FoxEatsGekko

New member

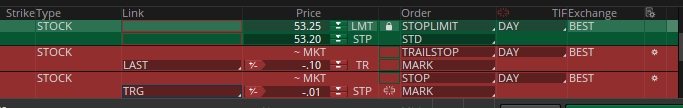

This is a 1st triggers OCO order type. From the looks of how this is set up, could anyone tell me what each of these 3 orders is set up to do? In this particular situation, my goal is to buy when the price rises above $53.20 but pay not more than $53.25. The second order is a simple trailing stop of 10 cents set to "LAST".

The intent of the third order is to set a stop price at a penny below the entry as evidenced by "TRG". I think my concern here is what references are made by "LAST" in order 2 and "TRG" in order 3. LAST of what? And TRG of what price or event? Just making sure I understand the settings in the Link field, basically what they are linked to.

The intent of the third order is to set a stop price at a penny below the entry as evidenced by "TRG". I think my concern here is what references are made by "LAST" in order 2 and "TRG" in order 3. LAST of what? And TRG of what price or event? Just making sure I understand the settings in the Link field, basically what they are linked to.