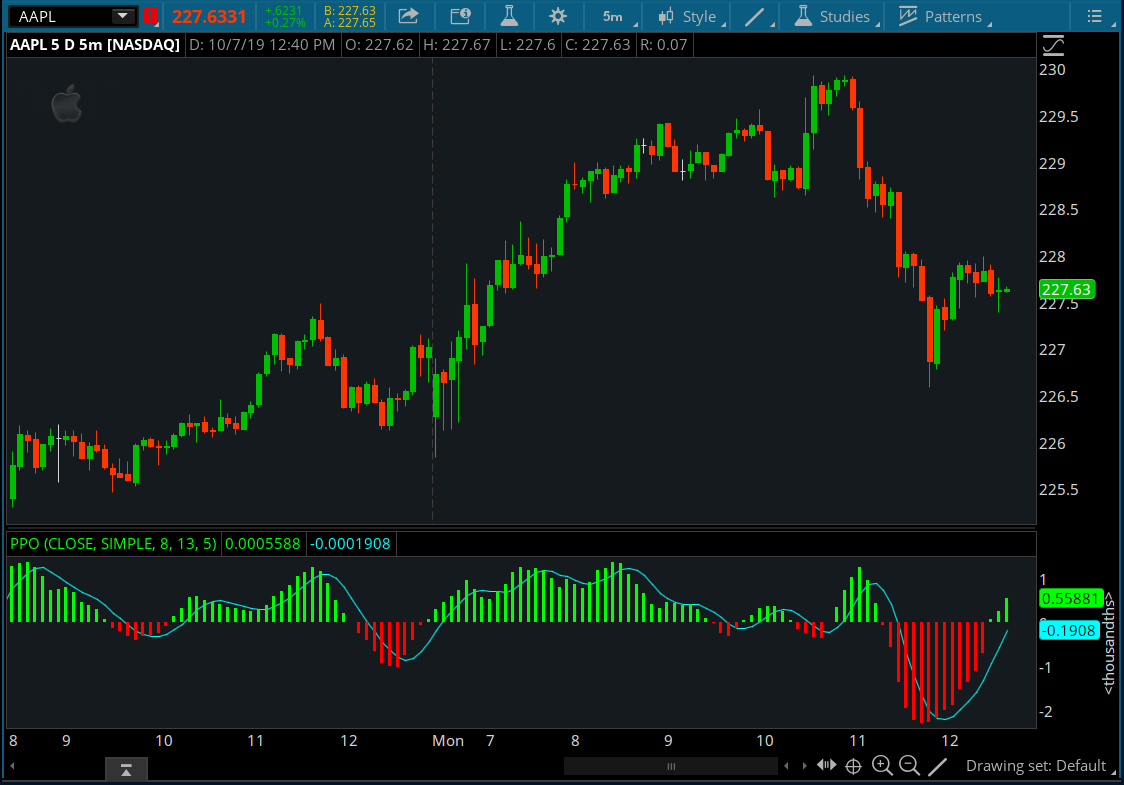

The Percentage Price Oscillator (PPO) is similar to Moving Average Convergence Divergence (MACD).

They are both momentum indicators used to gauge the strength and direction of a trend in a stock's price. Many times, they present with the same signals.

The PPO is considered superior in that the PPO is expressed as a percentage, making it easier to compare across different stocks and timeframes. Whereas the MACD has little comparitive value.

This script for ToS was created by Mobius.

They are both momentum indicators used to gauge the strength and direction of a trend in a stock's price. Many times, they present with the same signals.

The PPO is considered superior in that the PPO is expressed as a percentage, making it easier to compare across different stocks and timeframes. Whereas the MACD has little comparitive value.

This script for ToS was created by Mobius.

thinkScript Code

Code:

# PPO

# Mobius

# V01.03.2014

declare lower;

input c = close;

input AvgType = AverageType.Simple;

input nFast = 8;

input nSlow = 13;

input nSmooth = 5;

plot PPO = ((MovingAverage(AverageType = AvgType, c, nFast) -

MovingAverage(AverageType = AvgType, c, nSlow)) /

MovingAverage(AverageType = AvgType, c, nSlow));

PPO.SetPaintingStrategy(PaintingStrategy.Histogram);

PPO.AssignValueColor(if PPO > 0

then color.green

else color.red);

plot smooth = MovingAverage(AverageType = AvgType, PPO, nSmooth);

smooth.SetPaintingStrategy(PaintingStrategy.Line);

smooth.SetDefaultColor(Color.Cyan);

# End Code PPOShareable Link

https://tos.mx/hv8hVf

Last edited by a moderator: