Ghostwar19

Member

Youll have to follow me back to dm u, Just followedI have also developed extremely interesting thing using the fibonacci, I am not on discord but you can reach me on Twitter @germanbrito17

Youll have to follow me back to dm u, Just followedI have also developed extremely interesting thing using the fibonacci, I am not on discord but you can reach me on Twitter @germanbrito17

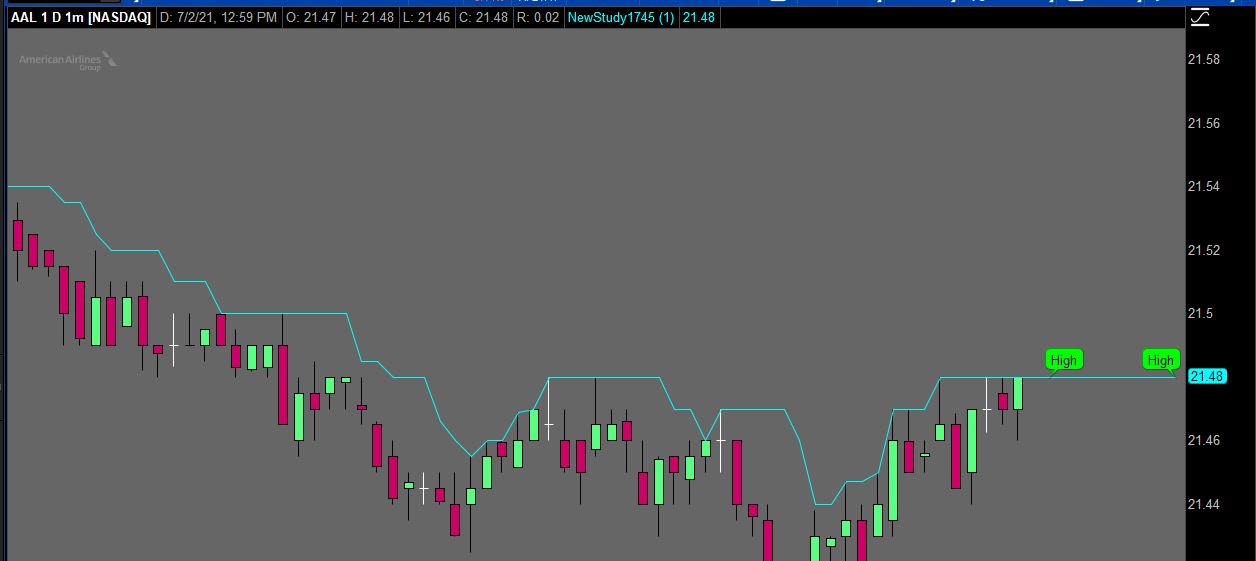

I would be vary interested in how you got the bubbles to appear in the middle. I would like center or right alignment.See if this might be what you are requesting. This will make the highest price's bar changed to show the high of a prior bar offset by the number of bars at the input.

Add the following code to the script:

input offset = 1;

Modify the following code in the script:

def a = if high == HighestAll(high) then high[offset] else a[1];

I would be vary interested in how you got the bubbles to appear in the middle. I would like center or right alignment.

Thanks!

Code:

Code:def h = if IsNaN(close) then h[1] else Highest(high, 5);#extends line to right plot hh = h; #Movable bubble #The IsNaN(close[n]) and !IsNaN(close[n1]) defines the last candle on the chart input n = 1; #used to move the bubble left and right def n1 = n + 1; AddChartBubble(IsNaN(close[n]) and !IsNaN(close[n1]), hh[n1] , "High", Color.GREEN, yes); #Places bubble to far right #The BarNumber() == HighestAll(BarNumber()) defines the last barnumber on the chart, including the right expansion space AddChartBubble(BarNumber() == HighestAll(BarNumber()), hh , "High", Color.GREEN, yes);

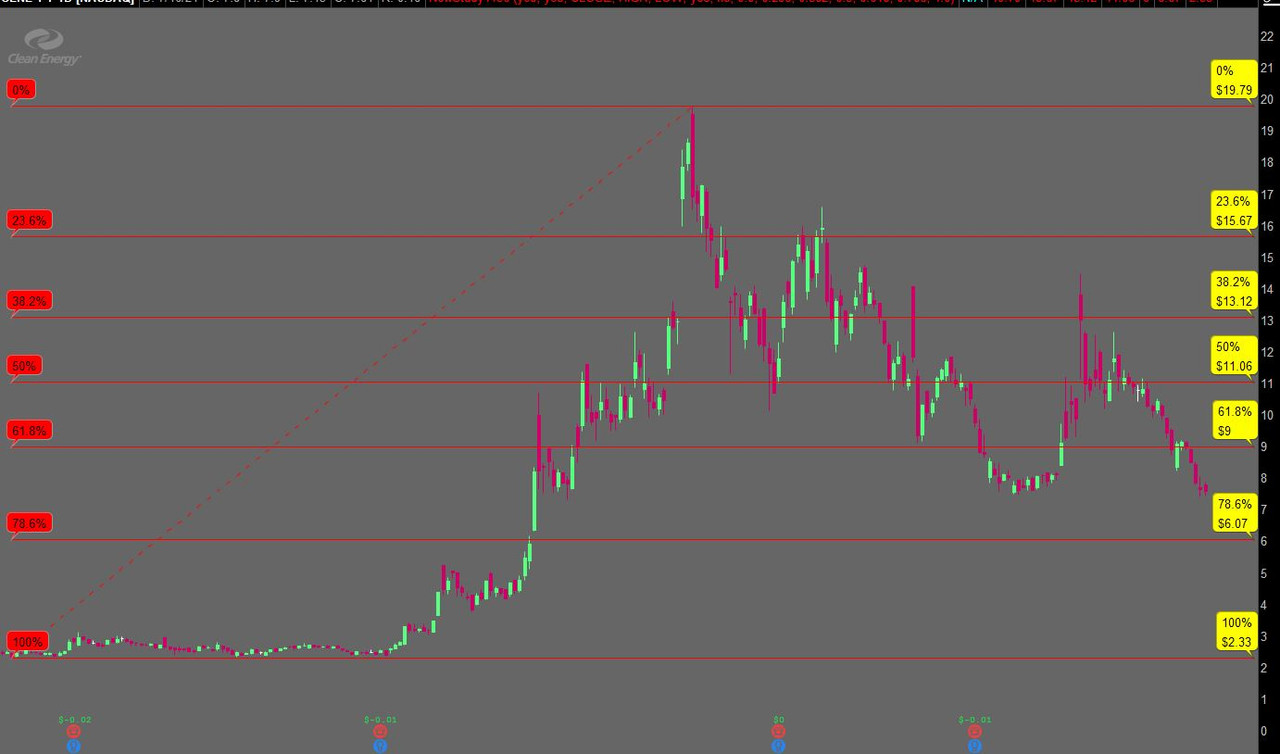

Can you please let me know how I can shift the bubbles to the right side and price tags on the fib lines. This will help me a lot. If it is a too much of coding and work then leave as is.

