SuperTrend TradingView Look-A-Like For ThinkOrSwim

I modified a version of SuperTrend that is already available for Thinkorswim to imitate the style.

mod note:

Day traders and scalpers often use the SuperTrend as a trend filter or entry/exit trigger:

Combine with volume, RSI, or moving averages for confirmation.

Use on 1-minute to 15-minute charts for intraday signals.

WARNING:

It’s not a standalone “buy/sell bot,” but it’s great for visual trend confirmation and alerts in fast markets.

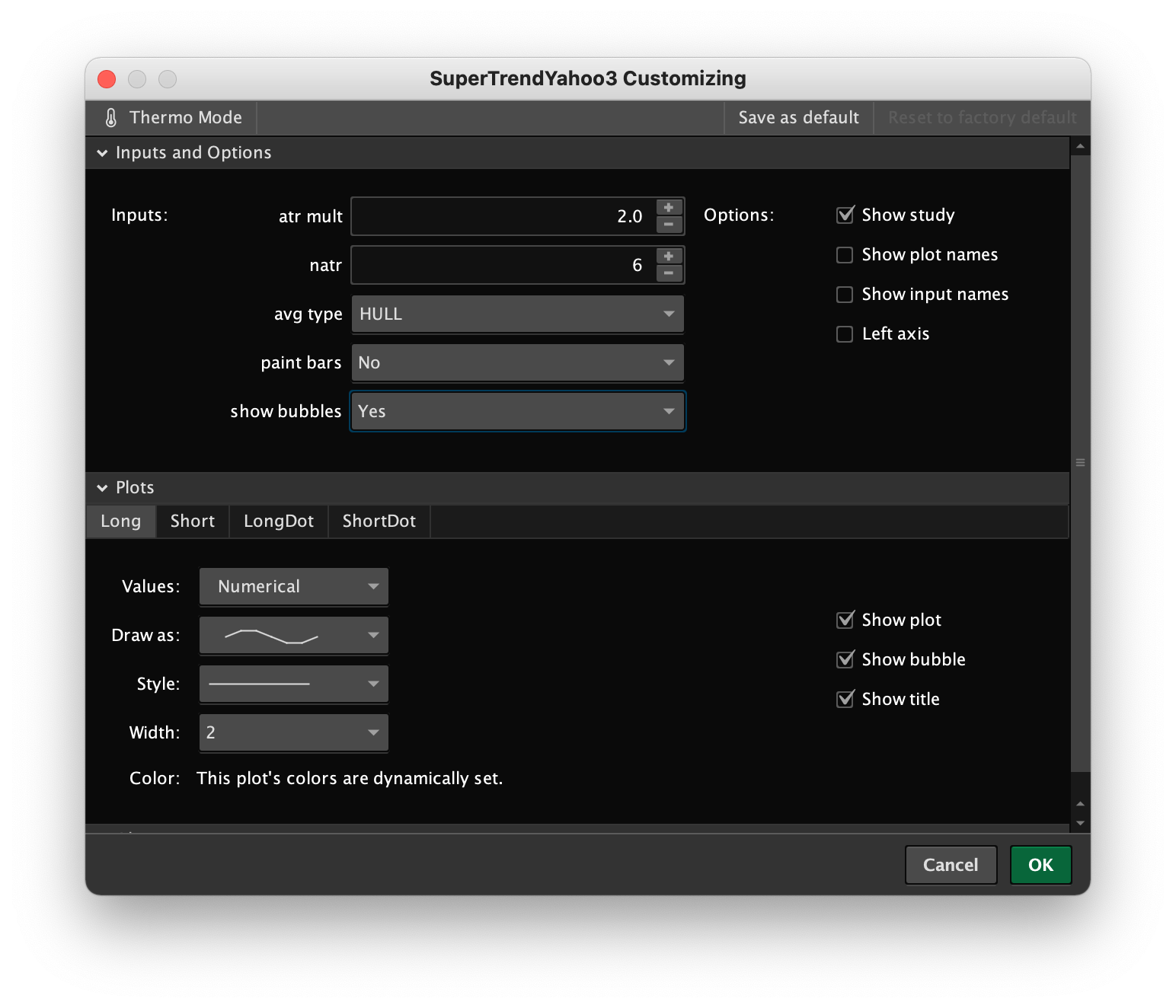

You can adjust the look from the options. Labels are turned off by default.

