssignValueColor(if gamma < .5 then anchorVWAP.Color("Down") else anchorVWAP.Color("Up"));

#Inputs:

input nFE = 8;#hint nFE: length for Fractal Energy calculation.

input AlertOn = no;

input Glength = 13;

input betaDev = 8;

input data = close;

def w = (2 * Double.Pi / Glength);

def beta = (1 - Cos(w)) / (Power(1.414, 2.0 / betaDev) - 1 );

def alpha = (-beta + Sqrt(beta * beta + 2 * beta));

def Go = Power(alpha, 4) * open +

4 * (1 – alpha) * Go[1] – 6 * Power( 1 - alpha, 2 ) * Go[2] +

4 * Power( 1 - alpha, 3 ) * Go[3] - Power( 1 - alpha, 4 ) * Go[4];

def Gh = Power(alpha, 4) * high +

4 * (1 – alpha) * Gh[1] – 6 * Power( 1 - alpha, 2 ) * Gh[2] +

4 * Power( 1 - alpha, 3 ) * Gh[3] - Power( 1 - alpha, 4 ) * Gh[4];

def Gl = Power(alpha, 4) * low +

4 * (1 – alpha) * Gl[1] – 6 * Power( 1 - alpha, 2 ) * Gl[2] +

4 * Power( 1 - alpha, 3 ) * Gl[3] - Power( 1 - alpha, 4 ) * Gl[4];

def Gc = Power(alpha, 4) * data +

4 * (1 – alpha) * Gc[1] – 6 * Power( 1 - alpha, 2 ) * Gc[2] +

4 * Power( 1 - alpha, 3 ) * Gc[3] - Power( 1 - alpha, 4 ) * Gc[4];

# Variables:

def o;

def h;

def l;

def c;

def CU1;

def CU2;

def CU;

def CD1;

def CD2;

def CD;

def L0;

def L1;

def L2;

def L3;

# Calculations

o = (Go + Gc[1]) / 2;

h = Max(Gh, Gc[1]);

l = Min(Gl, Gc[1]);

c = (o + h + l + Gc) / 4;

def gamma = Log(Sum((Max(Gh, Gc[1]) - Min(Gl, Gc[1])), nFE) /

(Highest(Gh, nFE) - Lowest(Gl, nFE)))

/ Log(nFE);

L0 = (1 – gamma) * Gc + gamma * L0[1];

L1 = -gamma * L0 + L0[1] + gamma * L1[1];

L2 = -gamma * L1 + L1[1] + gamma * L2[1];

L3 = -gamma * L2 + L2[1] + gamma * L3[1];

if L0 >= L1

then {

CU1 = L0 - L1;

CD1 = 0;

} else {

CD1 = L1 - L0;

CU1 = 0;

}

if L1 >= L2

then {

CU2 = CU1 + L1 - L2;

CD2 = CD1;

} else {

CD2 = CD1 + L2 - L1;

CU2 = CU1;

}

if L2 >= L3

then {

CU = CU2 + L2 - L3;

CD = CD2;

} else {

CU = CU2;

CD = CD2 + L3 - L2;

}