Thanks,

Code:

Code:#20210716 Sleepyz - modified to have optional bubbles on Left Side and/or Right Side of Fibonacci Lines #hint Price: Price used in the alerts on crossing retracement lines. <b>(Default is Close)</b> #hint onExpansion: Determines if the retracement lines are projected past the current bar into the right side expansion <b>(Default is Yes)</b> #hint Extend_to_left: Determines if the retracement lines are extended to the left side of the chart. <b>(Default is No)</b> #hint Coefficient0: Retracement Line 0: Retracement from the highest high to the lowest low.<b>(Default is 0%)</b> #hint Coefficient_1: Retracement Line 1: Retracement from the highest high to the lowest low.<b>(Default is 23.6%)</b> #hint Coefficient_2: Retracement Line 2: Retracement from the highest high to the lowest low.<b>(Default is 38.2%)</b> #hint Coefficient_3: Retracement Line 3: Retracement from the highest high to the lowest low.<b>(Default is 50%)</b> #hint Coefficient_4: Retracement Line 4: Retracement from the highest high to the lowest low.<b>(Default is 61.8%)</b> #hint Coefficient_5: Retracement Line 5: Retracement from the highest high to the lowest low.<b>(Default is 78.6%)</b> #hint Coefficient_6: Retracement Line 6: Retracement from the highest high to the lowest low.<b>(Default is 100%)</b> #wizard input: Price #wizard text: Inputs: Price: #wizard input: onExpansion #wizard text: onExpansion: #wizard input: Extend_to_left #wizard text: Extend_to_left: #wizard input: Coefficient0 #wizard text: Coefficient0: #wizard input: Coefficient_1 #wizard text: Coefficient_1: #wizard input: Coefficient_2 #wizard text: Coefficient_2: #wizard input: Coefficient_3 #wizard text: Coefficient_3: #wizard input: Coefficient_4 #wizard text: Coefficient_4: #wizard input: Coefficient_5 #wizard text: Coefficient_5: #wizard input: Coefficient_6 #wizard text: Coefficient_6: input show_bubbles_left = yes; input show_bubbles_right = yes; input price = close; input high = high; input low = low; input onExpansion = Yes; input Extend_to_left = no; input Coefficient0 = 0.000; input coefficient_1 = .236; input Coefficient_2 = .382; input Coefficient_3 = .500; input Coefficient_4 = .618; Input Coefficient_5 = .786; input Coefficient_6 = 1.000; def a = HighestAll(high); def b = LowestAll(low); def barnumber = barNumber(); def c = if high == a then barnumber else double.nan; def d = if low == b then barnumber else double.nan; rec highnumber = compoundValue(1, if IsNaN(c) then highnumber[1] else c, c); def highnumberall = HighestAll(highnumber); rec lownumber = compoundValue(1, if IsNaN(d) then lownumber[1] else d, d); def lownumberall = LowestAll(lownumber); def upward = highnumberall > lownumberall; def downward = highnumberall < lownumberall; def x = AbsValue(lownumberall - highnumberall ); def slope = (a - b) / x; def slopelow = (b - a) / x; def day = getDay(); def month = getMonth(); def year = getYear(); def lastDay = getLastDay(); def lastmonth = getLastMonth(); def lastyear = getLastYear(); def isToday = if(day == lastDay and month == lastmonth and year == lastyear, 1, 0); def istodaybarnumber = HighestAll(if isToday then barnumber else double.nan); def line = b + (slope * (barnumber - lownumber)); def linelow = a + (slopelow * (barnumber - highnumber)); def currentlinelow = if barnumber <= lownumberall then linelow else double.nan; def currentline = if barnumber <= highnumberall then line else double.nan; Plot FibFan = if downward then currentlinelow else if upward then currentline else double.nan; FibFan.SetStyle(Curve.SHORT_DASH); FibFan.AssignValueColor(color.red); fibfan.hidebubble(); def range = a - b; Plot Retracement0 = if downward and !onexpansion and !extend_to_left and barnumber >= highnumberall and barnumber <= istodaybarnumber then highestall((b + (range * coefficient0))) else if upward and !extend_to_left and !onexpansion and barnumber >= lownumberall and barnumber <= istodaybarnumber then highestall(a - (range * coefficient0)) else if downward and onexpansion and !extend_to_left and barnumber >= highnumberall then highestall((b + (range * coefficient0))) else if upward and onexpansion and barnumber >= lownumberall and !extend_to_left then highestall(a - (range * coefficient0)) else if downward and !onexpansion and extend_to_left and barnumber <= istodaybarnumber then highestall((b + (range * coefficient0))) else if upward and extend_to_left and !onexpansion and barnumber <= istodaybarnumber then highestall(a - (range * coefficient0)) else if downward and onexpansion and extend_to_left then highestall((b + (range * coefficient0))) else if upward and onexpansion and extend_to_left then highestall(a - (range * coefficient0)) else double.nan; Retracement0.assignvaluecolor(color.red); retracement0.hidebubble(); Plot Retracement1 = if downward and !onexpansion and !extend_to_left and barnumber >= highnumberall and barnumber <= istodaybarnumber then highestall((b + (range * coefficient_1))) else if upward and !extend_to_left and !onexpansion and barnumber >= lownumberall and barnumber <= istodaybarnumber then highestall(a - (range * coefficient_1)) else if downward and onexpansion and !extend_to_left and barnumber >= highnumberall then highestall((b + (range * coefficient_1))) else if upward and onexpansion and barnumber >= lownumberall and !extend_to_left then highestall(a - (range * coefficient_1)) else if downward and !onexpansion and extend_to_left and barnumber <= istodaybarnumber then highestall((b + (range * coefficient_1))) else if upward and extend_to_left and !onexpansion and barnumber <= istodaybarnumber then highestall(a - (range * coefficient_1)) else if downward and onexpansion and extend_to_left then highestall((b + (range * coefficient_1))) else if upward and onexpansion and extend_to_left then highestall(a - (range * coefficient_1)) else double.nan; Retracement1.assignvaluecolor(color.red); retracement1.hidebubble(); Plot Retracement2 =if downward and !onexpansion and !extend_to_left and barnumber >= highnumberall and barnumber <= istodaybarnumber then highestall((b + (range * coefficient_2))) else if upward and !extend_to_left and !onexpansion and barnumber >= lownumberall and barnumber <= istodaybarnumber then highestall(a - (range * coefficient_2)) else if downward and onexpansion and !extend_to_left and barnumber >= highnumberall then highestall((b + (range * coefficient_2))) else if upward and onexpansion and barnumber >= lownumberall and !extend_to_left then highestall(a - (range * coefficient_2)) else if downward and !onexpansion and extend_to_left and barnumber <= istodaybarnumber then highestall((b + (range * coefficient_2))) else if upward and extend_to_left and !onexpansion and barnumber <= istodaybarnumber then highestall(a - (range * coefficient_2)) else if downward and onexpansion and extend_to_left then highestall((b + (range * coefficient_2))) else if upward and onexpansion and extend_to_left then highestall(a - (range * coefficient_2)) else double.nan; Retracement2.assignvaluecolor(color.red); retracement2.hidebubble(); Plot Retracement3 = if downward and !onexpansion and !extend_to_left and barnumber >= highnumberall and barnumber <= istodaybarnumber then highestall((b + (range * coefficient_3))) else if upward and !extend_to_left and !onexpansion and barnumber >= lownumberall and barnumber <= istodaybarnumber then highestall(a - (range * coefficient_3)) else if downward and onexpansion and !extend_to_left and barnumber >= highnumberall then highestall((b + (range * coefficient_3))) else if upward and onexpansion and barnumber >= lownumberall and !extend_to_left then highestall(a - (range * coefficient_3)) else if downward and !onexpansion and extend_to_left and barnumber <= istodaybarnumber then highestall((b + (range * coefficient_3))) else if upward and extend_to_left and !onexpansion and barnumber <= istodaybarnumber then highestall(a - (range * coefficient_3)) else if downward and onexpansion and extend_to_left then highestall((b + (range * coefficient_3))) else if upward and onexpansion and extend_to_left then highestall(a - (range * coefficient_3)) else double.nan; Retracement3.assignvaluecolor(color.red); retracement3.hidebubble(); Plot Retracement4 = if downward and !onexpansion and !extend_to_left and barnumber >= highnumberall and barnumber <= istodaybarnumber then highestall((b + (range * coefficient_4))) else if upward and !extend_to_left and !onexpansion and barnumber >= lownumberall and barnumber <= istodaybarnumber then highestall(a - (range * coefficient_4)) else if downward and onexpansion and !extend_to_left and barnumber >= highnumberall then highestall((b + (range * coefficient_4))) else if upward and onexpansion and barnumber >= lownumberall and !extend_to_left then highestall(a - (range * coefficient_4)) else if downward and !onexpansion and extend_to_left and barnumber <= istodaybarnumber then highestall((b + (range * coefficient_4))) else if upward and extend_to_left and !onexpansion and barnumber <= istodaybarnumber then highestall(a - (range * coefficient_4)) else if downward and onexpansion and extend_to_left then highestall((b + (range * coefficient_4))) else if upward and onexpansion and extend_to_left then highestall(a - (range * coefficient_4)) else double.nan; Retracement4.assignvaluecolor(color.red); retracement4.hidebubble(); Plot Retracement5 = if downward and !onexpansion and !extend_to_left and barnumber >= highnumberall and barnumber <= istodaybarnumber then highestall((b + (range * coefficient_5))) else if upward and !extend_to_left and !onexpansion and barnumber >= lownumberall and barnumber <= istodaybarnumber then highestall(a - (range * coefficient_5)) else if downward and onexpansion and !extend_to_left and barnumber >= highnumberall then highestall((b + (range * coefficient_5))) else if upward and onexpansion and barnumber >= lownumberall and !extend_to_left then highestall(a - (range * coefficient_5)) else if downward and !onexpansion and extend_to_left and barnumber <= istodaybarnumber then highestall((b + (range * coefficient_5))) else if upward and extend_to_left and !onexpansion and barnumber <= istodaybarnumber then highestall(a - (range * coefficient_5)) else if downward and onexpansion and extend_to_left then highestall((b + (range * coefficient_5))) else if upward and onexpansion and extend_to_left then highestall(a - (range * coefficient_5)) else double.nan; Retracement5.assignvaluecolor(color.red); retracement5.hidebubble(); Plot Retracement6 = if downward and !onexpansion and !extend_to_left and barnumber >= highnumberall and barnumber <= istodaybarnumber then highestall((b + (range * coefficient_6))) else if upward and !extend_to_left and !onexpansion and barnumber >= lownumberall and barnumber <= istodaybarnumber then highestall(a - (range * coefficient_6)) else if downward and onexpansion and !extend_to_left and barnumber >= highnumberall then highestall((b + (range * coefficient_6))) else if upward and onexpansion and barnumber >= lownumberall and !extend_to_left then highestall(a - (range * coefficient_6)) else if downward and !onexpansion and extend_to_left and barnumber <= istodaybarnumber then highestall((b + (range * coefficient_6))) else if upward and extend_to_left and !onexpansion and barnumber <= istodaybarnumber then highestall(a - (range * coefficient_6)) else if downward and onexpansion and extend_to_left then highestall((b + (range * coefficient_6))) else if upward and onexpansion and extend_to_left then highestall(a - (range * coefficient_6)) else double.nan; Retracement6.assignvaluecolor(color.red); retracement6.hidebubble(); #Bubbles on Left Side AddChartBubble(show_bubbles_left and (downward and barnumber == highnumberall), retracement0, concat( (coefficient0 * 100), "%"), color.red, yes); AddChartBubble(show_bubbles_left and (upward and barnumber == lownumberall), retracement0, concat( (coefficient0 * 100), "%"), color.red, yes); AddChartBubble(show_bubbles_left and (downward and barnumber == highnumberall), retracement1, concat( (coefficient_1 * 100), "%"), color.red, yes); AddChartBubble(show_bubbles_left and (upward and barnumber == lownumberall), retracement1, concat( (coefficient_1 * 100), "%"), color.red, yes); AddChartBubble(show_bubbles_left and (downward and barnumber == highnumberall), retracement2, concat( (coefficient_2 * 100), "%"), color.red, yes); AddChartBubble(show_bubbles_left and (upward and barnumber == lownumberall), retracement2, concat( (coefficient_2 * 100), "%"), color.red, yes); AddChartBubble(show_bubbles_left and (upward and barnumber == lownumberall), retracement3, concat( (coefficient_3 * 100), "%"), color.red, yes); AddChartBubble(show_bubbles_left and (downward and barnumber == highnumberall), retracement3, concat( (coefficient_3 * 100), "%"), color.red, yes); AddChartBubble(show_bubbles_left and (downward and barnumber == highnumberall), retracement4, concat( (coefficient_4 * 100), "%"), color.red, yes); AddChartBubble(show_bubbles_left and (upward and barnumber == lownumberall), retracement4, concat( (coefficient_4 * 100), "%"), color.red, yes); AddChartBubble(show_bubbles_left and (downward and barnumber == highnumberall), retracement5, concat( (coefficient_5 * 100), "%"), color.red, yes); AddChartBubble(show_bubbles_left and (upward and barnumber == lownumberall), retracement5, concat( (coefficient_5 * 100), "%"), color.red, yes); AddChartBubble(show_bubbles_left and (downward and barnumber == highnumberall), retracement6, concat( (coefficient_6 * 100), "%"), color.red, yes); AddChartBubble(show_bubbles_left and (upward and barnumber == lownumberall), retracement6, concat( (coefficient_6 * 100), "%"), color.red, yes); #Bubbles on Right Side AddChartBubble(show_bubbles_right and (downward and BarNumber() == HighestAll(BarNumber())), retracement0, Concat( (coefficient0 * 100), "%\n") + Concat( "$", Round(retracement0, 2)), Color.YELLOW, yes); AddChartBubble(show_bubbles_right and (upward and BarNumber() == HighestAll(BarNumber())), retracement0, Concat( (coefficient0 * 100), "%\n") + Concat( "$", Round(retracement0, 2)), Color.YELLOW, yes); AddChartBubble(show_bubbles_right and (downward and BarNumber() == HighestAll(BarNumber())), retracement1, Concat( (coefficient_1 * 100), "%\n") + Concat( "$", Round(retracement1, 2)), Color.YELLOW, yes); AddChartBubble(show_bubbles_right and (upward and BarNumber() == HighestAll(BarNumber())), retracement1, Concat( (coefficient_1 * 100), "%\n") + Concat( "$", Round(retracement1, 2)), Color.YELLOW, yes); AddChartBubble(show_bubbles_right and (downward and BarNumber() == HighestAll(BarNumber())), retracement2, Concat( (coefficient_2 * 100), "%\n") + Concat( "$", Round(retracement2, 2)), Color.YELLOW, yes); AddChartBubble(show_bubbles_right and (upward and BarNumber() == HighestAll(BarNumber())), retracement2, Concat( (coefficient_2 * 100), "%\n") + Concat( "$", Round(retracement2, 2)), Color.YELLOW, yes); AddChartBubble(show_bubbles_right and (downward and BarNumber() == HighestAll(BarNumber())), retracement3, Concat( (coefficient_3 * 100), "%\n") + Concat( "$", Round(retracement3, 2)), Color.YELLOW, yes); AddChartBubble(show_bubbles_right and (upward and BarNumber() == HighestAll(BarNumber())), retracement3, Concat( (coefficient_3 * 100), "%\n") + Concat( "$", Round(retracement3, 2)), Color.YELLOW, yes); AddChartBubble(show_bubbles_right and (downward and BarNumber() == HighestAll(BarNumber())), retracement4, Concat( (coefficient_4 * 100), "%\n") + Concat( "$", Round(retracement4, 2)), Color.YELLOW, yes); AddChartBubble(show_bubbles_right and (upward and BarNumber() == HighestAll(BarNumber())), retracement4, Concat( (coefficient_4 * 100), "%\n") + Concat( "$", Round(retracement4, 2)), Color.YELLOW, yes); AddChartBubble(show_bubbles_right and (downward and BarNumber() == HighestAll(BarNumber())), retracement5, Concat( (coefficient_5 * 100), "%\n") + Concat( "$", Round(retracement5, 2)), Color.YELLOW, yes); AddChartBubble(show_bubbles_right and (upward and BarNumber() == HighestAll(BarNumber())), retracement5, Concat( (coefficient_5 * 100), "%\n") + Concat( "$", Round(retracement5, 2)), Color.YELLOW, yes); AddChartBubble(show_bubbles_right and (downward and BarNumber() == HighestAll(BarNumber())), retracement6, Concat( (coefficient_6 * 100), "%\n") + Concat( "$", Round(retracement6, 2)), Color.YELLOW, yes); AddChartBubble(show_bubbles_right and (upward and BarNumber() == HighestAll(BarNumber())), retracement6, Concat( (coefficient_6 * 100), "%\n") + Concat( "$", Round(retracement6, 2)), Color.YELLOW, yes); #Alerts alert((price crosses below Retracement0) , "Price crosses below Retracement Line 0"); alert((price crosses above Retracement0) , "Price crosses above Retracement Line 0"); alert((price crosses below Retracement1) , "Price crosses below Retracement Line 1"); alert((price crosses above Retracement1) , "Price crosses above Retracement Line 1"); alert((price crosses below Retracement2) , "Price crosses below Retracement Line 2"); alert((price crosses above Retracement2) , "Price crosses above Retracement Line 2"); alert((price crosses below Retracement3) , "Price crosses below Retracement Line 3"); alert((price crosses above Retracement3) , "Price crosses above Retracement Line 3"); alert((price crosses below Retracement4) , "Price crosses below Retracement Line 4"); alert((price crosses above Retracement4) , "Price crosses above Retracement Line 4"); alert((price crosses below Retracement5) , "Price crosses below Retracement Line 5"); alert((price crosses above Retracement5) , "Price crosses above Retracement Line 5"); alert((price crosses below Retracement6) , "Price crosses below Retracement Line 6"); alert((price crosses above Retracement6) , "Price crosses above Retracement Line 6");

See if this helps. Picture is set to showtodayonly == yes. You can move the bubbles left/right at the bubblemover input.Hi @BenTen & @MerryDay & @SleepyZ is there a way to obtain an Automatic Fib Retracement that uses the previous day (High of Day and Low of Day) and plots that on the next day chart? I want it to work mainly on the 15 min chart with the following levels:

-1 - Green

-0.62 - Green

-0.27 - Green

0 - Green

0.236 - Red

0.382 - Red

0.50 - Yellow

0.62 - Blue

0.705 - Blue

0.79 - Blue

1 - Green

1.27 - Green

1.618 - Green

2 - Green

Ruby:

Ruby:#Auto_FibPrevDay - plots high/low from previous day and fib levels based thereon input ShowTodayOnly = { default "No", "Yes"}; input showbubbles = yes; input bubblemover = 4; #Hint n: Number of Bars to shift bubble to the right input period = AggregationPeriod.DAY; input displace = 1; plot ORH = if showtodayonly and !IsNaN(close(period = period)[-1]) then double.nan else high(period = period)[displace]; plot ORL = if showtodayonly and !IsNaN(close(period = period)[-1]) then double.nan else low(period = period)[displace]; ORH.SetDefaultColor(Color.RED); ORH.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); ORH.SetLineWeight(2); ORL.SetDefaultColor(Color.GREEN); ORL.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); ORL.SetLineWeight(2); input F1 = -1.00; input F2 = -0.62; input F3 = -0.27; input F4 = 0.236; input F5 = 0.382; input F6 = 0.500; input F7 = 0.62; input F8 = 0.705; input F9 = 0.79; input F10 = 1.27; input F11 = 1.618; input F12 = 2.00; def rHi = ORH; def rLo = ORL; def range = rHi - rLo; plot FF1 = rLo + (range * F1); plot FF2 = rLo + (range * F2); plot FF3 = rLo + (range * F3); plot FF4 = rLo + (range * F4); plot FF5 = rLo + (range * F5); plot FF6 = rLo + (range * F6); plot FF7 = rLo + (range * F7); plot FF8 = rLo + (range * F8); plot FF9 = rLo + (range * F9); plot FF10 = rLo + (range * F10); plot FF11 = rLo + (range * F11); plot FF12 = rLo + (range * F12); def h = high(period = AggregationPeriod.DAY); def l = low(period = AggregationPeriod.DAY); FF1.SetDefaultColor(Color.GREEN); FF1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); FF1.SetLineWeight(1); FF2.SetDefaultColor(Color.GREEN); FF2.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); FF2.SetLineWeight(1); FF3.SetDefaultColor(Color.GREEN); FF3.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); FF3.SetLineWeight(1); FF4.SetDefaultColor(Color.RED); FF4.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); FF4.SetLineWeight(1); FF5.SetDefaultColor(Color.RED); FF5.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); FF5.SetLineWeight(1); FF6.SetDefaultColor(Color.YELLOW); FF6.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); FF6.SetLineWeight(1); FF7.SetDefaultColor(Color.BLUE); FF7.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); FF7.SetLineWeight(1); FF8.SetDefaultColor(Color.BLUE); FF8.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); FF8.SetLineWeight(1); FF9.SetDefaultColor(Color.BLUE); FF9.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); FF9.SetLineWeight(1); FF10.SetDefaultColor(Color.GREEN); FF10.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); FF10.SetLineWeight(1); FF11.SetDefaultColor(Color.GREEN); FF11.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); FF11.SetLineWeight(1); FF12.SetDefaultColor(Color.GREEN); FF12.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); FF12.SetLineWeight(1); def b = bubblemover; def b1 = b + 1; AddChartBubble(IsNaN(close[b]) and !IsNaN(close[b1]), FF1[b], F1, FF1.Takevaluecolor()); AddChartBubble(IsNaN(close[b]) and !IsNaN(close[b1]), FF2[b], F2, FF2.Takevaluecolor()); AddChartBubble(IsNaN(close[b]) and !IsNaN(close[b1]), FF3[b], F3, FF3.Takevaluecolor()); AddChartBubble(IsNaN(close[b]) and !IsNaN(close[b1]), FF4[b], F4, FF4.Takevaluecolor()); AddChartBubble(IsNaN(close[b]) and !IsNaN(close[b1]), FF5[b], F5, FF5.Takevaluecolor()); AddChartBubble(IsNaN(close[b]) and !IsNaN(close[b1]), FF6[b], F6, FF6.Takevaluecolor()); AddChartBubble(IsNaN(close[b]) and !IsNaN(close[b1]), FF7[b], F7, FF7.Takevaluecolor()); AddChartBubble(IsNaN(close[b]) and !IsNaN(close[b1]), FF8[b], F8, FF8.Takevaluecolor()); AddChartBubble(IsNaN(close[b]) and !IsNaN(close[b1]), FF9[b], F9, FF9.Takevaluecolor()); AddChartBubble(IsNaN(close[b]) and !IsNaN(close[b1]), FF10[b], F10, FF10.Takevaluecolor()); AddChartBubble(IsNaN(close[b]) and !IsNaN(close[b1]), FF11[b], F11, FF11.Takevaluecolor()); AddChartBubble(IsNaN(close[b]) and !IsNaN(close[b1]), FF12[b], F12, FF12.Takevaluecolor()); AddChartBubble(IsNaN(close[b]) and !IsNaN(close[b1]), orh[b], 1, orh.Takevaluecolor()); AddChartBubble(IsNaN(close[b]) and !IsNaN(close[b1]), orl[b], 0, orl.Takevaluecolor());

I think this might be what you want https://usethinkscript.com/threads/auto-fib-fibonacci-levels-indicator-for-thinkorswim.14/post-69424In the top example what can I add to the code to display the price level of the fib levels on the chart next to the percentage?

def gpH = value4 + (value4 * .05);

def gPL = value4 + (value4 * .01);

def gp = if price > gpL and price < gPH then 1 else Double.NaN;

plot gpArrow = if gp then low else Double.NaN;

gpArrow.SetPaintingStrategy(PaintingStrategy.ARROW_UP);Hi, Thanks much for helping community. Is there any possibility to provide Fibonacci extensions script.Folks here is version 1.3 of the Auto Fib study that now displays the bubbles on the right of the chart.

Please ensure that you increase the expansion area to that the bubbles have room to be displayed

Personally I set that to 22 on my chart settings

Chart Settings > Time Axis > Expansion Area

Given several changes to this code from the first time it was posted by @BenTen in 2018, I have created a change log

It details the various modifications to the base code that was made including a really nice cleaned up version from @theelderwand

Hope this helps

Code:# Auto Fib V1.3 # tomsk # 11.19.2019 # Automatically draws fibonacci retracements using the highest price and lowest price # from the current view and timeframe. # # Fibonacci retracements use horizontal lines to indicate areas of support or resistance # at the key Fibonacci levels before it continues in the original direction. These levels # are created by drawing a trendline between two extreme points and then dividing the # vertical distance by the key Fibonacci ratios of: 23.6%, 38.2%, 50%, 61.8%, 78.6%, and 100%. # CHANGE LOG # # V1.0 - 12.18.2018 - BenTen - Initial release of Auto Fib, created by Ryan Hendricks # V1.1 - 11.15.2019 - theelderwand - As script was difficult to read, made the following enhancements # Expands to right # Doesn't expand to left # Custom colors for Fibonacci bars (0.618 is GOLD color) # Custom line weights # Code is modularized so you can add extra plots as needed # V1.2 - 11.15.2019 - tomsk - Added an input selector for the colors of the label. You # can select from any of the colors listed - red, orange, # green, etc and bubbles for all the fib retracements will # utilize that color. # V1.3 - 11.19.2019 - tomsk - Modified the AddChartBubbles to be displayed on the right # side of the chart. Please ensure that you increase the # expansion area to that the bubbles have room to be displayed # Chart Settings > Time Axis > Expansion Area #hint Price: Price used in the alerts on crossing retracement lines. <b>(Default is Close)</b> #hint coefficient_0: Retracement Line 0: Retracement from the highest high to the lowest low.<b>(Default is 0%)</b> #hint Coefficient_1: Retracement Line 1: Retracement from the highest high to the lowest low.<b>(Default is 23.6%)</b> #hint Coefficient_2: Retracement Line 2: Retracement from the highest high to the lowest low.<b>(Default is 38.2%)</b> #hint Coefficient_3: Retracement Line 3: Retracement from the highest high to the lowest low.<b>(Default is 50%)</b> #hint Coefficient_4: Retracement Line 4: Retracement from the highest high to the lowest low.<b>(Default is 61.8%)</b> #hint Coefficient_5: Retracement Line 5: Retracement from the highest high to the lowest low.<b>(Default is 78.6%)</b> #hint Coefficient_6: Retracement Line 6: Retracement from the highest high to the lowest low.<b>(Default is 100%)</b> #wizard input: Price #wizard text: Inputs: Price: #wizard input: coefficient_0 #wizard text: coefficient_0: #wizard input: Coefficient_1 #wizard text: Coefficient_1: #wizard input: Coefficient_2 #wizard text: Coefficient_2: #wizard input: Coefficient_3 #wizard text: Coefficient_3: #wizard input: Coefficient_4 #wizard text: Coefficient_4: #wizard input: Coefficient_5 #wizard text: Coefficient_5: #wizard input: Coefficient_6 #wizard text: Coefficient_6: input price = close; input high = high; input low = low; input coefficient_0 = 0.000; input coefficient_1 = .236; input Coefficient_2 = .382; input Coefficient_3 = .500; input Coefficient_4 = .618; Input Coefficient_5 = .786; input Coefficient_6 = 1.000; input LabelColor = {default "MAGENTA", "CYAN", "PINK", "LIGHT_GRAY", "ORANGE", "RED", "GREEN", "GRAY", "WHITE"}; input n = 3; def n1 = n + 1; def a = HighestAll(high); def b = LowestAll(low); def barnumber = barNumber(); def c = if high == a then barnumber else double.nan; def d = if low == b then barnumber else double.nan; rec highnumber = compoundValue(1, if IsNaN(c) then highnumber[1] else c, c); def highnumberall = HighestAll(highnumber); rec lownumber = compoundValue(1, if IsNaN(d) then lownumber[1] else d, d); def lownumberall = LowestAll(lownumber); def upward = highnumberall > lownumberall; def downward = highnumberall < lownumberall; def x = AbsValue(lownumberall - highnumberall ); def slope = (a - b) / x; def slopelow = (b - a) / x; def day = getDay(); def month = getMonth(); def year = getYear(); def lastDay = getLastDay(); def lastmonth = getLastMonth(); def lastyear = getLastYear(); def isToday = if(day == lastDay and month == lastmonth and year == lastyear, 1, 0); def istodaybarnumber = HighestAll(if isToday then barnumber else double.nan); def line = b + (slope * (barnumber - lownumber)); def linelow = a + (slopelow * (barnumber - highnumber)); def currentlinelow = if barnumber <= lownumberall then linelow else double.nan; def currentline = if barnumber <= highnumberall then line else double.nan; Plot FibFan = if downward then currentlinelow else if upward then currentline else double.nan; FibFan.SetStyle(Curve.SHORT_DASH); FibFan.AssignValueColor(color.red); fibfan.hidebubble(); def range = a - b; def value0 = range * coefficient_0; def value1 = range * coefficient_1; def value2 = range * coefficient_2; def value3 = range * coefficient_3; def value4 = range * coefficient_4; def value5 = range * coefficient_5; def value6 = range * coefficient_6; def condition1 = downward and barnumber >= highnumberall; def condition2 = upward and barnumber >= lownumberall; Plot Retracement0 = if condition1 then highestall(b + value0) else if condition2 then highestall(a - value0) else double.nan; Plot Retracement1 = if condition1 then highestall(b + value1) else if condition2 then highestall(a - value1) else double.nan; Plot Retracement2 = if condition1 then highestall(b + value2) else if condition2 then highestall(a - value2) else double.nan; Plot Retracement3 = if condition1 then highestall(b + value3) else if condition2 then highestall(a - value3) else double.nan; Plot Retracement4 = if condition1 then highestall(b + value4) else if condition2 then highestall(a - value4) else double.nan; Plot Retracement5 = if condition1 then highestall(b + value5) else if condition2 then highestall(a - value5) else double.nan; Plot Retracement6 = if condition1 then highestall(b + value6) else if condition2 then highestall(a - value6) else double.nan; Retracement0.assignvaluecolor(CreateColor(255,255,255)); Retracement0.setLineWeight(4); retracement0.hidebubble(); AddChartBubble((downward and close[n1]) and IsNaN(close[n]), retracement0, concat( (coefficient_0 * 100), "%"), GetColor(LabelColor), yes); AddChartBubble((upward and close[n1]) and IsNaN(close[n]), retracement0, concat( (coefficient_0 * 100), "%"), GetColor(LabelColor), yes); Retracement1.assignvaluecolor(CreateColor(173,216,230)); Retracement1.setLineWeight(2); retracement1.hidebubble(); AddChartBubble((downward and close[n1]) and IsNaN(close[n]), retracement1, concat( (coefficient_1 * 100), "%"), GetColor(LabelColor), yes); AddChartBubble((upward and close[n1]) and IsNaN(close[n]), retracement1, concat( (coefficient_1 * 100), "%"), GetColor(LabelColor), yes); Retracement2.assignvaluecolor(CreateColor(0,197,49)); Retracement2.setLineWeight(2); retracement2.hidebubble(); AddChartBubble((downward and close[n1]) and IsNaN(close[n]), retracement2, concat( (coefficient_2 * 100), "%"), GetColor(LabelColor), yes); AddChartBubble((upward and close[n1]) and IsNaN(close[n]), retracement2, concat( (coefficient_2 * 100), "%"), GetColor(LabelColor), yes); Retracement3.assignvaluecolor(CreateColor(255,64,64)); Retracement3.setLineWeight(3); retracement3.hidebubble(); AddChartBubble((downward and close[n1]) and IsNaN(close[n]), retracement3, concat( (coefficient_3 * 100), "%"), GetColor(LabelColor), yes); AddChartBubble((upward and close[n1]) and IsNaN(close[n]), retracement3, concat( (coefficient_3 * 100), "%"), GetColor(LabelColor), yes); Retracement4.assignvaluecolor(CreateColor(255,215,0)); Retracement4.setLineWeight(5); retracement4.hidebubble(); AddChartBubble((downward and close[n1]) and IsNaN(close[n]), retracement4, concat( (coefficient_4 * 100), "%"), GetColor(LabelColor), yes); AddChartBubble((upward and close[n1]) and IsNaN(close[n]), retracement4, concat( (coefficient_4 * 100), "%"), GetColor(LabelColor), yes); Retracement5.assignvaluecolor(CreateColor(0,255,255)); Retracement5.setLineWeight(2); retracement5.hidebubble(); AddChartBubble((downward and close[n1]) and IsNaN(close[n]), retracement5, concat( (coefficient_5 * 100), "%"), GetColor(LabelColor), yes); AddChartBubble((upward and close[n1]) and IsNaN(close[n]), retracement5, concat( (coefficient_5 * 100), "%"), GetColor(LabelColor), yes); Retracement6.assignvaluecolor(CreateColor(255,255,255)); Retracement6.setLineWeight(4); Retracement6.hidebubble(); AddChartBubble((downward and close[n1]) and IsNaN(close[n]), retracement6, concat( (coefficient_6 * 100), "%"), GetColor(LabelColor), yes); AddChartBubble((upward and close[n1]) and IsNaN(close[n]), retracement6, concat( (coefficient_6 * 100), "%"), GetColor(LabelColor), yes); alert((price crosses below Retracement0) , "Price crosses below Retracement Line 0"); alert((price crosses above Retracement0) , "Price crosses above Retracement Line 0"); alert((price crosses below Retracement1) , "Price crosses below Retracement Line 1"); alert((price crosses above Retracement1) , "Price crosses above Retracement Line 1"); alert((price crosses below Retracement2) , "Price crosses below Retracement Line 2"); alert((price crosses above Retracement2) , "Price crosses above Retracement Line 2"); alert((price crosses below Retracement3) , "Price crosses below Retracement Line 3"); alert((price crosses above Retracement3) , "Price crosses above Retracement Line 3"); alert((price crosses below Retracement4) , "Price crosses below Retracement Line 4"); alert((price crosses above Retracement4) , "Price crosses above Retracement Line 4"); alert((price crosses below Retracement5) , "Price crosses below Retracement Line 5"); alert((price crosses above Retracement5) , "Price crosses above Retracement Line 5"); alert((price crosses below Retracement6) , "Price crosses below Retracement Line 6"); alert((price crosses above Retracement6) , "Price crosses above Retracement Line 6"); # End Auto Fib v1.3

Is it possible to provide full line code for 1.618 extension.The code that @BLT provided is very customizable. You can either change the fib levels via the user interface for any of the following standard definitions

Code:input fib1level = .236; input fib2level = .382; input fibMlevel = .500; input fib3level = .618; input fib4level = .764; input fib5level = 1.618; input fib6level = 2.618; input fib7level = -.618; input fib8level = -1.618;

Or, you can define more fib levels and add more plot lines. Either approach should be fine

See def F11 in the following link's code https://usethinkscript.com/threads/auto-fib-fibonacci-levels-indicator-for-thinkorswim.14/post-78338Is it possible to provide full line code for 1.618 extension.

When I import this script I see the 0% in the top and 100% at the bottom. How do I correct this?Created by RyanHendricks.

yep, 0% in the top and 100% at the bottom do appear. Right where they belong. It is a function of the script.When I import this script I see the 0% in the top and 100% at the bottom. How do I correct this?

Folks here is version 1.3 of the Auto Fib study that now displays the bubbles on the right of the chart.

Please ensure that you increase the expansion area to that the bubbles have room to be displayed

Personally I set that to 22 on my chart settings

Chart Settings > Time Axis > Expansion Area

Given several changes to this code from the first time it was posted by @BenTen in 2018, I have created a change log

It details the various modifications to the base code that was made including a really nice cleaned up version from @theelderwand

Hope this helps

Code:# Auto Fib V1.3 # tomsk # 11.19.2019 # Automatically draws fibonacci retracements using the highest price and lowest price # from the current view and timeframe. # # Fibonacci retracements use horizontal lines to indicate areas of support or resistance # at the key Fibonacci levels before it continues in the original direction. These levels # are created by drawing a trendline between two extreme points and then dividing the # vertical distance by the key Fibonacci ratios of: 23.6%, 38.2%, 50%, 61.8%, 78.6%, and 100%. # CHANGE LOG # # V1.0 - 12.18.2018 - BenTen - Initial release of Auto Fib, created by Ryan Hendricks # V1.1 - 11.15.2019 - theelderwand - As script was difficult to read, made the following enhancements # Expands to right # Doesn't expand to left # Custom colors for Fibonacci bars (0.618 is GOLD color) # Custom line weights # Code is modularized so you can add extra plots as needed # V1.2 - 11.15.2019 - tomsk - Added an input selector for the colors of the label. You # can select from any of the colors listed - red, orange, # green, etc and bubbles for all the fib retracements will # utilize that color. # V1.3 - 11.19.2019 - tomsk - Modified the AddChartBubbles to be displayed on the right # side of the chart. Please ensure that you increase the # expansion area to that the bubbles have room to be displayed # Chart Settings > Time Axis > Expansion Area #hint Price: Price used in the alerts on crossing retracement lines. <b>(Default is Close)</b> #hint coefficient_0: Retracement Line 0: Retracement from the highest high to the lowest low.<b>(Default is 0%)</b> #hint Coefficient_1: Retracement Line 1: Retracement from the highest high to the lowest low.<b>(Default is 23.6%)</b> #hint Coefficient_2: Retracement Line 2: Retracement from the highest high to the lowest low.<b>(Default is 38.2%)</b> #hint Coefficient_3: Retracement Line 3: Retracement from the highest high to the lowest low.<b>(Default is 50%)</b> #hint Coefficient_4: Retracement Line 4: Retracement from the highest high to the lowest low.<b>(Default is 61.8%)</b> #hint Coefficient_5: Retracement Line 5: Retracement from the highest high to the lowest low.<b>(Default is 78.6%)</b> #hint Coefficient_6: Retracement Line 6: Retracement from the highest high to the lowest low.<b>(Default is 100%)</b> #wizard input: Price #wizard text: Inputs: Price: #wizard input: coefficient_0 #wizard text: coefficient_0: #wizard input: Coefficient_1 #wizard text: Coefficient_1: #wizard input: Coefficient_2 #wizard text: Coefficient_2: #wizard input: Coefficient_3 #wizard text: Coefficient_3: #wizard input: Coefficient_4 #wizard text: Coefficient_4: #wizard input: Coefficient_5 #wizard text: Coefficient_5: #wizard input: Coefficient_6 #wizard text: Coefficient_6: input price = close; input high = high; input low = low; input coefficient_0 = 0.000; input coefficient_1 = .236; input Coefficient_2 = .382; input Coefficient_3 = .500; input Coefficient_4 = .618; Input Coefficient_5 = .786; input Coefficient_6 = 1.000; input LabelColor = {default "MAGENTA", "CYAN", "PINK", "LIGHT_GRAY", "ORANGE", "RED", "GREEN", "GRAY", "WHITE"}; input n = 3; def n1 = n + 1; def a = HighestAll(high); def b = LowestAll(low); def barnumber = barNumber(); def c = if high == a then barnumber else double.nan; def d = if low == b then barnumber else double.nan; rec highnumber = compoundValue(1, if IsNaN(c) then highnumber[1] else c, c); def highnumberall = HighestAll(highnumber); rec lownumber = compoundValue(1, if IsNaN(d) then lownumber[1] else d, d); def lownumberall = LowestAll(lownumber); def upward = highnumberall > lownumberall; def downward = highnumberall < lownumberall; def x = AbsValue(lownumberall - highnumberall ); def slope = (a - b) / x; def slopelow = (b - a) / x; def day = getDay(); def month = getMonth(); def year = getYear(); def lastDay = getLastDay(); def lastmonth = getLastMonth(); def lastyear = getLastYear(); def isToday = if(day == lastDay and month == lastmonth and year == lastyear, 1, 0); def istodaybarnumber = HighestAll(if isToday then barnumber else double.nan); def line = b + (slope * (barnumber - lownumber)); def linelow = a + (slopelow * (barnumber - highnumber)); def currentlinelow = if barnumber <= lownumberall then linelow else double.nan; def currentline = if barnumber <= highnumberall then line else double.nan; Plot FibFan = if downward then currentlinelow else if upward then currentline else double.nan; FibFan.SetStyle(Curve.SHORT_DASH); FibFan.AssignValueColor(color.red); fibfan.hidebubble(); def range = a - b; def value0 = range * coefficient_0; def value1 = range * coefficient_1; def value2 = range * coefficient_2; def value3 = range * coefficient_3; def value4 = range * coefficient_4; def value5 = range * coefficient_5; def value6 = range * coefficient_6; def condition1 = downward and barnumber >= highnumberall; def condition2 = upward and barnumber >= lownumberall; Plot Retracement0 = if condition1 then highestall(b + value0) else if condition2 then highestall(a - value0) else double.nan; Plot Retracement1 = if condition1 then highestall(b + value1) else if condition2 then highestall(a - value1) else double.nan; Plot Retracement2 = if condition1 then highestall(b + value2) else if condition2 then highestall(a - value2) else double.nan; Plot Retracement3 = if condition1 then highestall(b + value3) else if condition2 then highestall(a - value3) else double.nan; Plot Retracement4 = if condition1 then highestall(b + value4) else if condition2 then highestall(a - value4) else double.nan; Plot Retracement5 = if condition1 then highestall(b + value5) else if condition2 then highestall(a - value5) else double.nan; Plot Retracement6 = if condition1 then highestall(b + value6) else if condition2 then highestall(a - value6) else double.nan; Retracement0.assignvaluecolor(CreateColor(255,255,255)); Retracement0.setLineWeight(4); retracement0.hidebubble(); AddChartBubble((downward and close[n1]) and IsNaN(close[n]), retracement0, concat( (coefficient_0 * 100), "%"), GetColor(LabelColor), yes); AddChartBubble((upward and close[n1]) and IsNaN(close[n]), retracement0, concat( (coefficient_0 * 100), "%"), GetColor(LabelColor), yes); Retracement1.assignvaluecolor(CreateColor(173,216,230)); Retracement1.setLineWeight(2); retracement1.hidebubble(); AddChartBubble((downward and close[n1]) and IsNaN(close[n]), retracement1, concat( (coefficient_1 * 100), "%"), GetColor(LabelColor), yes); AddChartBubble((upward and close[n1]) and IsNaN(close[n]), retracement1, concat( (coefficient_1 * 100), "%"), GetColor(LabelColor), yes); Retracement2.assignvaluecolor(CreateColor(0,197,49)); Retracement2.setLineWeight(2); retracement2.hidebubble(); AddChartBubble((downward and close[n1]) and IsNaN(close[n]), retracement2, concat( (coefficient_2 * 100), "%"), GetColor(LabelColor), yes); AddChartBubble((upward and close[n1]) and IsNaN(close[n]), retracement2, concat( (coefficient_2 * 100), "%"), GetColor(LabelColor), yes); Retracement3.assignvaluecolor(CreateColor(255,64,64)); Retracement3.setLineWeight(3); retracement3.hidebubble(); AddChartBubble((downward and close[n1]) and IsNaN(close[n]), retracement3, concat( (coefficient_3 * 100), "%"), GetColor(LabelColor), yes); AddChartBubble((upward and close[n1]) and IsNaN(close[n]), retracement3, concat( (coefficient_3 * 100), "%"), GetColor(LabelColor), yes); Retracement4.assignvaluecolor(CreateColor(255,215,0)); Retracement4.setLineWeight(5); retracement4.hidebubble(); AddChartBubble((downward and close[n1]) and IsNaN(close[n]), retracement4, concat( (coefficient_4 * 100), "%"), GetColor(LabelColor), yes); AddChartBubble((upward and close[n1]) and IsNaN(close[n]), retracement4, concat( (coefficient_4 * 100), "%"), GetColor(LabelColor), yes); Retracement5.assignvaluecolor(CreateColor(0,255,255)); Retracement5.setLineWeight(2); retracement5.hidebubble(); AddChartBubble((downward and close[n1]) and IsNaN(close[n]), retracement5, concat( (coefficient_5 * 100), "%"), GetColor(LabelColor), yes); AddChartBubble((upward and close[n1]) and IsNaN(close[n]), retracement5, concat( (coefficient_5 * 100), "%"), GetColor(LabelColor), yes); Retracement6.assignvaluecolor(CreateColor(255,255,255)); Retracement6.setLineWeight(4); Retracement6.hidebubble(); AddChartBubble((downward and close[n1]) and IsNaN(close[n]), retracement6, concat( (coefficient_6 * 100), "%"), GetColor(LabelColor), yes); AddChartBubble((upward and close[n1]) and IsNaN(close[n]), retracement6, concat( (coefficient_6 * 100), "%"), GetColor(LabelColor), yes); alert((price crosses below Retracement0) , "Price crosses below Retracement Line 0"); alert((price crosses above Retracement0) , "Price crosses above Retracement Line 0"); alert((price crosses below Retracement1) , "Price crosses below Retracement Line 1"); alert((price crosses above Retracement1) , "Price crosses above Retracement Line 1"); alert((price crosses below Retracement2) , "Price crosses below Retracement Line 2"); alert((price crosses above Retracement2) , "Price crosses above Retracement Line 2"); alert((price crosses below Retracement3) , "Price crosses below Retracement Line 3"); alert((price crosses above Retracement3) , "Price crosses above Retracement Line 3"); alert((price crosses below Retracement4) , "Price crosses below Retracement Line 4"); alert((price crosses above Retracement4) , "Price crosses above Retracement Line 4"); alert((price crosses below Retracement5) , "Price crosses below Retracement Line 5"); alert((price crosses above Retracement5) , "Price crosses above Retracement Line 5"); alert((price crosses below Retracement6) , "Price crosses below Retracement Line 6"); alert((price crosses above Retracement6) , "Price crosses above Retracement Line 6"); # End Auto Fib v1.3

See if this helps https://usethinkscript.com/threads/auto-fib-fibonacci-levels-indicator-for-thinkorswim.14/post-69424Good morning, new to the scene here. I love this auto fib, however the % bubbles are allows covering the last few candles on all charts. Is there a way to move them out of the way? Not able to attach screenshot, only asked for http//: Thank you in advance for your help.

Dan

Is there a more recent version?

Good morning, new to the scene here. I love this auto fib, however the % bubbles are allows covering the last few candles on all charts. Is there a way to move them out of the way? Not able to attach screenshot, only asked for http//: Thank you in advance for your help.

Dan

Is there a more recent version?

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| T | Auto Fib (Fibonacci) Extensions Indicator for ThinkorSwim | Indicators | 18 | |

|

|

Repaints Auto Trend Lines For ThinkOrSwim | Indicators | 6 | |

|

|

Auto Significant Price Levels for ThinkorSwim | Indicators | 158 | |

|

|

Auto Volatility Standard Deviation Levels for ThinkorSwim | Indicators | 23 | |

|

|

Auto Resistance/Support Break Detector | Indicators | 35 |

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.