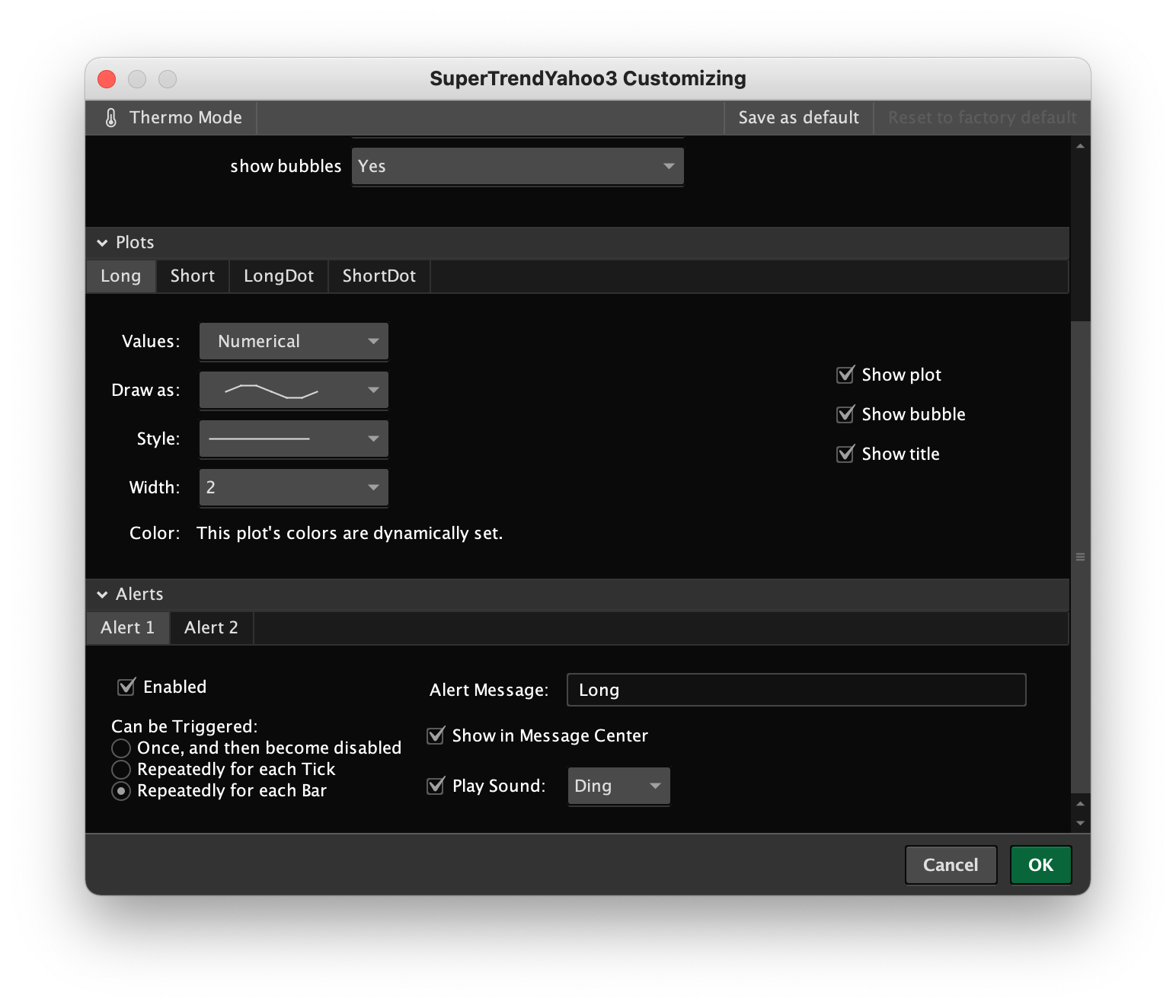

It also has alerts for trend change.

I modified a version of SuperTrend that is already available for Thinkorswim to imitate the style.

mod note:

Day traders and scalpers often use the SuperTrend as a trend filter or entry/exit trigger:

✦ Enter long positions when the line flips green or a “BUY” alert appears.

✦ Enter short positions when it flips red or a “SELL” alert appears.

✦ Enter short positions when it flips red or a “SELL” alert appears.

Combine with volume, RSI, or moving averages for confirmation.

Use on 1-minute to 15-minute charts for intraday signals.

WARNING:

It’s not a standalone “buy/sell bot,” but it’s great for visual trend confirmation and alerts in fast markets.

You can adjust the look from the options. Labels are turned off by default.

It also has alerts for trend change.

Python:

# SuperTrend Yahoo Finance Replica - Modified from Modius SuperTrend

# Modified Modius ver. by RConner7

# Modified by Barbaros to replicate look from TradingView version

# v3.0

input AtrMult = 1.00;

input nATR = 6;

input AvgType = AverageType.HULL;

input PaintBars = no;

input ShowBubbles = no;

def ATR = ATR("length" = nATR, "average type" = AvgType);

def UP_Band_Basic = HL2 + (AtrMult * ATR);

def LW_Band_Basic = HL2 + (-AtrMult * ATR);

def UP_Band = if ((UP_Band_Basic < UP_Band[1]) or (close[1] > UP_Band[1])) then UP_Band_Basic else UP_Band[1];

def LW_Band = if ((LW_Band_Basic > LW_Band[1]) or (close[1] < LW_Band[1])) then LW_Band_Basic else LW_Band[1];

def ST = if ((ST[1] == UP_Band[1]) and (close < UP_Band)) then UP_Band

else if ((ST[1] == UP_Band[1]) and (close > Up_Band)) then LW_Band

else if ((ST[1] == LW_Band[1]) and (close > LW_Band)) then LW_Band

else if ((ST[1] == LW_Band) and (close < LW_Band)) then UP_Band

else LW_Band;

plot Long = if close > ST then ST else Double.NaN;

Long.AssignValueColor(Color.GREEN);

Long.SetLineWeight(2);

plot Short = if close < ST then ST else Double.NaN;

Short.AssignValueColor(Color.RED);

Short.SetLineWeight(3);

def LongTrigger = isNaN(Long[1]) and !isNaN(Long);

def ShortTrigger = isNaN(Short[1]) and !isNaN(Short);

plot LongDot = if LongTrigger then ST else Double.NaN;

LongDot.SetPaintingStrategy(PaintingStrategy.POINTS);

LongDot.AssignValueColor(Color.GREEN);

LongDot.SetLineWeight(4);

plot ShortDot = if ShortTrigger then ST else Double.NaN;

ShortDot.SetPaintingStrategy(PaintingStrategy.POINTS);

ShortDot.AssignValueColor(Color.RED);

ShortDot.SetLineWeight(4);

AddChartBubble(ShowBubbles and LongTrigger, ST, "BUY", Color.GREEN, no);

AddChartBubble(ShowBubbles and ShortTrigger, ST, "SELL", Color.RED, yes);

AssignPriceColor(if PaintBars and close < ST

then Color.RED

else if PaintBars and close > ST

then Color.GREEN

else Color.CURRENT);

Alert(LongTrigger, "Long", Alert.BAR, Sound.Ding);

Alert(ShortTrigger, "Short", Alert.BAR, Sound.Ding);

# End Code SuperTrend Yahoo Finance Replica

Last edited by a moderator: