ChocolateVol

New member

see code fix in next post

Hi, I'm stuck with this script. Syntax appears to be right but for some reason I cant figure out why its not working. Issue is popping up at the ATM_option line.

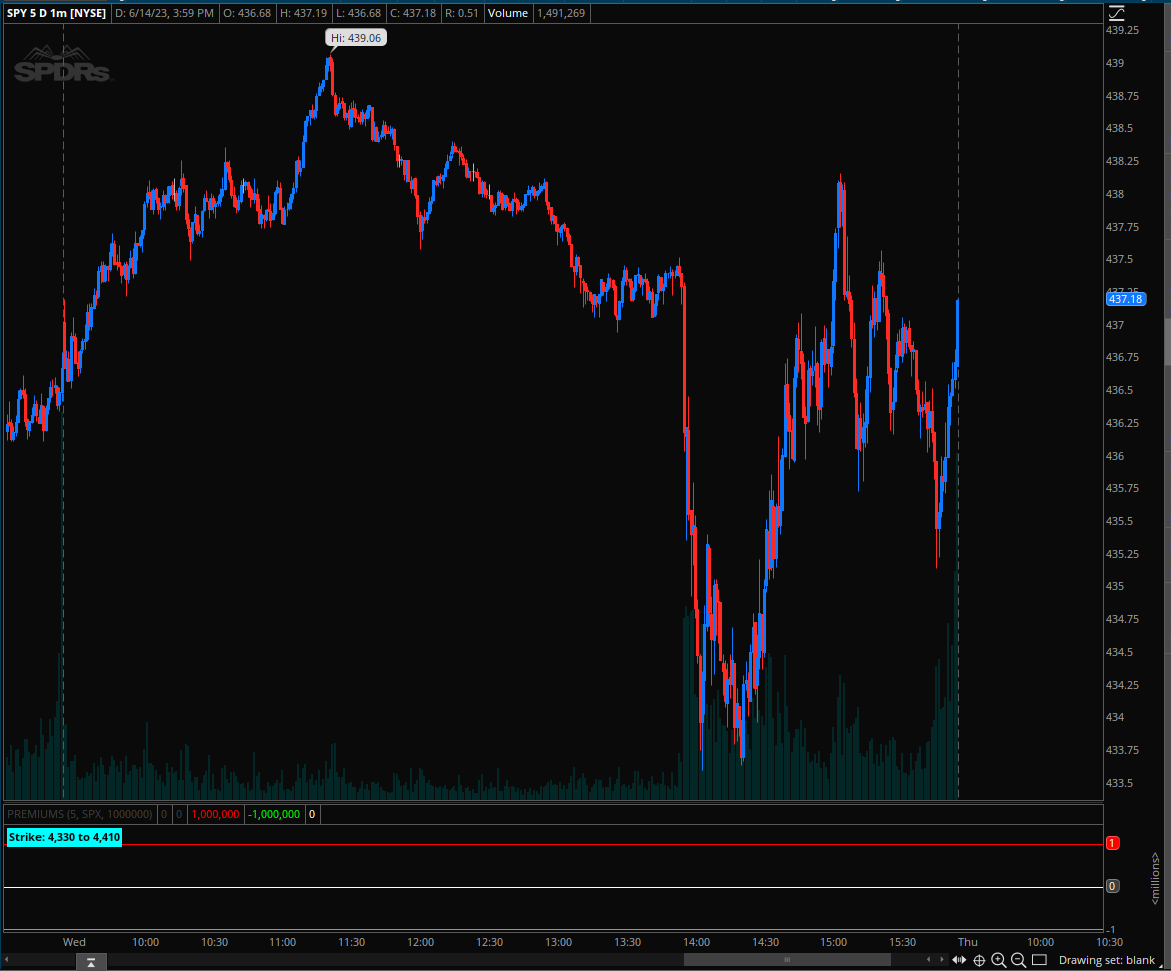

My goal is to track the intraday 0 DTE option volume for ATM calls and puts for SPX and SPY that are within the daily market maker's expected move (using the prior day's VIX close).

Once I can make it work for SPX calls I want to replicate for SPY and also use it on PUTS in a lower study or as an inverted negative histogram in the same plot.

I'm trying to track institutional buying/selling pressure (hence the threshold for size).

When the script is valid, ideally I want to explore beyond volume to track premium (price*volume) and gamma.

This on itself would ultimately always be a bias confirmation not an isolated trading signal.

Hi, I'm stuck with this script. Syntax appears to be right but for some reason I cant figure out why its not working. Issue is popping up at the ATM_option line.

My goal is to track the intraday 0 DTE option volume for ATM calls and puts for SPX and SPY that are within the daily market maker's expected move (using the prior day's VIX close).

Once I can make it work for SPX calls I want to replicate for SPY and also use it on PUTS in a lower study or as an inverted negative histogram in the same plot.

I'm trying to track institutional buying/selling pressure (hence the threshold for size).

When the script is valid, ideally I want to explore beyond volume to track premium (price*volume) and gamma.

This on itself would ultimately always be a bias confirmation not an isolated trading signal.

Last edited by a moderator: